Let’s Break This Down Together...

Sorting out SEIS tax relief can feel confusing. You might be wondering how it works, what you’re eligible for, or where to even start.

This guide walks you through the essentials, from how SEIS works and who qualifies, to how founders can claim relief the right way. We’ll also cover key deadlines, HMRC forms, and the impact on your future tax bill. It’s everything you need to understand SEIS in plain English, with none of the tax jargon. Let’s dive in and make it simple.

SEIS Tax Relief for Startup Founders UK 2025: What's It All About?

SEIS offers tax incentives to investors who purchase shares in early-stage startups. Investors can claim up to 50% income tax relief on investments up to £200,000, making your business an attractive proposition.

The key benefits of SEIS include reducing investor risk, supporting startup growth, and making it easier for companies to secure funding. SEIS also encourages private investment by offering attractive tax incentives. Companies can raise up to £250,000 in total funds raised under SEIS in 2025, providing crucial early funding.

This capital injection can be transformative when you’re still developing your product or service. SEIS funding can drive the company's growth by enabling strategic hires, product development, or marketing initiatives.

Qualifying businesses must be under 3 years old with assets below £350,000, and SEIS shares must not carry special rights to the company's assets to qualify, perfect for genuine startups. These parameters ensure the scheme benefits those who need it most. It is important to confirm the company's eligibility for SEIS before seeking investment to ensure compliance and maximize the benefits of the scheme.

Why founders love the Seed Enterprise Investment Scheme (SEIS) in 2025

SEIS makes your startup significantly more attractive to potential investors, especially private investors seeking tax-efficient opportunities. They love tax breaks almost as much as exciting business ideas.

It creates opportunity to raise essential seed capital when you need it most. Those challenging early stages become slightly less daunting with SEIS in your toolkit. Investors pay no capital gains tax on shares held for at least 3 years. This additional layer of appeal can tip the scales in your favour during funding conversations.

They can also claim reinvestment relief when rolling over previous gains. Loss relief provides additional security, making even risky, at risk investment more palatable. If the company fails, SEIS investors can offset losses from their at risk investment against their income tax, helping to recoup part of the investment.

This risk mitigation is a key reason SEIS investors are drawn to early-stage startups. All these investor benefits translate to one big founder benefit: easier fundraising!

Who can actually use SEIS income tax relief?

Your company must be UK-based with a permanent establishment here. Only qualifying companies can access SEIS benefits, no offshore structures allowed if you want to qualify.

You need to have been trading for less than 3 years at the time of share issue. SEIS eligible businesses must meet this trading age requirement, as SEIS is truly designed for startups in their infancy. Your team must be small, fewer than 25 employees at the time of investment. This reinforces the scheme’s focus on early-stage ventures.

Gross assets cannot exceed £350,000 before investment. SEIS eligible companies must not exceed this threshold, which keeps the focus squarely on genuine startups rather than established businesses.

Most trades qualify, with some exceptions like property development and financial services. I once advised a founder who nearly lost eligibility after pivoting towards property tech - a careful restructure saved their SEIS status.

SEIS vs EIS: Spot the differences

When comparing the Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS), it's important to understand how each enterprise investment scheme eis supports UK startups at different stages. SEIS and EIS are both UK government-backed venture capital schemes designed to support startups.

SEIS offers 50% income tax relief compared to EIS’s 30%. This higher rate reflects the greater risk associated with very young companies. The SEIS investment limit is £250,000 versus a much higher £5 million for EIS, which allows for larger funding rounds as companies scale. This aligns with the typical funding needs at different growth stages.

Your company age limit is 3 years for SEIS versus 7 years for EIS. This timeline reinforces SEIS’s focus on nascent businesses. The schemes have different gross asset and employee thresholds. SEIS remains more accessible for tiny startups just beginning their journey.

Investors can benefit from multiple venture capital schemes, such as SEIS and EIS, within the same tax year, maximizing their tax relief opportunities. Collectively, SEIS/EIS are powerful tools for encouraging investment and supporting company growth.

Advance Assurance: Getting Pre-Approved

Advance Assurance is your startup’s golden ticket when it comes to securing SEIS funding. It’s a formal thumbs-up from HMRC, confirming that your business is likely to qualify for the seed enterprise investment scheme.

