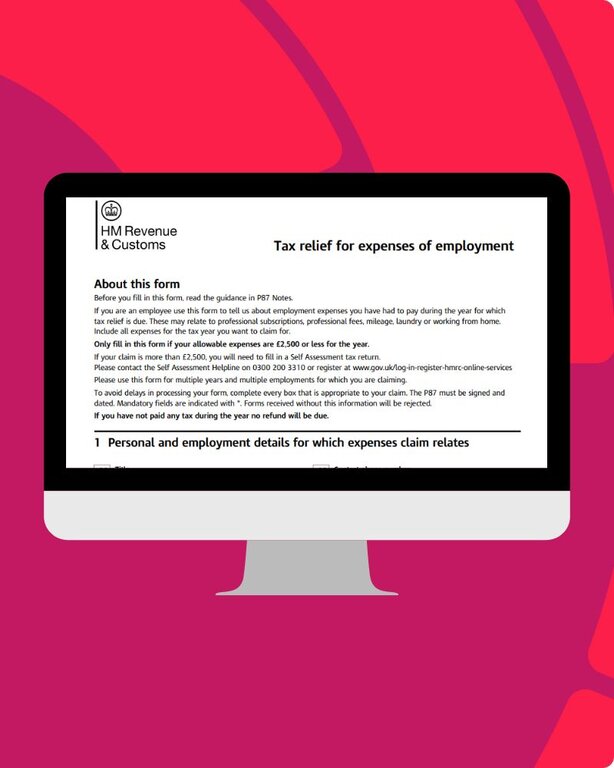

Introduction to the P87 Form: Tax Relief Explained

If you’re an employee in the UK and incur work-related expenses, you may be eligible for tax relief through the P87 form. Understanding this form can be quite beneficial, as it can help you claim back money that you’ve spent on essentials for your job. Whether it's tools, equipment, or travel costs, completing a P87 form ensures you're not out of pocket for items or services that are critical to your employment.

The P87 form is designed to be straightforward, making it easier for employees to claim tax relief on specific work expenses. However, knowing the ins and outs of the form, including what can be claimed and how to process the claim, is key for maximising your reimbursement. This article delves into the nitty-gritty details, offering step-by-step guidance to help you through the process.

Filing a P87 form isn’t just about getting some extra money back; it’s about making sure you’re fairly compensated for the expenses you’ve borne in the line of duty. Let this guide serve as your roadmap to navigating the complexities of the P87 form and ensuring you make the most of your entitlements.

Eligible Work Expenses

To be eligible for tax relief via the P87 form, the expenses must be necessarily incurred for your job, meaning they must be essential for you to perform your work duties. You can only claim costs that are directly related to your role. Common eligible expenses include the upkeep of uniforms, such as cleaning and repair, professional fees or subscriptions related to your occupation, and travel expenses like mileage for business trips that are not reimbursed by your employer. It's important that these expenses are solely for work purposes, as personal costs are not deductible. Proper documentation is required to support your claims.

Ease of Submission

Submitting the P87 form is now more convenient than ever, thanks to the digital services offered by HMRC. You can submit your form online through the HMRC portal, which simplifies the process and often results in faster processing times. For those who prefer traditional methods, a paper form can be completed and sent via post. The online submission is typically quicker, with electronic acknowledgments and faster updates. HMRC’s user-friendly portal guides you through each step, ensuring that you provide all necessary information for your claim. The Pie tax app can provide personalized advice and help navigate complexities.

Over 300,000 employees in the UK use the P87 form annually to claim tax relief, underscoring its significance as a vital tool for reimbursing work-related expenses. This widespread usage demonstrates its essential role in helping employees recover costs incurred during their job duties.The P87 Form Use

Collectively, UK taxpayers saved over £135 million last year using the P87 form, highlighting the substantial financial benefits of claiming entitled tax relief. This significant saving underscores the importance of utilizing the P87 form to recoup eligible work-related expenses and reduce overall tax liabilities.Tax Relief Savings

How to Complete a P87 Form

Filling out a P87 form is straightforward if you know what information to include and where to find it. You will need your National Insurance number and your employer’s PAYE reference, which is typically found on your payslip. Additionally, you will need to provide details of the expenses incurred, including dates and the nature of the expenses.

Begin by downloading the P87 form from the HMRC website. Next, fill in sections one and two with your personal details and your employer’s details. In section three, provide detailed descriptions of your expenses. Ensure that you have receipts or records of these expenses in case HMRC requests further information.

