Let’s Break This Down Together...

Choosing between EIS and VCT schemes can be confusing. Both offer tax benefits, but they work very differently.

This guide compares the key features of each scheme, including income tax relief, capital gains, dividends, and holding periods. You’ll also find tips on who each option is best suited for in 2025.

By the end, you’ll know which route suits your tax and investment goals – and how to make the most of the reliefs. Let’s dive in.

Introduction to Tax-Efficient Investments

Tax-efficient investments are a powerful way for UK investors to grow their wealth while reducing their tax burden. Schemes like the Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCTs) are specifically designed to encourage investment in small, high-growth businesses, often referred to as knowledge-intensive companies, by offering a range of valuable tax reliefs.

With the Enterprise Investment Scheme EIS, investors can claim income tax relief of up to 30% on investments in qualifying companies, making it an attractive option for those looking to offset their income tax bill. EIS also allows for capital gains tax deferral, so gains realised from other assets can be reinvested into EIS shares to postpone paying capital gains tax. For those seeking even greater tax benefits, the Seed Enterprise Investment Scheme (SEIS) offers up to 50% income tax relief on investments in very early-stage businesses.

Venture Capital Trusts, or VCTs, provide another route to tax-efficient investing. VCT schemes offer tax-free income through dividends and exemption from capital gains tax on profits from VCT shares. Many VCTs are listed on the London Stock Exchange, giving investors access to a diversified portfolio of early-stage companies and potentially reducing investment risk compared to investing in a single business.

These tax reliefs are designed to encourage investment in sectors that drive innovation and economic growth. However, the tax rules and qualifying status of companies can be complex, and the investment risk is higher than with more traditional assets. It’s essential for investors to understand the requirements and seek professional advice to ensure they benefit fully from the available tax reliefs.

What Are EIS and VCT Schemes?

The Enterprise Investment Scheme (EIS) allows you to invest directly in small, early-stage companies. An 'eis company' is a qualifying early-stage business eligible for EIS investment, and 'eis companies' are typically high-growth, innovative SMEs. In return, you get generous tax reliefs to offset the higher risks involved.

An 'eis investment' refers to investing in shares of EIS companies to benefit from tax incentives such as income tax relief and capital gains tax deferral. By investing in multiple EIS companies, you can build an 'eis portfolio' that targets high-growth potential while spreading risk.

VCTs are listed companies and a type of venture capital trust on the London Stock Exchange that pool investors’ money to build portfolios of small, growing businesses. The companies listed on the London Stock Exchange are the VCTs themselves, which then invest in a diversified portfolio of early-stage businesses.

VCTs invest in a range of small, high-growth companies to provide diversification and reduce risk. They work more like funds, offering instant diversification. Both schemes were created to help channel private investment into businesses that might struggle to secure traditional funding. They’ve been around since the 1990s but continue to evolve.

EIS vs VCT Checklist 2025: Key Tax Differences

Let’s compare the most important tax features for both schemes in 2025:

Income Tax Relief:

- EIS: 30% relief on investments up to £1 million yearly (or £2 million if investing in “knowledge-intensive” companies). The maximum investment that qualifies for income tax relief is £2 million per tax year for EIS.

- VCT: 30% relief on investments up to £200,000 per tax year. The maximum investment that qualifies for income tax relief is £200,000 per tax year for VCTs.

To qualify for relief, investors must purchase new shares in EIS and VCTs, not second-hand shares. EIS also allows you to carry back investments to the previous tax year for income tax relief.

Minimum Holding Period:

- EIS: at least three years to keep your tax relief

- VCT: at least five years to keep your tax relief

VCT shares must be held for five years to retain tax relief.

Capital Gains Tax:

- EIS: No CGT on profits when you sell shares held for at least three years. Plus, you can defer other capital gains by reinvesting them into EIS. Any gain on disposal of qualifying shares is exempt from capital gains tax if the holding period is met. EIS offers tax free growth on qualifying investments.

- VCT: No CGT on any profits when you sell your shares, provided you have held them for at least five years. Any gain on disposal of qualifying shares is exempt from capital gains tax if the holding period is met. VCTs also offer tax free growth on qualifying investments.

