A Complete Guide to Claiming Investment Scheme for Tax Relief

Managing your tax reliefs is a key aspect of UK self-assessment, particularly when it comes to investment schemes like the Enterprise Investment Scheme (EIS), Seed Enterprise Investment Scheme (SEIS), Community Investment Tax Relief (CIT), and Venture Capital Trusts (VCT). These schemes offer valuable tax reliefs, but they must be accurately recorded to ensure compliance with HMRC requirements.

In this guide, we’ll walk you through the process of declaring your investment schemes as income sources within the Pie Tax App. By following our step-by-step instructions, you can easily manage and categorise your investments, making your self-assessment process more straightforward and ensuring that all your tax reliefs are correctly accounted for.

Your Step-by-Step Guide

Follow these easy steps to ensure your tax reliefs are accurately recorded for your self-assessment:

Open the Pie Tax App and find the 'Quick Add' button in the middle of the navigation bar.Click 'Quick Add' in the Navigation Bar

After clicking 'Quick Add', select 'Add tax relief' from the screen to open the options menu.Select 'Add tax relief'

Next, you’ll see various types of tax reliefs. Tap ‘Investment Schemes’ to continue.Choose Investment Schemes

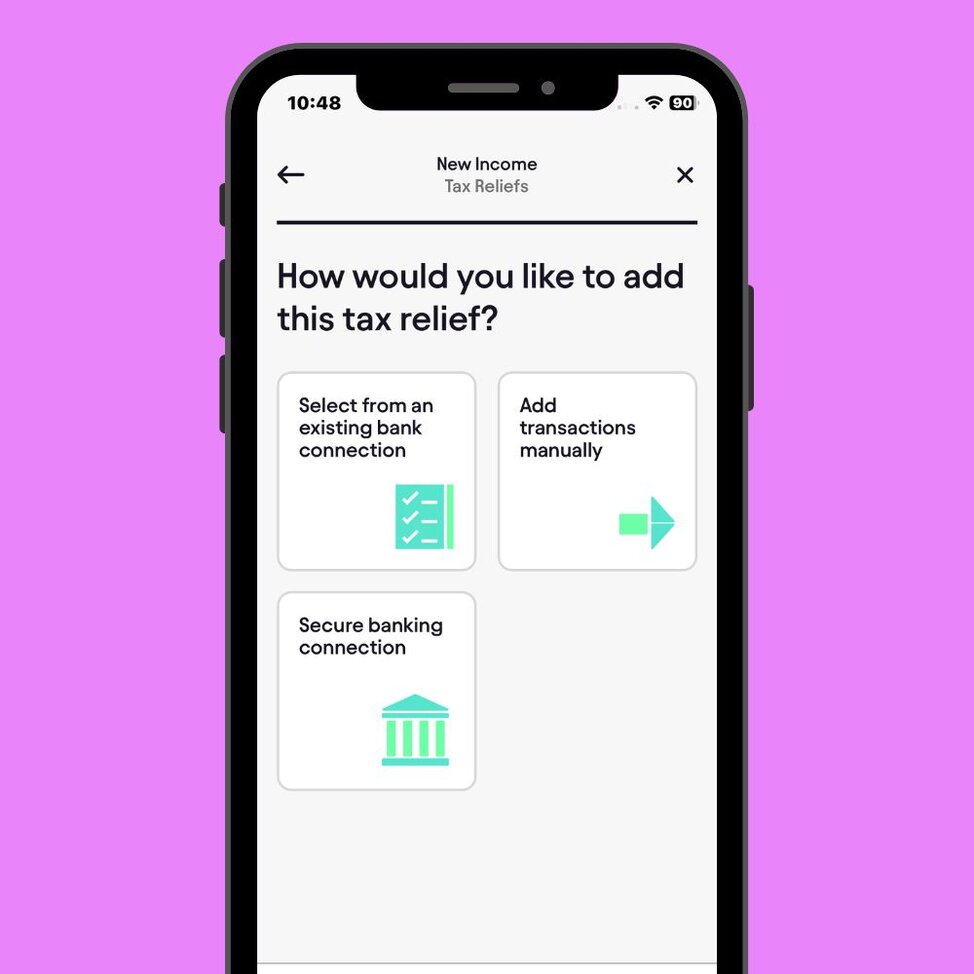

At this stage, you’ll decide how to input your investment scheme. You can either connect the app to your bank account, select from an existing bank connection, or enter the details manually.Select how you want to add your investment scheme data

