Lets get started...

Ever wondered how to invest in exciting startups while getting generous tax breaks? The Enterprise Investment Scheme (EIS) might be just what you're looking for. It's a government-backed scheme that rewards investors for taking risks on smaller UK companies. The tax perks are seriously worth knowing about.

Higher-rate taxpayers especially love EIS as part of their tax planning toolkit. It helps diversify investment portfolios while offering some impressive tax benefits. Since its launch, EIS has helped thousands of UK startups secure the funding they need to grow. That's good for the economy and potentially great for investors too.

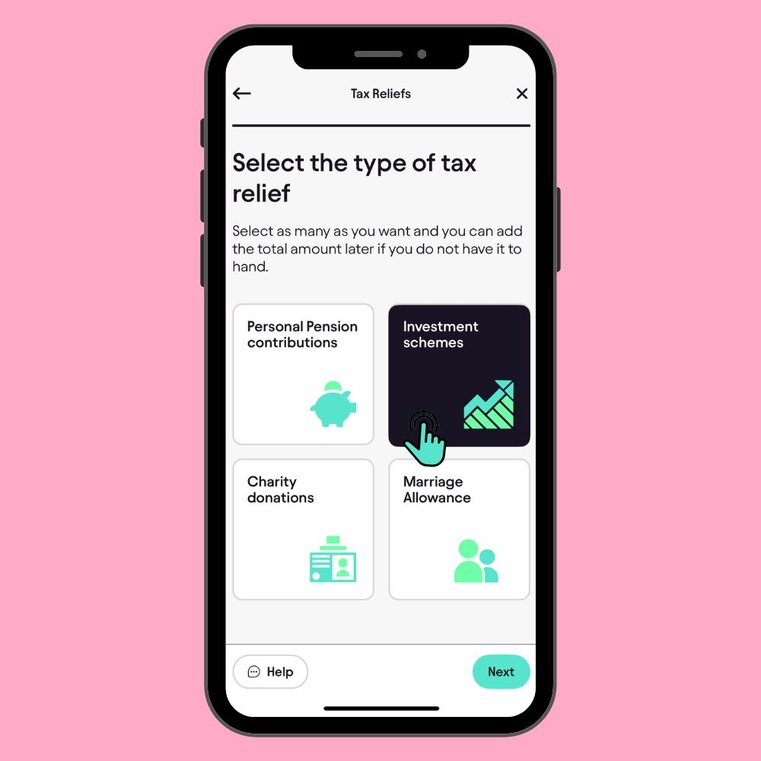

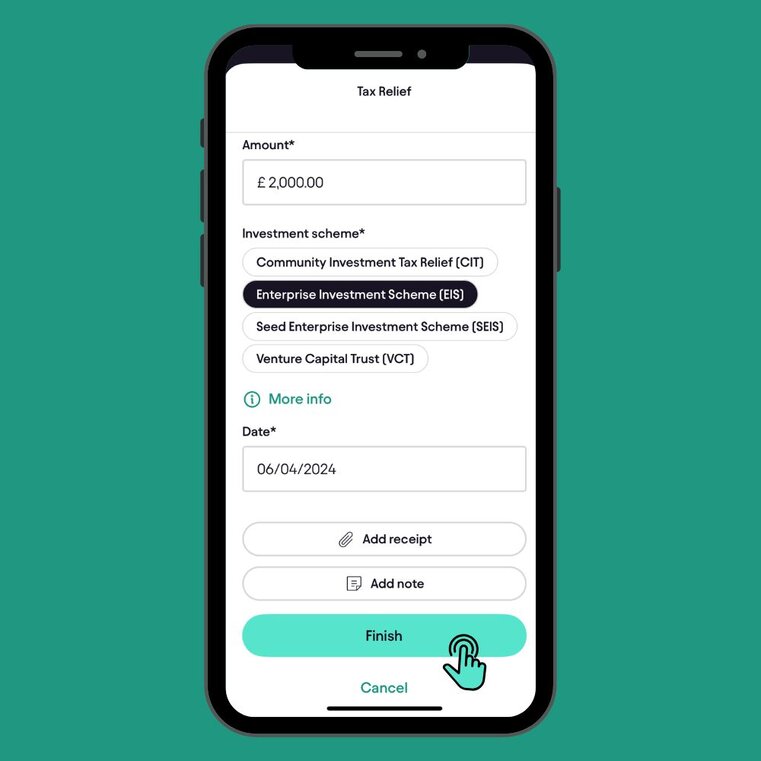

The UK's first personal tax app, Pie tax, makes claiming EIS tax relief simple with our straightforward digital tools. Or if you're just here to get to grips with it all, let's break it down!

