What you need to know...

Investing in Enterprise Investment Scheme (EIS) companies offers some of the most generous tax incentives available to UK investors. These government-backed schemes provide multiple tax reliefs designed to encourage investment in early-stage, higher-risk companies.

Over 53,000 companies have received investment through the EIS, helping to drive growth, job creation, and innovation across the UK. The scheme continues to support the next generation of UK businesses, with many portfolio companies benefiting from hands-on involvement and ongoing support to scale and succeed.

EIS investments can reduce your income tax bill, defer capital gains, and potentially deliver tax-free growth. Individual investors can participate in EIS opportunities directly or through syndicates and angel networks, pooling resources to fund EIS-eligible companies and benefit from the scheme’s tax advantages. Understanding the qualifying criteria and compliance requirements is essential to maximise these substantial benefits.

Pie tax, the UK’s first personal tax app, helps track your EIS investments and alerts you when it’s time to claim reliefs. Or if you’re just here to get to grips with it all, let’s break it down!

Introduction to the Enterprise Investment Scheme (EIS)

The Enterprise Investment Scheme (EIS) is a cornerstone of the UK government’s strategy to encourage investment in early-stage, high-risk companies with strong growth potential. Launched in 1994, the EIS was designed to help innovative businesses access the capital they need to grow, while offering investors a suite of generous tax benefits in return for taking on higher risk.

By investing in EIS-eligible companies, individuals can access a range of tax reliefs, including income tax relief, capital gains tax exemption, and inheritance tax relief. These incentives are specifically structured to make supporting early-stage companies more attractive, helping to fuel innovation and economic growth across the UK. The scheme has already helped over 53,000 companies receive investment, demonstrating its vital role in supporting the next generation of UK businesses.

For investors, the EIS offers a compelling combination of potential high returns and significant tax benefits. Whether you’re looking to reduce your income tax bill, shelter capital gains, or plan for inheritance tax, the EIS provides a flexible and rewarding way to invest in the future of British enterprise.

What tax benefits do EIS investments offer?

When you invest in EIS-qualifying companies, you unlock several valuable tax advantages. These benefits can significantly improve your overall returns, even accounting for the higher risk profile.

The headline benefit is 30% income tax relief on investments up to £1 million per tax year. This limit increases to £2 million if you’re investing in knowledge-intensive companies. You can also enjoy tax-free growth on your investment if you hold the shares for at least three years. This means no capital gains tax on any profits when you eventually sell.

If your EIS shares are eventually sold at a loss, you can benefit from loss relief by offsetting the loss against either income tax or capital gains tax. This provides valuable downside protection that isn’t available with most investments.

And if you’ve recently sold another asset at a profit, investing in EIS can let you defer that capital gains tax liability. The tax only becomes due when you sell your EIS shares. To claim EIS relief, you must follow the correct process and submit the necessary forms to HMRC, ensuring you meet all eligibility requirements. Tax reliefs depend on your individual circumstances, such as your personal tax situation and how long you hold the investment. Tax rules may change, which can affect your eligibility and the level of benefits you receive.

What exactly are EIS companies?

EIS companies are small, unlisted UK businesses that meet specific criteria set by HMRC. To achieve EIS eligibility, companies qualify by being unlisted, having a limited number of employees and assets, operating in eligible sectors, and meeting age requirements. EIS eligibility means the company can offer tax-advantaged investments to qualifying investors under the scheme, provided it continues to meet these criteria.

These companies must conduct a qualifying trade most business activities are eligible. However, certain sectors like financial services, property development, and energy generation are excluded. Investors must purchase EIS qualifying shares to access the tax benefits associated with the scheme. The company can’t have been trading for more than seven years (or ten years for knowledge-intensive companies). This ensures the scheme supports genuinely early-stage businesses.

The maximum a company can raise through EIS is £5 million per year and £12 million in its lifetime. Knowledge-intensive companies benefit from higher limits to support research-heavy ventures. Companies raise funding through EIS by issuing new shares to investors and must follow a specific process to ensure compliance with EIS rules.

EIS investments often target early stage technology companies, as these businesses have high growth potential and are well-suited to the scheme. Some EIS funds may also consider company revenue as a factor, sometimes requiring a minimum revenue threshold, and there is typically no minimum investment required for EIS eligibility, though individual funds may set their own minimums. Strong management teams are a key consideration for EIS companies, as experienced leadership increases the likelihood of business success and investor returns.

How to claim your EIS tax relief

Claiming your EIS tax reliefs is straightforward but requires some paperwork and timing awareness. I once missed claiming relief for a year because I misplaced my EIS3 certificate, a mistake I won't repeat! After investing, you'll need to wait until the company sends you an EIS3 certificate. This typically arrives after they've been trading for at least four months post-investment.

