Introduction

Celebrity chef Jamie Oliver has called for urgent tax reforms to support the UK’s restaurant and hospitality sector, warning that the current tax structure risks damaging the industry’s creativity and long-term prospects.

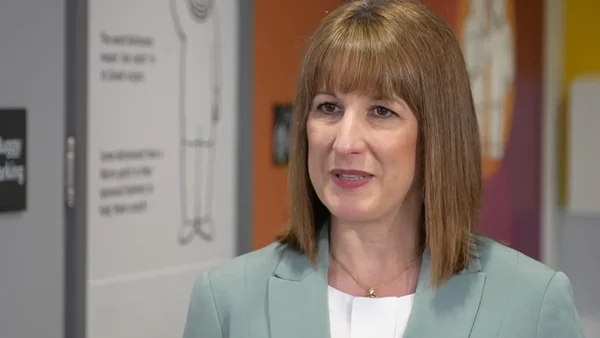

His remarks follow a period of public concern over increases in business rates and the standard VAT rate, which have placed considerable strain on businesses still grappling with higher costs and weakened consumer confidence. Industry figures are now urging Chancellor Rachel Reeves to consider comprehensive changes aimed at preserving jobs and preventing closures.

Hospitality sector faces growing costs

The hospitality industry, which includes restaurants, hotels, and cafés, has been vocal in its opposition to rising business rates and the continued application of the standard 20 per cent VAT rate. While recent government relief measures for pubs and live music venues provided some respite through a property tax discount, other hospitality businesses were not included in these schemes.

Many operators report that, without further support, profit margins are being eroded. There is a broader concern that increased financial pressure will force smaller operators out of the market and lead to job losses across the sector.

Celebrity chef’s public appeal

In a recent opinion piece, Jamie Oliver urged the government to carry out a data-led review of the effects current tax policy is having on the industry. He wrote that “seasoned operators are leaving the industry, family businesses are folding and the next generation of talent is looking at the financial hurdles and deciding it simply is not worth the fight.”

Oliver stated, “When the government chips away at margins until there is nothing left but a smouldering wick, confidence and creativity die.” He warned that the UK’s reputation for culinary innovation is at stake, adding, “Our culinary creativity is being slowly extinguished, and the government is not just letting it happen they are the ones stubbing it out.”

Reaction across industry and public

Oliver’s concerns align with comments recently made by other prominent chefs and industry leaders, including Gordon Ramsay. Ramsay described the sector as “facing a bloodbath” due to “catastrophic” increases in operational costs, stating publicly that he had “never seen it so bad” for British restaurants and other venues.

Some publicans have announced bans on certain Members of Parliament from their venues as a protest against rising taxes, reflecting widespread frustration among business owners. Industry groups continue to call for urgent dialogue with the Treasury and other ministers to discuss possible avenues for relief.

Debate over VAT and business rates

A key point of contention is the UK’s standard 20 per cent VAT rate for hospitality, which is significantly higher than in several other European nations. For example, Ireland’s VAT rate for food service is set to fall to 9 per cent from July, a level many UK restaurateurs view as fairer and more competitive.

Jamie Oliver commented, “That gap alone shows how much harder it is for UK restaurants to invest, grow, and create jobs.” Calls have intensified for VAT on hospitality to be reduced to European levels and for a wider overhaul of the business rates system, which critics argue does not adequately value the societal benefits of community-based venues.

Economic and cultural implications

The ongoing debate about tax policy and hospitality is set against a backdrop of economic uncertainty and broader pressures on consumer spending. Many independent operators warn that, without structural reforms, high streets could become dominated by major corporate chains and delivery-only kitchens, to the detriment of local identity.

Oliver asked, “Is this the Britain we want? A country where every high street is identical, dominated by corporate logos and delivery-only warehouses?” He argued that protecting small businesses is key to maintaining diversity and resilience in the UK economy.

Final Summary

Jamie Oliver’s plea for urgent tax reform highlights the mounting challenges faced by the UK’s hospitality sector in an era of rising costs and increasing operational pressures. As voices across the industry warn of job losses, diminished innovation, and the potential loss of unique British dining culture, attention is turning to policymakers to consider wide-ranging reforms to VAT and business rates.

The coming months are likely to see significant discussions between government and industry leaders regarding the future of the sector. For individuals tracking business policy changes and tax matters, the Pie app continues to provide timely updates and expert analysis.