For founders, this pre-approval is a game changer; it gives potential investors the confidence that they’ll be able to claim those generous tax reliefs, including income tax relief and capital gains tax relief, on their investment.

To get Advance Assurance, you’ll need to submit a detailed application to HMRC. This includes a well thought out strategy for your company’s growth, a robust business plan, and clear financial projections.

You’ll also need to provide supporting evidence that your business meets the strict criteria of the enterprise investment scheme SEIS. The process can take several weeks, so it’s wise to apply early, especially if you’re planning a funding round.

Securing Advance Assurance not only reassures investors about the availability of SEIS tax reliefs, but it can also give your business a competitive edge in a crowded market. With this pre-approval in hand, you’re far more likely to attract investors looking to benefit from income tax relief, capital gains tax relief, and the other perks that come with SEIS funding.

Getting your SEIS eligible companies sorted

Complete the SEIS1 form via HMRC’s online service. It’s straightforward but requires attention to detail to avoid delays. Submit your company business plan and financial projections. These documents support your application and demonstrate viability. Some investors may choose to invest through a SEIS fund for diversification.

Request advance assurance before approaching investors. This is important for securing funding, as it gives them confidence in the tax benefits they’ll receive. Once approved, you’ll issue SEIS3 certificates to investors. These documents allow them to claim SEIS tax relief and claim tax relief on their Self Assessment tax returns.

The SEIS3 certificate includes a unique investment reference number provided by HMRC. Remember to maintain proper compliance documentation throughout. The three-year period requires ongoing attention to detail. Investors can sometimes claim SEIS tax relief for the previous tax year if eligible.

Tax Relief Examples: How Much Can You Save?

The SEIS scheme is packed with tax reliefs that can make a real difference to investors’ bottom lines. Let’s break down what this could look like in practice. Suppose an investor puts £10,000 into a SEIS-eligible early stage company.

Thanks to SEIS tax relief, they can claim income tax relief of up to 50% that’s £5,000 off their income tax bill for the tax year. This immediate saving makes SEIS investments far more attractive, especially for those looking to support innovative UK startups.

But the benefits don’t stop there. If the company grows and the value of the SEIS shares increases, the investor can sell those shares after three years and pay no capital gains tax on any profits.

This capital gains tax exemption can lead to substantial savings, especially if the company’s value takes off. These SEIS tax reliefs help reduce the financial risk of backing early stage companies. By claiming SEIS tax relief, investors can lower their tax liability, protect themselves against losses, and potentially enjoy significant returns, all while supporting the next generation of UK startups.

Watch out for these SEIS capital gains tax relief traps

Missing the 3-year trading deadline for applications is a common pitfall. Set reminders well in advance to avoid disappointment. Exceeding the £250,000 funding limit will disqualify you. This limit applies to the total funds raised under SEIS and other UK government venture capital schemes, so track your investments carefully, especially when raising from multiple sources.

Inadvertently breaching qualifying trade requirements can happen. Business model shifts should be evaluated for SEIS impact before implementation. Failing to maintain proper records for HMRC compliance might cause problems. Organised documentation from day one prevents headaches later.

Not securing advance assurance before seeking investment complicates fundraising. This preliminary step builds investor confidence and smooths the process. SEIS is a UK government initiative, and strict compliance with all requirements is essential to maintain eligibility for these venture capital schemes.

Staying Compliant: Maintenance After Approval

Getting SEIS approval is just the beginning staying compliant is what keeps those valuable tax reliefs intact for your investors. After your company receives SEIS funding, you must ensure that the funds are used strictly for qualifying business activities, such as hiring, product development, or marketing.

Using SEIS funds for non-qualifying purposes, like paying off old debts or acquiring another business, can put your company’s SEIS status at risk. Within three years of issuing SEIS shares, your company must submit a compliance statement to HMRC, confirming that all SEIS conditions have been met.

This is a crucial step, failure to comply can result in investors losing their income tax relief, capital gains tax exemption, and other SEIS tax benefits.

To stay on the right side of the rules, keep detailed records of how SEIS funds are spent and seek professional advice if you’re unsure about any aspect of the scheme. By maintaining compliance, your company can continue to attract investors, benefit from SEIS tax reliefs, and fuel your growth with confidence.

