Major HMRC Operation Targets London Currency Exchange

HM Revenue and Customs (HMRC) has seized more than £1.1 million in cash during a large-scale raid on a London-based money service business (MSB), suspected of laundering criminal proceeds. The coordinated operation, which took place on October 9, involved over 100 HMRC officers who carried out simultaneous searches across nine business and residential properties, as well as four vehicles.

Seven men were arrested on suspicion of money laundering offences under sections 327, 328, and 329 of the Proceeds of Crime Act (2002). All have since been released under investigation while inquiries continue.

Over £1 Million in Cash and Assets Seized

During the raids, officers discovered piles of banknotes including Scottish currency and more than $30,000 in US cash at the exchange office. A further £120,000 was recovered from one of the vehicles searched. Alongside the money, investigators also seized gold, electronic devices, and extensive paper records.

The seized funds are being held under the Proceeds of Crime Act, with HMRC granted permission by the courts to retain the assets for six months while the investigation progresses.

Crackdown on Illicit Financial Activity

This latest operation forms part of HMRC’s ongoing efforts to clamp down on money laundering within the UK’s financial services sector. Money service businesses, which include currency exchanges, money transmitters, and cheque cashers, are considered high-risk under anti-money laundering regulations due to the large volumes of cash transactions they handle.

HMRC stated that it remains committed to protecting the UK’s financial integrity and preventing criminal networks from exploiting legitimate businesses to disguise illicit gains.

HMRC Responds: “We Will Investigate Any Business Suspected of Laundering”

Margaret Mousley, Deputy Director at HMRC’s Fraud Investigation Service, commented:

“We will always be on the side of the law-abiding majority and will investigate any business suspected of laundering the proceeds of crime. This is a significant amount of money, and the courts have agreed we can hold it for six months while our investigations continue.”

Mousley also urged members of the public to report any suspicions of tax fraud or money laundering via the official government portal at GOV.UK.

The Legal Framework: Proceeds of Crime Act and AML Rules

Under the Money Laundering Regulations, all MSBs must register with HMRC and comply with strict reporting obligations. The Proceeds of Crime Act (2002) allows authorities to seize cash and assets suspected to be linked to illegal activity, even before a conviction is secured.

These laws are designed to disrupt organised crime by removing the financial incentive and stopping the flow of illicit money through legitimate financial systems.

Broader Economic and Policy Context

The UK’s fight against money laundering has intensified in recent years following several high-profile investigations into financial misconduct. Regulators, including HMRC and the Financial Conduct Authority (FCA), are now collaborating more closely to detect suspicious activity within both traditional and fintech-based services.

Experts have noted that London’s status as a global financial hub makes it a key target for money launderers, increasing the importance of regulatory vigilance and stronger compliance systems.

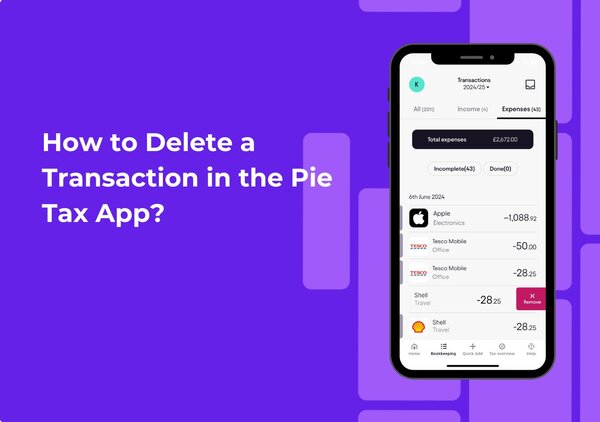

Simplifying UK Tax and Compliance

Pie is a UK-based fintech platform designed to make tax compliance simple for individuals, freelancers, and small businesses. Through its easy-to-use app, Pie helps users manage taxes, monitor HMRC updates, and file reports efficiently empowering financial transparency and compliance in the digital age.