Dividends:

- EIS: Taxed as normal

- VCT: Completely tax-free with no upper limit. Dividends received from VCT shares are tax-free and do not need to be included in your tax return.

Loss Relief:

- EIS: If investments fail, you can offset losses against income tax or capital gains

- VCT: No loss relief available

Please note: Tax reliefs depend on maintaining the qualifying status of the investment. Tax treatment and tax treatment depends on your individual circumstances and current legislation.

Risk and Liquidity Considerations

EIS investments typically carry higher risk as you’re investing directly in single companies. These are considered high risk investments, and the value of your investment can fall to zero if the company fails. If the company fails, you could lose your entire investment.

VCTs spread risk across multiple companies, but their overall performance can still be volatile. The built-in diversification offers some cushioning against individual company failures. The net return from VCTs depends on the performance of the underlying companies and the amount invested.

When it comes to getting your money back, VCTs have a clear advantage. As listed companies, you can sell your shares on the market (though often at a discount).

EIS shares are typically locked up until the company is sold or listed. This could take many years, with no guaranteed exit. The timing of when you have invested can affect your eligibility for tax reliefs and liquidity options.

Who Should Choose EIS in 2025?

EIS might be right for you if you have significant income tax liability to offset. Individuals investing in EIS can benefit from a range of tax reliefs, including income tax relief, capital gains deferral, and inheritance tax advantages. The government introduced EIS to encourage investment in innovative businesses and continues to support the scheme through ongoing policy updates.

You should be comfortable with higher risk and illiquidity. The investor must meet certain eligibility criteria, and anyone who invests in EIS should be aware of the associated risks. Many investors use EIS as part of their year-end tax planning.

I once advised a client who had sold his business and faced a substantial capital gains bill. By investing 50% of the proceeds into EIS, he deferred the tax and eventually paid much less. When selling EIS shares, there are specific tax implications to consider, including potential relief or loss recovery. Certain events, such as death, do not give rise to a withdrawal of tax relief, so benefits may remain intact.

EIS also works well for inheritance tax planning, as shares qualify for Business Relief after just 2 years.

Who Should Choose VCTs in 2025?

VCTs might suit you better if you want tax-free income through dividends. A VCT investment provides tax-free dividends and capital gains. They offer built-in diversification and better liquidity than EIS investments.

The VCT scheme is designed to encourage investment in early-stage companies through tax incentives. They appeal to investors approaching or in retirement who want tax-efficient income streams. The tax-free dividend aspect can be particularly valuable.

Dividends received from VCTs are exempt from income tax, making them especially attractive for those seeking tax-free returns.

VCTs are also ideal if you prefer a more hands-off investment approach. Fund managers handle all the selection and monitoring of portfolio companies.

Practical Considerations for 2025

Both schemes have specific rules about eligible companies. These rules have tightened in recent years, focusing on genuine growth businesses.

The earlier stage focus means both EIS and VCT investments now typically carry more risk than before. The tax reliefs are generous precisely because of this risk.

For the 2025 tax year, both schemes remain under Treasury review. While no major changes are currently announced, staying informed is essential.

Remember that tax benefits should never be the only reason for investing. The underlying business case must make sense too.

Final Thoughts

When choosing between EIS and VCT investments, consider your broader financial situation. Your tax position, risk tolerance, and liquidity needs all matter.

EIS offers more flexible tax reliefs and inheritance tax benefits but with higher risk.

VCTs provide tax-free dividends and better liquidity but with less flexibility on timing.

Many sophisticated investors use both schemes as part of a balanced approach. This creates a complementary strategy that maximises different tax benefits. Always chat with a qualified tax advisor before making decisions. The rules can be complex and personal circumstances vary greatly.

Pie.tax: Simplifying EIS vs VCT Checklist 2025 Tax

Keeping track of your EIS and VCT investments doesn't need to be complicated. Pie tax helps you monitor tax reliefs, holding periods, and how these investments affect your overall tax position.

Our smart dashboard shows exactly how much income tax you've saved. We'll even remind you when your minimum holding periods are approaching.

For investors juggling multiple tax reliefs, Pie tax automatically calculates how everything fits together. No more spreadsheets or wondering if you've maximised your allowances.

The UK's first personal tax app makes it simple to see your investment tax impact in real-time. We highlight opportunities you might miss when planning your next tax year.