Final Thoughts

SEIS continues to be a powerful tool for UK startup founders in 2025. The enhanced limits and expanded eligibility criteria make it more accessible than ever. The scheme provides crucial tax advantages that can make or break a young company’s funding journey.

For example, qualifying SEIS shares may be exempt from the need to pay capital gains tax due to capital gains disposal relief, provided certain conditions, such as holding periods, are met.

These benefits often determine whether a startup can secure that vital early capital. Always seek professional advice when applying for SEIS to ensure compliance. With proper planning and execution, SEIS can transform your business idea into a thriving enterprise.

Pie: Simplifying SEIS for Startup Founders

Starting your SEIS journey doesn’t have to be overwhelming. Pie, the UK’s first personal tax app, is designed specifically for the UK taxpayer looking to manage

SEIS investments and tax returns efficiently. The app guides you through the process with clear, tailored explanations based on your sector. You can easily track your SEIS investments, add them to your tax return, and file everything seamlessly with Pie.

Quick and Easy Guide to Adding SEIS Tax Relief in the Pie App

Follow these steps to add SEIS tax Relief:

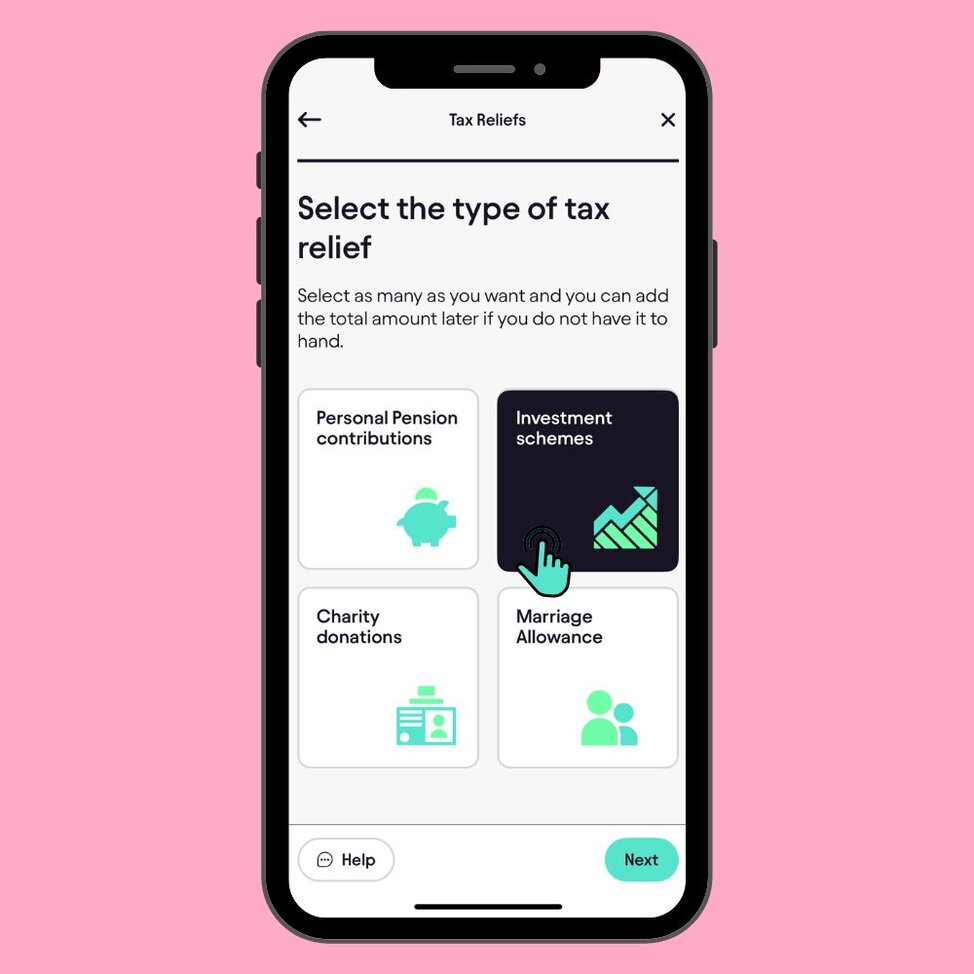

To add SEIS tax relief, simply tap ‘Quick Add’ on the home screen of the Pie Tax App. From there, select ‘Add Tax Relief’, then choose ‘Tax Relief Investment Schemes’.Step 1

