Lets get started...

The Enterprise Investment Scheme (EIS) is one of the UK's most powerful tax incentives for investors looking to back early-stage businesses. Created to encourage investment in smaller, higher-risk companies, EIS offers substantial income tax relief, capital gains exemptions, and loss relief.

For companies, it's a gateway to essential growth capital. For investors, it's an opportunity to significantly reduce tax liability while supporting innovation. The scheme has helped thousands of UK businesses raise billions in funding since its introduction in 1994.

Pie tax, the UK's first personal tax app, helps you track your EIS investments and calculate relief in real time. Or if you're just here to get to grips with it all, let's break it down!

What's EIS and why should investors care?

The Enterprise Investment Scheme (EIS) is a government initiative designed to help smaller, higher-risk companies raise finance by offering tax relief to investors. Launched in 1994, it’s been a game-changer for UK startups and growth businesses that might otherwise struggle to secure funding. Created to encourage investment in smaller, higher-risk companies, EIS primarily benefits small companies that are young, innovative, and seeking growth.

Companies can raise up to £5 million each year through EIS, with a lifetime limit of £12 million. Only an EIS qualifying company can access these funds, provided it meets specific criteria such as being within a certain age limit, having a limited asset base, and operating in a qualifying trade.

That’s serious growth capital for ambitious businesses looking to scale. For investors, it’s a chance to support innovation while enjoying some of the most generous tax breaks available in the UK. For companies, it’s a gateway to essential growth capital, helping them raise money for expansion and development.

I remember advising a client who invested £50,000 in a qualifying company under EIS rules, a tech startup. Not only did he receive £15,000 in immediate tax relief, but when the company was acquired three years later, his profit was completely tax-free. It transformed his view of tax-efficient investing.

The tax perks that make EIS so attractive

The headline benefit is 30% income tax relief on investments up to £1 million per tax year. Invest £10,000 and you could knock £3,000 off your tax bill, a substantial saving for any taxpayer. Investors can claim income tax relief to directly reduce their income tax bill, making EIS a powerful tool for tax planning.

If you hold your EIS shares for at least three years, any profit you make is completely free from Capital Gains Tax. This zero-tax growth potential is remarkably generous compared to most investment vehicles.

Should your investment not work out, loss relief allows you to offset losses against either income tax or capital gains tax. This risk mitigation feature means your downside is significantly reduced.

After two years, EIS shares typically qualify for Inheritance Tax relief through Business Property Relief. This makes them useful for estate planning alongside their income tax advantages. To claim tax relief, investors must follow the correct procedures and ensure they meet all eligibility requirements. Tax reliefs depend on individual circumstances and compliance with EIS rules.

You can also benefit from capital gains deferral by reinvesting the proceeds from other assets into EIS-qualifying companies. This is achieved through deferral relief, which allows you to postpone paying Capital Gains Tax until a later date, effectively pressing pause on your tax bill while putting that money to productive use. Tax rules can change over time and may affect the availability or amount of EIS tax reliefs, so it’s important to stay informed about current legislation.

Who can offer EIS investments?

Not every company qualifies for EIS. The business must be an unquoted UK company with a permanent establishment in the UK, and it cannot be listed on a recognised stock exchange such as the London Stock Exchange. An EIS qualifying company must meet specific criteria, and eis investment opportunities are typically available in high-growth, innovative sectors. The company’s gross assets must not exceed £15 million before investment and £16 million after.

The company must have fewer than 250 full-time equivalent employees. It must also be within 7 years of its first commercial sale, or 10 years for knowledge-intensive companies that focus on research and development. A knowledge intensive company is one that is primarily engaged in research, development, or innovation, and may benefit from relaxed eligibility criteria and additional tax reliefs compared to other EIS-eligible businesses.

Many financial and property activities are excluded from the scheme. EIS is designed for trading companies taking genuine commercial risks, not asset-backed ventures or financial intermediaries. The presence of qualifying subsidiaries is also important, as only subsidiaries that meet EIS requirements can be included when determining a company’s eligibility for the scheme.

The rules are strict because the tax benefits are generous. HMRC wants to ensure relief goes to genuine entrepreneurial businesses rather than tax-avoidance vehicles. EIS is a key part of the UK’s venture capital landscape, sitting alongside other venture capital schemes such as Venture Capital Trusts and Social Investment Tax Relief. Investment trust structures, approved by HMRC, are also used to invest in qualifying companies through these schemes.

Advance Assurance: Getting the Green Light for EIS

Advance Assurance is a vital first step for companies hoping to unlock the benefits of the Enterprise Investment Scheme (EIS). Essentially, it’s a way for businesses to get a preliminary thumbs-up from HMRC that their proposed share issue is likely to qualify for EIS tax reliefs. For investors, this assurance is invaluable, it means you can invest with greater confidence that your money will be eligible for income tax relief, capital gains tax exemption, and loss relief if things don’t go as planned.

