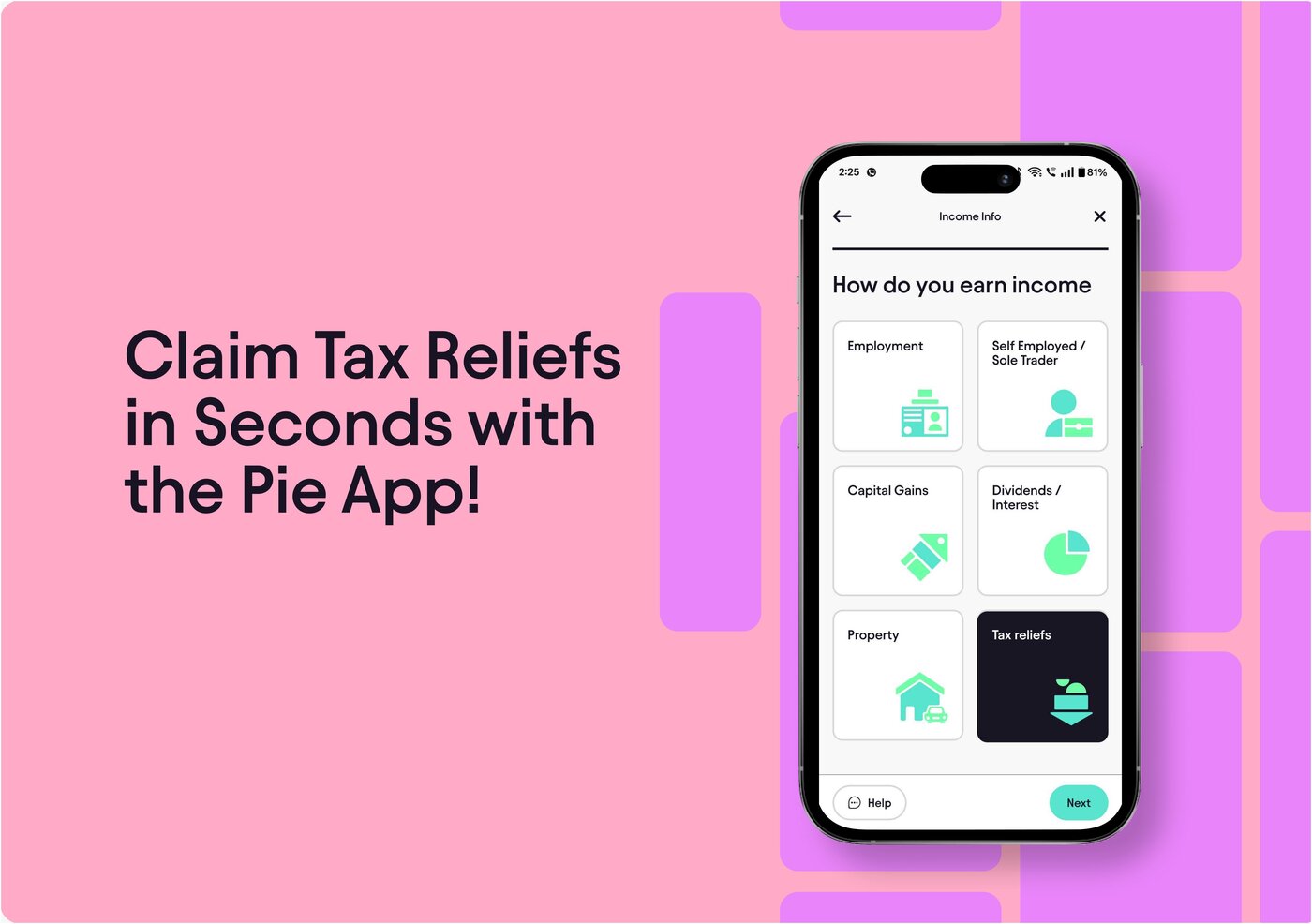

No More Paperwork: Claim Tax Reliefs with Just a Few Taps

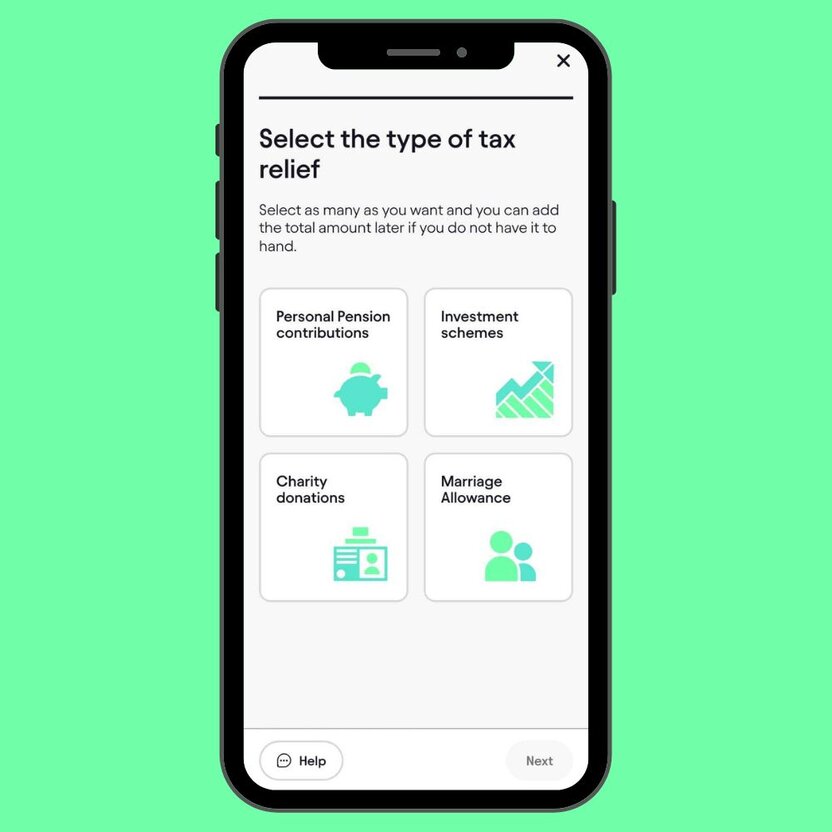

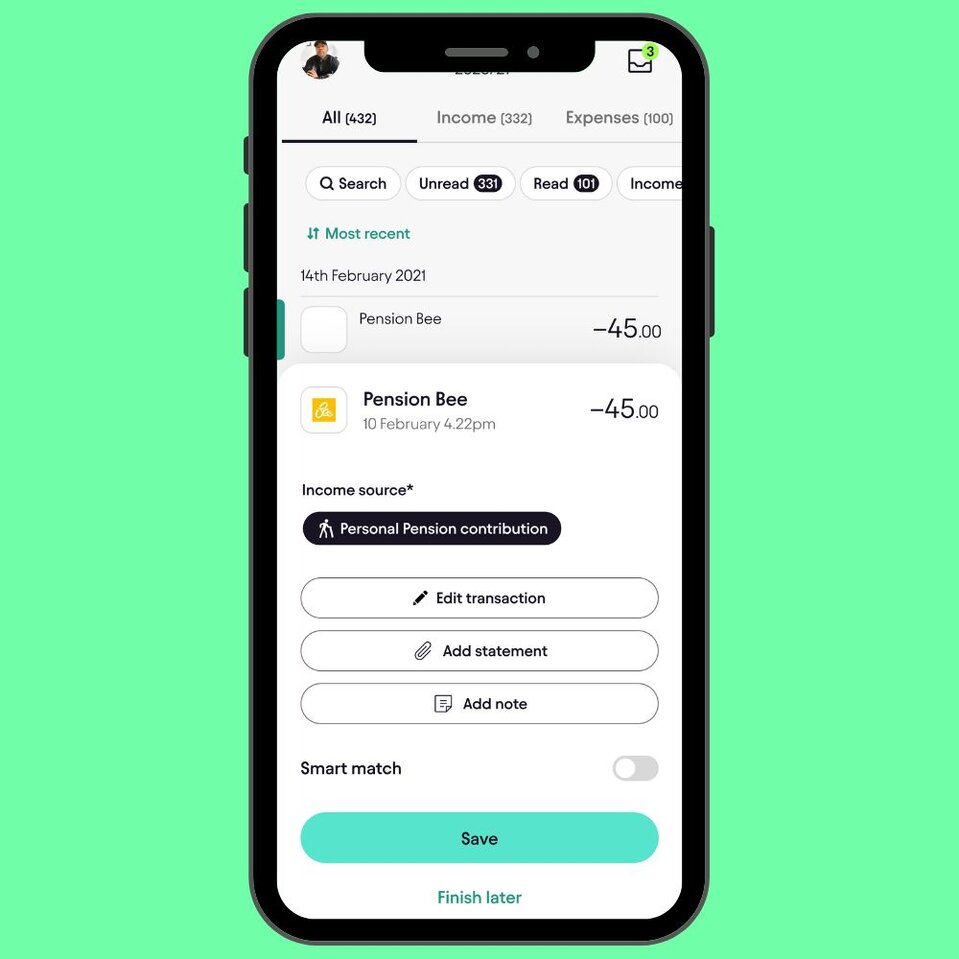