What's the Enterprise Investment Scheme all about?

The Enterprise Investment Scheme (EIS) is a tax-advantaged way to invest in small, growing companies. Investors have invested significant amounts in EIS-qualifying companies, supporting innovation and growth. The scheme was created by the government to encourage investment in businesses that might otherwise struggle to get funding.

When you invest through EIS, you can claim back 30% of your investment as income tax relief. That means if you invest £10,000, you could reduce your income tax bill by £3,000. You can invest up to £1 million per tax year in EIS-qualifying companies. This limit jumps to £2 million if you’re investing in “knowledge-intensive” companies.

For the companies receiving investment, they can raise up to £5 million each year through EIS. The total funds raised by companies under EIS are used to support business growth and expansion. There’s a lifetime cap of £12 million for most businesses. Funds raised through other venture capital schemes, such as the SEIS scheme and other venture capital schemes, count towards these annual and lifetime limits.

Many companies have received investment through EIS, which has had a significant impact on their ability to grow and create jobs. There is an expected rise in the value of shares for early-stage investments, although outcomes are not guaranteed.

EIS Investment Process

Navigating the Enterprise Investment Scheme (EIS) investment process is key to unlocking the full range of tax reliefs and benefits available to investors. It all starts with finding qualifying companies, these are typically innovative SMEs with fewer than 250 employees and gross assets under £15 million before investment.

Once you’ve identified a suitable opportunity, you can invest directly or through an investment scheme such as a venture capital trust, depending on your preferences and risk appetite.

After making your EIS investment, the company will apply to HM Revenue & Customs (HMRC) for EIS approval. Once HMRC confirms the company qualifies, you’ll receive the all-important EIS3 certificate.

This document is essential for you to claim tax relief on your Self Assessment tax return. To ensure you don’t miss out, it’s crucial to keep track of your paperwork and submit your claim within the required timeframe.

Given the complexity of the EIS rules and the importance of meeting all eligibility criteria, many investors choose to seek professional advice. This helps ensure that both the company and the investment itself qualify for the scheme, so you can confidently claim your tax reliefs and enjoy the benefits of supporting high-growth UK businesses.

Advance Assurance: Getting Pre-Approval for EIS

Advance assurance is a valuable step for companies looking to attract EIS investors. Essentially, it’s a way for a business to get a preliminary thumbs-up from HMRC that their planned share issue is likely to qualify for the Enterprise Investment Scheme. For investors, this pre-approval offers peace of mind that their investment should be eligible for those all-important tax reliefs.

To apply for advance assurance, companies need to submit a detailed application to HMRC. This includes a robust business plan, financial forecasts, and clear information about the company’s qualifying trades. HMRC will review the submission and, if everything is in order, issue a letter confirming that the proposed investment appears to meet EIS requirements.

While advance assurance isn’t a cast-iron guarantee, it’s a strong indicator that the company is on the right track. For both companies and investors, it helps clarify the rules of the investment scheme and reduces the risk of nasty surprises down the line. If you’re considering an EIS investment, asking whether the company has advance assurance can be a smart move.

Tax benefits that make EIS worth a look

The headline benefit is that 30% income tax relief we mentioned. It’s like getting an instant discount on your investment. If your EIS shares increase in value, you won’t pay any Capital Gains Tax when you sell them. You must hold them for at least three years to qualify.

What if things go wrong? EIS offers loss relief too. However, it’s important to remember that EIS investments are considered high risk, and investors should be aware of the tax rules that apply to these investments. If your investment performs poorly, you can offset losses against either income tax or capital gains tax.

There’s an inheritance tax perk as well. Once you’ve held EIS shares for two years, they become exempt from inheritance tax under Business Property Relief rules.

