Let’s Break This Down Together...

Thinking about investing and wondering how to make the most of your money? The Enterprise Investment Scheme (EIS) could be your new best friend. It’s packed with generous tax perks, but let’s be honest, the jargon can be a bit of a minefield. That’s where we come in.

We’re here to break it down clearly and calmly, so you can back brilliant UK businesses and claim what you’re owed with confidence. Whether you’re just getting started or you’ve already dipped your toes in, this step-by-step guide will help you navigate EIS tax relief like a pro.

Introduction

The Enterprise Investment Scheme (EIS) offers some of the most generous tax reliefs available to UK investors. Yet many people find the rules confusing and miss out on significant benefits.The EIS is a government backed initiative supported by the UK government to encourage investment in early-stage businesses. Understanding EIS doesn’t need to be complicated.

With the right approach, you can claim up to 30% income tax relief while backing early stage businesses that need your support. The Enterprise Investment Scheme (EIS) is designed for private individuals investing in growing companies, and timing is key.

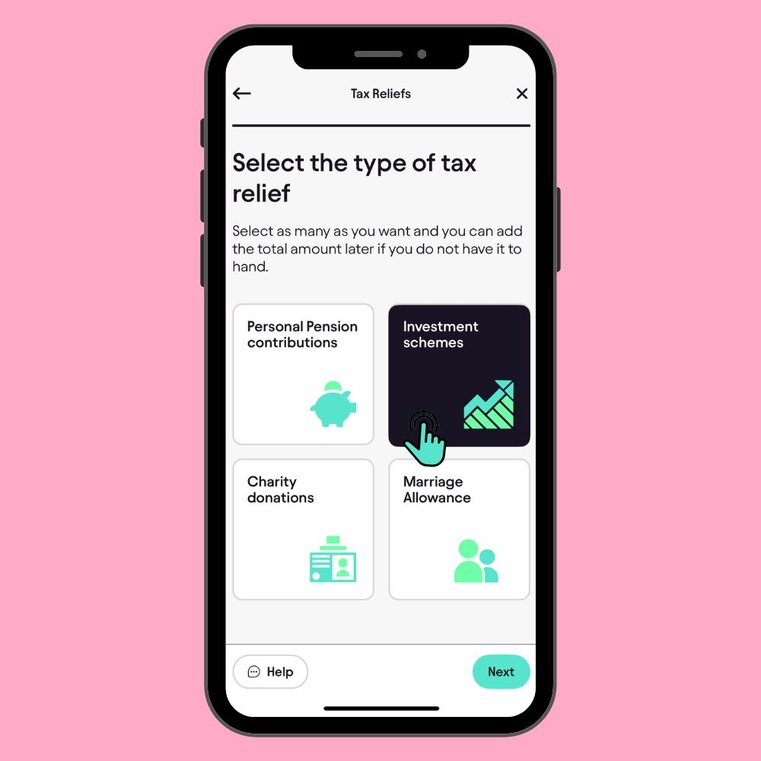

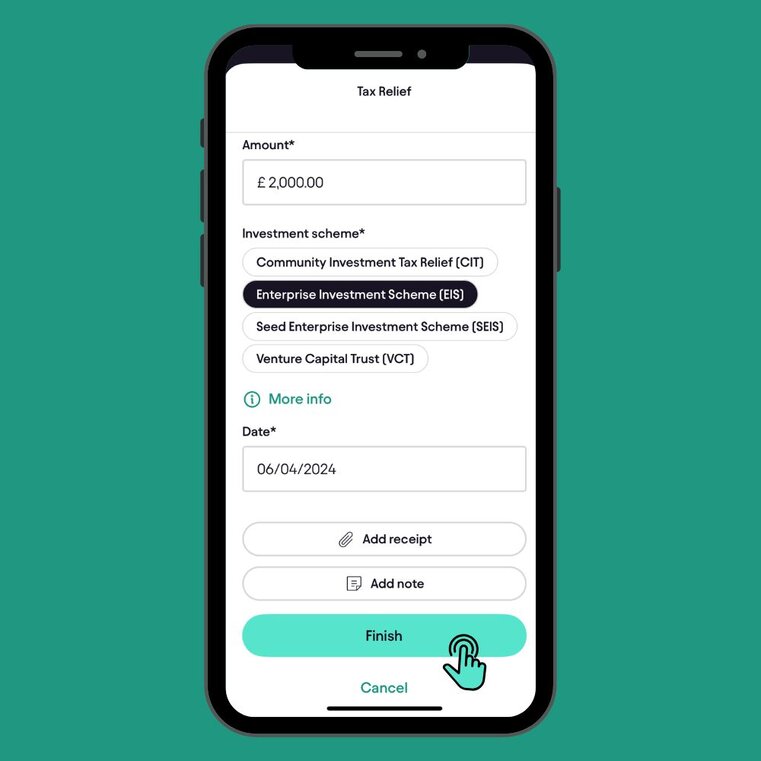

If you’ve invested through EIS, you can enter your investment details directly in the Pie app and claim the relief through your tax return. The app guides you through each step, so you don’t miss out on what you’re entitled to.

What is the Enterprise Investment Scheme?

The Enterprise Investment Scheme is a venture capital scheme and a government programme designed to help small businesses and companies in their early stages raise money.

It offers tax reliefs to investors who buy new shares in these companies. The headline attraction is 30% income tax relief on investments up to £1 million per tax year. This can increase to £2 million if you’re investing in a knowledge-intensive company.

The scheme is designed for companies carrying out qualifying trades, and knowledge intensive companies may qualify for higher investment limits. If you invest £10,000 in an EIS-qualifying company, you could reduce your income tax bill by £3,000.

That’s a significant saving right from the start. A company's eligibility for EIS depends on factors such as the timing of its first commercial sale, any previous investment, and when it received investment.You’ll also pay no Capital Gains Tax on profits when you sell your shares after three years. Plus, there’s inheritance tax relief and the ability to offset losses against income tax. EIS is part of the broader venture capital landscape in the UK.

