Steps to Accurately Enter Your Student Loan Details for Self-Assessment

Managing your business finances becomes easier when you can filter out personal transactions from your view. The good news is that you don't need to delete personal transactions in Pie Tax only reconciled transactions are included in your tax return. Instead, you can simply hide personal transactions to focus on your business income and expenses.

Why You Don't Need to Delete Personal Transactions

Before we show you how to hide transactions, it's important to understand that:

- Only reconciled transactions are added to your tax return

- Personal transactions that aren't reconciled won't affect your tax calculations

- Hiding transactions keeps your records intact while giving you a cleaner view

How to Hide Personal Transactions Using Income Source Filter

Follow these simple steps to filter your income transactions by source:

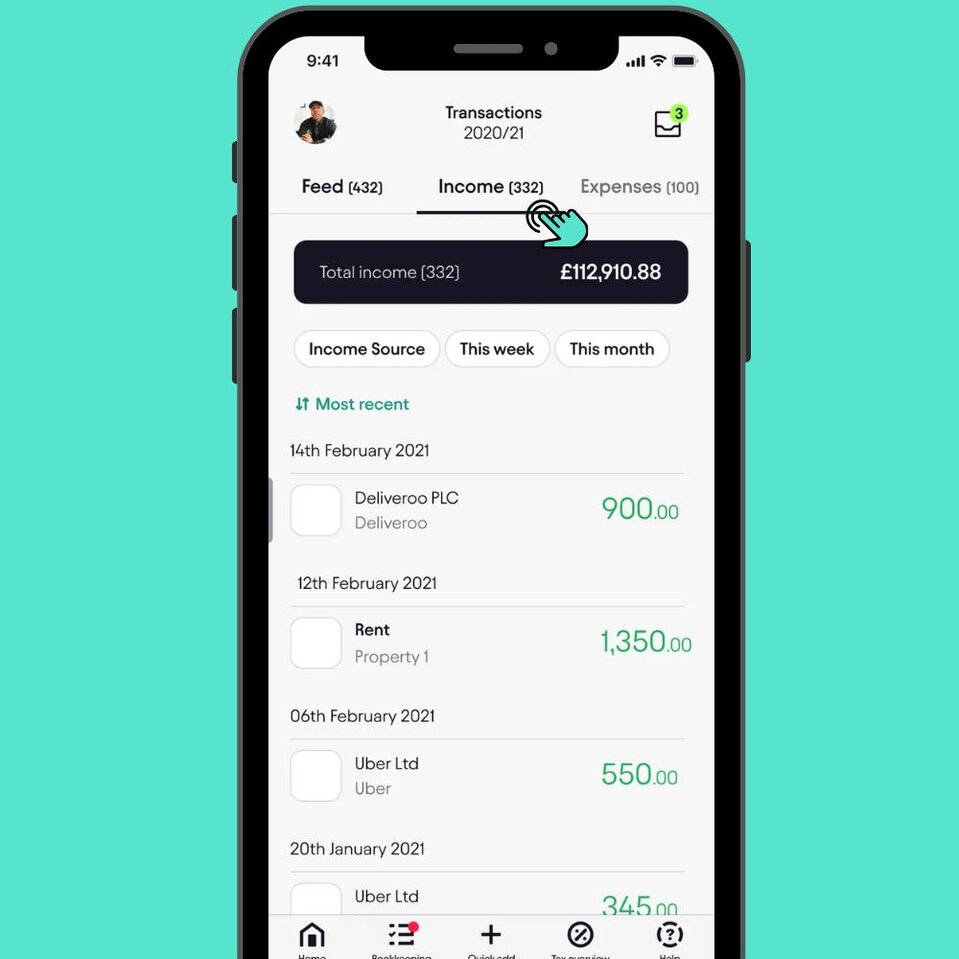

Open your Pie Tax app and tap on the Income tab in your Transactions screen. You'll see your total income and all income transactions listed below.Navigate to the Income Table

Look for the filter buttons below your total income amount. Tap on the "transaction" button to view transactions grouped by their source.Tap on "Transaction"