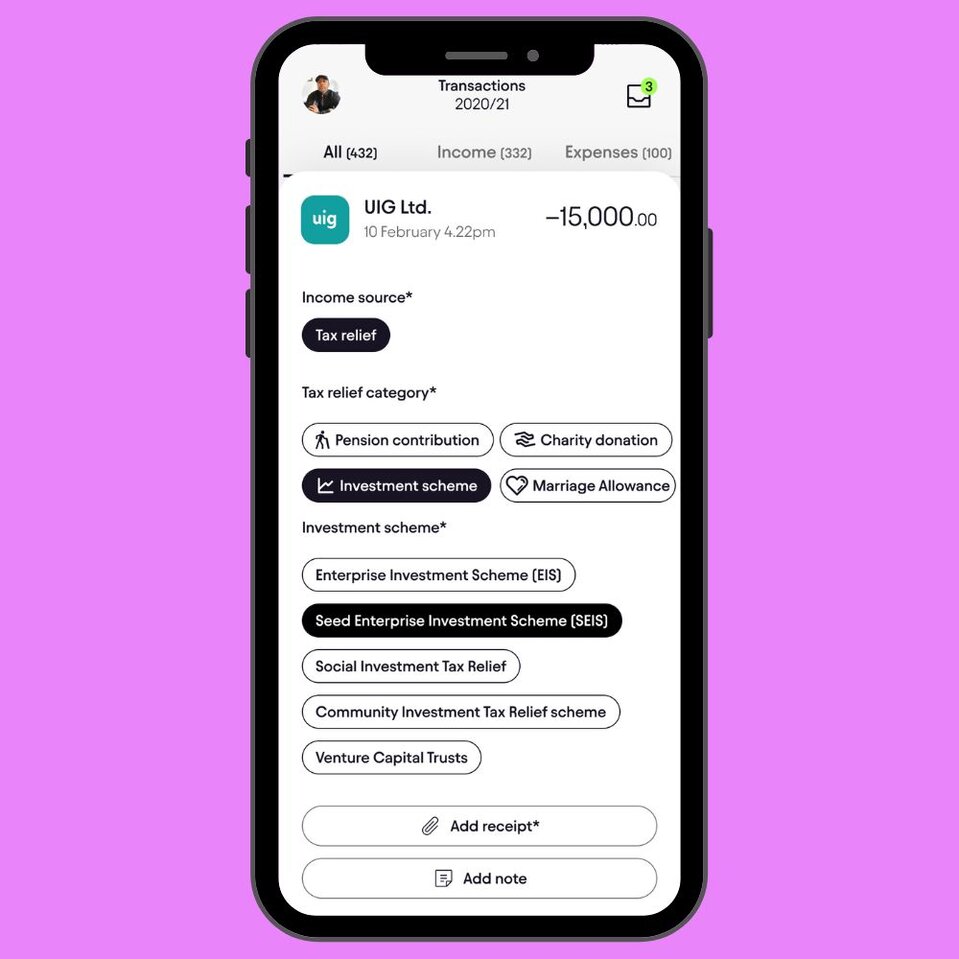

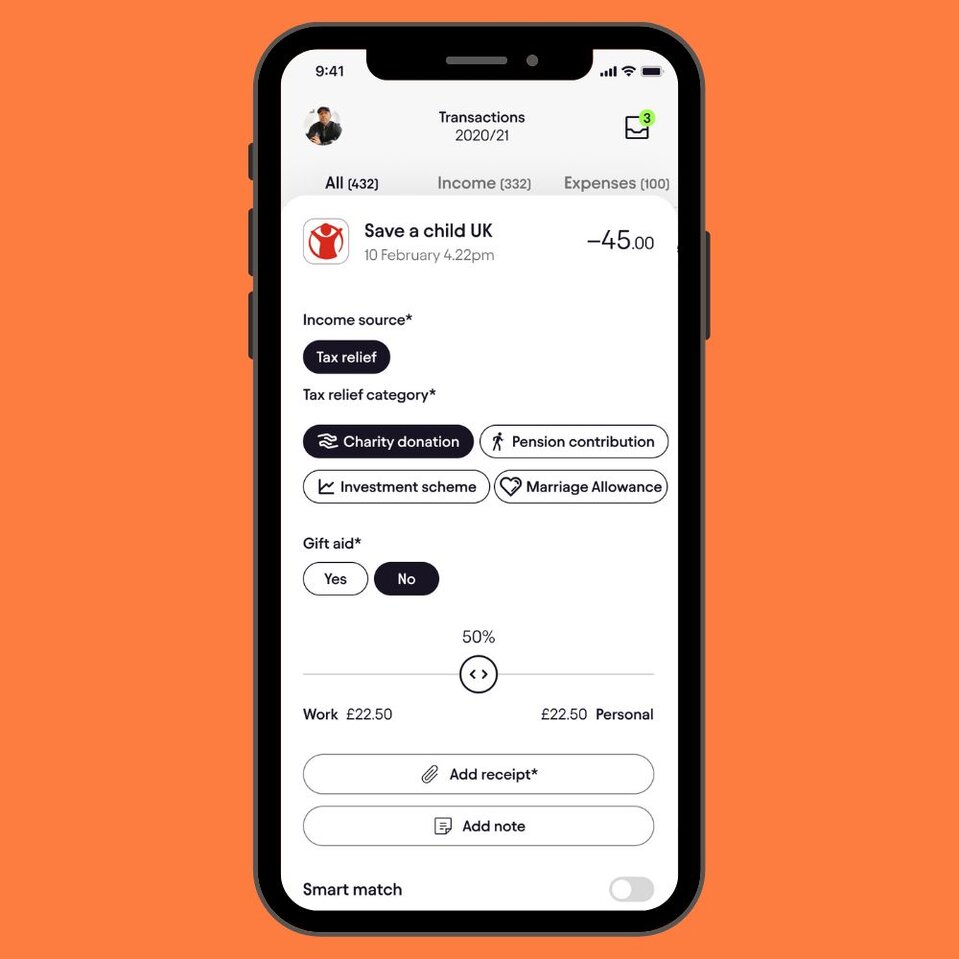

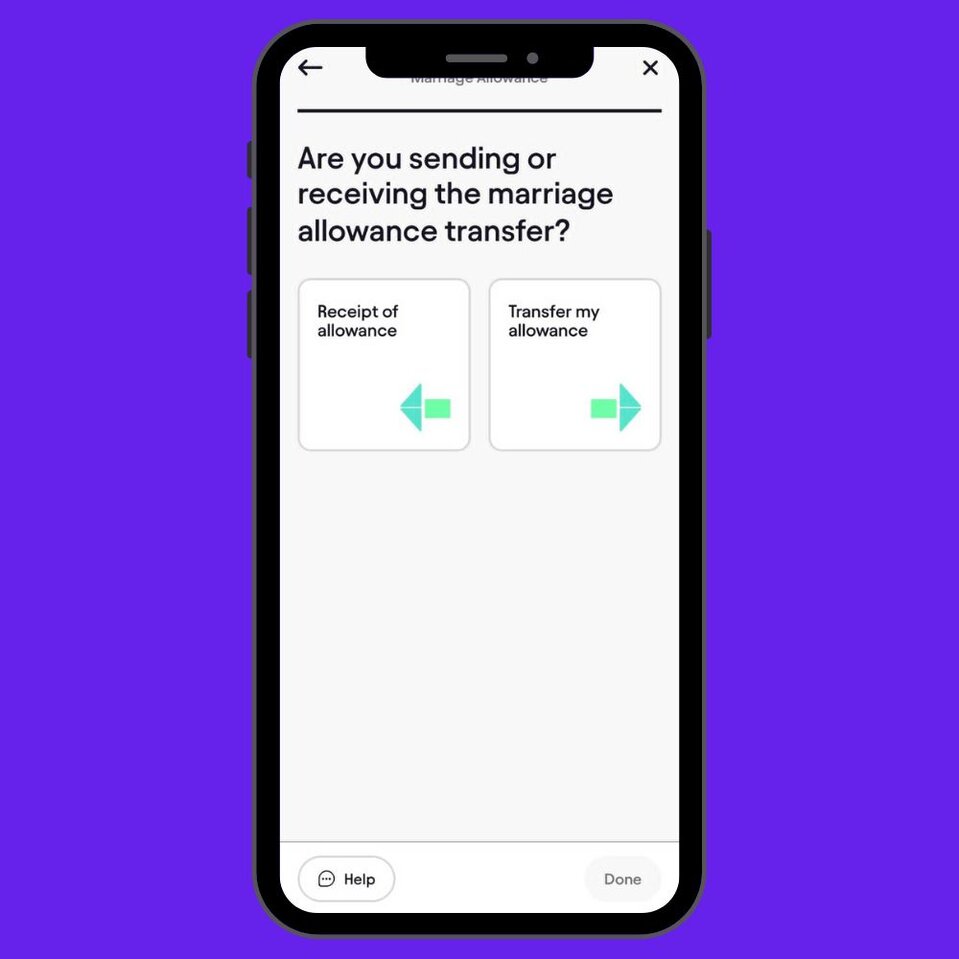

We’re thrilled to announce that a brand new tax