How to Send PayPal Data to Simplify Your Taxes

PayPal has become a vital payment tool for small business owners, freelancers, and self-employed individuals. Whether you’re receiving payments or managing expenses, keeping track of your PayPal activity is key for accurate tax reporting.

To help you streamline the process, we now process PayPal transaction reports. All you need to do is export your PayPal transaction history and send it to us via the Pie Tax App. Our expert tax assistants will take care of the rest, ensuring your taxes are handled accurately and efficiently.

Below, we’ll guide you through the steps to export your PayPal transactions, highlight key benefits, and answer your most pressing questions.

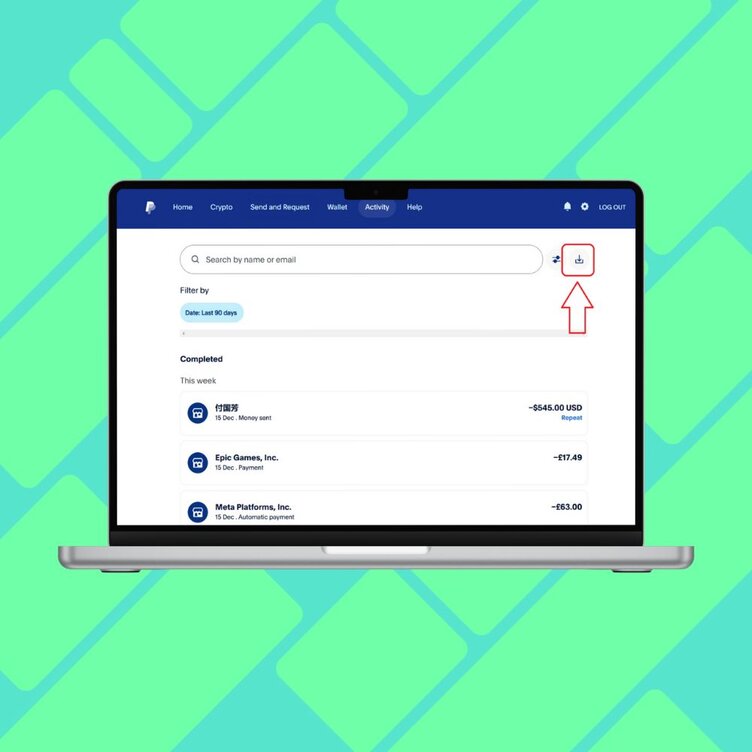

6 Easy Steps to Export and Send Your PayPal Transactions

Key Benefits

By exporting your transactions in a CSV file, you avoid the hassle of manual data entry, saving valuable time.Save Time

With the Pie App and expert assistants, your financial records are processed with precision, reducing errors.Ensure Accuracy

Let our team handle your PayPal data, so you can focus on growing your business without worrying about taxes.Stress-Free Tax Reporting