Once your form is filled out, review it to make sure all information is accurate. Submit your completed form to HMRC either online or via post. If everything is in order, you should receive notification of your tax relief shortly thereafter. Be sure to keep a copy of the submission for your records.

Processing Times and Reimbursements

After submitting your P87 form, the processing time can vary based on the submission method. Electronic submissions are generally processed faster, typically within 4-6 weeks. This quicker turnaround is due to the efficiency of the online system, which minimizes delays and accelerates processing.

On the other hand, paper submissions may take longer, usually around 8-10 weeks. This extended time frame accounts for postal delivery times and the manual handling required for processing paper forms. Once your submission has been processed, it is crucial to check your PAYE tax code.

The tax code may be adjusted to account for your tax relief, which can result in an increase in your take-home pay. Alternatively, if you receive a direct reimbursement, the amount will typically be deposited into your bank account. Keeping track of these changes ensures you receive the correct tax relief and benefit from the savings promptly.

Tips for Tax Relief

Future developments may lead to more streamlined, automated processing of P87 forms, making it even easier to claim tax relief.Automating tax relief claims

HMRC may broaden the scope of eligible work expenses, offering more opportunities for tax relief to employees across various industries.Expansion of eligible expenses

The adoption of more sophisticated digital platforms for submitting and tracking P87 claims can facilitate faster and more accurate reimbursement processes.Enhanced digital tools:

Fun Fact about Tax Relief

Did you know that the average tax relief claimed via a P87 form is £180? That's a substantial amount that can help cover out-of-pocket work expenses, ensuring that you're not financially strained by your job requirements.

How to Maximise Your Tax Relief

To ensure you’re claiming the maximum tax relief possible, it’s essential to keep accurate records of all your work-related expenses. Use an organised system, whether digital or paper-based, to keep track of receipts, invoices, and mileage logs. This will make it much easier when it comes time to fill out your P87 form and ensure you don’t miss any eligible expenses.

Another key strategy is to stay informed about changes in HMRC regulations. Tax laws and allowable expenses can change, and keeping up-to-date will ensure you’re always claiming your full entitlements. Subscribing to relevant newsletters or setting reminders to check the HMRC website periodically can be incredibly beneficial.

Travel expenses can accumulate rapidly, so maintain a detailed log of your business-related travel, including dates, distances, and purposes. Additionally, you can claim public transport costs; therefore, save all tickets and receipts as proof. Accurate records ensure you can maximize your eligible tax relief on these expenses.Claiming for Travel

Uniforms and specialised equipment required for your job can also be claimed through the P87 form. Keep receipts of any purchases. If your employer provides these items but does not reimburse you for maintenance (like cleaning uniforms), you can include these costs in your claim.Uniform and Equipment Costs

Summary

Claiming tax relief using the P87 form is a straightforward process that can save you a significant amount of money. By understanding the types of expenses that are eligible and ensuring you keep accurate records, you can maximise your claim. Submitting your form online can speed up the process, while paying attention to updates from HMRC can help you stay informed about any changes in regulations.

The Expert tax assistants available on the Pie app make this process easier by offering guidance through every step. Additionally, using the Pie Tax App can streamline your submission, track your claim, and potentially speed up your reimbursement.

The financial relief you receive through a successful P87 claim can substantially offset necessary work-related expenditures, ensuring that you aren’t financially disadvantaged by your job requirements. By staying organised and informed, you can make the most of the P87 form and the benefits it offers.

Frequently Asked Questions

What expenses can I claim using a P87 form?

You can claim expenses necessarily incurred for your job, such as uniforms, travel costs, equipment, and professional fees. Always check the latest HMRC guidelines for a comprehensive list.

How do I submit the P87 form?

The P87 form can be submitted online through the HMRC portal or via post. Online submissions generally offer faster processing times.

How long does it take to process a P87 form?

Electronic submissions usually take around 4-6 weeks, while paper forms can take approximately 8-10 weeks to process. Keep an eye on your updated tax code.

What happens if my P87 claim is denied?

If your claim is denied, HMRC will usually provide a reason. You can contact them for further clarification and may be able to provide additional information or appeal their decision.

Can I claim for previous tax years using the P87 form?

Yes, you can claim for expenses incurred in the past four tax years. Ensure you have all necessary records and receipts to support your claim.