Lets break it down...

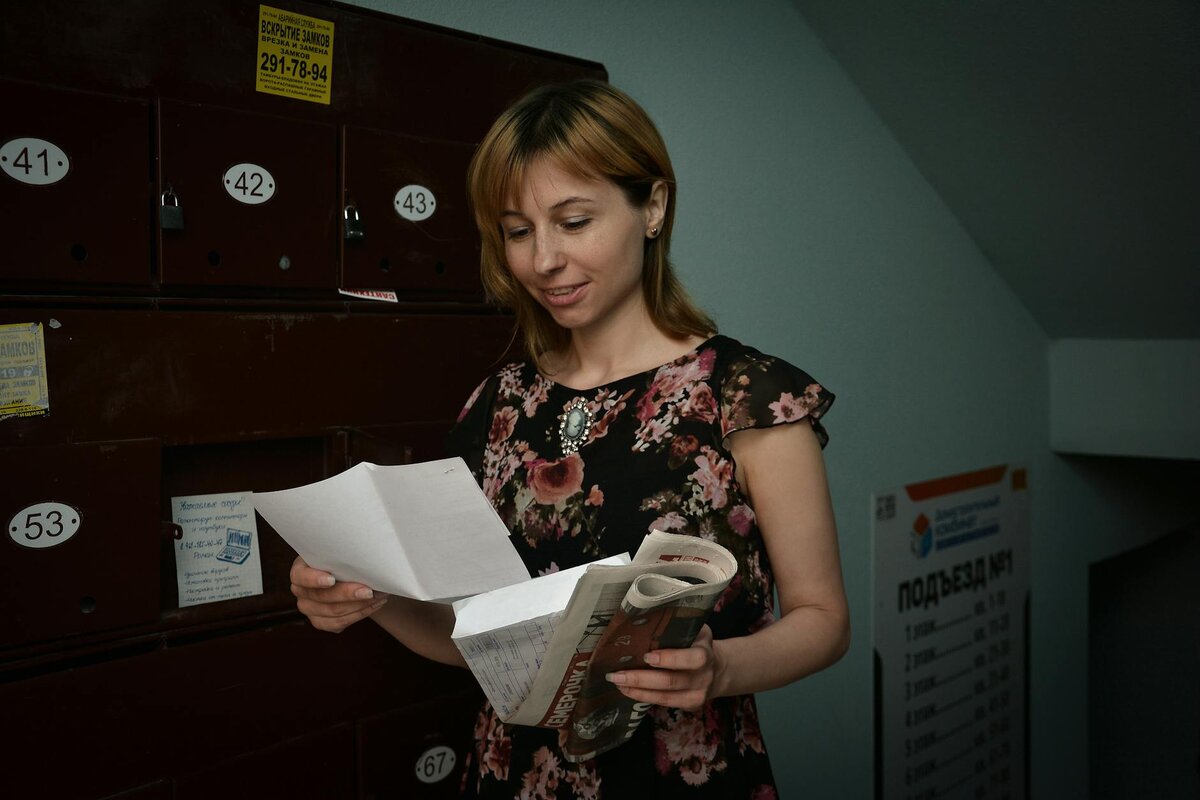

Receiving a letter from HMRC can make anyone’s heart skip a beat. But not all HMRC communications signal trouble, nudge letters are more like a tap on the shoulder than a slap on the wrist.

These nudge letters are also known as 'one to many letters' because they are sent to multiple taxpayers at once as part of HMRC's compliance strategy to encourage people to review and update their tax affairs.

The UK’s first personal tax app, Pie tax, helps you stay on top of your tax affairs so you’re less likely to receive these prompts. Or if you’re just here to get to grips with it all, let’s break it down!

What Are HMRC Nudge Letters?

HMRC nudge letters are gentle prompts sent to taxpayers when the tax authority spots something that needs attention. They’re not formal investigations but rather a way of encouraging you to check your tax affairs. These letters are designed to prompt taxpayers to review their tax affairs and encourage individuals to comply voluntarily with their obligations.

These letters are part of HMRC’s softer approach to tax compliance. Instead of immediately launching an investigation, they give you a chance to sort things out yourself. Educational nudge letters are sometimes used to help UK taxpayers better understand their obligations and avoid mistakes.

The name “nudge” comes from behavioural economics, it’s about giving people a little push to do the right thing. I once received one about a missing interest declaration, and the tone was surprisingly helpful rather than accusatory.

Typically, nudge letters highlight specific areas where HMRC thinks there might be an issue. This could include undeclared income, incorrect claims or discrepancies in your tax return.

Why HMRC Sends These Letters

HMRC doesn’t send nudge letters randomly. They’re usually triggered by information HMRC already has that doesn’t match what you’ve reported.