To qualify for Advance Assurance, a company must meet strict criteria. The business needs to be a small or medium-sized enterprise (SME) with gross assets not exceeding £15 million before the investment and £16 million immediately after. The company must also be carrying out a qualifying business activity, so sectors like property development, banking, and certain financial services are excluded. For knowledge intensive companies, which focus on research, development, and innovation, the rules are a bit more flexible, making it easier for these high-growth businesses to qualify for EIS.

The process itself involves submitting a detailed application to HMRC. Companies must provide information about their business activities, financial forecasts, and demonstrate a genuine commercial plan, not just a scheme to avoid tax. This is where Advance Assurance really shines: it gives both the company and potential investors clarity on whether the investment will meet the requirements for EIS tax reliefs.

Once Advance Assurance is granted, the company can approach investors with confidence, knowing that their EIS investments are likely to qualify for valuable tax incentives. Investors can look forward to up to 30% income tax relief on their investment, capital gains tax exemption on any growth (provided they hold the EIS shares for at least the minimum holding period of three years), and the possibility of loss relief if the company fails. These tax reliefs make EIS investments particularly attractive, especially for those looking to support early stage businesses while managing their tax bill.

How to invest in EIS and claim your tax relief

You can invest directly in EIS-qualifying companies or through an EIS fund that spreads your money across multiple businesses. The latter approach offers diversification, which can be wise given the high-risk nature of these investments. Note that there is usually a minimum investment required, which can vary by fund or company, with typical amounts around £10,000.

If you invest through an EIS fund, the fund manager will handle the paperwork, manage the investment portfolio, and issue compliance certificates to investors once the investments are made. Many companies apply for ‘advance assurance’ from HMRC before raising funds. Companies that have received advance assurance provide greater confidence to investors about tax relief eligibility before they commit their capital.

You claim the relief via your self-assessment tax return, either in the tax year you made the investment or the previous year. This flexibility, known as ‘carrying back’, offers valuable tax planning opportunities. For tax purposes, claiming in the previous tax year refers to applying relief to the last tax year, while the preceding tax year can refer to an earlier period if you have unused EIS allowance, allowing you to optimise your tax position.

Eligibility to claim EIS relief can be affected by your role in the company. Paid directors are generally not eligible to claim EIS relief unless specific exceptions apply, while unpaid directors may still qualify for certain tax reliefs.

Watch out for these EIS pitfalls

Remember that EIS investments are high-risk. The tax relief is generous because there's a real chance you could lose your money. Never invest funds you cannot afford to lose. Your investment must be for genuine commercial reasons, not just tax avoidance. HMRC takes a dim view of schemes designed primarily to save tax rather than support business growth.

Relief can be withdrawn if the company loses its qualifying status within 3 years of investment. Company compliance matters, so due diligence on management is essential.

EIS investments are highly illiquid, there's no easy way to sell your shares until the company is sold or listed on a stock exchange. You should be prepared to lock up your capital for at least three years.

Advance assurance from HMRC isn't a guarantee that final EIS relief will be approved. However, it significantly increases the likelihood of qualifying, providing some reassurance to cautious investors.

EIS funds versus direct investments: what's best?

EIS funds offer instant diversification across multiple companies, reducing the impact if one business fails. This portfolio approach can be safer for first-time EIS investors.

With direct investments, you have more control but need to do thorough due diligence yourself. This approach suits investors with sector expertise or professional advisors.

Fund managers handle all the paperwork and monitoring of investments. This administrative support can save you considerable time and hassle, especially if you're investing in multiple companies.

Some funds specialise in specific sectors like technology or healthcare. This specialisation lets you focus on areas you understand or care about while benefiting from expert selection. Approved EIS Knowledge Intensive Funds offer additional benefits around the timing of tax relief. These advantages can be valuable for tax planning, particularly near the end of the tax year.

Final Thoughts

The Enterprise Investment Scheme offers remarkable tax incentives that can transform your tax bill while supporting innovative UK businesses. The combination of income tax relief, tax-free growth and loss protection creates a compelling proposition.

However, never let the tax tail wag the investment dog. Only put money into EIS that you can afford to lose, and always consider how it fits into your broader financial plans.

The best EIS investments combine solid business prospects with the tax benefits. The most successful investors focus on the company's potential first, viewing the tax advantages as a welcome bonus.

If you're interested in EIS, speaking with a qualified financial advisor is worthwhile. They can ensure these investments align with your goals and circumstances before you commit.

