Lets get started...

The Enterprise Investment Scheme (EIS) offers significant tax advantages to investors willing to back early-stage companies. EIS is one of several UK government-supported venture capital schemes designed to encourage private investment in early stage businesses by providing attractive tax incentives.

Established in 1994, EIS encourages investment in smaller, higher-risk businesses by offering income tax relief, capital gains exemptions, and loss relief. EIS tax benefits also include the potential for tax free growth on qualifying investments, making it a compelling option for investors seeking efficient returns.

Understanding the intricate EIS rules is crucial for investors to properly claim and maintain their tax benefits. The scheme has helped thousands of UK businesses raise billions in funding while providing investors with substantial tax incentives.

Our tax experts at Pie tax, the UK’s first personal tax app, can help you navigate EIS investments easily. Or if you’re just here to get to grips with it all, let’s break it dow

What is the Enterprise Investment Scheme?

The EIS is a government scheme designed to help smaller, higher-risk companies raise money by offering tax reliefs to investors who buy new shares.

Since 1994, it has become a popular way for investors to support growing businesses while enjoying significant tax benefits. EIS funds are managed investment vehicles that pool investor capital to diversify across multiple EIS-eligible companies, with the investment process typically involving professional due diligence, deal selection, and portfolio management.

The main attraction is the 30% income tax relief on investments up to £1 million per tax year (or £2 million for knowledge-intensive companies). Each EIS investment must meet certain criteria, including a minimum investment amount set by the scheme or fund manager.

Beyond this initial relief, EIS also offers capital gains tax exemptions on profits from shares held for at least three years. Investors should be aware of their annual EIS allowance to maximise their tax relief opportunities.

EIS Qualifying Companies: Who Can You Invest In?

When considering an EIS investment, it’s crucial to understand which companies actually qualify for the scheme. EIS qualifying companies are typically small to medium-sized enterprises (SMEs) that meet strict eligibility criteria set by the UK government. To be eligible under the Enterprise Investment Scheme (EIS), a company must have gross assets of £15 million or less before the investment and employ fewer than 250 full-time staff.

To qualify for EIS tax relief, both the company and the investor must meet specific conditions set by HMRC. Companies must be UK-based, unquoted, with fewer than 250 employees and gross assets under £15 million before investment. To be considered an EIS qualifying company, the business must also engage in a qualifying business activity and meet additional criteria set by HMRC.

For investors, you can’t be connected to the company, such as being an employee or holding more than 30% of shares. Only qualifying investors are eligible for EIS tax relief, and unpaid directors may also qualify under certain conditions.

You must hold the shares for at least three years, and they must be newly issued, paid for in cash, with no preferential rights. If these rules are broken during the three-year period, HMRC can withdraw your tax relief, a costly mistake I’ve seen investors make. Always check that companies have advance assurance from HMRC before investing to protect your tax position. Advance assurance helps confirm a company's EIS qualifying status, but investors should also ensure the company continues to meet the requirements so that their EIS qualifying investment remains eligible.

Tax Benefits That Make EIS Attractive

The 30% income tax relief is just the beginning, you can claim this against your current tax bill or carry it back to the previous tax year. Investors can claim income tax relief and claim tax relief on their EIS investments, directly reducing their income tax bill.

After holding shares for three years, any gain you make when selling is completely free from capital gains tax.If your EIS shares are sold at a loss, you can offset this against either income tax or capital gains tax, softening the blow of unsuccessful investments.

You can also defer capital gains tax on other assets if you reinvest the proceeds into EIS shares within certain timeframes. This is known as capital gains deferral relief or CGT deferral relief, and it allows investors to postpone paying capital gains tax by reinvesting gains into EIS qualifying shares. Reinvestment relief and deferral relief are valuable tools for tax planning, enabling investors to manage when they pay capital gains tax.

As a bonus, EIS shares become exempt from inheritance tax after you’ve held them for just two years. To benefit from these reliefs, investors must follow the correct procedures to claim EIS tax relief and pay capital gains tax only when required.

Common Mistakes When Claiming EIS Relief

Many investors forget to obtain their EIS3 certificate from the company – without this document, you cannot claim your tax relief. Before an EIS3 certificate can be issued, the company must submit a compliance statement to HMRC, and each certificate includes a unique investment reference used for tax purposes.

Some investors sell their shares too early, not realising that the three-year holding period is essential for maintaining the tax benefits. It’s easy to miss the claim deadline, you have up to five years after the 31st January following the tax year of your investment.

