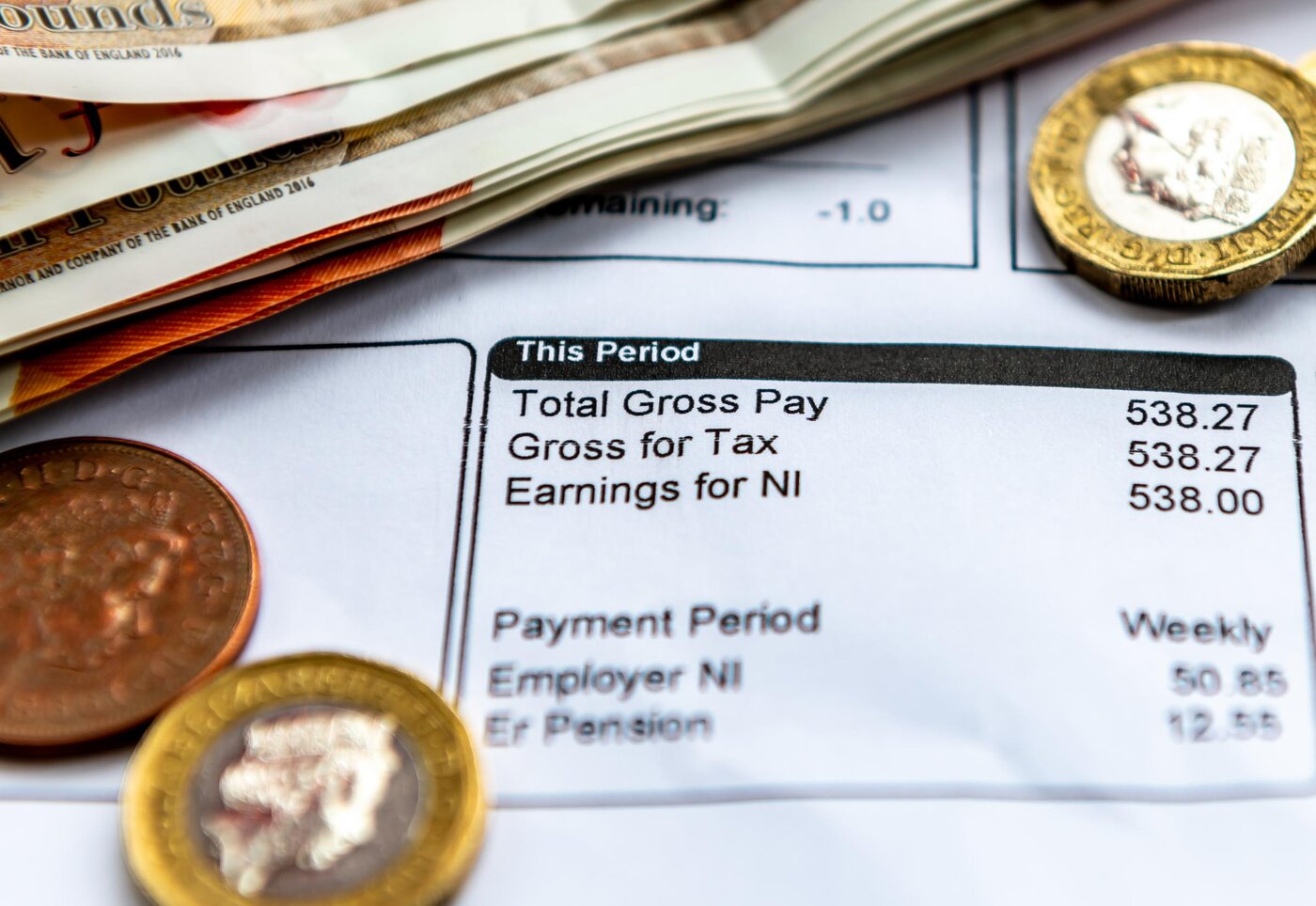

A significant proportion of UK taxpayers are missing out on pension tax relief potentially worth thousands of pounds, according to recently released data. Evidence gathered from a Freedom of Information request has revealed that well over £1 billion may remain unclaimed annually by those failing to claim higher rate tax relief on their pension contributions.

