Understanding Self Assessment Registration

Are you a taxpayer in the UK, puzzled about how to register for self assessment using your Government Gateway login? Worry not! We've got you covered with a comprehensive guide on how to complete this process with ease.

Understanding Self Assessment Registration

When you need to register for self assessment, it's crucial to understand the following components:

This is an essential online account that allows you to access various government services, including tax self assessment. Having this account is a prerequisite for registration.Government Gateway Account

This 10-digit number is issued by HMRC and is necessary for filing tax returns. You need to apply for it if you don’t have one already.Unique Taxpayer Reference (UTR)

Knowing the key deadlines for registration and submission can save you from penalties. Typically, you need to register by October 5th in the tax year after you’ve started your self-employment or require self assessment.Deadlines

How to Register for Self Assessment

Follow these steps to register for UK self assessment seamlessly:

Options for Registering

Option 1: Online Registration

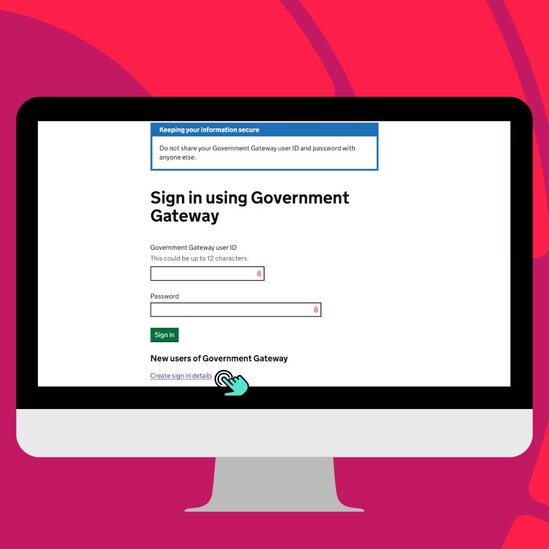

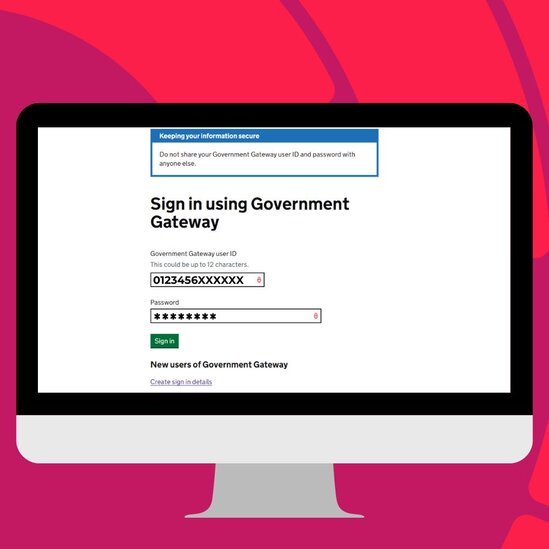

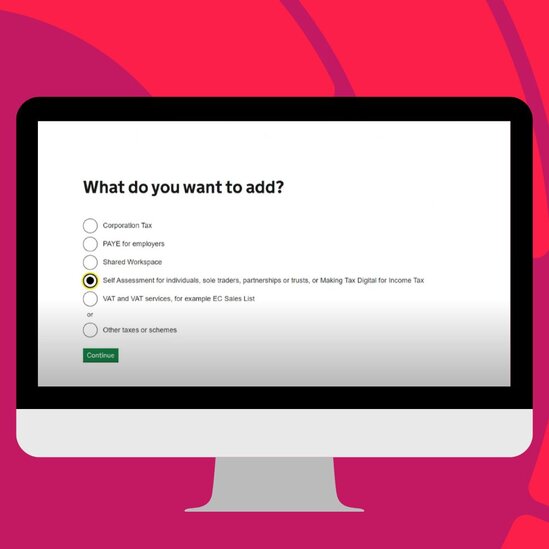

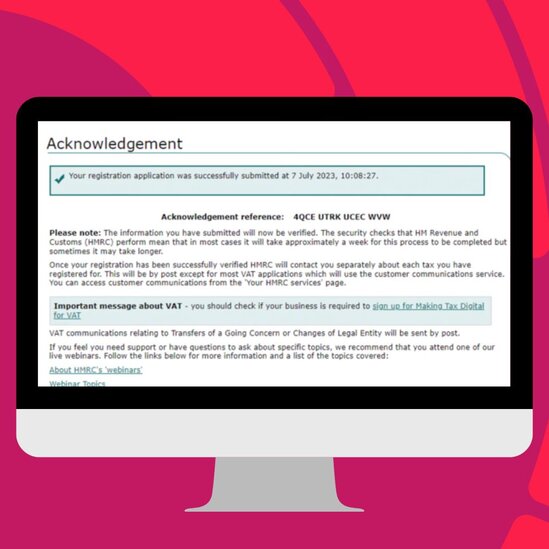

This is the most straightforward method. It involves filling out the registration form through the Government Gateway account online. The process is user-friendly and designed to guide you step-by-step. Additionally, you can save your progress and return to complete the form later if needed. Online registration also allows for instant submission and confirmation, reducing the waiting time compared to traditional methods.

Option 2: Paper Form

Alternatively, you can download, print, and post the necessary paper forms to HMRC. This method may take longer and is less efficient than online registration. However, it can be a good option if you prefer handling physical documents or if you encounter issues with online submission. Keep in mind that mailing the forms might result in delays, so plan accordingly to ensure your registration is completed on time.

Additional Considerations

Ensure you are eligible for self-assessment by checking the HMRC guidelines.Check Your Eligibility:

Maintain accurate records of your income and expenses throughout the year to facilitate smooth filingKeep Records:

If the process feels overwhelming, consider consulting a tax advisor.Seek Professional Help:

Expert Assistance with PIE Tax

Navigating self-assessment registration can be complex, but with PieTax, you have access to expert assistance and tools to guide you through the process. Our user-friendly software ensures you complete your registration accurately and timely.

Over 11 million individuals in the UK registered for self-assessment in the last tax year.

Approximately 700,000 self-assessment files were submitted late in the last tax year, incurring penalties.

Frequently Asked Questions

How long does it take to receive a UTR number?

It typically takes up to 10 working days to receive your UTR number after registering for self assessment.

Can I register for self assessment if I’m employed and self-employed?

Yes, you can and should register for self assessment if you have multiple sources of income.

What happens if I miss the registration deadline?

Missing the deadline may lead to penalties and interest on unpaid tax.

Can I submit my self assessment form online?

Yes, you can submit your self assessment form online via your Government Gateway account.

Do I need to register for self assessment if my earnings are below the personal allowance?

You still need to register if you have income that needs to be reported, but you may not owe any tax if your earnings are below the personal allowance.