Guide to Declaring Charity Donations for Tax Relief

When it comes to managing your self-assessment in the UK, declaring your charity donations for tax relief is an important step that can help reduce your tax bill. Whether you’ve donated through Gift Aid or made other types of charitable contributions, accurately recording these donations ensures you benefit from the available tax reliefs. In this guide, we’ll walk you through how to declare your charity donations, including Gift Aid, using the Pie Tax App.

With our step-by-step instructions, you can easily manage and track your charitable giving, making your self-assessment process simpler and ensuring compliance with HMRC requirements.

Your Step-by-Step Guide

Follow these easy steps to ensure your tax reliefs are accurately recorded for your self-assessment:

Open the Pie Tax App and find the 'Quick Add' button in the middle of the navigation bar.Click 'Quick Add' in the Navigation Bar

After clicking 'Quick Add', select 'Add tax relief' from the screen to open the options menu.Select 'Add tax relief'

Next, you’ll see various types of tax reliefs. Tap ‘Charity Donations’ to continue.Choose Charity Donations

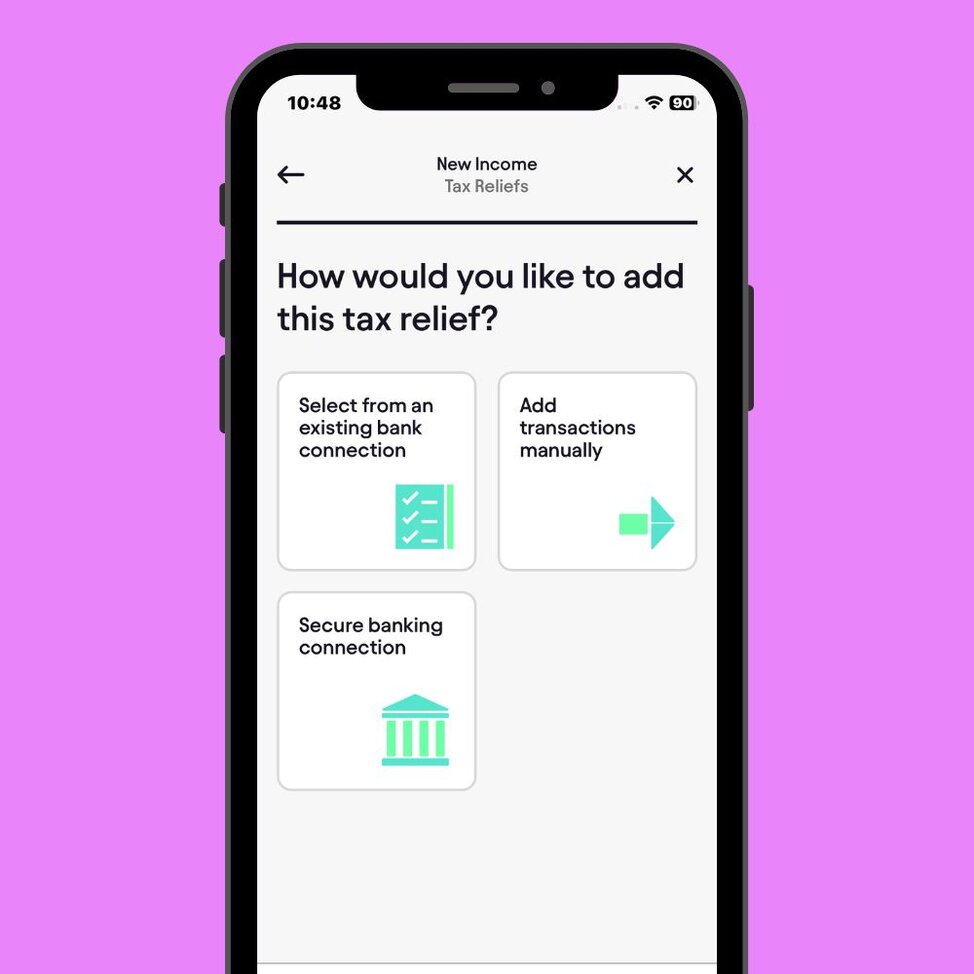

At this stage, you’ll decide how to input your investment scheme. You can either connect the app to your bank account, select from an existing bank connection, or enter the details manually.Select how you want to add your investment scheme data

If you choose this option, the app will take you to the Bookkeeping section, where you can reconcile charity donations from your bank account.Reconcile on Bookkeeping

If you prefer to enter the details manually, you'll be asked to specify which charities you participate in. For each donation, enter the yearly amount you have invested.Enter Manually

After entering the details, you can view them in the 'Income Account' section or the Tax Overview section of the app.Review Tax Relief Summary

Key Benefits

Declare donations, including Gift Aid, to get full tax relief.Maximise Tax Relief

Manage all donations in one app for a hassle-free process.Easy Self-Assessment

Auto-reconcile or manually input donations for HMRC compliance.Accurate Records

Frequently Asked Questions

How do I add my charity donations in the Pie Tax App?

You can add charity donations by accessing the 'All Incomes' section and selecting 'Tax Reliefs', then choose 'Charity Donations'.

Can I link my bank account to track donations automatically?

Yes, you can link your bank account to automatically reconcile your charity donations in the Bookkeeping section of the app.

Do I need to declare whether my donations were made through Gift Aid?

Yes, the app will prompt you to confirm whether your donations were made through the Gift Aid scheme to ensure accurate tax relief.

Can I enter my charity donations manually?

Absolutely, you can manually enter your charity donations by specifying the total amount donated and whether they were made through Gift Aid.

How do I review my charity donations once added?

After adding your donations, you can review them in the ‘Income Accounts’ section to ensure everything is correctly recorded.