Lets get started...

Ever wondered how to make the most of the Enterprise Investment Scheme? The tax benefits are impressive, but there are important limits to know about.

The UK's first personal tax app, Pie tax, helps you track and maximise your EIS tax relief with smart calculations and timely reminders. Or if you're just here to get to grips with it all.

What are EIS limits and why should you care?

The Enterprise Investment Scheme offers generous tax breaks to encourage investment in early-stage companies. The eligibility criteria for EIS are strict, and a company must meet specific requirements to qualify. EIS is designed to support small companies, and the company's structure and activities are key to qualifying. But there are caps on how much you can invest and how much relief you can claim.

Understanding these limits helps you plan your investments more strategically. It can also help you avoid nasty surprises when your tax return is due. The main limits include how much you can invest each year (£1 million standard, or £2 million for knowledge-intensive companies). Your tax relief is capped at 30% of your investment, limited by your income tax liability.

Companies also face restrictions on how much they can raise through EIS. Current limits are £5 million per year and £12 million lifetime, with higher thresholds for knowledge-intensive companies. In addition, a company must not engage in excluded activities, as most trades are eligible except for those specifically excluded by HMRC.

How EIS limits work for investors

As an investor, you can put up to £1 million into EIS-qualifying companies each tax year. Individual investors are eligible for EIS income tax relief on their initial investment, provided certain conditions are met. This investment qualifies for 30% income tax relief on that amount.

If you’re keen on backing innovation, you can invest an additional £1 million in knowledge-intensive companies. This effectively doubles your annual limit to £2 million.

You’ll need to hold your shares for at least three years to keep the tax relief. EIS shares must not carry preferential rights to dividends or assets on winding up, to maintain eligibility. Selling earlier means HMRC will claw back any relief you’ve claimed.

There’s also a limit on your ownership stake, you can’t hold more than 30% of the company. This includes shares held by associates like family members.

Company fundraising restrictions

Companies using EIS face their own set of limits. They can raise a maximum of £5 million per year from venture capital schemes, including EIS, SEIS and VCTs combined. The money raised from all these sources, including venture capital trusts and other venture capital schemes, counts towards both the annual and the company's lifetime limits.

There’s also a lifetime cap of £12 million that companies can raise through these schemes. This cap applies across the company's lifetime and includes any previous investment received under EIS, SEIS, venture capital trusts, or other venture capital schemes. Knowledge-intensive companies benefit from a higher £20 million lifetime limit.

The timing matters too. Companies generally need to raise EIS funds within 7 years of their first commercial sale. This extends to 10 years for knowledge-intensive businesses.

Before investment, the company’s gross assets must not exceed £15 million. After investment, they must stay below £16 million to maintain eligibility. To qualify, the company must be unquoted and not listed on a stock exchange, although being listed on AIM is permitted.

Advance Assurance Process: Getting Pre-Approval for EIS

For companies looking to raise investment under the Enterprise Investment Scheme (EIS), securing Advance Assurance from HMRC can be a game-changer. Advance Assurance is essentially a green light from HMRC, indicating that your company and its planned share issue are likely to qualify for EIS tax reliefs. While not a legal guarantee, this pre-approval gives both founders and potential investors greater confidence that the investment will meet the requirements of the enterprise investment scheme.

The process starts with the company preparing an application to HMRC, outlining how it meets the EIS qualifying conditions. This typically includes details about the company’s business activities, financial forecasts, ownership structure, and how the funds raised will be used. You’ll also need to provide supporting documents, such as your business plan, information about any qualifying subsidiaries, and a description of your intended equity investment.

Once submitted, HMRC will review your application and, if satisfied, issue an Advance Assurance letter. This letter can be shared with prospective investors as proof that your company is on track to qualify for EIS. For many investors, especially those new to EIS investments, seeing Advance Assurance in place is a key factor in their decision-making process.

Obtaining Advance Assurance doesn’t just make your company more attractive to investors—it also helps streamline the investment process and reduces the risk of issues arising later when claiming EIS tax relief. It’s a proactive step that demonstrates your commitment to compliance and maximising the tax benefits available under the enterprise investment scheme EIS.

Tax relief timing and limits

The headline 30% income tax relief is limited by your income tax liability for the year. If you invest £100,000 but only pay £25,000 in income tax, your relief is capped at £25,000.

One handy feature is the ability to carry back EIS relief to the previous tax year. This effectively lets you double your annual investment limit and claim against last year’s income tax. The amount of income tax relief claimed can affect the calculation of capital losses if the investment is sold at a loss.

Capital Gains Tax benefits are also valuable – you can defer CGT on unlimited gains by reinvesting into EIS companies. This is known as deferral relief, where deferred gains become taxable again upon certain events such as the sale of shares or leaving UK tax residency. The period beginning with the date of disposal and ending three years later is relevant for reinvestment to claim deferral relief. I once deferred a significant property sale gain this way, saving thousands in immediate tax.

After holding EIS shares for two years, they typically qualify for Business Property Relief. This means they’re free from Inheritance Tax, offering estate planning benefits. EIS investments can also provide CGT exemption on gains if the shares are held for the required period, and SEIS investors may benefit from similar exemptions.