Advance Assurance: Why It Matters Before You Invest

Advance assurance is a vital part of the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) process, especially for companies looking to attract new investors. Essentially, advance assurance is confirmation from HMRC that your company is likely to qualify for the investment scheme before you start raising money.

This gives potential investors confidence that their investment should be eligible for valuable tax reliefs under the enterprise investment scheme EIS or SEIS. To apply for advance assurance, your company will need to submit detailed information to HMRC, including a comprehensive business plan, financial forecasts, and the amount of investment you hope to raise.

This upfront preparation not only demonstrates your company’s readiness but also reassures investors that you meet the strict requirements of the investment scheme. For early stage companies, securing advance assurance can make a significant difference in attracting investment, as it removes much of the uncertainty for investors who want to claim tax relief.

In short, advance assurance is a powerful tool to boost your company’s credibility and make your investment opportunity more appealing to both new and experienced investors.

How to Use the Enterprise Investment Scheme: A Step-by-Step Guide

Step 1: Check if you're eligible as an investor

You can’t claim EIS relief if you’re “connected” to the company. Only eligible investors can claim EIS relief, which means you must not own more than 30% of the shares, be an employee, or otherwise meet the specific criteria set out for eligible investors.

Directors can sometimes qualify, but there are strict rules. You also need enough income tax liability to offset against your EIS relief. Remember, you can only reduce your tax bill to zero, not get a refund. This is something I learned the hard way when I first invested in an EIS company years ago.

Step 2: Find qualifying EIS companies

Look for companies that have received “advance assurance” from HMRC. This confirms the investment should qualify for EIS relief.

Many companies raise funds through EIS investment platforms or crowdfunding sites. These often pre-screen businesses to ensure they meet EIS requirements. The company's eligibility also depends on carrying out qualifying trades and not exceeding certain ownership or funding limits.

The company must be relatively small with fewer than 250 employees. Their gross assets must be under £15 million before your investment. The timing of the company's first commercial sale is also an important factor in determining EIS eligibility.