With advanced data analysis tools, HMRC can spot patterns and inconsistencies across millions of tax records. When something looks off with your taxpayer's records, a nudge letter might follow. If discrepancies are found, HMRC asks for clarification or further information to ensure your records are accurate and up to date.

Common triggers include information from banks, property transactions, overseas bank accounts, offshore income, or third-party reports. HMRC often reviews data for specific tax years, such as the 2023/24 or 2024/25 tax year, and may focus on offshore income or overseas bank accounts, especially under the Common Reporting Standard, which enables international data exchange.

Sometimes these letters are part of wider campaigns targeting specific groups. Landlords, crypto investors, or those with overseas income often receive targeted communications.

Common Types of Nudge Letters

Property income letters are sent when HMRC suspects you’re renting out property but haven’t declared all the income. They might reference Land Registry records or rental deposit schemes. Offshore investment letters target those with overseas assets or income that might not have been fully reported. HMRC receives information from over 100 countries under automatic exchange agreements.

Cryptocurrency nudges are increasingly common as HMRC cracks down on unreported crypto gains. They often obtain data directly from exchanges and trading platforms.

Self-employment letters might arrive if HMRC thinks your declared income doesn’t match your lifestyle. They may reference industry benchmarks or third-party payment information. HMRC may also encourage you to complete a self assessment if they believe you have underpaid taxes, ensuring all income is properly declared and tax obligations are met.

VAT compliance nudges often highlight discrepancies in VAT returns. They might suggest your turnover indicates you should be VAT-registered. These nudge letters often prompt disclosures or voluntary disclosure to HMRC, allowing taxpayers to correct underpaid tax and ensure compliance with their taxes.

Triggers for Receiving a Nudge Letter

Receiving a nudge letter from HMRC is often the result of sophisticated checks on your tax affairs. HMRC uses advanced data analysis and international information exchange agreements to compare the information you provide in your tax returns with data from banks, financial institutions, and overseas tax authorities.

If they spot discrepancies, such as undeclared income, missing capital gains, or inconsistencies in your taxable income, a nudge letter from HMRC may follow.

Common triggers include not reporting income from overseas accounts, failing to declare capital gains from property or investments, or mismatches between your declared income and information HMRC receives from third parties. Sometimes, even small errors or omissions can prompt a nudge letter, as HMRC’s systems are designed to encourage voluntary compliance before moving to more formal action.

If you receive a nudge letter, it’s a sign that HMRC has identified something in your tax position that needs attention. Taking this prompt seriously and reviewing your tax affairs can help you resolve any issues quickly and avoid further scrutiny.

How to Respond Properly

First, don’t panic! A nudge letter isn’t an accusation, it’s an opportunity to check your affairs and put things right. Never ignore these letters. HMRC sets deadlines for responses, and failing to meet them can escalate the matter unnecessarily. Check your records carefully against the issues raised in the letter. This might involve reviewing bank statements, invoices or previous tax submissions.

Getting professional advice before responding is often wise. A tax accountant can help identify any genuine issues and frame your response appropriately. Seeking professional assistance can also ensure your response is accurate and compliant with HMRC requirements.

Be honest in your response, if you’ve made an error, explain how it happened. Demonstrating that any mistake was genuine rather than deliberate can significantly affect outcomes. It is important to make a full disclosure and provide any further information HMRC requests to ensure compliance and avoid legal repercussions.

If you discover an error, you may need to notify HMRC using the Digital Disclosure Service, which is their online platform for voluntary disclosures.

What Happens If You Ignore Them

Ignoring a nudge letter doesn’t make the issue go away, it often makes things worse. Ignoring a nudge letter can lead to a compliance check, where HMRC will note your lack of response in their compliance systems and may review your records in detail.

HMRC may escalate to formal compliance checks or investigations. These are much more intensive, intrusive and stressful than responding to the initial nudge. HMRC may also notify penalties for late responses or non-compliance, which can include interest charges.

Penalties for tax errors are typically higher if HMRC has to discover them rather than you disclosing them voluntarily. The difference can be substantial. Your risk rating with HMRC might increase, meaning you’re more likely to face scrutiny in future years. This creates an ongoing compliance burden.

The tax issues won’t disappear and could accumulate interest and penalties over time. Unresolved issues can result in increased tax liability and, in severe cases, criminal prosecution. What starts as a small matter can grow into a significant financial problem.

Your Rights When Receiving a Nudge Letter

As a taxpayer, you have the right to seek professional advice before responding. Consulting a tax specialist isn’t an admission of guilt but a prudent step. If you need more time to gather information, you can request an extension to the deadline. HMRC will often grant reasonable requests.

