Let’s Break This Down Together...

Making Tax Digital for Income Tax Self Assessment (MTD for Income Tax) is the most significant shift in the UK’s tax system for generations. It marks the government’s next step in modernising tax for the digital age, designed to make income tax administration more accurate, efficient, and less stressful

The MTD for IT rules will be introduced in stages from self-employment or property income:

- From April 2026, for anyone earning £50,000 or more in total qualifying income

- From April 2027, for those earning £30,000 or more

- From April 2028, for those earning £20,000 or more

That means more self-employed individuals, sole traders, and landlords will soon need to use MTD compatible accounting software to maintain digital records and submit quarterly updates directly to HMRC’s systems.

This is exactly where Pie Tax makes life easier, it’s fully MTD ready, approved by HMRC, and designed to handle all your quarterly updates automatically, so you don’t have to worry about missing a single deadline - and best of all it's completely fre

Stay on Top of Your Taxes All Year with Real-Time Digital Updates

Instead of filing one Self Assessment tax return each year, you’ll be sending digital updates every quarter, giving you a clear, up-to-date picture of your tax position all year round. Pie Tax helps you track your tax in real time, spot opportunities to save, and stay compliant without the stress of spreadsheets or manual upload.

If that sounds complicated, don’t worry. Pie Tax makes Making Tax Digital for Income as easy as pie, simple setup, smart automation, and expert support when you need it

The Biggest Change to UK Tax in Generations

The government’s Making Tax Digital programme is reshaping how we all interact with HMRC. Initially planned for 2024 and later adjusted to begin in stages from 2026, the rollout will now include earners of £20,000+ from April 2028.

It’s part of HMRC’s long term plan to modernise income tax self assessment creating a system that’s more accurate, efficient, and accessible for everyone.

There’s a growing choice of software products, both free and paid, developed by the software industry in partnership with HMRC to support small businesses and those with straightforward affairs.

How to Stay Compliant with Making Tax Digital

Use the booking section in the Pie app to record your income and expenses digitally and stay compliant with MTD requirements.Keep your income and expense records digitally

Stay compliant by sending your tax updates every quarter instead of once a year, the Pie app makes the process simple and stress-freeQuarterly Filing

Submit your final tax returns effortlessly with Pie App, a free, MTD-compatible tool that ensures your submission is fully compliant at no extra cost.The Final Submission

Why HMRC Is Going Digital and What It Means for You

The move to Making Tax Digital for Income Tax is about bringing the UK tax system into the modern world.

By replacing paper records with digital tools and quarterly reporting, HMRC aims to:

- Reduce errors and missed entries

- Help taxpayers get their income tax right the first time

- Provide a clearer view of your tax position throughout the year

- Ease the administrative burdens that come with traditional self assessment

For most self-employed individuals and landlords, it means less end-of-year stress and more control. By using digital record keeping and MTD-compatible accounting software, you’ll always have a real-time view of your income, expenses, and estimated tax, helping you plan ahead confidently.

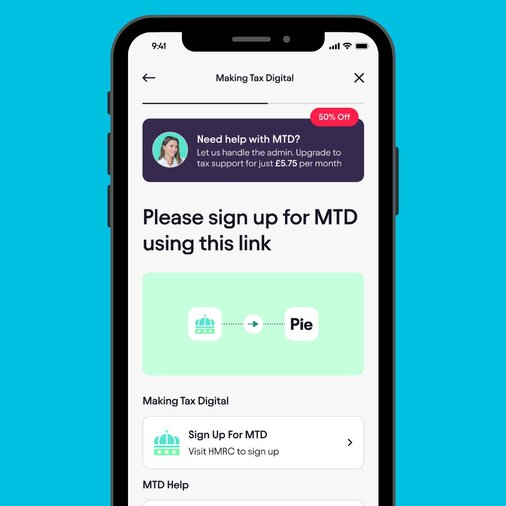

Get MTD Ready. Sign Up in the Pie App

Getting started with Making Tax Digital has never been easier. With the Pie app, you can sign up for MTD directly and connect to HMRC in just a few simple steps.

The app handles setup, digital record keeping, and quarterly submissions automatically, saving you time and reducing stress

By managing everything in one place, Pie keeps you compliant, organised, and always up to date with your tax position. No spreadsheets, no confusion, just smart, seamless tax made easy

What exactly is MTD for IT

Making Tax Digital for Income Tax Self Assessment (MTD for IT) is HMRC’s plan to modernise the UK tax system by making it fully digital.

The goal is to make tax administration more effective, accurate, and straightforward while helping taxpayers get their tax right the first time.

Instead of filing one annual Self Assessment tax return, you will use MTD-compatible software to keep digital records of your income and expenses.

Every transaction and detail from your income sources, such as trading or property, must be stored digitally to meet MTD requirements.You will then submit quarterly updates to HMRC throughout the tax year, giving you a clearer and more accurate view of your tax position as you go. This means no more waiting until January to know what you owe or worrying about missed receipts.

