Let’s Make EIS Work for Your Year-End Tax Planning

EIS isn’t just a great investment tool; it can also be a smart way to reduce your tax bill.

With careful timing and planning, you can use EIS reliefs to offset income tax or even carry them back to the previous year.

This guide explains how to make the most of EIS as part of your year-end tax strategy.

What is EIS and Why It's a Tax Planning Superstar

The Enterprise Investment Scheme was created to encourage investment in early-stage UK companies. By offering generous tax incentives, the government hopes to fuel innovation and growth in small businesses. EIS also supports investment in knowledge-intensive companies, which are often innovative and R&D-focused. These knowledge-intensive businesses may offer unique tax relief benefits due to their high growth potential and focus on research and development.

When you invest in EIS-qualifying companies, you receive 30% EIS income tax relief on investments up to £1 million per tax year. This means you can potentially reduce your income tax bill by up to £300,000 annually.

The relief applies to the tax year in which the EIS shares are issued. This makes it perfect for year-end planning when you have a clearer picture of your overall tax position.

Beyond income tax relief, EIS investments held for at least three years are free from Capital Gains Tax when sold. This combination of upfront relief and tax-free growth makes EIS particularly attractive for higher-rate taxpayers.

How to Use EIS for End-of-Year Tax Planning

Timing is everything with EIS investments. To reduce your current tax year liability, you’ll need to invest before April 5th. This deadline is crucial and non-negotiable, as it marks the end of the tax year for planning purposes.

One of EIS’s most flexible features is the “carry back” option. This allows you to apply the tax relief to the previous year instead of the current one. While EIS lets you carry back relief to the previous year, other allowances such as pension contributions may allow you to carry forward unused allowances from earlier years to maximise your tax benefits.

If you’ve had a particularly high-income year, perhaps from a bonus or business profits, EIS can help smooth out your tax liability. The 30% relief directly reduces your income tax bill pound for pound. To claim tax relief or claim relief, you’ll need to obtain your EIS3 certificate and submit the relevant details through your tax return, either by amending a previous return or including it in your current filing.

For maximum impact, review your tax position about 2-3 months before the end of the tax year. This gives you enough time to select quality EIS investments rather than making rushed decisions.

Remember that while tax benefits are attractive, EIS investments should still make commercial sense. These are investments in early-stage companies that carry genuine risks alongside their tax advantages. Careful planning is essential to maximise the benefits of EIS and other available reliefs.

Using EIS to Defer Capital Gains Tax

Had a profitable year selling assets? EIS can help defer Capital Gains Tax too. If you’ve realised capital gains, reinvesting that amount into EIS investments allows you to defer the tax until you sell your EIS shares. This process is known as deferring capital gains tax (CGT), where 'CGT' stands for Capital Gains Tax.

The timing rules are slightly different here, you can defer gains made up to three years before your EIS investment, or up to one year after. This flexibility is brilliant for tax planning. CGT deferral relief (also known as EIS deferral relief) allows you to postpone your CGT liability by reinvesting gains into EIS shares. Deferral relief can be claimed for gains arising in previous years as well as the current year, but it cannot be carried forward into future tax years.

Year-end is the perfect time to calculate exactly how much capital gains liability you’re facing. When doing so, remember to use your annual exemption and annual allowance for CGT, as these can reduce your CGT liability before considering EIS deferral. These allowances interact with EIS deferral by letting you offset some gains tax-free, while deferring the rest through EIS.

Always ensure you follow the correct process when claiming EIS deferral relief, including specifying when claiming deferral relief arose, to maximise your tax benefits.

EIS and Your Taxable Income: What You Need to Know

EIS investments can play a significant role in managing your taxable income and optimising your overall tax efficiency. The 30% income tax relief you receive from EIS investments directly reduces your income tax liability, which can lower your taxable income for the year. This is particularly beneficial for higher-rate and additional-rate taxpayers, as it can help bring your taxable income below key thresholds, potentially preserving personal allowances or reducing exposure to higher tax rates.

In addition to income tax relief, EIS investments can be used to offset capital gains tax liabilities, providing further tax relief and helping you manage your overall tax position. By carefully planning your EIS investments, you can ensure that you make the most of available tax reliefs and minimise your tax liability across multiple tax years. It’s important to understand how EIS interacts with your other sources of income and reliefs, so consulting a tax advisor is highly recommended.

Practical Steps for End-of-Year EIS Implementation

Start by getting a clear picture of your tax position. Use Pie tax or consult with your accountant to understand exactly what you owe before making decisions.

Consider EIS funds rather than direct company investments if you’re approaching the year-end. These funds can provide EIS certificates more quickly, ensuring you get relief in the current tax year.

Keep all your EIS documentation organised. You’ll need your EIS3 certificates when claiming tax relief on your Self Assessment return. When submitting your tax return to claim EIS relief or claiming EIS deferral relief, make sure to include the relevant forms and follow the correct process and deadlines set by HMRC.

Set calendar reminders for the three-year holding period. Selling EIS shares too early will trigger a clawback of the income tax relief you received.

Last year, I nearly missed the EIS deadline after procrastinating until late March. The rush to complete due diligence on investments in just days was unnecessarily stressful and limited my options.

Common Pitfalls to Avoid with EIS Tax Planning

Here are some common mistakes to avoid: Don't invest solely for tax reasons. HMRC can challenge relief if investments are made primarily for tax avoidance rather than commercial purposes.