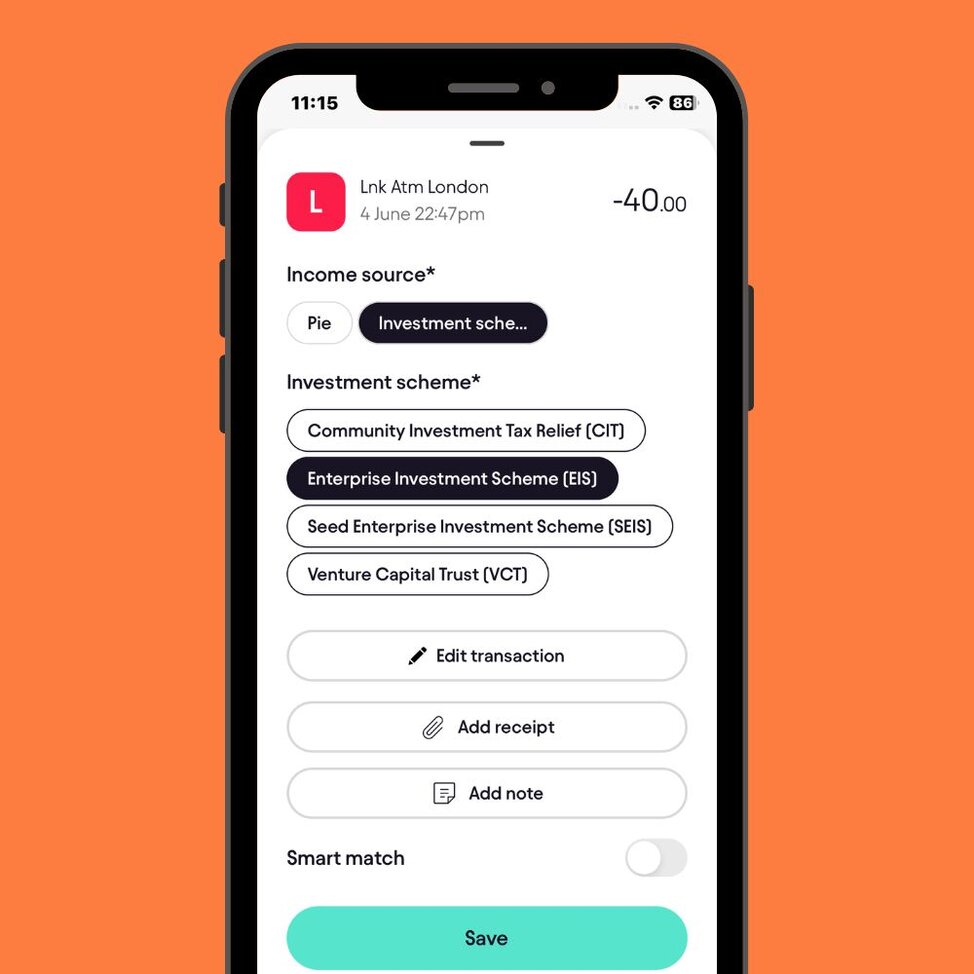

If you choose this option, the app will take you to the Bookkeeping section, where you can reconcile investment schemes from your bank account and categorise each transaction correctly (CIT, EIS, SEIS, or VCT).Reconcile on Bookkeeping

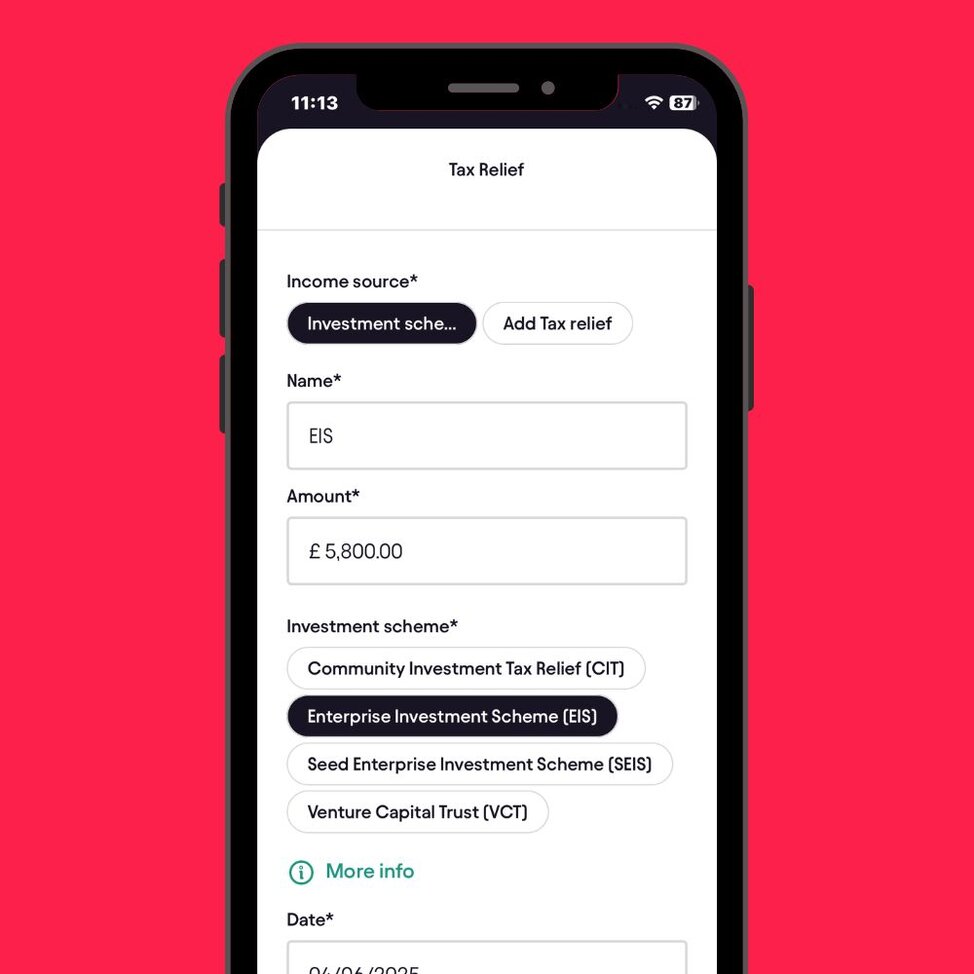

If you prefer to enter the details manually, you'll be asked to specify which investment schemes you participate in. For each scheme (CIT, EIS, SEIS, or VCT), enter the yearly amount you have invested.Enter Manually