Step 3: Make your investment

When you’re ready to invest, you’ll need to buy new ordinary shares directly from the company. Buying existing shares from another investor won’t qualify for EIS relief. The ordinary shares must be fully paid and meet EIS requirements.

Keep all paperwork related to your investment. You’ll need proof of the date and amount of your initial investment, as well as documentation of when the company received investment, to ensure EIS compliance. The minimum investment period is three years. Plan your finances accordingly before committing your money.

Step 4: Wait for your EIS3 certificate

After you’ve invested, the company must submit an EIS1 form to HMRC. If approved, HMRC will issue EIS3 certificates, also known as EIS certificates or compliance certificates, to the company to pass on to you.

This process typically takes 2-3 months, though it can sometimes take longer. The certificate includes a unique investment reference, which you will need when claiming your tax relief. You can’t claim your tax relief without this certificate. Some companies are more efficient than others at handling this paperwork. It’s worth asking about their track record before investing.

Step 5: Claim your tax relief

Once you have your EIS3 certificate, you can claim your income tax relief. Most people do this through their Self Assessment tax return. In some cases, such as when claiming deferral relief or loss relief, you may need to complete a claim form and submit it to HMRC along with your EIS certificates. You can claim relief for the tax year in which you made the investment.

Alternatively, you can carry it back to the previous tax year if that’s more beneficial. Additional tax benefits available through EIS include deferral relief, which allows you to defer capital gains tax by completing the relevant claim form, and loss relief, which lets you offset investment losses against your income tax to reduce your overall tax liability. You have up to five years after the 31 January following the tax year of your investment to claim the relief. Don’t leave it too late.

Step 6: Hold your investment for at least three years

To keep your tax reliefs, you must hold your EIS shares for at least three years. This period starts from the date of issue or when the company started trading, if later.

If you sell before this time, HMRC will claw back the income tax relief you received. The three-year clock starts ticking from different points depending on circumstances. Be prepared for the long-term nature of these investments. They're not suitable if you might need quick access to your money.

Common EIS Pitfalls to Avoid

Not all small companies qualify for EIS. Certain activities are excluded, such as property development, farming, hotels, and financial services. Timing matters for capital gains tax deferral. If you want to use EIS to defer a recent gain, you must make your EIS investment within three years.

Also, your previous investment history can affect eligibility for EIS relief, as certain rules apply to companies that have already received investment under similar schemes. HMRC won’t approve EIS status if they think the main purpose is tax avoidance rather than genuine business growth.

This is called the “risk to capital” condition, and securing SEIS/EIS advance assurance often involves direct interaction with HM Revenue & Customs (HMRC).

Be wary of becoming “connected” to the company after investing. Taking a job there or increasing your shareholding above 30% could invalidate your relief. This information is for general guidance only and does not constitute tax advice. For personalised advice, consult HM Revenue or a qualified professional.

Final Thoughts

The Enterprise Investment Scheme offers fantastic tax benefits that can significantly boost your investment returns. It also supports innovative UK businesses that might otherwise struggle to find funding. There are rules to follow and paperwork to complete. But with careful planning, the tax advantages make it worthwhile for many investors.

Always consider seeking professional advice before making EIS investments. Everyone's tax situation is different, and the rules do change occasionally. Remember that these investments are high-risk by nature. The tax reliefs help offset this risk, but you should be prepared to lose money if the company fails.

Simplifying Enterprise Investment Scheme Step-by-Step Guide Tax

Keeping track of your EIS investments and their tax benefits shouldn’t give you a headache and with Pie, it doesn’t. The UK’s first personal tax app makes it simple. No more manual calculations or second-guessing what you’re entitled to.

When tax return season rolls around, your EIS information is already organised and ready to go. Just a few clicks, and your EIS claims are submitted properly to HMRC. Curious how much easier EIS tax management could be? Take a look at the Pie app and discover a clearer, calmer way to handle your tax.

Quick and Easy Guide to Adding EIS Tax Relief in the Pie App

Follow these steps to add EIS tax Relief