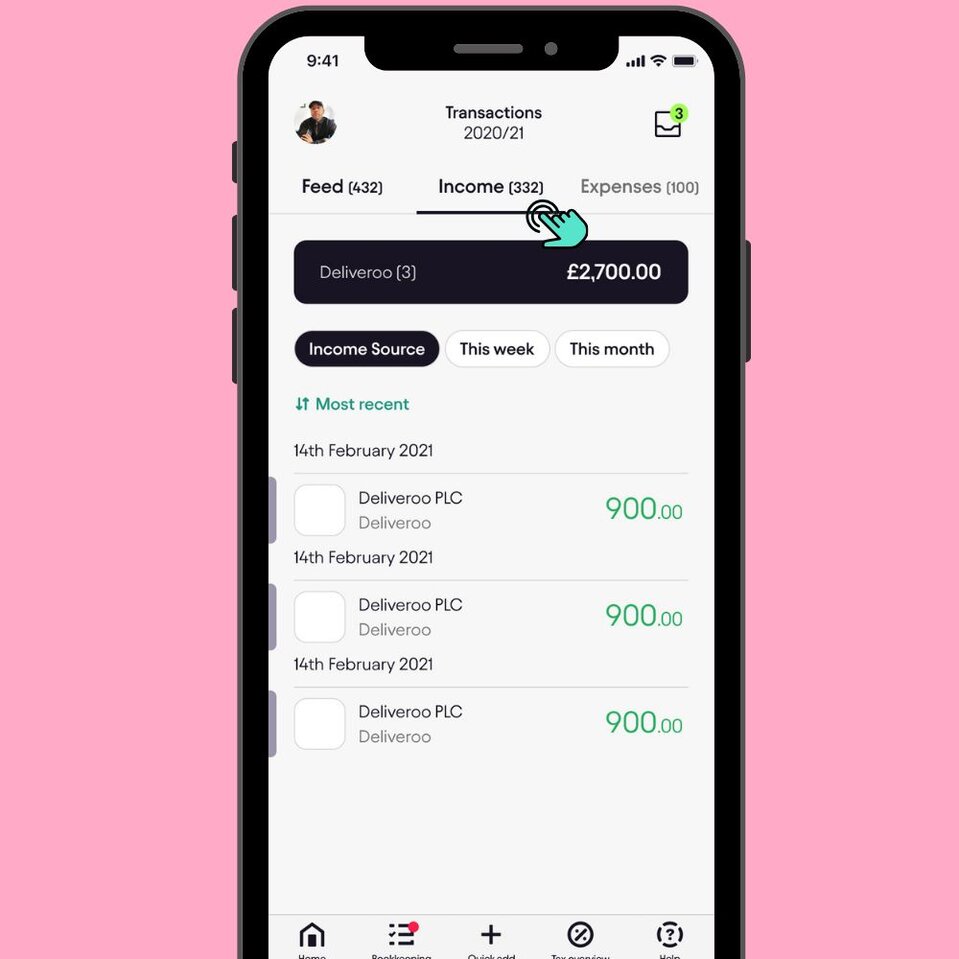

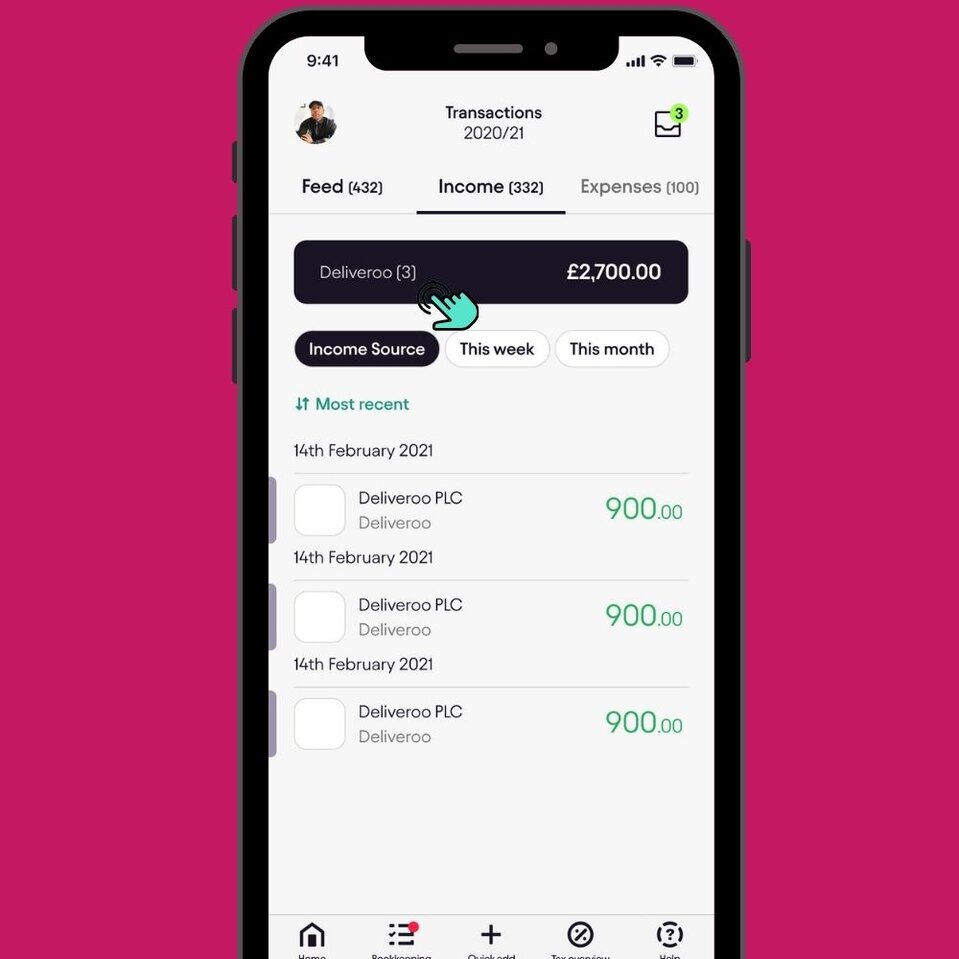

Once you tap "Income Source," your transactions will be automatically filtered and grouped by source. In the example shown, you can see:Select a Specific Income Source

