Why Tax Forecasting Matters

Tax shouldn't be a guessing game. Yet for many UK businesses and individuals, estimating future tax bills feels exactly like that - a shot in the dark.

Traditional methods of tax planning often rely on last year's figures with basic adjustments. This approach leaves significant room for error and unexpected liabilities.

Modern tax forecasting uses data to transform how we anticipate obligations. It replaces guesswork with evidence-based predictions.

At Pie.tax, the UK's first personal tax app, we help clients save an average of 15% through our forecasting tools. Or if you're just here to get to grips with it all, let's break it down!

What Exactly Is Predictive Analytics Tax Forecasting?

Predictive analytics tax forecasting uses sophisticated algorithms to analyse your financial data. It predicts future tax liabilities with remarkable accuracy.

Unlike traditional forecasting, it combines multiple data sources. Your transactions, business trends, and recent tax law changes all feed into the system.

Think of it as a financial crystal ball that improves over time. The systems learn from patterns in your data to make increasingly accurate predictions.

Good forecasting tools provide probability ranges rather than fixed numbers. This helps you understand both likely outcomes and potential variations.

How UK Taxpayers Benefit

The most obvious benefit is eliminating nasty tax surprises. When you can see what's coming, you can prepare properly.

Better forecasting enables smarter timing of expenses and income. The system might suggest December rather than January for purchases based on your projected position.

Cash flow improves when you're setting aside the right amount for tax. No more scrambling for funds or restricting your working capital through overpayment.

For business owners, predictive analytics provides solid evidence for planning decisions. It's not just professional opinion anymore – it's backed by data.

Last year, I watched a client save over £12,000 by adjusting their dividend timing. The forecasting tool spotted an opportunity that traditional planning would have missed.

The Technology Behind the Magic

Machine learning algorithms power these systems. They continuously improve their predictions as more data becomes available.

Natural language processing helps interpret complex tax regulations. The technology applies rules correctly to your specific situation.

Clear visualisations transform complicated calculations into understandable graphics. Charts and graphs make tax planning less intimidating.

Modern systems connect directly to your accounting software through APIs. This ensures predictions use your latest financial information.

Cloud computing means you don't need expensive hardware. Sophisticated calculations happen in data centres and deliver results to your devices.

Practical Applications for UK Taxpayers

Corporation tax forecasting becomes more reliable with projected earnings. The system accounts for seasonal patterns and growth trends.

VAT calculations get smarter by recognising your business cycles. This helps you prepare for quarterly payments with greater accuracy.

Company directors can model different salary and dividend combinations. The system identifies the most tax-efficient approach for your situation.

Investment planning improves with better capital gains tax predictions. This helps you time asset sales more strategically.

Inheritance tax planning benefits from scenario modelling. Families gain clearer understanding of potential liabilities and mitigation strategies.

Challenges to Consider

Data quality is crucial for accurate forecasting. Predictions are only as good as the information feeding them.

Integration with existing financial systems can sometimes be tricky. Businesses with older technology may face additional hurdles.

Privacy concerns must be addressed properly. Any system handling financial data must comply with GDPR and maintain robust security.

There's a learning curve for teams used to traditional methods. However, most modern interfaces are becoming increasingly user-friendly.

Smaller businesses need to evaluate cost-benefit carefully. Fortunately, affordable options are increasingly available as technology advances.

Getting Started

Begin by auditing your current tax data. Assess how accurate, complete and accessible it is for forecasting purposes.

Identify your specific tax pain points. Focus on areas causing the most stress or uncertainty for quick wins.

Consider whether in-house solutions or advisor partnerships make more sense. Your situation and resources will determine the best approach.

Start with focused applications before expanding. Success in one area builds confidence for wider implementation.

Set clear metrics to measure forecast accuracy over time. This helps refine your approach and demonstrate value.

Final Thoughts

Predictive analytics isn't just changing tax forecasting. It's transforming how UK businesses approach financial planning altogether.

The technology continues to become more accessible. Options now exist for businesses of all sizes and complexity levels.