relief feature is live, and it’s designed to make claiming tax reliefs effortless. Whether you've invested in an investment scheme such as EIS, pension contribution, supported a charity, or qualify for the marriage allowance, you’ll be able to claim your reliefs with just a few taps on your phone.

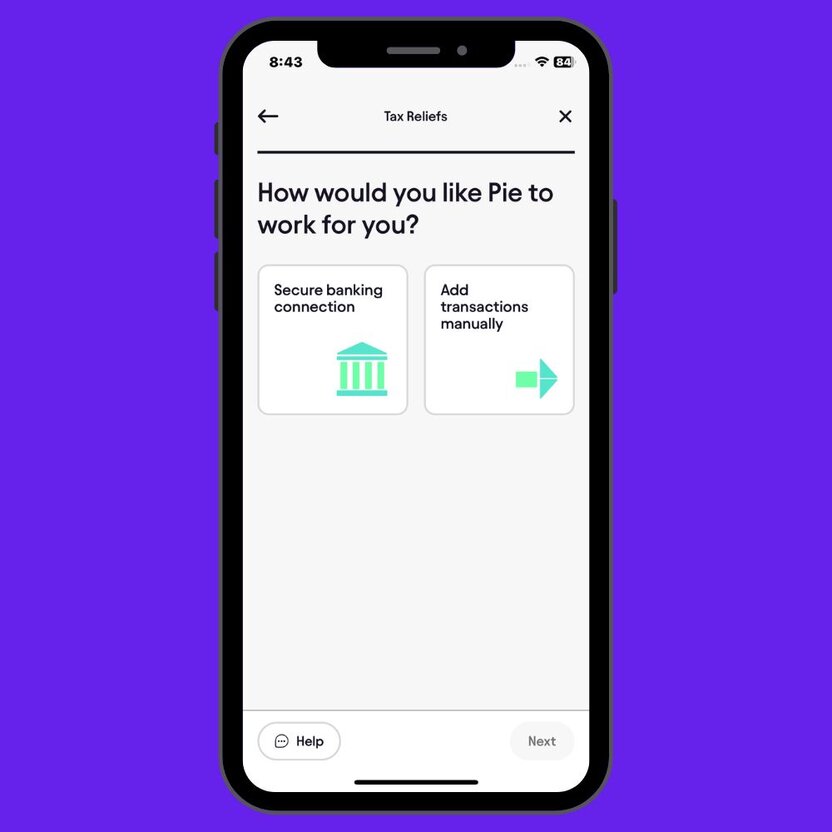

Gone are the days of fiddling with paperwork or second guessing how to include reliefs in your return. With our new in-app feature, you simply connect to your bank and select the type of relief.