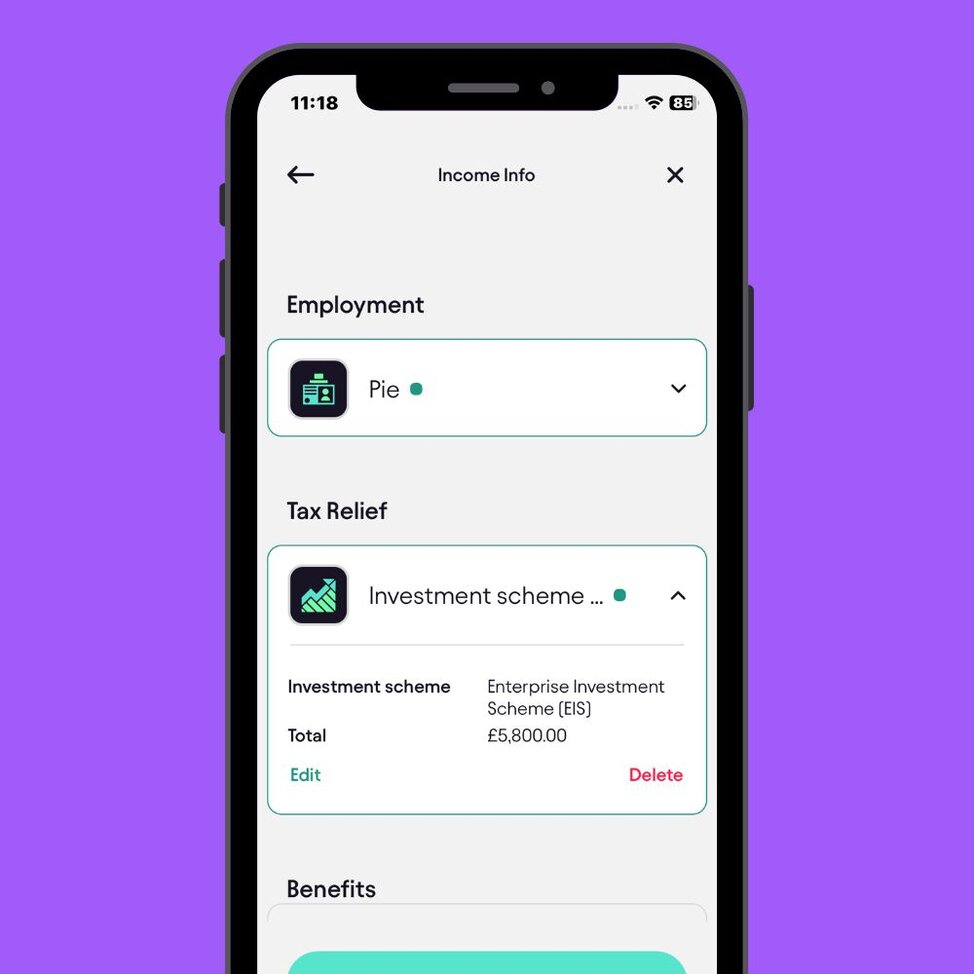

After entering the details, you can view them in the 'Income Account' section or the Tax Overview section of the app.Review Tax Relief Summary

Key Benefits

Easily record your investment schemes to ensure correct tax reliefs and HMRC compliance.Accurate Tax Reliefs

Manage all your investment schemes in one app, streamlining your tax filing process.Simplified Self-Assessment

Ensure every eligible scheme is declared to maximise your tax savings.Maximise Tax Savings

Frequently Asked Questions

How do I declare my investment schemes in the Pie Tax App?

You can declare your investment schemes by navigating to the ‘All Incomes' section in your profile and selecting 'Tax Reliefs', then 'Investment Schemes'.

What types of investment schemes can I add?

You can add schemes like the (CIT) Community Investment Tax Relief, (EIS) Enterprise Investment Scheme, (SEIS) Seed Enterprise Investment Scheme, and (VCT) Venture Capital Trust

Can I connect my bank account to add investment schemes?

Yes, you can connect your bank account to reconcile your investment schemes directly from your transactions.

Is it possible to manually enter my investment scheme details?

Yes, you can manually enter the details of each investment scheme and the amount invested annually.

How can I review the investment schemes I’ve added?

After adding your schemes, go to the ‘Income Accounts’ section in your profile to review and confirm that all details are correct.