Capital Gains Considerations

One of the standout tax benefits of EIS investments is the potential exemption from capital gains tax (CGT). If you hold your EIS shares for at least three years, any profit you make when you sell them is completely free from CGT, a significant advantage compared to many other investments. This means you can enjoy the growth of your capital without worrying about a tax bill eating into your returns.

However, timing is everything. If you sell your EIS shares before the three-year mark, you could lose this exemption and become liable for CGT on any gains. It’s also worth noting that EIS investments can be used strategically to defer or offset capital gains from other investments, making them a powerful tool for tax planning.

Given the interplay between EIS, other investments, and your overall tax position, it’s wise to seek professional advice to make the most of these opportunities. By understanding the capital gains implications, you can structure your portfolio to maximise your tax benefits while supporting the growth of innovative UK businesses.

How to qualify for EIS tax relief

Not every company or investor qualifies for EIS. The company must be UK-based, unquoted, and carrying out a qualifying trade. The company can’t have gross assets worth more than £15 million before your investment. After investment, this limit rises to £16 million. EIS eligibility and investment caps are also influenced by state aid regulations, which ensure compliance with government tax rules and prevent unfair competitive advantages.

It must have fewer than 250 full-time employees when the shares are issued. This helps target the scheme at genuine small and medium enterprisese As an investor, you can’t be “connected” to the company. This means you can’t be an employee, paid director, or hold more than 30% of the shares.

Claiming your EIS tax relief

After you invest, the company will apply to HMRC for approval. Once approved, they'll send you an EIS3 certificate - your golden ticket to tax relief.

You claim the relief through your Self Assessment tax return. Simply enter the details from your EIS3 certificate in the appropriate section.

You can even carry back EIS relief to the previous tax year. This flexibility is particularly useful for tax planning purposes.

Most people receive their relief either as a tax rebate or as a reduction in their tax bill. I once received a £4,500 rebate from a £15,000 EIS investment – a welcome boost to my finances that year!

Watch out for these EIS pitfalls

Remember that three-year holding period? If you sell your shares earlier, HMRC will claw back your tax relief. The company needs to keep following EIS rules during those three years too. If they break the rules, your relief could be withdrawn.

Certain “excluded activities” don’t qualify for EIS. These include property development, financial activities, and energy generation. Some investors get caught out by the “connected persons” rules. Check you’re not too closely linked to the company before investing.

Other schemes, such as social investment tax relief, have their own eligibility criteria and pitfalls, so investors should review the specific rules before investing.

EIS vs SEIS: What's the difference?

The Seed Enterprise Investment Scheme (SEIS) is EIS’s little sibling. It’s designed for very early-stage companies just starting out. EIS and SEIS are both venture capital schemes created to support smaller businesses, and there are other venture capital schemes available for different types of companies.

SEIS offers even more generous tax relief - 50% rather than 30%. However, investment limits are much lower at £100,000 per tax year. Companies can raise a maximum of £150,000 under SEIS. This compares to the £5 million limit under EIS.

Many startups use SEIS for their first funding round. They then move to EIS as they grow and need more capital.

Final Thoughts

EIS offers a rare win-win: you get to back exciting growth companies while enjoying substantial tax breaks. While the tax benefits are tempting, always look at the business case first. Even with tax relief, investing in early-stage companies carries real risks.

The scheme has stood the test of time since 1994. It has helped thousands of UK businesses grow while rewarding investors for their risk-taking. For most people, EIS works best as part of a balanced investment strategy. It's not suitable for your entire portfolio.

Pie tax: Simplifying Enterprise Investment Scheme Tax

Managing your EIS investments shouldn't give you a headache. Pie tax tracks your investments alongside other income sources, making tax time much easier. Our app helps you understand how EIS fits into your wider tax position.

When it's time to claim your relief, we'll guide you through the process step by step. This ensures you don't miss out on any tax savings. We can help you maximise your EIS benefits while keeping everything HMRC-compliant. Pop over to our website if you'd like to see how we make EIS tax simple.

Quick and Easy Guide to Adding EIS Tax Relief in the Pie App

Follow these steps to add EIS tax Relief