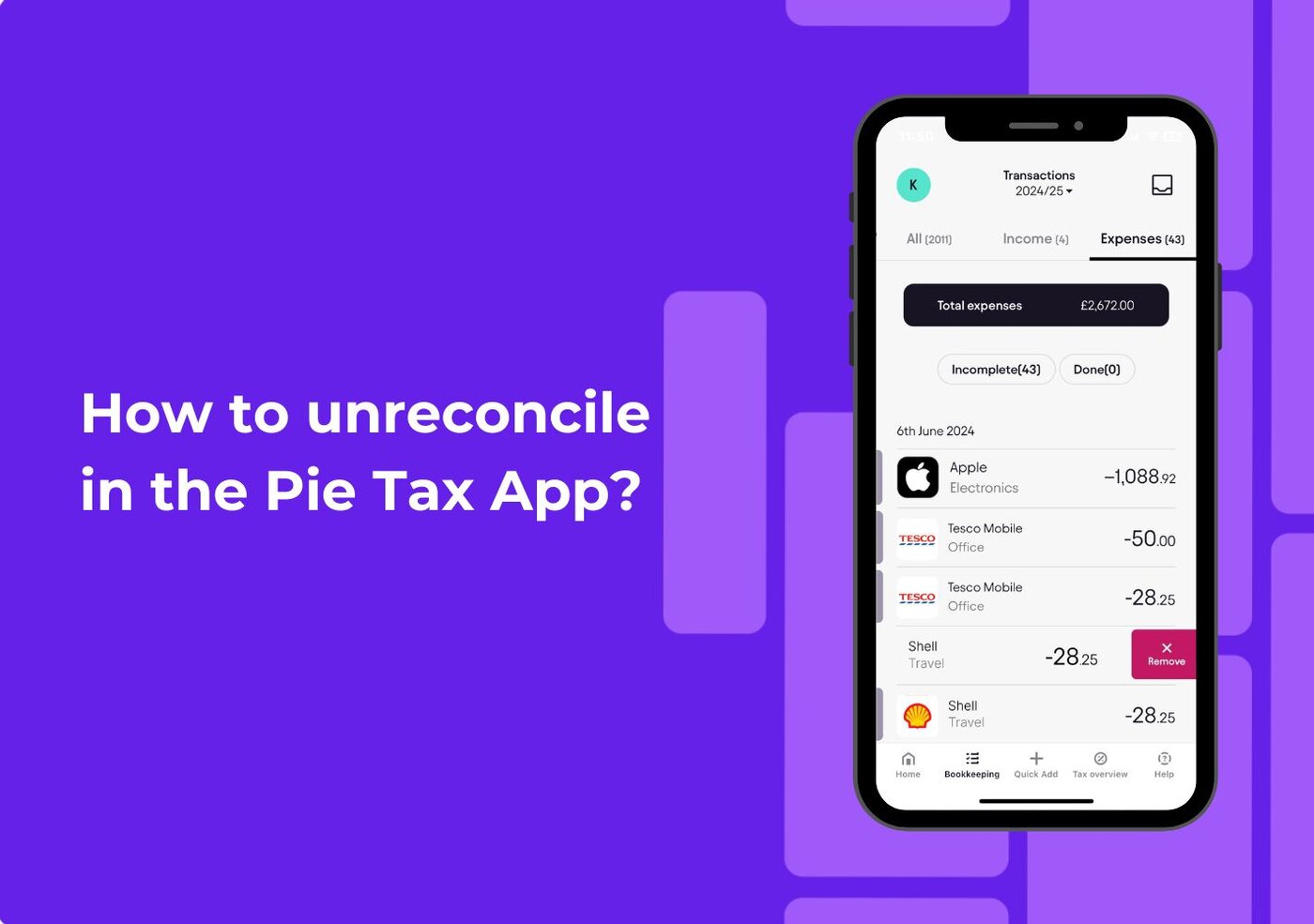

A Simple Guide to Removing Income or Expense Entries

Keeping your bookkeeping clean is one of the easiest ways to stay in control of your tax life. Whether you’ve added something by mistake or simply need to tidy up your records, deleting an entry in the Pie Tax App is simple, fast, and stress-free. Here’s exactly how to do it step-by-step.

Your Step-by-Step Guide

Open the Pie Tax App and navigate to the "Bookkeeping" section, which you’ll find on the navigation bar on your home screen.Go to the Bookkeeping Section

Once you're in the Bookkeeping section, select either the Income or Expenses tab, depending on the type of Income or Expenses entry you wish to delete.Choose Income or Expenses Tab

If you're removing an income entry, tap on the Income tab. Scroll through the list to locate the entry you’ve added. Once found, swipe left on the entry to reveal a red button marked ‘Remove’. Tap it and confirm by selecting Yes when the pop-up notification appears.Deleting Income Entries

Once you’ve deleted the entry, take a moment to review your records to ensure everything is accurate. This will help you stay compliant and maintain a clean, up-to-date record for your self-assessment.Review and Confirm

Troubleshooting Common Issues

Sometimes, issues can arise during the process. Here are some common problems and solutions:

Ensure you're in the correct Income or Expenses tab, and double-check the date of the entry to locate it.Can't Find the Entry?

Fully swipe left on the entry until the red Remove button appears. Restart the app if needed and try again.Delete Button Not Appearing?

If the entry doesn't delete after confirmation, refresh the app and verify that the entry has been removed from your records.Entry Not Deleting?

Frequently Asked Questions

Can I undelete a transaction once it’s been removed?

At the moment, deleted entries can’t be restored. Double-check before confirming to make sure you’re removing the correct one.

Does deleting a transaction affect my tax projection?

Yes, your tax projection updates automatically based on your income and expenses. Removing an entry means your projection will adjust accordingly.

Can I delete both income and expense entries?

Yes, you can delete both income and expense entries, including mileage, by following the same steps in their respective tabs.

Why won’t the entry delete after I confirm?

If the entry doesn’t delete, try refreshing the app and verify that the entry has been removed from your records.

Do I need to delete incorrect entries before submitting my self-assessment?

It’s strongly recommended. Accurate bookkeeping leads to a correct tax return, helps you stay compliant, and avoids any unwanted surprises later.