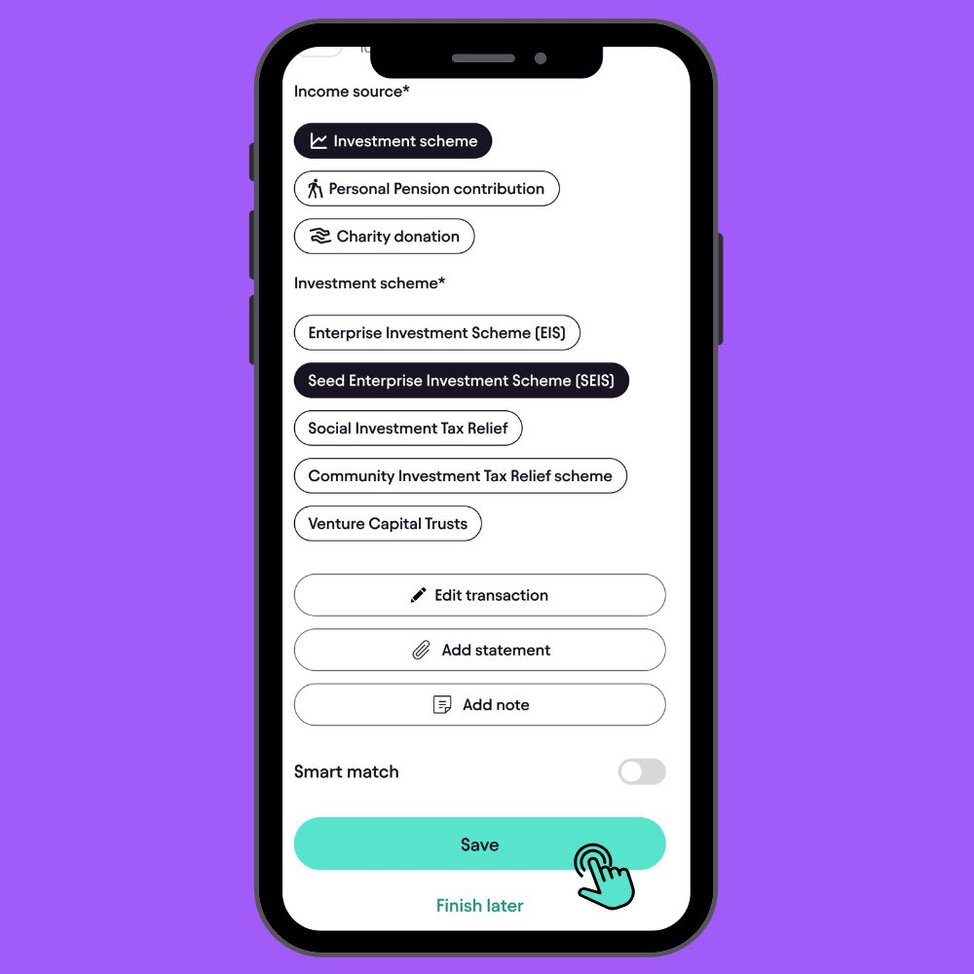

Next, select the specific investment relief you want to claim. Enter the name of the investment, the amount, and the date the investment was completed. Step 2

Frequently Asked Questions

What is the maximum investment amount a startup can raise under SEIS in 2025?

Startups can raise up to £250,000 under SEIS in 2025. This cap ensures the scheme remains targeted at early-stage businesses needing seed funding.

How much income tax relief do SEIS investors receive?

How long must a company have been trading to qualify for SEIS?

Your business must have been trading for less than 3 years at the time of issuing shares. SEIS is specifically designed for early-stage startups, unlike EIS, which allows companies up to 7 years old.

Can investors benefit from capital gains tax (CGT) relief under SEIS?

Yes! Investors pay no capital gains tax on SEIS shares held for at least 3 years. They can also claim loss relief if the investment fails and reinvestment relief when rolling over gains from other assets.

What are the key differences between SEIS and EIS?

SEIS offers 50% income tax relief, while EIS provides 30%.

SEIS has a £250,000 funding cap, whereas EIS allows up to £5 million.

SEIS is for companies under 3 years old, while EIS extends to 7 years.

SEIS has stricter asset (£350,000 max) and employee (<25 staff) limits.