Lets get started....

Renting out your property on Airbnb can be a brilliant way to earn extra income. However, airbnb rental income is subject to tax, and you are required to pay rental income tax on any earnings from short term rentals.

HMRC sees your Airbnb earnings as taxable income. Paying tax on Airbnb rental income is essential to comply with HMRC rules, and they expect you to declare it properly through Self Assessment.

Getting your head around what counts as income and what expenses you can claim is essential. This knowledge helps you stay on the right side of the tax rules and understand how much tax you may need to pay, depending on your total income and tax band. Rental income tax is the specific tax owed on your Airbnb earnings.

Pie tax, the UK’s first personal tax app, makes tracking your Airbnb income and expenses simple with automatic calculations. Or if you’re just here to get to grips with it all, let’s break it down!

What Counts as Taxable Airbnb Income?

All money you receive from guests counts as income that HMRC wants to know about. This includes the nightly rate, cleaning fees, and any other charges you pass on to guests. Airbnb income is considered separately from your main income, and may be eligible for specific tax allowances depending on your situation.

If you’re an occasional host, you might benefit from the £1,000 Property Allowance. This means if your total property income is under £1,000 for the tax year, you don’t need to declare it. For those renting out a room in their own home, the Rent-a-Room scheme offers a tax-free allowance of up to £7,500 per year.

This can be particularly valuable for London hosts where rates are higher. It’s important to understand the legal terms that define eligibility for the Rent-a-Room scheme or Furnished Holiday Let (FHL) status.

Regular income from Airbnb is combined with your other earnings, such as employment or self employment income, to determine your overall tax band and liability. If you have self employment income or are in self employment, you must declare all sources of income for tax purposes.

Remember though, these allowances apply to your gross income before expenses. You can’t use both allowances for the same property. The amount of tax you pay depends on your total income and which tax band you fall into.

National Insurance and Business Considerations

Running an Airbnb can sometimes mean you’re treated as self-employed for national insurance purposes, especially if your rental income is significant or you provide extra services to guests. If your rental income goes over £6,725 in a tax year, you may have to pay Class 2 National Insurance contributions, though from the 2024/25 tax year, these will be abolished.

For those with rental income above £12,570, Class 4 National Insurance contributions may apply, adding to your overall tax bill. It’s important to treat your Airbnb as a property business: register for self assessment, keep accurate records, and claim all allowable expenses to reduce your taxable income.

If you invest in capital expenditure, such as new furniture or equipment for your property, you may be able to claim capital allowances, further lowering your tax bill. Staying on top of the tax rules and understanding your obligations will help you run your Airbnb more efficiently and avoid any surprises at the end of the tax year.

How to Handle Your Airbnb Income on Self Assessment

You'll need to register for Self Assessment if your property income exceeds £1,000 in a tax year. The same applies if you're not covered by Rent-a-Room, or if HMRC specifically asks you to file a return. The deadline for registering is 5 October after the end of the tax year. For income earned between 6 April 2023 and 5 April 2024, you'd need to register by 5 October 2024.

When filling out your tax return, you'll complete the UK property pages (SA105). If your property qualifies as a Furnished Holiday Let, you'll use a different section. Keep all your records for at least five years after the submission deadline. HMRC can check your figures at any point during this time.

Expenses You Can Claim to Reduce Your Tax Bill

One of the best ways to lower your tax bill is by claiming all eligible expenses against your Airbnb income. This includes Airbnb service fees, cleaning costs, welcome pack items, and gardening services as part of property maintenance expenses. Insurance premiums and marketing expenses to promote your listing are also deductible. I once saved nearly £300 in tax by properly tracking the professional photos I commissioned for my listing.

For bills like electricity and internet, you can claim the proportion used for your Airbnb guests. If you rent out part of your home 50% of the time, you might claim 50% of that part’s share of the bills. Repairs and maintenance are claimable, but be careful with improvements. Adding an extension or undertaking major renovations counts as capital expenditure and can’t be deducted from rental income.

If you’ve bought furniture specifically for your Airbnb, you may be able to claim these costs through capital allowances. This is especially true if you qualify as a Furnished Holiday Let.

Capital Gains Tax Implications

If you decide to sell a property that you’ve used for Airbnb rentals, you may need to pay capital gains tax (CGT) on any profit you make from the sale. The amount of CGT you owe depends on your total gains, your tax band, and whether you qualify for any reliefs.

