Lets get stuck in...

EIS funds offer UK investors significant tax advantages while supporting growing businesses. These government-backed investment vehicles provide up to 30% income tax relief on investments up to £1 million annually.

They also offer capital gains tax exemptions, loss relief, and inheritance tax benefits when held for qualifying periods. EIS funds pool investor capital to spread risk across multiple early-stage companies with high growth potential.

Pie tax, the UK's first personal tax app, makes tracking your EIS investments and tax benefits simple with our easy-to-use dashboard. Or if you're just here to get to grips with it all, let's break it down!

What exactly are EIS funds?

Enterprise Investment Scheme (EIS) funds are managed portfolios that invest in qualifying early-stage companies with high growth potential. An EIS qualifying company is a business that meets specific criteria set by the UK government, such as size, age, and trading activity, to be eligible for EIS funding and associated tax reliefs.

Companies qualify for EIS funding by fulfilling these requirements, ensuring they can benefit from the scheme. The UK government introduced them in 1994 to encourage investment in small, higher-risk businesses.

Unlike direct EIS investments where you pick individual companies, EIS funds are managed by professionals. The fund manager actively invests in these companies by selecting and monitoring a portfolio on your behalf, spreading risk across multiple businesses.

Most funds focus on specific sectors like technology, healthcare or renewable energy, and many EIS funds specifically target early stage technology companies. Others take a more generalist approach, giving investors exposure to various industries simultaneously.

The tax perks that make EIS funds attractive

The tax benefits of EIS funds are what make them truly special for UK investors. You can claim 30% EIS tax relief on investments up to £1 million per tax year, or £2 million for knowledge intensive businesses.

Any profit you make is completely free from Capital Gains Tax if you hold the shares for at least three years. You can also defer other capital gains by reinvesting them into EIS funds.

If investments perform poorly, loss relief allows you to offset losses against either income tax or capital gains tax. After holding EIS shares for two years, they typically qualify for Business Relief, making them exempt from inheritance tax.

Tax reliefs depend on your individual circumstances, the holding period, and the ongoing EIS eligibility of the investment. EIS eligibility criteria must be met for investors to claim these tax reliefs.

I once helped a client who saved over £15,000 in income tax through an EIS investment of £50,000. When one company in the portfolio later failed, loss relief meant he recovered nearly half of that specific loss through additional tax relief.

How EIS funds work in practice

When you invest in an EIS fund, your money is pooled with other investors and managed by investment professionals. Most funds have minimum investment amounts between £10,000 and £25,000, making them accessible to many serious investors.

The fund manager deploys capital across multiple qualifying companies, usually 5-15 businesses. Funds are invested in EIS qualifying companies that meet strict eligibility criteria. To qualify, companies must have gross assets below a certain threshold both before and after investment, ensuring they are small and early-stage.

Additionally, companies must engage in a qualifying business activity, meaning the trade must be intended to generate profit and cannot include excluded activities such as banking, farming, or property development. Many companies have received investment through EIS funds, supporting business growth, job creation, and innovation across the UK. This creates a diversified portfolio that helps mitigate the inherent risks of early-stage investing.

Investment timeframes generally range from 4-7 years before you might expect full exits from all companies. Patience is essential, as these are not liquid investments you can quickly convert to cash. There are two types of EIS funds: “Approved” funds issue tax certificates on the fund’s closing date. “Unapproved” funds (more common) issue certificates when each individual investment is made.

Who can invest in EIS funds?

EIS funds are open to UK taxpayers, and are primarily available to UK residents who have enough tax liability to claim the reliefs. You need to be comfortable locking away capital for several years and with the high-risk nature of early-stage investing. EIS funds often pool capital from individual investors and angel investors, who may invest alongside each other and bring industry expertise as well as financial support.

The tax reliefs help cushion potential losses, but they don’t eliminate risk entirely. Some companies in the portfolio may fail completely, while others might deliver substantial returns.

You cannot be “connected” to the companies receiving investment. This means you can’t be an employee or own more than 30% of the shares in any business receiving your funds.

What happens if an EIS company fails?

When investing in early stage companies through the Enterprise Investment Scheme, it’s important to remember that not every business will succeed. If a company in your EIS fund fails, you may be able to claim loss relief to help offset the financial impact. This valuable tax relief allows you to set the loss against either your income tax or capital gains tax, depending on what works best for your individual circumstances.

To qualify for loss relief, you must have held your EIS shares for at least three years from the date of issue. If the company fails after this period, you can claim the relief in the tax year the loss occurs. This can significantly reduce the net loss on your investment, making EIS investments more attractive despite their high-risk nature.

EIS investments are designed to encourage investment in early stage businesses, which often operate in fast-moving sectors like technology or consumer tech. While these companies offer exciting growth potential, they are also more vulnerable to market changes, competition, and management challenges. That’s why thorough investment research and due diligence are essential before you invest in EIS qualifying companies.

