Let’s Make Sure You Get Your EIS Tax Relief Right...

Claiming EIS tax relief can offer generous savings, but simple mistakes can cost you.

From paperwork issues to timing errors, there are key things HMRC won’t overlook.

This guide highlights the common pitfalls so you can avoid delays, rejections, or lost relief.

What is EIS Tax Relief and Why Should You Care?

EIS offers a generous 30% income tax relief on investments up to £1 million annually. That means for every £10,000 you invest, you could get £3,000 back from HMRC.

SEIS (Seed Enterprise Investment Scheme) and EIS are two key tax relief schemes: SEIS is designed for very early-stage startups, while EIS targets slightly more established companies.

But the benefits don’t stop there. You’ll also enjoy Capital Gains Tax exemption on EIS shares held for at least 3 years. A qualifying investment must meet HMRC criteria, and it’s important to invest within the annual investment limits and maximum investment thresholds, especially for knowledge-intensive companies, which have higher allowances.

Loss relief provides a safety net if investments underperform. Inheritance Tax exemption kicks in after a 2-year holding period.

To maintain capital gains tax relief and other EIS benefits, you must meet the three-year holding period requirement. EIS investment also allows for capital gains tax relief, deferral relief, and inheritance tax relief, provided certain conditions are met.

Both the investor and the company must meet specific eligibility criteria, including requirements related to ordinary share capital and the company's assets.

These tax incentives make EIS one of the most attractive ways to invest in growing British businesses. They significantly reduce your tax bill while supporting innovation.

How to Make EIS Investments the Right Way

Making the most of EIS tax relief starts with a smart approach to your EIS investments. First, ensure you’re investing in an EIS qualifying company; these are typically early-stage companies that are unlisted, have fewer than 250 full-time employees, and gross assets not exceeding £15 million. Always check that the company has received EIS advance assurance from HMRC, which gives you confidence that your investment is likely to qualify for valuable tax relief.

Before committing your money, take time to review the company’s business plan, financial projections, and management team. Understanding the terms of your investment, including share price, company valuation, and any special conditions, will help you avoid surprises down the line.

Once you’ve invested, keep all documentation safe and make sure you receive your EIS3 certificate. This is essential for claiming EIS tax relief. Submit your claim to HMRC within the required timeframe to secure your tax benefits. If you’re unsure about any part of the process, seeking professional advice from a tax advisor or accountant can help you navigate the paperwork and ensure you’re eligible for all the tax reliefs available. By following these steps, you can claim EIS tax relief with confidence and maximise the tax benefits of supporting innovative UK businesses.

Top Mistakes That Could Cost You Your EIS Relief

Missing deadlines tops the list of EIS claim disasters. You must claim within 5 years of the tax year the shares were issued, but waiting that long is risky. Submitting your self assessment tax return on time is crucial for claiming tax relief, as missing the deadline can prevent you from making a valid tax relief claim.

Many investors submit their EIS3 certificates after their self-assessment deadline. This instantly invalidates their claim for that tax year. When making your tax relief claim, it is important to include the money invested and all relevant details from the EIS3 certificate to ensure your claim is processed correctly.

Others forget they can carry back relief to the previous tax year when beneficial. This oversight potentially costs thousands in immediate tax savings, especially if your taxable income was higher in the previous year, allowing you to maximise your claim income tax relief.

Companies must apply for EIS certificates within 4 months of issuing shares. If they miss this window, investors can’t claim relief regardless of how qualifying the investment might be.

To maximise your benefits, you must accurately report your taxable income and claim income tax relief through your self assessment tax return, ensuring all documentation and deadlines are met when claiming tax relief.

Documentation Blunders That HMRC Won't Forgive

Losing your EIS3 certificate is surprisingly common and extremely problematic. No certificate means no relief, it’s that simple. The EIS3 form is essential for claiming enterprise investment scheme tax relief, as it is the official document required to support your claim with HMRC.

Incorrectly completing the additional information section on your tax return can trigger HMRC inquiries. It may even cause automatic rejection of your claim, and such errors can jeopardise your ability to claim tax relief.

Many investors fail to keep proof of share purchase and payment. This evidence becomes critical if HMRC questions your claim.

Not reporting disposal of EIS shares when required can lead to unexpected tax bills. It might also result in potential penalties down the line.

Qualification Misunderstandings That Invalidate Claims

Not all small businesses qualify for EIS. The company must meet HMRC’s risk-to-capital condition, meaning genuine risk and growth potential. It is also essential that the company carries out a qualifying trade and avoids joint ventures or similar arrangements that could affect eligibility for EIS relief.

Being connected to the company as a director disqualifies your claim. Owning more than 30% of shares (including family holdings) also makes you ineligible. Holding non EIS shares during certain periods can also impact your eligibility for EIS relief.

Investing in excluded activities won’t qualify, no matter how promising the business. These include property development, financial services, and energy generation.

When issuing SEIS and EIS shares, it is important to issue SEIS and EIS shares on separate dates and maintain proper records for both schemes to ensure compliance and eligibility for tax reliefs.

Many investors mistakenly believe they can invest in established companies. EIS is primarily for companies within their first 7 years (or 10 for knowledge-intensive businesses). When reviewing a business plan, it is important to understand the company intends to grow and comply with all SEIS and EIS requirements.

Timing Mistakes That Reduce Your Relief

Selling shares before the 3-year minimum holding period triggers a clawback of your tax relief. If you fail to meet the three year holding period, you may also have to pay capital gains tax and lose other reliefs. This is a common mistake during market volatility.