Pie tax: Simplifying EIS Scheme Tax

Keeping track of EIS investments and their tax implications shouldn't give you a headache. Pie tax makes it simple by bringing all your tax-efficient investments into one clear dashboard.

The UK's first personal tax app lets you monitor all your EIS investments in one place. You can instantly see exactly how much tax relief you're entitled to and when you can claim it.

Our real-time calculations show how your investments affect your overall tax position. This visibility takes the guesswork out of tax planning and helps maximise your relief. Fancy seeing how it could work for you? Take a peek at our app and discover how we're making tax less taxing for EIS investors.

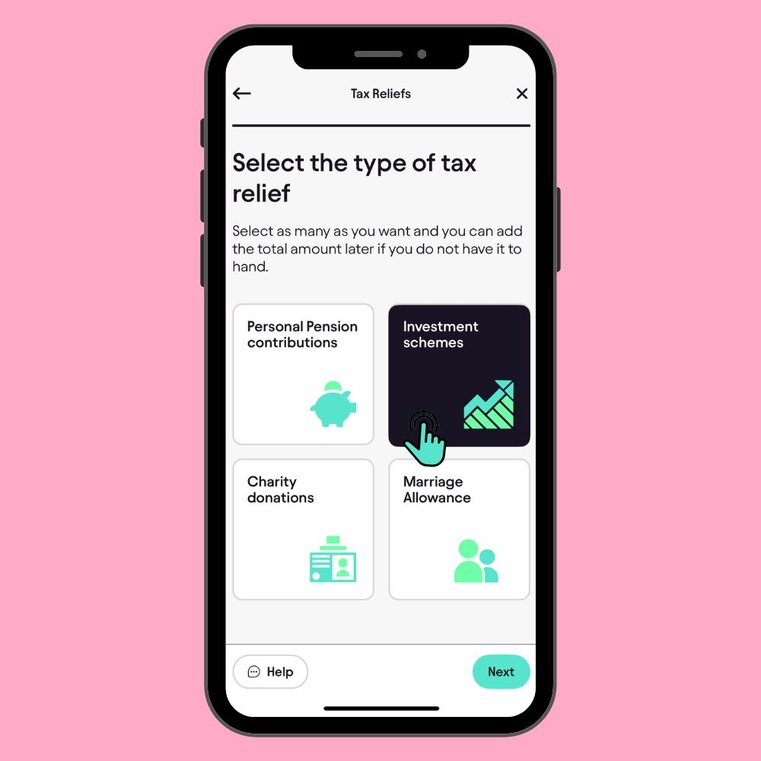

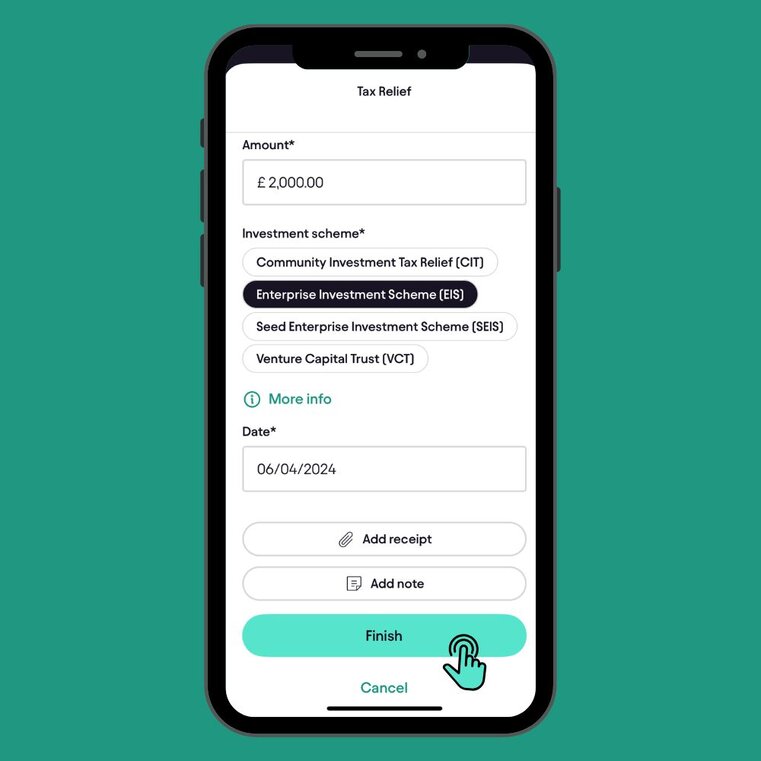

Quick and Easy Guide to Adding EIS Tax Relief in the Pie App

Follow these steps to add EIS tax Relief