Frequently Asked Questions

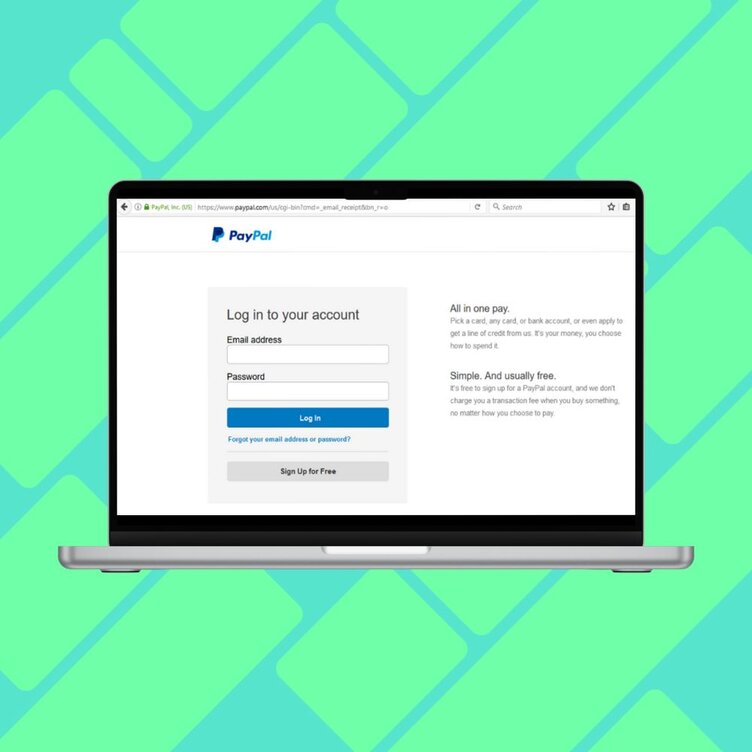

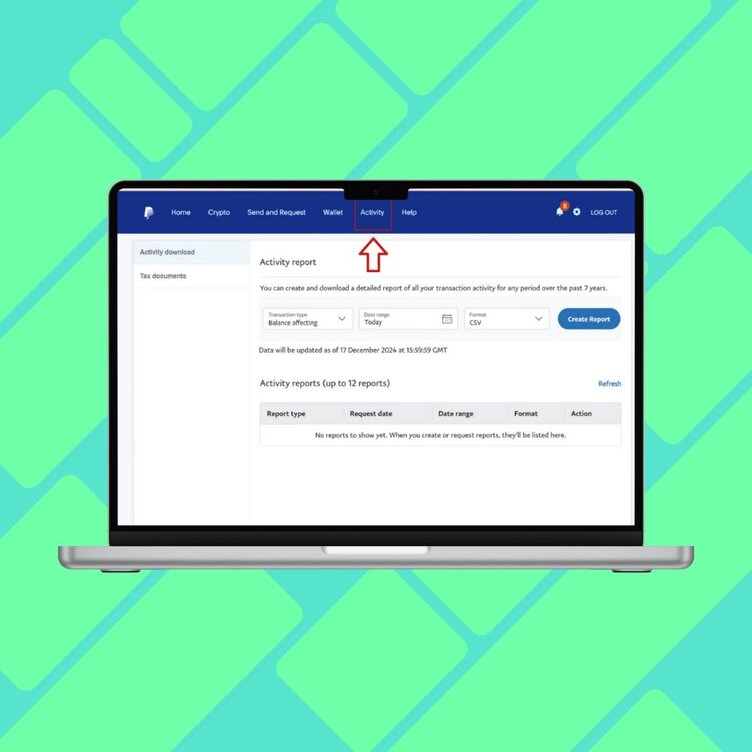

How do I access my PayPal activity report?

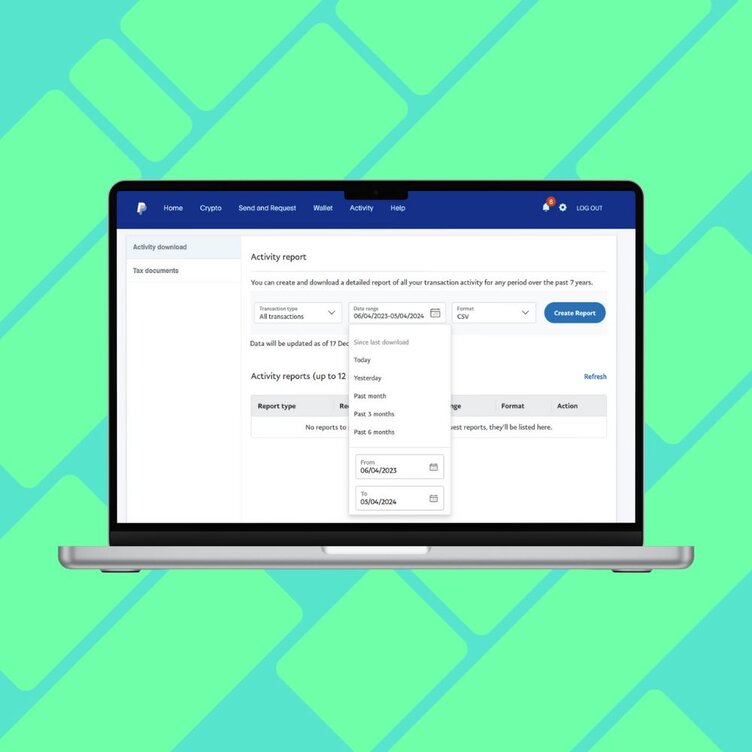

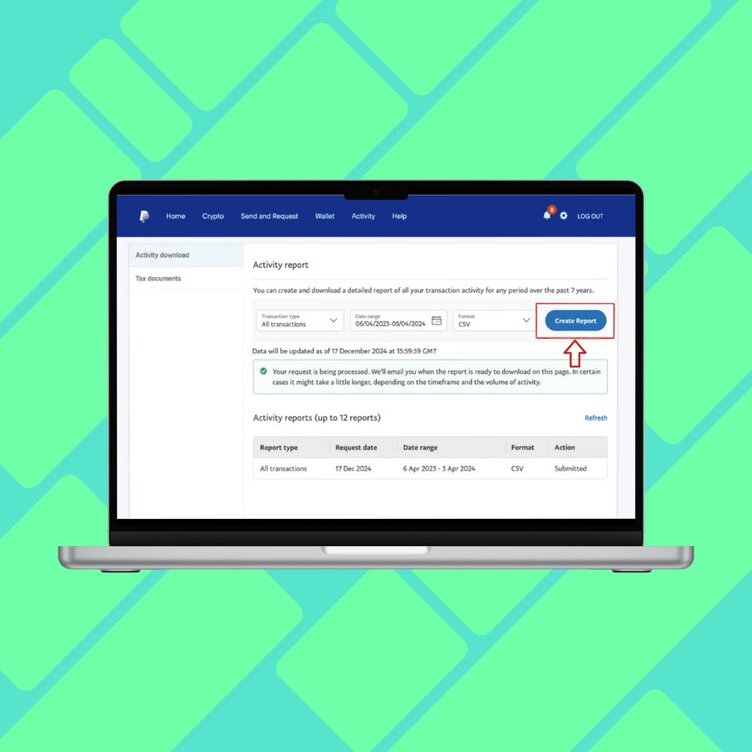

Log in to your PayPal account, go to the Activity section, and follow the steps to create and download a CSV report.

Why do I need to export my PayPal transactions?

Exporting your PayPal data ensures accurate tax calculations, especially if you use PayPal for business payments.

How long does it take to generate the PayPal report?

Once requested, PayPal will process your report. You’ll receive an email when the report is ready to download.

Is my PayPal data secure with Pie Tax App?

Yes, your financial data is handled securely and confidentially by our expert tax assistants.

Can I submit multiple tax years with the Pie Tax App?

Yes, you can submit data for multiple tax years, ensuring all your tax obligations are covered efficiently.