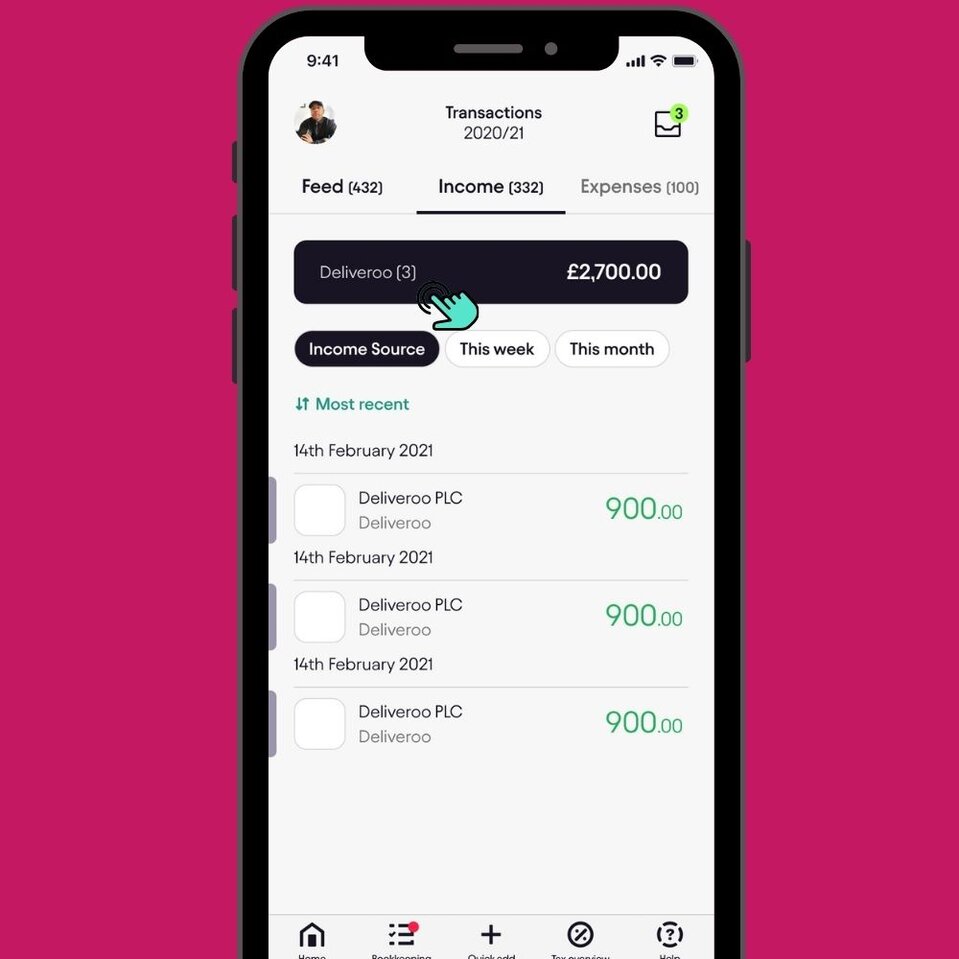

You can tap on "Income Source" again to switch between different income sources and set transaction to HideView Different Income Sources

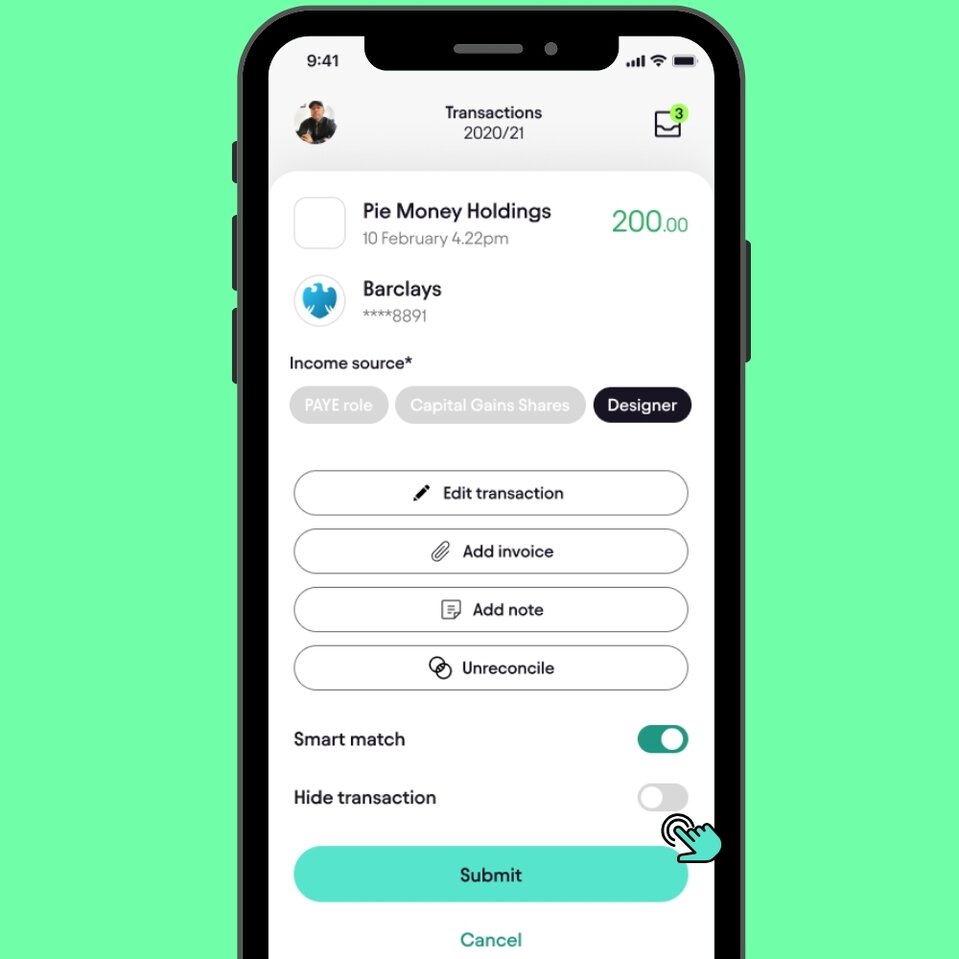

On the transaction details page, scroll down past the transaction information, income source options, and action buttons (Edit transaction, Add invoice, Add note, Unreconcile). You'll find two toggle options at the bottom:Scroll Down to "Hide Transaction" Toggle