For example, if the property was your main residence at any point, you might be able to claim private residence relief, which can reduce your CGT bill. In some cases, entrepreneurs’ relief (now called Business Asset Disposal Relief) may also be available if the property was used for business purposes.

Because capital gains tax rules can be complex and the reliefs available depend on your individual circumstances, it’s wise to seek professional tax advice before selling. This will help you claim all the reliefs you’re entitled to and ensure you pay the correct amount of tax.

Council Tax and VAT Obligations

As an Airbnb host, you’ll usually be responsible for paying council tax on your property if it’s available for short-term letting for fewer than 140 days in a tax year. If your property is let out for longer periods and meets certain criteria, you may instead be liable for business rates, which could exempt you from paying council tax.

It’s important to check with your local authority to confirm your property’s status and ensure you pay council tax or business rates as required.

If your total rental income from Airbnb and other sources exceeds £85,000 in a tax year, you may also need to register for value added tax (VAT). This means you’ll have to charge VAT on your bookings and pay it to HMRC. Understanding your council tax and VAT obligations is essential to avoid unexpected bills or penalties and to keep your Airbnb business running smoothly.

Making Tax Digital for Airbnb Hosts

Making Tax Digital (MTD) is a government initiative designed to modernise the UK tax system by requiring digital record-keeping and online tax submissions. As an Airbnb host, you may need to comply with MTD rules, especially if your rental income is high or you operate as a business. MTD aims to make tax reporting more accurate and efficient, helping you avoid errors and penalties.

Using digital accounting software can make it easier to track your rental income, allowable expenses, and tax reliefs throughout the tax year. Submitting your tax return electronically ensures you meet your tax obligations and can help you take advantage of available tax reliefs. Staying up to date with MTD requirements and seeking professional tax advice when needed will help you manage your Airbnb taxes confidently and efficiently.

Property Rental or Furnished Holiday Let?

Your tax position can be much more favourable if your property qualifies as a Furnished Holiday Let (FHL). This classification offers better tax treatment than a standard rental.

To qualify as an FHL, your property must be in the UK or EEA and fully furnished. It must be available for commercial letting for at least 210 days a year and actually let for at least 105 days. These requirements are set out in specific legal terms by HMRC, so it’s important to understand the official legal definition and criteria for FHL status.

FHL status brings several tax benefits: you can claim capital allowances on furniture and equipment. Your profits count as earnings for pension purposes, and you might get better treatment for capital gains tax. Standard rentals don’t get these perks, but they’re still subject to the same income tax rates as any other income you earn.

Making Tax Digital for Airbnb Hosts

MTD for Income Tax starts in 2026, so it’s worth getting ready now.

Choose MTD-compatible software like Pie that connects to your bank accounts to record income and expenses automatically.

Review your current record-keeping methods and move towards digital tracking to stay compliant. Speak with your accountant about their MTD plans and which software they recommend.

Getting set up early will make future tax submissions smoother and stress-free.

Property Rental or Furnished Holiday Let?

Your tax position can be much more favourable if your property qualifies as a Furnished Holiday Let (FHL). This classification offers better tax treatment than a standard rental.

To qualify as an FHL, your property must be in the UK or EEA and fully furnished. It must be available for commercial letting for at least 210 days a year and actually let for at least 105 days. These requirements are set out in specific legal terms by HMRC, so it’s important to understand the official legal definition and criteria for FHL status.

FHL status brings several tax benefits: you can claim capital allowances on furniture and equipment. Your profits count as earnings for pension purposes, and you might get better treatment for capital gains tax. Standard rentals don’t get these perks, but they’re still subject to the same income tax rates as any other income you earn.

Common Airbnb Tax Mistakes to Avoid

Many hosts fail to keep proper records throughout the year. Come tax time, they're left scrambling through bank statements trying to piece together their income and expenses. Another mistake is claiming for personal use periods. If you stay in your Airbnb property yourself, you can't claim expenses for those periods.

Some hosts forget about council tax implications. If you're letting your property for short periods, you might need to pay business rates instead of council tax. Don't forget to check your mortgage terms too. Many standard residential mortgages don't allow for short-term letting, and your insurance might not cover it either.

Final Thoughts

Getting your Airbnb tax right isn't just about avoiding penalties. It's about making sure you're not paying more tax than you need to. Take time to understand which expenses you can claim and keep organised records throughout the year. This simple habit can save you hundreds of pounds.