You can claim the relief via your self-assessment tax return or by writing directly to HMRC. The claim forms are attached to your EIS3 certificate for convenience. Claims can be made up to five years after the 31 January following the tax year of the investment. This gives you plenty of time to sort out your paperwork.

Remember that you can carry back income tax relief to the previous tax year. This is particularly useful if you had a higher tax liability then or want to maximise relief.

Avoiding common EIS pitfalls

Being aware of the rules around "connected persons" is crucial for successful EIS investing. If you're connected to the company as a director or substantial shareholder, you may not qualify for some reliefs. Your tax relief will be withdrawn if the company ceases to qualify within three years of investment. This makes due diligence on the company's plans and compliance essential.

An Advance Assurance from HMRC doesn't guarantee final approval for EIS status. Companies must still meet all conditions throughout the relevant holding period. Be wary of EIS investments that focus more on the tax benefits than on the underlying business potential. The best investments combine both tax efficiency and genuine growth prospects.

Keep detailed records of all your EIS investments, certificates, and claim dates. HMRC may ask for evidence several years after your investment during routine checks.

Final Thoughts

EIS investments offer a powerful combination of tax efficiency and growth potential. This makes them an attractive option for many UK investors looking to diversify their portfolios. While the tax benefits are substantial, they should always be considered alongside the inherent risks. Early-stage companies have high failure rates, even with the best management teams.

Remember that rules can change with government policy, so staying informed is essential. Regular reviews of the latest HMRC guidance will help protect your position. With careful selection and proper tax planning, EIS investments can form a valuable part of a diversified strategy. They're particularly useful for higher-rate taxpayers seeking tax-efficient growth.

Pie tax: Simplifying EIS Investment Tax

Keeping track of your EIS investments doesn't need to be complicated with the right tools at your fingertips. Pie tax was designed specifically to solve the headaches of managing tax-efficient investments. Our smart dashboard shows you exactly how much tax you're saving and when you need to take action. You'll never miss a deadline or forget about an investment again.

Pie tax securely stores all your EIS certificates in one place, accessible whenever you need them. No more hunting through filing cabinets or email folders at tax return time. Why not explore how the Pie tax app could simplify your EIS tax management and help maximise your investment returns?

Quick and Easy Guide to Adding EIS Tax Relief in the Pie App

Follow these steps to add EIS tax Relief and track your real time tax figures

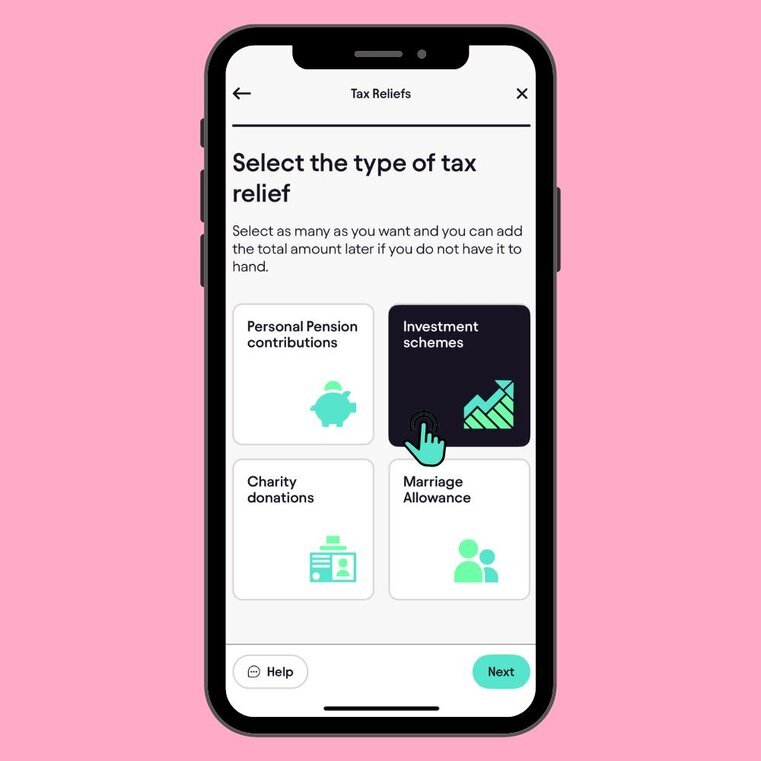

To add EIS tax relief, simply tap on 'Quick Add' on the home screen on the Pie App. Select the specific investment scheme you want to claim.Step 1

Once you’ve added all the information, you can view your real-time tax figures on the "Homepage" of the Pie App. Step 2