What you need to know

Multi-factor authentication requires you to provide two or more verification methods before accessing your tax accounts. Think of it as adding multiple locks to your front door instead of just one.

The system typically combines something you know (like your password) with something you have (like your mobile phone). Sometimes it includes something you are (like your fingerprint).

For tax purposes, this usually means entering your Government Gateway password and then confirming with a code sent to your mobile. This two-step process significantly enhances security.

HMRC now requires this extra security step for most online tax services. This includes Self Assessment, PAYE, and VAT accounts.

How HMRC uses multi-factor authentication

When logging into your Government Gateway account, you'll first enter your user ID and password. Then, you'll need to provide a second verification method.

HMRC typically sends a verification code via SMS to your registered mobile number. You'll have a limited time to enter this code to complete your login. Some services now offer the option to use authenticator apps instead of SMS. These apps generate time-limited codes that refresh every 30 seconds.

Business tax accounts often have stricter authentication requirements. This reflects the more sensitive information and higher-value transactions they contain.

Why multi-factor authentication matters for taxpayers

Tax accounts contain your most sensitive personal and financial information. This is precisely what identity thieves are after.

Even if someone manages to steal your password, they'd still need your phone to access your account. This additional barrier stops most unauthorised access attempts.

Last year, I nearly fell victim to a sophisticated phishing attempt claiming to be HMRC. MFA prevented the scammers from accessing my account despite having my password.

MFA prevents criminals from filing fraudulent tax returns in your name. Without it, you could face delayed refunds and administrative nightmares.

For business owners, MFA helps meet compliance requirements. It also creates an audit trail of who accessed tax accounts and when.

Common MFA methods for your tax accounts

SMS verification is the most widely used method. HMRC sends a code to your mobile number, which is simple but requires mobile signal.

Authenticator apps generate codes directly on your phone, even without internet connection. These are generally considered more secure than SMS methods. Some systems now support biometric verification using fingerprint or face recognition. This offers convenience alongside enhanced security.

Hardware security keys provide the highest level of protection. These physical devices connect to your computer or phone for verification. Always set up backup methods or recovery codes. You'll be grateful if you ever lose access to your primary verification device!

Setting up MFA with HMRC

Log into your Government Gateway account and look for security settings. HMRC will guide you through adding MFA to your account. You'll need to register and verify your mobile phone number. HMRC will send a test code to confirm everything works properly.

Consider setting up alternative verification methods if offered. This provides a backup if your primary method becomes unavailable. Test the system before critical tax deadlines approach. Authentication problems during the January rush would be particularly stressful.

If you manage a business with multiple authorised users, each team member needs their own MFA setup. This maintains security while enabling appropriate access.

Handling MFA challenges

Lost your phone? Don't panic. HMRC has account recovery options, though the process might take time. Setting up alternative verification methods is crucial for avoiding lockouts. This foresight can save tremendous hassle later.

For those less comfortable with technology, HMRC offers support services. You can also authorise an agent or family member to help with setup. If you travel internationally, receiving SMS codes might be difficult. Authentication apps are usually better for frequent travellers.

Remember that the few seconds MFA takes protects you from the massive headache of tax identity theft. The minor inconvenience is worthwhile.

Final Thoughts

Multi-factor authentication provides essential protection for your sensitive tax information. In today's digital world, this extra security layer is increasingly necessary.

While adding an extra step to your login process might seem inconvenient, the benefits far outweigh this minor disruption. The peace of mind alone justifies the additional seconds spent.

As tax-related fraud becomes more sophisticated, these security measures will only grow in importance. Taking time to understand and implement MFA now can prevent significant problems later.

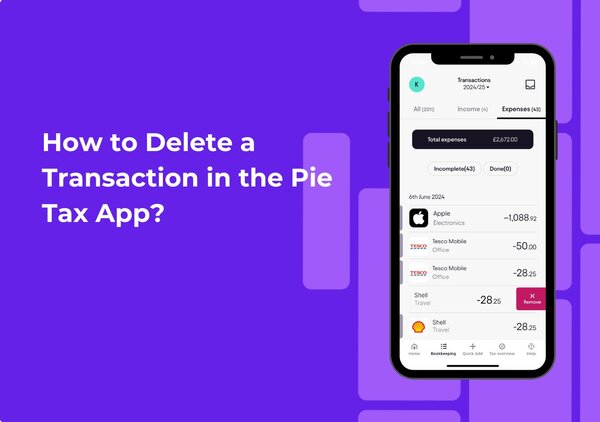

Pie tax: Simplifying Multi-Factor Authentication Tax

Tax security shouldn't come at the cost of user-friendliness. The UK's first personal tax app, Pie tax, integrates robust security measures that protect your information without creating frustrating barriers.

Our bank-level encryption and seamless MFA integration work quietly in the background. This allows you to focus on what matters understanding your tax situation clearly.

Pie tax handles complex tax situations with ease, whether you're juggling multiple income streams or navigating self-employment. Our automated systems maintain strict security while eliminating tedious data entry.

Curious to see how it works? Explore the Pie.tax app to experience tax management that's both secure and simple.