By keeping everything stored digitally and updating HMRC regularly, you’ll always have a real-time picture of your tax position. It’s designed to help you stay in control, avoid surprises, and manage your finances with confidence.

Who needs to comply with MTD for IT?

You must follow MTD for IT rules if you are self-employed or a landlord and your total qualifying income meets the relevant threshold for your start date. This includes income from trading, property, or a combination of both.

If you have multiple sources of income, you will need to submit quarterly updates for each. Sole traders and landlords must keep their records digitally and use approved accounting software to send information directly to HMRC’s systems.

Non-resident companies and those classed as digitally excluded (for example, due to age, disability, or location) may be exempt from MTD for IT, subject to HMRC recognised.

MTD Rollout: When Does It All Kick In?

The MTD for IT timeline has been revised several times, but the current schedule is now fixed. April 2026 marks the start for businesses and landlords with income over £50,000. The relevant tax years determine when you must comply, as your income and turnover in specific tax years affect your inclusion and deadlines for MTD.

Those with income between £30,000-£50,000 will join in April 2027. General partnerships with income above £50,000 begin using the system from April 2028.

Once in the system, you’ll need to submit updates to HMRC after each quarter. This quarterly reporting process requires you to submit quarterly reports, which must be submitted quarterly within one month after each quarter ends. You’ll also complete an end of period statement and final declaration annually.

Until your mandatory start date, you’ll continue using the traditional Self Assessment system. This gives you time to prepare and adjust your record-keeping practices.

Going Digital: What Records You’ll Need to Keep

Under MTD for IT, you must keep records of income and expenses digitally. You’ll need to use MTD compatible software for this purpose. Your software must connect to HMRC's systems to enable digital submissions.

Digital links must exist between all parts of your record keeping system. Your submissions will go directly from your software to HMRC. There are various tax digital software options available, including free software products developed by the software industry in collaboration with HMRC to help small businesses and straightforward taxpayers comply with MTD requirements.

You can still use spreadsheets if they’re connected to HMRC via bridging software. Paper receipts remain valid, but their information needs transferring to your digital records. Adapting to digital record-keeping may introduce administrative burdens for some businesses, such as additional compliance steps and ongoing costs.

When I first heard about these requirements, I worried about scanning hundreds of receipts. Thankfully, you won’t need to scan every receipt, just record the details digitally in your chosen software.

Quarterly Updates: What You’ll Need to Submit

With the introduction of MTD for Income Tax, you’ll need to submit quarterly updates to HMRC using approved, MTD-compatible software.

Each update will include a summary of your income and expenses for every business or property income source you have, organised in a way that’s similar to the current self assessment tax return.

These quarterly updates are designed to keep your tax position accurate and up-to-date throughout the tax year, helping you avoid surprises and stay compliant with income tax rules.

For each tax year, you’ll need to submit your updates by the deadlines set for the tax year quarters: 7 August, 7 November, 7 February, and 7 May. It’s important to ensure your digital record keeping is thorough and that you use compatible software to submit your information

This not only helps you meet HMRC’s requirements but also makes it easier to track your property income, business expenses, and overall tax return data

Final Declaration: End-of-Year Process

After you’ve submitted your four quarterly updates for the tax year, the next step is the Final Declaration. This is a crucial part of the MTD for Income Tax process, as it replaces the traditional self assessment tax return. The Final Declaration is where you review all your income and expenses for the year, make any necessary accounting adjustments, and confirm your final tax position with HMRC.

You’ll need to use MTD compatible accounting software or bridging software to submit your Final Declaration, ensuring all your digital records are accurate and complete.

The deadline for this submission is 31 January following the end of the tax year, just like the current self assessment system. Getting your Final Declaration right is essential for self employed individuals and landlords, as it determines your final tax liability and helps avoid any delays or penalties.

How to prepare for MTD for IT

While 2026 might seem distant, starting preparations now will make the transition smoother. Research MTD compatible software options that suit your business needs.

Using prewritten templates and digital tools can help save time when communicating with clients about MTD. The software industry is working closely with HMRC to provide solutions for all taxpayers.

Review your current record keeping methods and identify necessary changes. Speak with your accountant about their plans for supporting MTD clients

Simplify Your Digital Tax Management with Pie Tax

Some basic MTD compatible software packages start from as little as £18 per month, but Pie Tax stands out from the rest it is the only MTD software that is completely free and HMRC recognised software provider, Pie automatically records your income and expenses, calculates your estimated tax, and prepares quarterly updates without the need for spreadsheets or manual uploads

It gives you a real-time view of your tax position, helping you plan ahead, spot opportunities to save, and stay compliant with ease. Designed for simplicity, Pie doesn’t require accounting experience and comes with smart support whenever you need guidance.

Whether you’re a sole trader, landlord, or have multiple income streams, Pie saves time, reduces errors, and makes digital tax management genuinely stress-free compared to other MTD products. You can download the Pie Tax app and get started in minutes.