Lets get started...

EIS advance assurance provides startups with HMRC’s confirmation that their investment opportunity qualifies for tax benefits. This preliminary approval gives investors confidence in receiving their promised tax reliefs.

Without this assurance, raising capital becomes significantly more challenging in the competitive UK startup ecosystem. Most serious investors now not only expect to see this documentation before committing funds, but it is also expected as a standard part of the investment process.

Proper preparation can dramatically increase your chances of first-time approval. Strategic planning is essential when seeking advance assurance, as it helps align your funding goals with scheme requirements and ensures a smoother application process. Our data shows that well-prepared applications are approved 80% faster than incomplete submissions. Conducting thorough diligence during your application preparation is vital to meet regulatory requirements and make informed decisions.

What Exactly Is EIS Advance Assurance?

EIS advance assurance is essentially HMRC’s preliminary thumbs-up that your company qualifies for the Enterprise Investment Scheme tax reliefs. The advance assurance service is a non-statutory, discretionary service provided by HMRC to companies seeking to demonstrate eligibility for tax-advantaged investments. It provides written confirmation before you actually accept investment.

While not legally required, it’s practically essential for attracting serious investors to your startup. EIS is a government-backed venture capital scheme designed to encourage investment in high-growth startups. I’ve seen promising ventures struggle for months without it, only to secure funding within weeks after approval.

The process typically takes 4-6 weeks from submission to decision, though this can vary during busy periods. For companies seeking to raise venture capital under the EIS, this is an important step in the application process. HMRC’s response times often slow considerably near tax year-end.

It’s not a guarantee of final approval, but it significantly reduces the risk for both you and your potential investors. Think of it as removing a major obstacle from your fundraising path.

Why Every Startup Should Apply for Advance Assurance

Most savvy investors simply won’t commit capital without seeing your advance assurance letter first. Advance assurance gives investors the confidence to invest, knowing their investment is likely to qualify for tax relief. This document substantially reduces uncertainty around whether they’ll receive their valuable tax benefits.

The 30% income tax relief, capital gains exemptions, and loss relief make EIS particularly attractive. These incentives often tip the scales for investors choosing between multiple opportunities, especially when considering enterprise investment schemes such as EIS and SEIS.

In today’s competitive funding landscape, having advance assurance makes your investment opportunity stand out. It demonstrates professionalism and preparedness that investors appreciate. Advance assurance is also relevant for other venture capital schemes, not just EIS.

It helps identify potential eligibility issues before you accept investment, saving potentially awkward conversations later. Prevention is always better than trying to fix problems after money has changed hands.

Are You Eligible for EIS?

To qualify for EIS or any venture capital scheme, your company must provide the following information to HMRC as part of the eligibility criteria: Your company must be unquoted and UK-based with a permanent establishment here. This means having a physical presence where substantive business activities occur.

You need to conduct a qualifying trade, many financial services and property businesses are excluded. HMRC maintains a detailed list of excluded activities worth reviewing.

Your gross assets must not exceed £15 million before investment, and you must have fewer than 250 full-time equivalent employees. These thresholds are strictly enforced. Your company needs to be independent and not controlled by another company. Complex corporate structures can sometimes create unexpected barriers to qualification.

The investment must present a genuine risk of loss to investors so-called “capital preservation” schemes generally don’t qualify. HMRC scrutinises this aspect particularly closely.

How to Apply for EIS Advance Assurance

You can apply online for EIS advance assurance using HMRC’s portal. The application form EIS(AA), along with all supporting documents, must be submitted to HMRC. Make sure to include a covering letter with your application and supporting documents, and ensure all attachments are clearly labelled and referenced in your covering letter.

You can also authorise an agent to act on your behalf to submit the application. The agent can act as your representative throughout the process, handling submissions and communications with HMRC. If you are applying for both EIS and SEIS, you must submit separate applications for each scheme.

Include a solid business plan and financial projections that show how the investment will help your business grow. These should be realistic and demonstrate genuine commercial potential.

Answer the risk-to-capital condition questions clearly, showing both risk to investors’ capital and potential for growth. This balance is crucial for successful applications. The process for SEIS applications is similar, but may have some differences in required documentation.

Why HMRC Might Say No

Insufficient evidence that the investment meets the risk-to-capital condition, investments must genuinely risk loss. Arrangements that appear too safe will raise red flags. Before submitting an application, companies should conduct their own due diligence to ensure all eligibility criteria are met and compliance requirements are thoroughly evaluated.