Knowledge-intensive companies: bigger limits

The government offers extra incentives for investing in research-heavy, innovative companies. These must meet specific “knowledge-intensive” criteria to qualify. A knowledge intensive company is typically one that focuses on research and development (R&D) or innovation, and meets certain requirements regarding R&D spending, skilled employees, and product development.

Investors can place up to £2 million annually in these companies, double the standard limit. This encourages funding for businesses developing cutting-edge technologies.These companies can raise up to £10 million per year through venture capital schemes. This is considerably more than the standard £5 million limit.

They also benefit from a higher lifetime limit of £20 million instead of £12 million. Plus, they have a longer 10-year window to raise funds after their first commercial sale. To maintain eligibility, the company must carry out a qualifying business activity for at least four months after the investment.

Common pitfalls with EIS limits

Exceeding investment limits is an easy trap to fall into, especially across multiple companies. Going over the limit could result in losing tax relief on the excess amount. The “connected persons” rules catch many investors out. If you’re connected to the company as a director or through family ties, your investment might not qualify.

All EIS investments must pass the “risk-to-capital” condition. HMRC needs to be satisfied you’re taking a genuine commercial risk, not just seeking tax advantages. Anti avoidance rules are in place to prevent manipulation of the scheme for tax avoidance purposes.

Even if a company has HMRC advance assurance, this doesn’t guarantee tax relief. The final decision comes after the company submits its compliance statement. Companies with a qualifying subsidiary must ensure these subsidiaries meet the 90% ownership and activity requirements to maintain EIS eligibility.

Similar rules and pitfalls apply to the Seed Enterprise Investment Scheme, and investors should be aware of the differences and compliance requirements.

Final Thoughts

EIS limits exist to balance generous tax incentives with supporting genuine entrepreneurial businesses. They ensure the scheme helps companies that truly need funding.

Working within these limits requires planning, but the tax benefits make it worthwhile for many investors. The potential for investment growth adds to the appeal.

The rules do change periodically, so it's worth checking the latest limits before investing. Budget announcements often contain updates to the scheme. Remember that while tax relief is attractive, the quality of the underlying investment should always be your primary consideration. EIS companies are high-risk by nature.

Pie tax: Simplifying EIS Limits Tax

Keeping track of EIS investments and their tax implications shouldn't give you a headache. Pie tax makes the complex simple with our intuitive dashboard.

The UK's first personal tax app, Pie tax, shows you exactly how much tax relief you're eligible for. We calculate this based on your income and other investments.

Our dashboard gives you a clear view of how close you are to your annual EIS investment limits. This helps you plan your tax-efficient investing strategy throughout the year. Pop over to our website if you'd like to see how we make EIS tax simple.

Quick and Easy Guide to Adding EIS Tax Relief in the Pie App

Follow these steps to add EIS tax Relief and track your real time tax figures

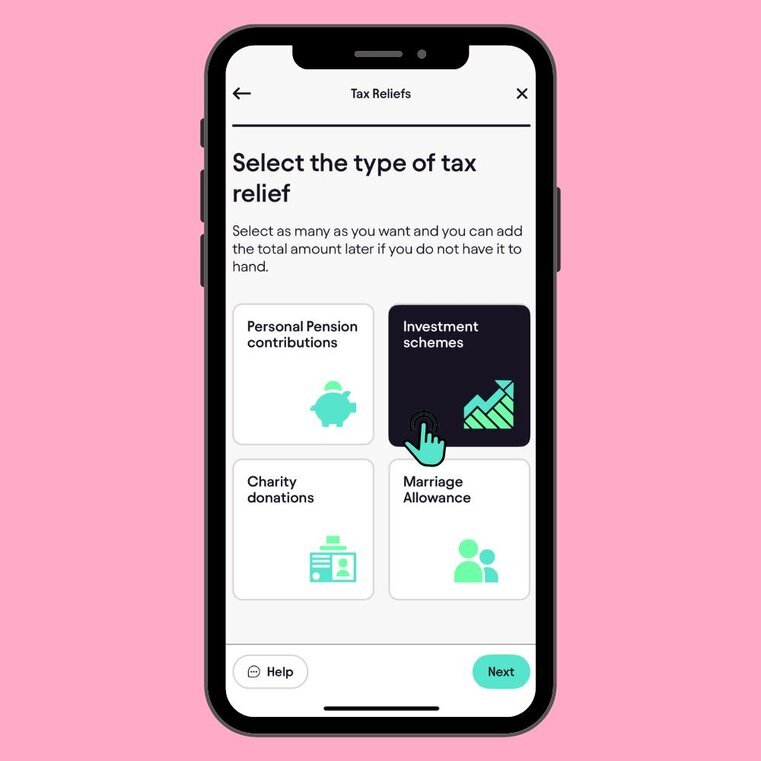

To add EIS tax relief, simply tap on 'Quick Add' on the home screen on the Pie App. Select the specific investment scheme you want to claim.Step 1

Once you’ve added all the information, you can view your real-time tax figures on the "Homepage" of the Pie App. Step 2