Fancy seeing how it works? Explore the Pie tax app to discover how we can simplify your investment tax planning.

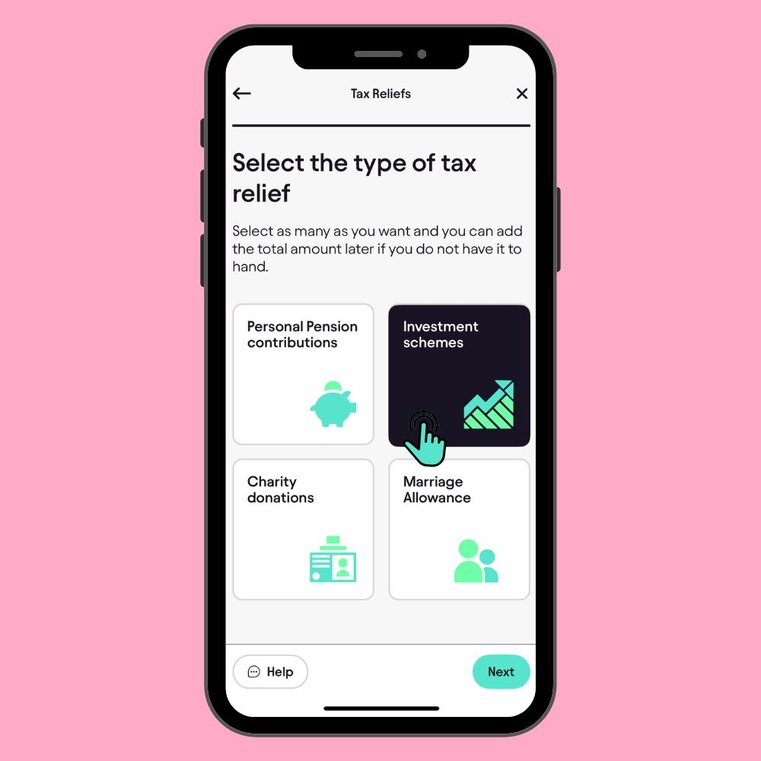

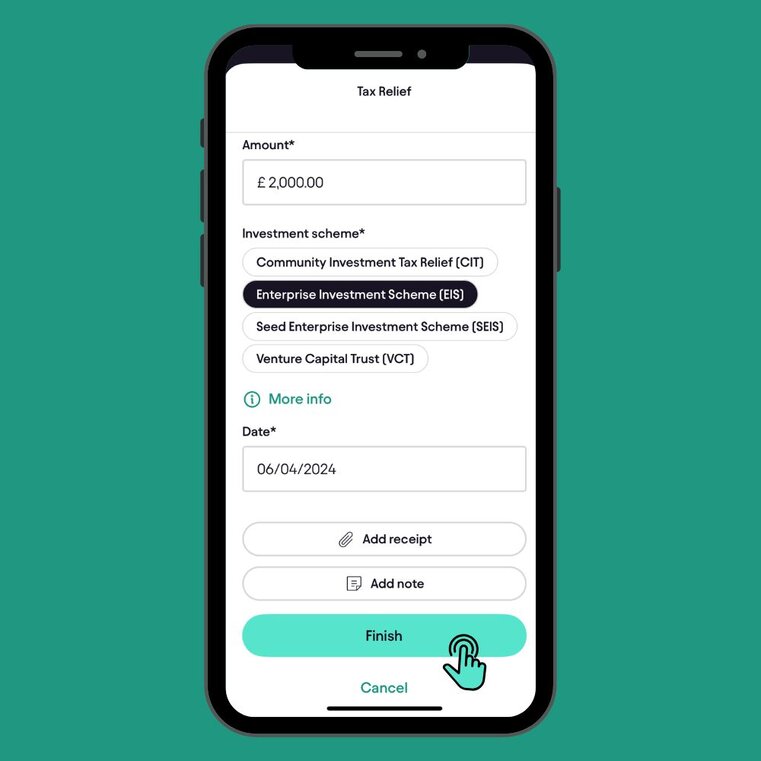

Quick and Easy Guide to Adding EIS Tax Relief in the Pie App

Follow these steps to add EIS tax Relief