How to Enter Your Child Benefit Figures in the Pie Tax App

Managing your Child Benefit figures accurately is crucial when it comes to self-assessment and tax reporting in the UK. With the Pie Tax App, you can easily add and update your Child Benefit information, ensuring that all your financial records are precise and up-to-date. This not only helps you maintain compliance with HMRC regulations but also prevents potential penalties for non-disclosure. In this guide, we will walk you through the simple steps to enter your Child Benefit figures into the Pie Tax App.

From accessing the app's profile settings to updating your income accounts, we'll ensure you have all the information you need to declare your Child Benefits correctly and confidently.

Your Step-by-step Guide

Managing your Child Benefit figures accurately in the Pie Tax App is essential for your self-assessment tax submissions to HMRC. This guide will walk you through each step to ensure your Child Benefits are correctly recorded and reported.

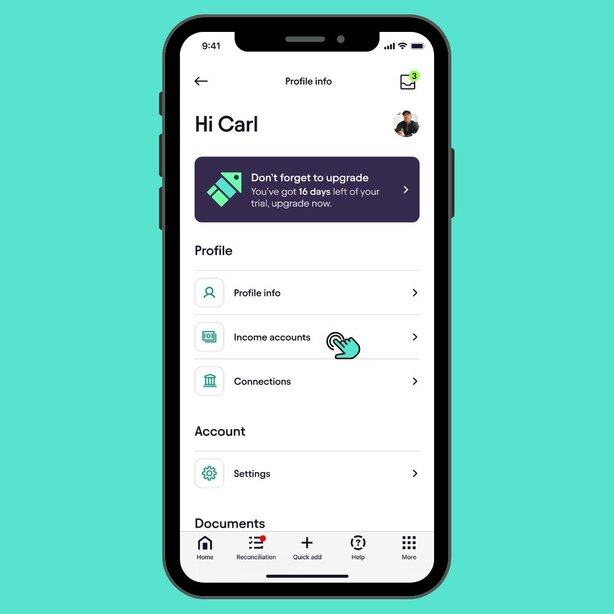

Launch the Pie Tax App on your device. Once the app is open, tap the avatar icon located in the top left corner of the screen to access your profile.Open the App and Access Your Profile

Within your profile settings, find and tap on ‘Income Accounts’ to view and manage all your income sources.Navigate to Income Accounts

Scroll down until you find the ‘Benefits’ section. Tap on ‘Add Child Benefit’ to start entering your Child Benefit details.Add Child Benefit

You’ll be asked, “Are you receiving Child Benefits?” Select ‘Yes’ if you are currently receiving Child Benefits, or ‘No’ if you are not. If you select 'No,' you can skip the rest of the steps.Confirm Receipt of Child Benefits

Enter the number of children for whom you are receiving benefits. This information is crucial for calculating the total benefit amount.Enter Number of Children Receiving Benefits

On the next page, input the total amount of Child Benefit you have received for the current year. Ensure this figure is accurate to avoid discrepancies in your tax report.Input Total Child Benefit Received

Your newly added benefit will be listed in the income accounts section as successful. This will help you view your real-time tax figures and prepare your submission to HMRC.Success Confirmation

Key Benefits of Adding Child Benefits

Ensure accurate self-assessment by entering Child Benefit figures to avoid HMRC penalties.Accurate Tax Reporting

Add Child Benefits for up-to-date records and real-time tax figures.Real-Time Financial Overview

Declare your Child Benefits easily to comply with HMRC requirements.Easy HMRC Compliance

Frequently Asked Questions

How do I add my Child Benefit figures in the Pie Tax App?

Open the app, go to your profile, tap ‘Income Accounts,’ and then select ‘Add Child Benefit.’

Why is it important to enter my Child Benefit figures accurately?

Accurate figures help avoid HMRC penalties and ensure proper tax reporting.

What happens if I don’t declare my Child Benefits to HMRC?

You may face penalties for non-disclosure if you don’t declare your Child Benefits.

How much is the Child Benefit amount per child?

You get £24 a week for your first child and £15.90 a week for each additional child

Can I skip entering Child Benefits if I’m not receiving any?

Yes, simply select ‘No’ when asked if you receive Child Benefits, and skip the remaining steps.