John Lewis reports £88m loss amid rising costs

The John Lewis Partnership has revealed a £88 million pre-tax loss for the 26 weeks ending 26 July 2025, a sharp decline from the £30 million loss reported a year earlier. The department store and Waitrose owner blamed a mix of higher taxes, increased operational costs, and restructuring charges for the deeper deficit, despite posting stronger sales.

Sales across the group rose by 4% to £6.2 billion, showing that consumer demand remained steady. However, additional costs hit the bottom line, including £29 million linked to new packaging rules and higher employer National Insurance contributions, alongside £54 million in exceptional expenses from ongoing transformation programmes and non-cash asset write-downs.

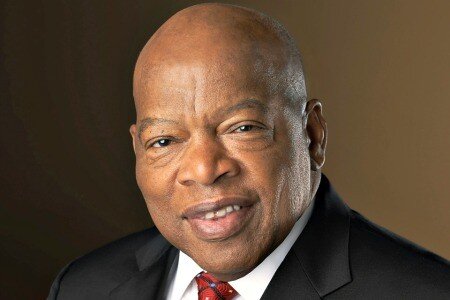

Chairman Jason Tarry, who took on the role in September 2024, stressed that the partnership remains focused on its turnaround efforts while preparing for the crucial Christmas trading season.

Rising tax and regulatory costs

The group confirmed that government measures introduced over the past year added significantly to its operating costs. The new packaging levy, known as “extended producer responsibility”, shifted the burden of recycling from councils to companies, with food retailers like Waitrose especially affected.

At the same time, higher National Insurance contributions increased staff-related costs. Combined, these added around £29 million to the partnership’s expenses in the first half of 2025.

Transformation expenses outweigh tax hikes

While tax and regulatory changes played a role, the largest factor behind the widened losses was the company’s internal restructuring. The partnership recorded £54 million in exceptional costs, mostly linked to business transformation, IT upgrades, and non-cash impairments.

These restructuring costs reflect John Lewis’s broader strategy to adapt to changing shopping habits, streamline operations, and reposition itself in a challenging retail environment.

Sales resilience offers some optimism

Despite the financial hit, sales figures offered a more positive picture. Total group sales increased by 4% year-on-year, suggesting customers remain engaged with the brand. Both John Lewis department stores and Waitrose supermarkets contributed to the rise, though margins remain under pressure.

Analysts noted that while sales growth is encouraging, the gains were not enough to offset the combined impact of new costs, transformation charges, and an increasingly competitive retail landscape.

Preparing for Christmas trading

The partnership is now looking ahead to the festive period, traditionally its most profitable time of year. With half-year results showing losses, the Christmas trading window will be pivotal for balancing the books and rebuilding confidence in its turnaround plan.

Management has pledged to improve customer experiences, enhance product ranges, and focus on value, in hopes of securing a strong festive performance.

Sector-wide challenges

John Lewis’s results highlight broader struggles in the UK retail sector. Food and general retailers alike are being squeezed by environmental levies, higher staff costs, and lingering inflationary pressures.

Industry experts warn that while regulation is reshaping retail operations, businesses also need to adapt to digital disruption and shifting consumer expectations if they are to remain competitive.

Consumer Reactions and Advice

Energy-saving advice campaigns are being relaunched to encourage households to cut consumption, but campaigners argue these measures are insufficient. Money-saving groups recommend reviewing fixed-rate deals, though many remain more expensive than the price cap. Citizens Advice has called for stricter regulation of suppliers to prevent aggressive billing practices and ensure fair treatment of customers.

Final Summary

The John Lewis Partnership’s latest results paint a picture of a retailer in transition. The £88 million half-year loss was driven by a mix of policy-driven costs (£29m) and transformation expenses (£54m), alongside a competitive retail market. While sales grew 4% to £6.2 billion, the additional financial pressures outweighed gains.

At Pie, we believe money should feel like yours to claim not something hidden behind jargon, stress, or confusion. That’s why we make taxes simple, clear, and even a little delightful, so you can focus on life rather than admin.

Chairman Jason Tarry faces the challenge of stabilising the business while investing in long-term changes. The upcoming Christmas trading season will be decisive in determining whether John Lewis can offset losses and build momentum into 2026. The results reflect not only the company’s internal restructuring but also the wider headwinds facing UK retailers under rising costs and evolving regulations.