Another common error is investing in companies that don’t actually qualify for EIS, despite their marketing claims. Fund managers play a key role in ensuring investments meet EIS requirements, and similar rules apply to other schemes such as venture capital trusts, the Seed Enterprise Investment Scheme, social investment tax relief, and investment trusts.

I once advised a client who nearly lost £30,000 in tax relief because the company hadn’t secured proper EIS status before taking his investment.

How to Claim Your EIS Tax Relief

Once you’ve invested, the company should apply to HMRC for permission to issue EIS3 certificates to its investors. When you receive your EIS3 (usually 4-6 months after investing), you can claim relief through your Self Assessment tax return. You must claim EIS tax relief in the correct tax year for tax purposes, following current tax rules.

If you’ve already submitted your tax return, you can amend it online within 12 months of the filing deadline. For investments from previous years, you can still claim by writing to HMRC or including them in your next tax return. You can claim income tax relief and claim tax relief for the previous year if you meet the eligibility criteria.

Remember you can also ‘carry back’ your investment to the previous tax year, which is handy if you had a higher tax bill then. The carry-back option is only available if the same investment has not already been used to claim relief in another year.

Final Thoughts

EIS offers valuable tax breaks for investors willing to take risks on growing businesses, but the rules require careful navigation. These tax benefits come with conditions, particularly the three-year holding requirement and restrictions on your connection to the company.

While the tax advantages are generous, remember that these investments still carry significant risk. Never invest solely for tax reasons, and consider seeking professional advice before making substantial EIS investments.

This approach will help ensure you stay compliant with the rules and maximise your available tax reliefs.

Pie tax: Simplifying EIS Rules Tax

Managing your EIS investments becomes straightforward with the right tools at your fingertips. Pie tax, the UK's first personal tax app, tracks your EIS investments and automatically calculates your tax relief entitlements.

Our dashboard gives you a clear overview of all your investments, making it easy to provide accurate information on your tax return.

Fancy seeing how it works? Take a look at the Pie tax app today.

Quick and Easy Guide to Adding EIS Tax Relief in the Pie App

Follow these steps to add EIS tax Relief and track your real time tax figures

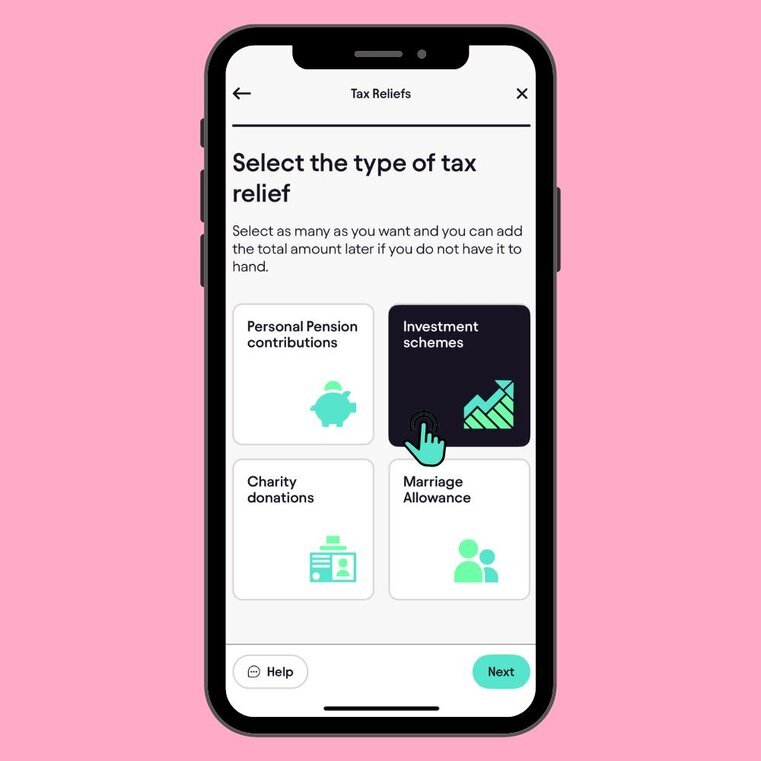

To add EIS tax relief, simply tap on 'Quick Add' on the home screen on the Pie App. Select the specific investment scheme you want to claim.Step 1

Once you’ve added all the information, you can view your real-time tax figures on the "Homepage" of the Pie App. Step 2