Ultimately, while the failure of an EIS company can result in a loss, the combination of income tax relief, capital gains tax exemption, inheritance tax benefits, and loss relief helps to cushion the blow. By carefully selecting funds, conducting your own research, and seeking expert advice, you can make the most of the opportunities EIS funding offers, while managing the risks that come with investing in early stage businesses.

Common questions about EIS funds

When do I get my tax relief? With approved funds, you get all certificates at once. With unapproved funds, you receive them as investments are made, potentially spanning multiple tax years. Can I sell my investment early? Technically yes, but it’s difficult to find buyers. You’ll also lose your tax relief if you sell within three years of the investment date. Specific rules define the procedures for transferring or inheriting EIS shares, which can affect tax reliefs and the status of both original investors and beneficiaries.

How do I claim the tax relief? You’ll need to complete the relevant sections of your Self Assessment tax return. This requires the EIS3 certificates provided by the fund manager. It is recommended to consult a reliable guide or trusted source to ensure you follow the correct process and understand your eligibility.

What happens if a company fails?” You can claim loss relief against either income tax or capital gains tax. This reduces the impact of the loss, typically recovering between 20-45% depending on your tax situation.

What is the Seed Enterprise Investment Scheme (SEIS) and how does it differ from EIS?” The Seed Enterprise Investment Scheme is designed to encourage investment in very early-stage, smaller companies by offering higher tax reliefs than EIS. SEIS has different eligibility criteria, investment limits, and risk factors compared to EIS, and investors must hold shares for a specific period to maintain tax benefits.

Final Thoughts

EIS funds offer a powerful combination of tax benefits and growth potential for investors willing to accept higher risk. The 30% income tax relief provides an immediate boost, while capital gains exemptions add long-term advantages.

It’s important to remember that past performance is not indicative of future performance, and investors should be aware of the risks involved, including the potential for loss and limited liquidity. EIS funds often prioritise companies with strong management teams to increase the likelihood of success, but future performance remains uncertain.

These investments should form part of a balanced portfolio rather than your entire investment strategy. They’re particularly valuable for higher-rate taxpayers looking to support innovative businesses while reducing their tax burden.

Always seek professional financial advice before investing in EIS funds. These investments aren’t suitable for everyone, and tax rules can change over time, potentially affecting their benefits.

Pie tax: Simplifying EIS Funds Tax

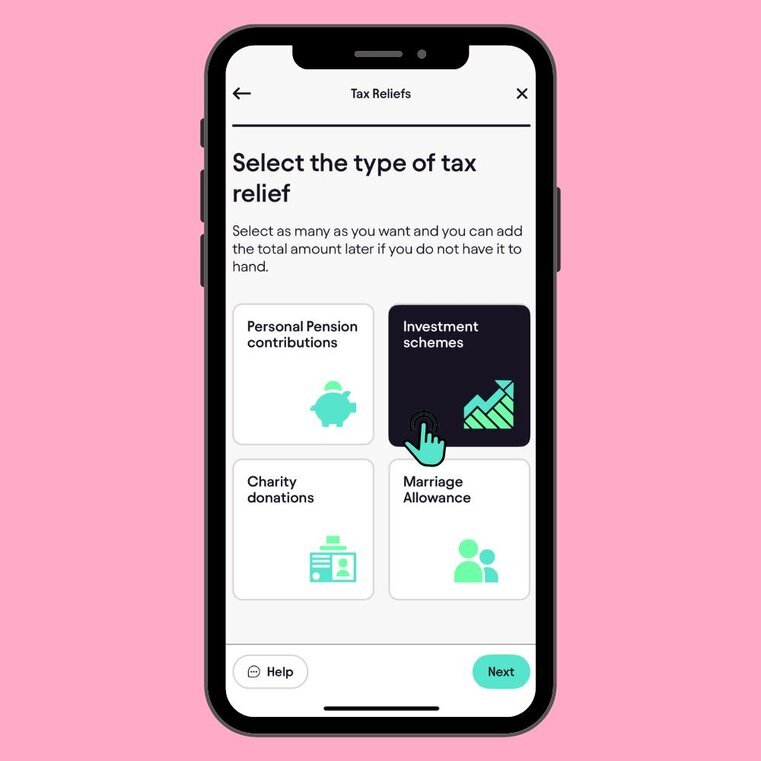

Managing your EIS investments and their tax implications shouldn't give you a headache. Pie tax, the UK's first personal tax app, you can easily track your EIS investments through our tax relief feature and submit your Self Assessment directly to HMRC.

We generate all the documentation you need for HMRC claims, saving you hours of paperwork. Our dashboard gives you a clear overview of your tax position across all investments at any time. Take a look at our app if you'd like to see how we can make your EIS tax journey smoother and more rewarding.

Quick and Easy Guide to Adding EIS Tax Relief in the Pie App

Follow these steps to add EIS tax Relief and submit Self-assessment Tax Return

To add EIS tax relief, simply tap on 'Quick Add' on the home screen on the Pie App. Select the specific investment scheme you want to claim.Step 1

Once you’ve confirmed that all progress pills are complete, tap on the ‘Submit to HMRC’ button. Step 2