If your situation is complex or your income substantial, getting advice from a tax professional could save you far more than it costs. The right guidance often pays for itself. Remember that tax rules change regularly, so stay informed to keep your tax affairs in good order. HMRC updates their guidance frequently, especially for the growing sharing economy.

Pie tax: Simplifying Airbnb Income Tax UK Tax

Dealing with your Airbnb taxes shouldn't be something that keeps you awake at night. Many hosts find the process stressful and time-consuming. Pie tax, the UK's first personal tax app, makes it easy with real-time tax calculations specifically designed for property hosts. You can see exactly what you owe as you go.

Our smart match feature allows you to add multiple expenses at once. Nothing gets missed. We connect directly to your bank account, giving you a clear picture of your tax position throughout the year. No more last-minute panic before the January deadline.

Curious about how we can make your tax life easier? Take a look at our app to see how it works.

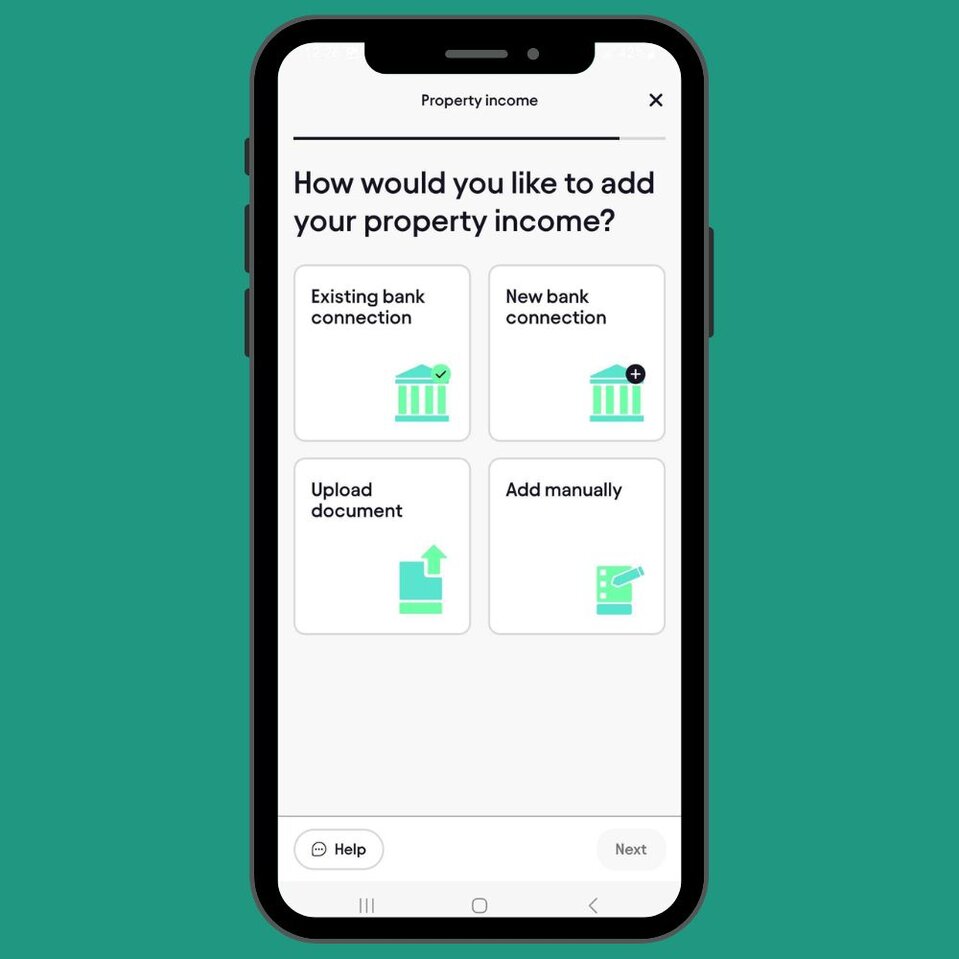

Quick and Easy Guide to Adding Property Income in the Pie App

Follow these steps to get started:

To add Property income source, simply tap on 'Quick Add' on the home screen on the Pie App. Select create an Income type for Property. Step 1

Once you’ve created an income source, you can choose to add income via existing bank connection, new bank connection, upload a document, or manually. Step 2