With increasing numbers of people drawn into higher tax brackets due to wage growth and frozen thresholds, the importance of self assessment filings and awareness around pension relief has grown considerably.

This issue highlights both an administrative challenge and a need for greater financial literacy among higher earners, particularly as HMRC’s annual tax return deadline prompts millions to review their personal tax affairs.

Growing Number of Higher Rate Taxpayers

Recent fiscal years have seen a notable increase in the number of UK taxpayers paying higher (40%) or additional (45%) rate income tax. Figures from the 2023/24 tax year indicated there were approximately 6.9 million higher and additional rate taxpayers.

Projections suggest this number rose to 8.3 million in 2025/26, and trends indicate it is set to increase further. One factor driving this is the ongoing freeze to income tax thresholds, which continues to bring more middle-income earners into higher tax bands.

As more individuals are affected, the likelihood of overlooking tax relief opportunities also climbs. Many new higher rate taxpayers are either unaware of their entitlement to extra pension-related tax relief or are unfamiliar with the process required to claim it.

How Pension Tax Relief Works

Under the 'relief at source' (RAS) system, which is used by many personal and stakeholder pension schemes, employees make pension contributions from their net (post-tax) earnings. HMRC then automatically applies basic rate tax relief (20%) to these contributions.

For example, an £800 contribution from net pay becomes £1,000 in the pension pot after this top-up. However, for those who pay income tax at the higher or additional rate, further relief can be claimed.

A higher rate taxpayer can reclaim an extra 20% on their contributions, while an additional rate taxpayer can claim an extra 25%. This supplementary claim is vital to ensure individuals receive their full entitlement.

Understanding the Self Assessment Tick Box

To obtain the full tax relief, higher and additional rate taxpayers must actively indicate their gross pension contributions on their Self Assessment tax return. Failure to complete this section leads to a loss in supplementary relief.

Sir Steve Webb, partner at pension consultancy LCP and former pensions minister, explained: 'With more and more people being brought into higher rates of income tax, it is increasingly important that they claim all the tax relief to which they are entitled.'

On average, higher rate taxpayers could be owed £1,756 per year, while additional rate taxpayers could be owed £2,195, based on the average pension contribution figure of £8,782 gross declared on recent tax returns.

The Scale of Unclaimed Tax Relief

Despite eligibility, HMRC data shows a considerable shortfall in claims. Approximately 6.8 million people contributed to RAS pensions in 2023/24. It is estimated that 1.1 million higher rate and 170,000 additional rate taxpayers could be entitled to claim extra relief.

However, only 316,000 individuals reportedly claimed through their tax returns, suggesting nearly 800,000 eligible contributors may miss out. This shortfall represents a collective potential loss exceeding £1 billion annually.

The figures might underestimate the total, as higher earners often contribute more to pensions than the average used in these calculations.

Alternative Methods for Claiming Relief

While the Self Assessment form is the most common route for claiming extra relief, HMRC confirms other avenues exist. Taxpayers can request an adjustment to their tax code or write directly to HMRC.

However, the degree to which these methods are used is unclear, and figures may either overstate or understate the actual number of those missing out.

Crucially, pension savers are urged not only to review their current returns but also to consider making backdated claims for up to four previous tax years if eligible relief has not been claimed.

Final Summary

Hundreds of thousands of higher and additional rate taxpayers could be missing out on crucial pension tax relief each year, costing individuals an average of up to £2,195 annually and resulting in over £1 billion unclaimed collectively.

The growth in higher tax rate payers is likely to make this issue more widespread in years to come. Enhanced understanding of the Self Assessment process, along with timely action on both current and backdated claims, can help retirees maximise their future security.

For those seeking clarity on their tax position or wanting to make the most of available reliefs, tools such as the Pie app offer accessible support and resources.