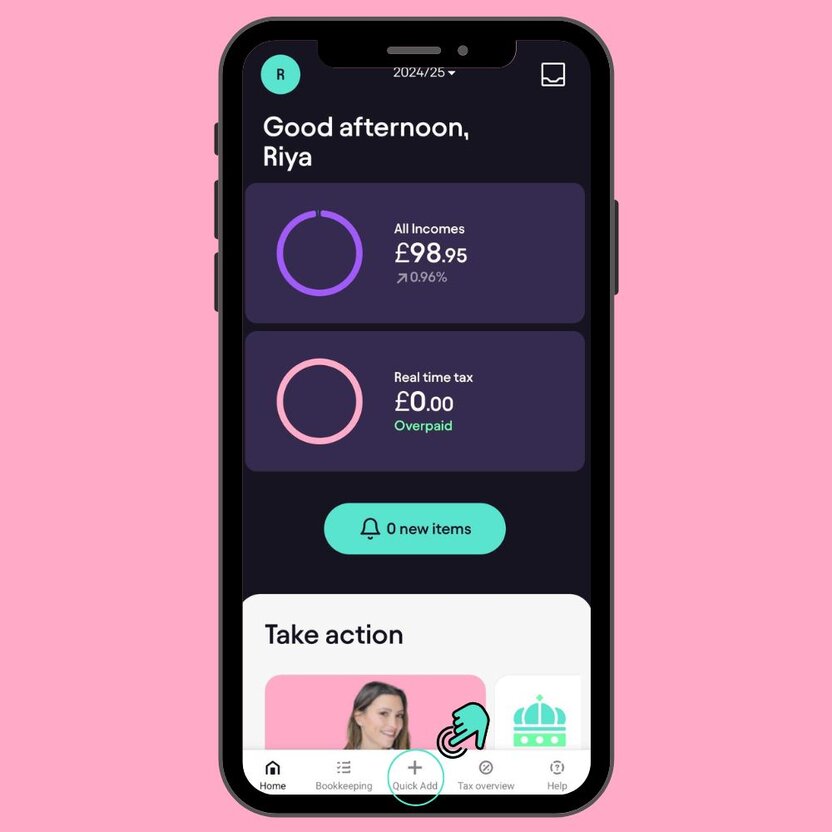

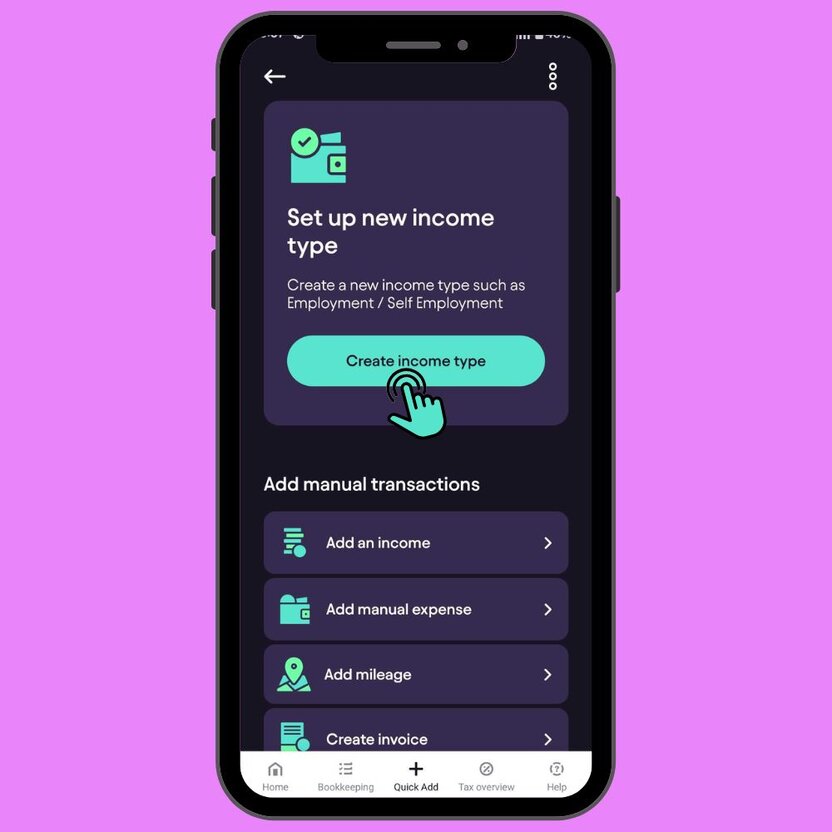

Simple Steps to Add Tax Reliefs

Follow these quick steps to claim pension contributions, charity donations, and more in the Pie App:

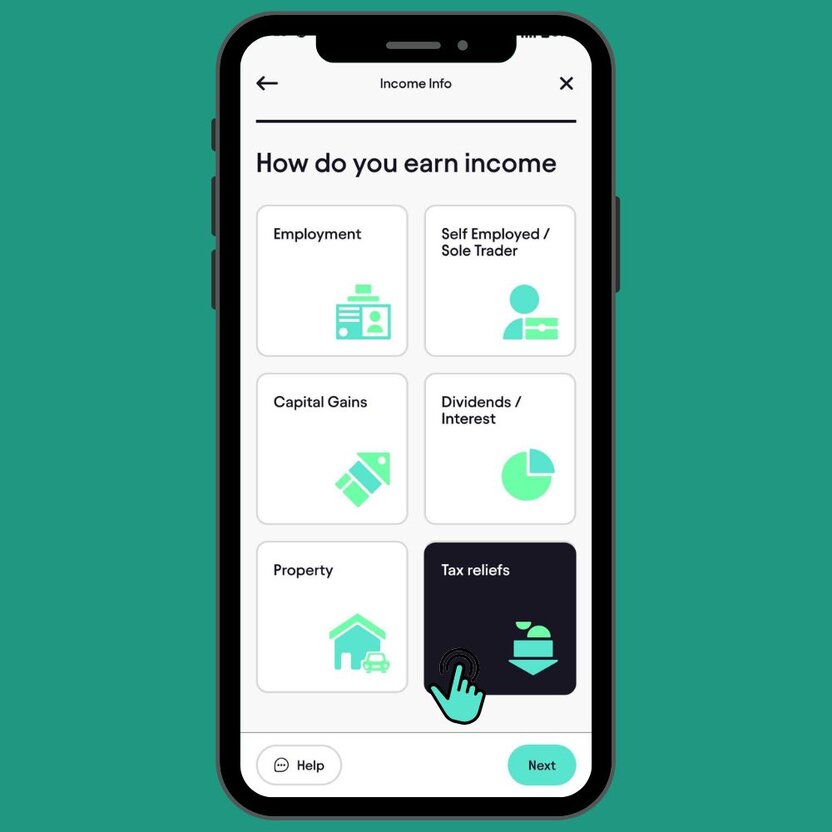

Types of Tax Reliefs You Can Claim in the Pie App

Next, select the relevant tax relief type, whether it’s personal pension contribution, investment schemes, charity donations, or marriage allowance. Choose a bank connection or enter the information manually. Tap Finish to log the relief. That’s it, your claim is saved and ready for your return.

Frequently Asked Questions

When will the feature go live?

The feature is live from 24th May! If you're not seeing it yet, make sure your Pie App is updated to the latest version. Keep an eye out for notifications to start using it right away.

Can I claim tax relief for previous years?

Yes, in most cases you can claim tax reliefs for the past four years.

Is Gift Aid applied automatically?

Yes, gift aid is automatically claimed.

Who qualifies for the Marriage Allowance?

If one partner earns less than £12,570 and the other is a basic-rate taxpayer, you may be eligible.

What if I make a mistake when entering my relief?

No problem, you can edit or remove any relief entry before you submit your tax return to HMRC.