You can ask HMRC to clarify what information they hold that prompted the letter. This helps you understand exactly what you’re addressing. If you believe HMRC is mistaken, you have the right to explain why with supporting evidence. Misunderstandings do occur in tax matters.

Remember that these letters are not formal assessments or demands. They’re prompts to review your position and make corrections if necessary. Understanding your rights as a taxpayer and responding appropriately helps ensure compliance with HMRC requirements.

Avoiding Future Nudge Letters

The best way to avoid receiving future nudge letters is to keep your tax affairs in excellent order. This means accurately reporting all sources of income, including overseas income and capital gains, on your tax returns, and ensuring you meet all your obligations under UK tax law. Double-check your figures, keep thorough records, and submit your tax returns on time to demonstrate good tax compliance.

Seeking professional advice from a qualified tax advisor can be invaluable, especially if your finances are complex or you’re unsure about certain aspects of your taxable income. A tax advisor can help you understand your tax liabilities, spot potential issues before they arise, and guide you through any tricky areas of UK tax law.

Regularly reviewing your tax affairs and staying informed about changes in tax regulations can also help you avoid mistakes that might trigger a nudge letter from HMRC. By taking a proactive approach and seeking professional advice when needed, you can reduce the risk of penalties and ensure your tax position remains secure.

Limited Companies and Nudge Letters

Limited companies are not immune to nudge letters from HMRC. If there are discrepancies in your company’s tax returns, or if HMRC suspects undeclared income or errors in your corporation tax filings, you may receive a nudge letter addressed to the company. As a director or person with significant control, you have a legal obligation to ensure your company’s tax affairs are accurate and fully compliant with UK tax law.

If your limited company receives a nudge letter, it’s important to act quickly. Review your company’s tax position, check for any undeclared taxable income, and seek professional advice if you’re unsure about any aspect of your tax compliance. A tax specialist can help you address HMRC’s concerns, correct any mistakes, and negotiate with HMRC if necessary.

Ignoring a nudge letter can lead to more serious consequences, such as a formal tax investigation, financial penalties, or even further enforcement actions. By responding promptly and ensuring your company’s tax affairs are in order, you can minimise risks and maintain your professional reputation.

Seeking Guidance on Nudge Letters

If you receive a nudge letter from HMRC, seeking professional advice is one of the most effective steps you can take. A tax advisor with experience in HMRC communications can help you review your tax position, identify any discrepancies, and guide you through the disclosure process if needed.

Professional advice is especially important if you’re unsure why you received the nudge letter or if you’re concerned about the potential for serious consequences. A tax specialist can help you prepare a clear, accurate response to HMRC, reducing the risk of further action such as formal investigations or penalties.

By seeking guidance early, you can ensure that you’re meeting all your tax obligations and addressing any issues before they escalate. This proactive approach not only helps resolve the immediate concern but also gives you peace of mind about your ongoing tax compliance.

Remember, responding to a nudge letter with the support of a tax advisor can make the process smoother and help you avoid any unnecessary complications with HMRC.

Final Thoughts

HMRC nudge letters are becoming a common part of the tax landscape. HM Revenue (HMRC) uses nudge letters as part of their compliance strategy to encourage voluntary tax compliance and address undisclosed income or assets. They represent a more collaborative approach to tax compliance that gives you the chance to fix issues proactively.

Responding promptly and thoroughly is always the best approach. Even if you’ve made mistakes, coming forward voluntarily typically results in lower penalties. Keep good records of all your tax affairs, this makes responding to any HMRC queries much easier. Digital record-keeping systems can be particularly helpful for quick reference.

The key is to view nudge letters as an opportunity rather than a threat. Seeking help from professionals with a proven track record in handling HMRC nudge letters can be beneficial. They allow you to correct your tax position before more serious consequences develop.

Pie tax: Simplifying HMRC Nudge Letter Meaning Tax

Getting a nudge letter can be worrying, but staying on top of your tax affairs can help you avoid them altogether. Pie tax tracks all your income streams in real-time, flagging potential issues before HMRC spots them.

Our direct HMRC integration means your tax submissions are accurate and complete. We address the very issues that typically trigger those unwanted nudge letters. Pie tax can also connect you with qualified tax advisers for support and guidance on handling tax documentation and certificates of tax position.

With Pie tax, you can store all your tax records securely in one place. This makes it easy to respond confidently if HMRC does get in touch. The app also helps you manage disclosures to HMRC efficiently, ensuring your voluntary financial disclosures are submitted correctly and on time.

The app sends timely reminders about tax deadlines and obligations. These gentle prompts help ensure you never miss important submissions.

Want to reduce your chances of receiving HMRC nudge letters? Take a look at how Pie tax could help simplify your tax life.