Receiving value from the company within the 3-year period can also invalidate your claim. This includes excessive dividends or discounted services.

Many investors misalign income tax claims with the correct tax year. This is especially problematic when using carry-back provisions. By adjusting your tax code or making timely claims, you may be able to receive tax relief sooner or even benefit from immediate income tax relief.

If your EIS investment fails, you may be able to claim loss relief against your income or capital gains.

Delaying investment until after a company becomes too established is risky. You might be investing in a company that no longer qualifies for EIS.

Final Thoughts

EIS tax relief offers fantastic benefits for investors willing to support growing businesses. However, the rules are strict and the paperwork unforgiving.

Keep meticulous records and verify a company's EIS advance assurance before investing. Submit your claims promptly to avoid missing crucial deadlines.

When in doubt, get professional advice before committing funds. Remember that HMRC won't remind you about claiming relief – it's entirely your responsibility.

Pie.tax: Simplifying EIS Tax Relief Claims

Navigating EIS tax relief shouldn't give you a headache. The UK's first personal tax app makes including your investments in your self-assessment straightforward.

Pie tax real-time tax calculations feature instantly shows how your EIS investments affect your overall tax position. This helps you make smarter decisions about when to invest and when to claim.

Curious to see how it works? Pop over to our website to explore how the UK's first personal tax app could transform your investment tax experience.

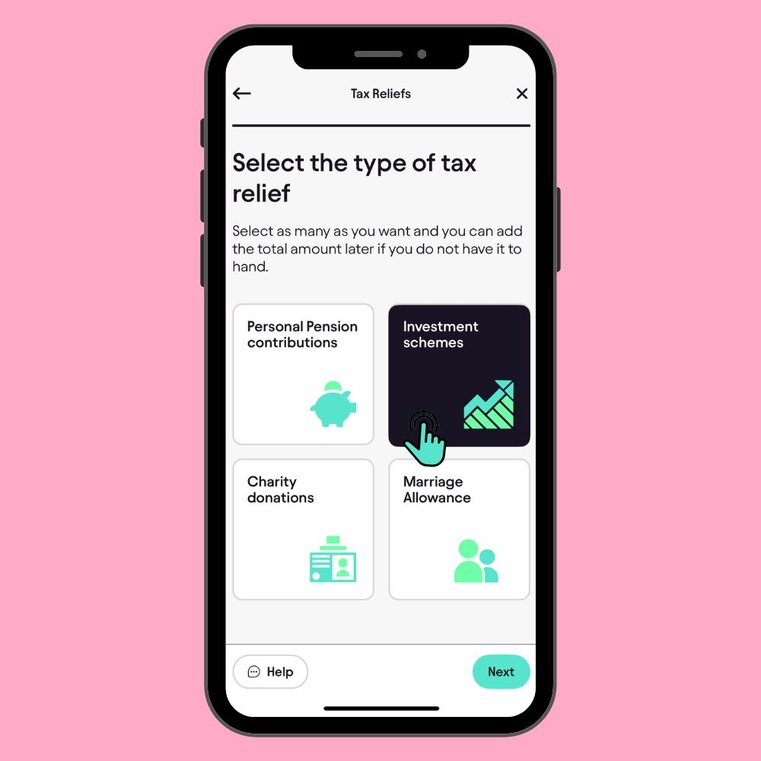

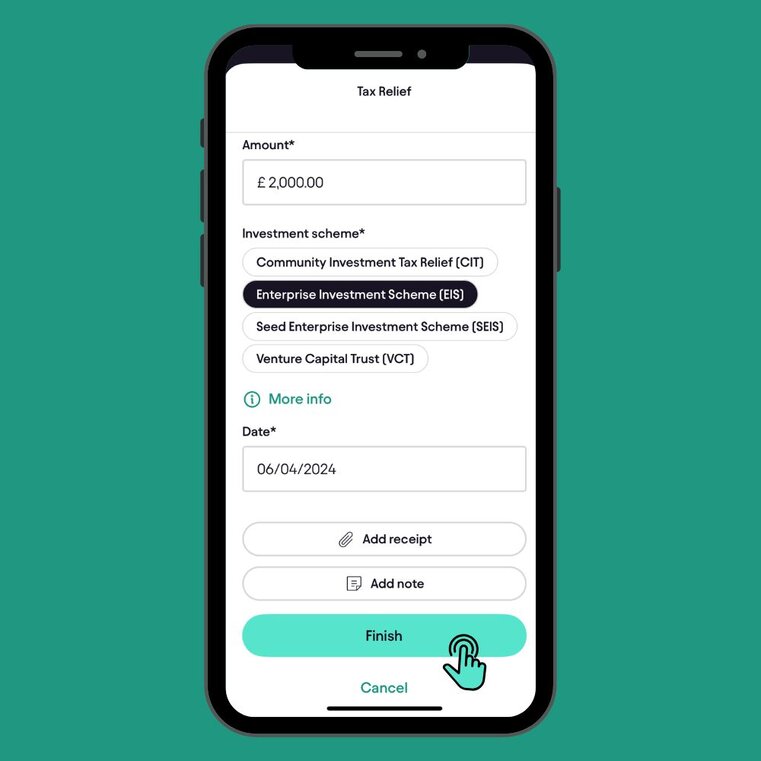

Quick and Easy Guide to Adding EIS Tax Relief in the Pie App

Follow these steps to add EIS tax Relief