Beware of liquidity constraints. EIS investments are typically locked up for at least three years, and even after that, finding buyers for shares in private companies can be challenging.

Remember that not all small companies qualify for EIS. The rules are strict, companies must be UK-based, under certain size limits, and conduct qualifying trades.

Watch out for the "risk to capital" condition. HMRC expects genuine risk in EIS investments, not artificially structured schemes designed purely for tax benefits

.

Final Thoughts

EIS offers fantastic tax advantages when incorporated into your end-of-year planning. The 30% income tax relief alone makes it worth considering for higher-rate taxpayers.

The additional benefits, CGT deferral, tax-free growth, and inheritance tax exemption, create a powerful tax planning tool when used correctly. Few other investments offer such comprehensive tax advantages.

Always balance tax benefits against investment risks. EIS companies are early-stage businesses that might fail, potentially losing your investment despite the tax relief cushion.

With careful timing and professional advice, EIS can transform your tax position while supporting innovative British businesses. This creates a win-win when done right.

Pie: Simplifying EIS in End-of-Year Tax Planning

Navigating EIS tax relief becomes straightforward with the right tools in your corner. Pie shows you instantly how potential EIS investments could reduce your tax bill.

The UK's first personal tax app helps you track all your income sources and existing reliefs. This makes it easy to see how your EIS investment would optimise your tax position.

Curious to see how much you could save? Take a look at Pie today and see your potential EIS tax relief applied to your self-assessment and calculated in real-time.

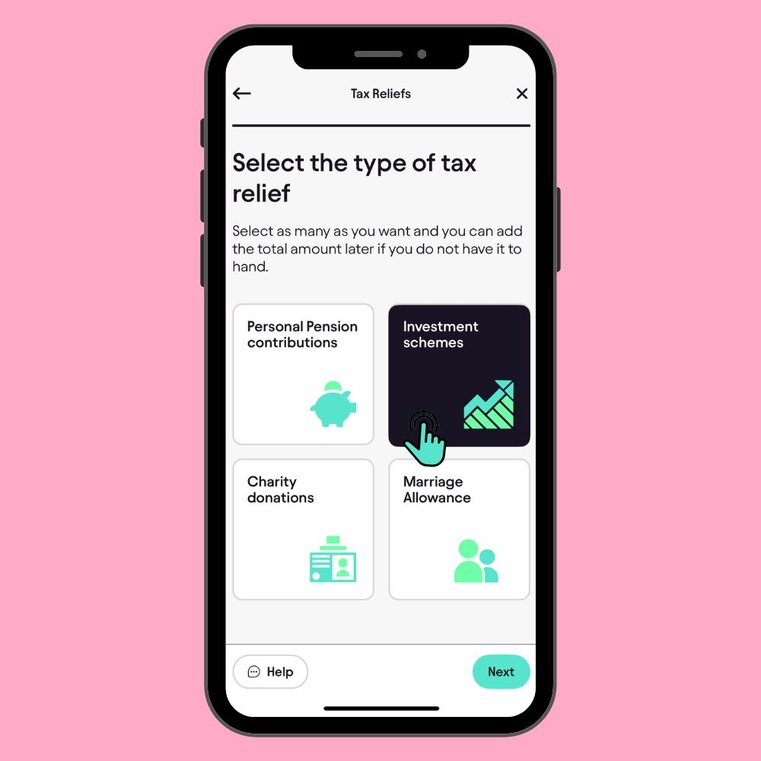

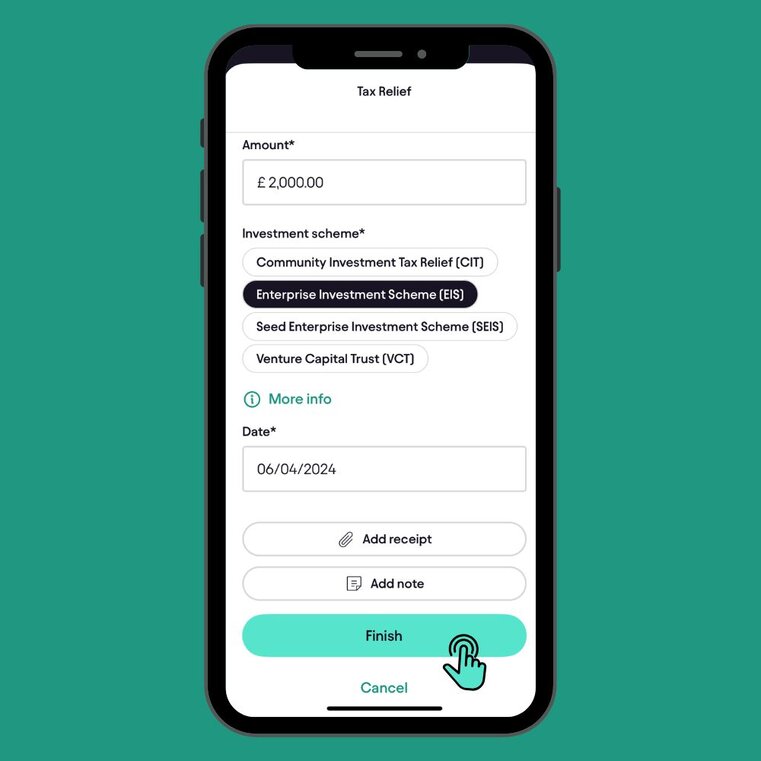

Quick and Easy Guide to Adding EIS Tax Relief in the Pie App

Follow these steps to add EIS tax Relief