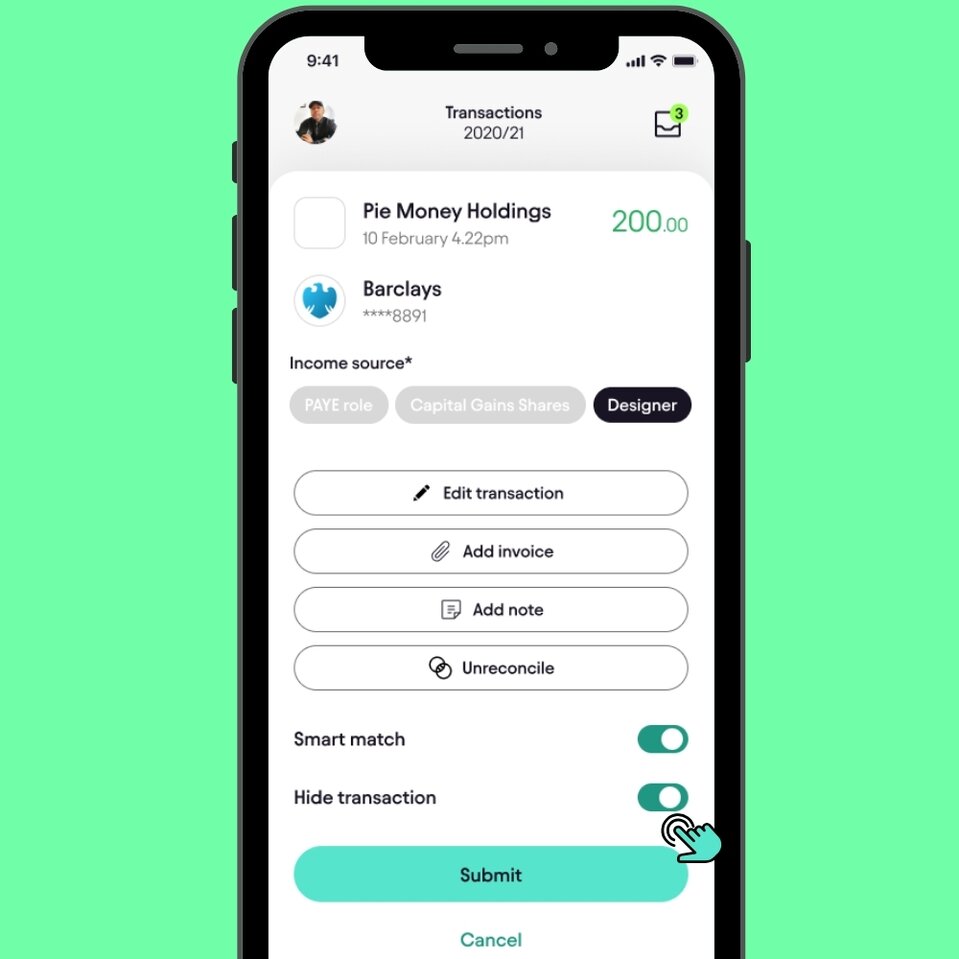

Tap the toggle switch next to "Hide transaction" to turn it on. The toggle will turn green/teal, indicating the transaction will be hidden from your main transaction list.Toggle "Hide Transaction" On