Poorly explained growth plans or missing documentation that leaves HMRC guessing about your intentions. Ambiguity rarely works in your favour with tax authorities. Including pre-arranged exit mechanisms or excessive investor protections that reduce genuine risk. These can undermine the scheme’s intended purpose.

Company structure issues or activities that don’t qualify under EIS rules. Even minor involvement in excluded activities can jeopardise your application. Previous investments or arrangements that breach EIS conditions, even if made before your application. Your company’s entire history matters in this assessment.

What Happens After You Get Approval?

Your advance assurance does not have a specific expiry date, but it is generally valid for investments made within the next 6 months. Significant delays beyond this timeframe may require a fresh application.

You can raise funds through multiple rounds under the same assurance, provided your business plans remain broadly similar. Material changes should be communicated to HMRC, as changes in your company's circumstances may affect the validity of your advance assurance.

After issuing shares, you’ll need to submit an EIS compliance statement to HMRC for final approval. This confirms that you’ve actually followed through as planned.

Remember to notify HMRC of any significant changes to your business plans that might affect eligibility. Transparency helps maintain your good standing. Once HMRC approves your EIS compliance statement, your investors receive EIS3 certificates they need to claim their tax relief. These are essential documents that investors are expected to receive promptly.

Final Thoughts

EIS advance assurance isn't just a box-ticking exercise, it's a vital step for UK startups seeking investment. The process requires attention to detail but delivers substantial benefits.

While the application might seem daunting at first, understanding the requirements and preparing properly will significantly boost your chances of approval. Organisation is key.

Remember that HMRC wants to prevent tax avoidance, not block legitimate business funding. Being transparent and thorough in your application demonstrates good faith and professionalism.

Pie tax: Simplifying EIS Advance Assurance Tax

Starting your EIS journey shouldn’t give you sleepless nights. Pie tax offers step-by-step guidance through the entire process.

We help track all compliance requirements both before and after investment, ensuring you maintain your valuable EIS status as you grow. Our automated reminders prevent costly oversights.

The UK’s first personal tax app provides clear documentation templates specifically designed for successful HMRC submissions. These templates incorporate best practices from hundreds of approved applications.

Fancy seeing how it works? Take a peek at the Pie tax app today.

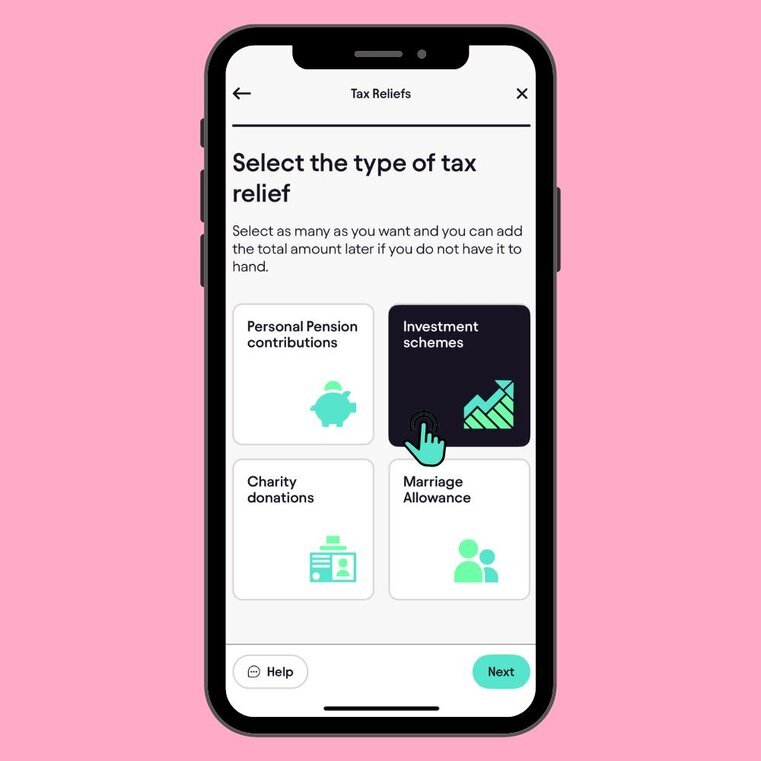

Quick and Easy Guide to Adding EIS Tax Relief in the Pie App

Follow these steps to add EIS tax Relief and submit Self-assessment Tax Return

To add EIS tax relief, simply tap on 'Quick Add' on the home screen on the Pie App. Select the specific investment scheme you want to claim.Step 1

Once you’ve confirmed that all progress pills are complete, tap on the ‘Submit to HMRC’ button. Step 2