The question isn't whether to use predictive analytics for tax planning. It's how quickly you can implement it to gain competitive advantage.

Those who embrace these tools gain more control over their financial future. Fewer surprises and more strategic tax decisions await early adopters.

Pie tax: Simplifying Predictive Analytics Tax Forecasting

We know that implementing advanced tax forecasting can feel overwhelming. Our app makes it accessible even if you're not a tax expert.

Pie tax offers real-time tax liability updates with predictive elements. Our system learns from your specific situation to improve accuracy over time.

Our multiple-income dashboard brings together all your revenue streams. Smart analytics give you a clear picture of future obligations across everything you do.

If you're curious about how predictive tax forecasting could work for you, the Pie tax app is ready when you are.

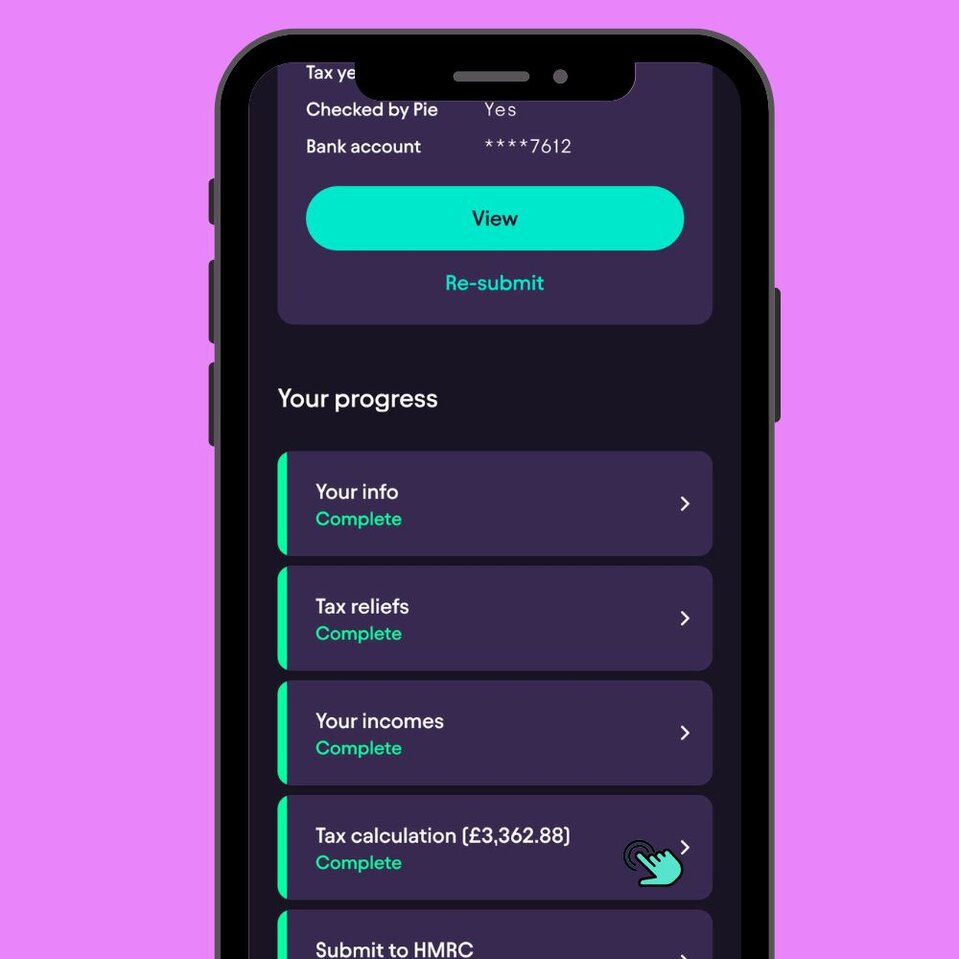

Quick and Easy Guide to Check Real Time Tax Figure in the Pie App

Follow these steps to track your real time tax figures

Open the Pie app, input your income and expenses, and instantly view your real-time tax calculations.Step 1

Once you’ve added all the information, you can view your real-time tax figures on the "Homepage" of the Pie App. Step 2