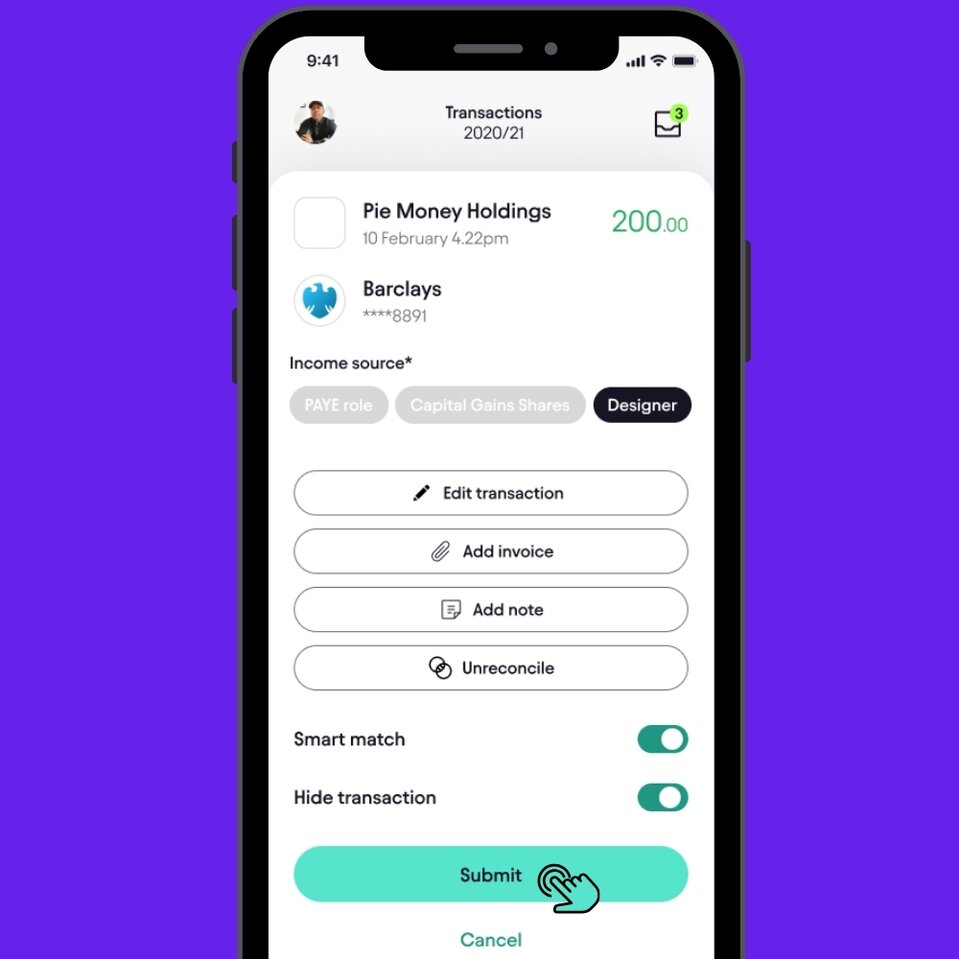

Once you've enabled "Hide transaction," tap the Submit button at the bottom of the screen to save your changes. The transaction will now be hidden from your transaction feed.Submit Your Changes

What Happens When You Hide a Transaction?

When you hide a transaction:

- It disappears from your Feed, Income, and Expenses views

- It won't clutter your transaction list

- It remains in your account records

- It won't be included in your tax calculations (unless it's reconciled)

- You can unhide it anytime by following the same steps and toggling it off

Tips for Managing Personal vs. Business Transactions

- Review regularly: Check your transactions periodically to identify personal vs. business transactions

- Hide systematically: When you spot personal transactions, hide them right away to keep your feed clean

- Use income sources: Categorize transactions properly using income source tags before hiding

- Don't rush to delete: Remember, hiding is reversible but deleting is permanent

- Reconcile wisely: Only reconcile genuine business transactions for your tax return

Need to Unhide a Transaction?

To unhide a transaction, simply:

- Access the hidden transaction (you may need to adjust your filters or search)

- Open the transaction details

- Toggle "Hide transaction" back to OFF (gray/white)

- Tap Submit

Need More Help?

If you're unsure whether a transaction should be hidden or included in your tax return, or if you need help managing your transactions, visit our Help section in the app or contact our support team.