Surge in HMRC Letters Targets Crypto Holders

HMRC has more than doubled the number of tax warning letters sent to cryptocurrency investors in the past year, as soaring digital asset values push undeclared capital gains to record highs.

According to data from UHY Hacker Young, HMRC issued 65,000 “nudge” letters in the tax year ending April 2025 a sharp rise from 27,700 letters sent the previous year. The increase comes amid a renewed crackdown on tax avoidance within the fast-growing crypto sector.

£12.9 Billion in Crypto Assets Held by UK Investors

An estimated 7 million adults in the UK now hold around £12.9 billion worth of cryptocurrency, up from £7.8 billion in 2022. With prices rebounding since 2023, analysts warn that undeclared capital gains could be substantial, as many investors remain unaware of their tax obligations.

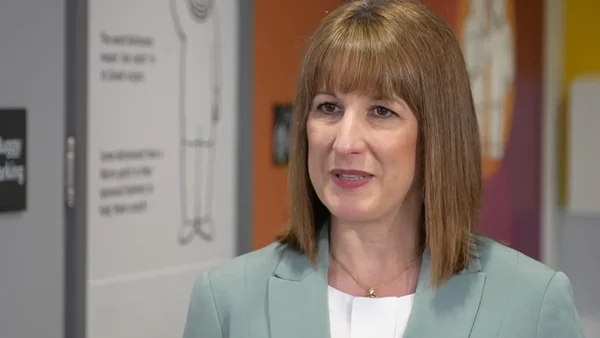

“HMRC is clearly stepping up its efforts to identify crypto traders who may have underpaid tax,” said Neela Chauhan, partner at UHY Hacker Young. “Some crypto users don’t realise they should have declared their gains in the first place.”

HMRC Cracks Down with “Nudge” Letters

The letters, often referred to as “nudge notices,” are sent to individuals suspected of failing to declare profits from crypto trading, staking, mining, or airdrops. They urge recipients to disclose their holdings voluntarily before HMRC launches formal investigations, which can lead to penalties or prosecution.

Chauhan noted that while some traders intentionally avoid paying tax, others simply misunderstand the complex rules governing digital assets. “The tax rules on cryptocurrency can be unclear, particularly when determining whether gains should be taxed as income or capital,” she said.

Capital Gains and Income Tax Risks

Crypto investors may face capital gains tax (CGT) when selling assets, or income tax if classified as professional traders. HMRC also considers income generated through mining, staking, and airdrops as taxable.

Failure to report these correctly can trigger serious consequences, including financial penalties and potential legal action. Experts warn that traders conducting frequent transactions are more likely to fall under income tax treatment.

Policy Shift and Rising Market Interest

UHY Hacker Young highlighted that the UK government’s softened stance towards digital assets, especially pound-pegged stablecoins, could encourage more individuals to enter the market. However, this growing participation risks intensifying the issue of undeclared crypto gains.“Those holding larger crypto portfolios should seek professional advice to avoid facing severe penalties,” Chauhan added.

HMRC’s Expanding Focus on Crypto

HMRC’s increased scrutiny marks part of a broader effort to tighten compliance in emerging financial sectors. The tax authority has partnered with major cryptocurrency exchanges to obtain transaction data, improving its ability to identify unreported gains.

Industry observers predict that crypto tax enforcement will remain a major focus in the coming fiscal year, as regulators work to close the gap between digital finance innovation and tax compliance.