Let’s dive into the details

Not sure how to make the most of your EIS investment when your income varies year to year?

This guide explains how EIS income tax relief carry back works, when to use it, and how to claim it.

Learn how to boost your refund and reduce last year’s tax bill with confidence — let’s dive in!

What is EIS Income Tax Relief?

Enterprise Investment Scheme (EIS) tax relief is one of the UK’s most generous tax incentives. It’s designed to encourage investment in early-stage companies, but only certain companies that meet HMRC’s qualifying criteria are eligible for EIS relief.

Other schemes, such as the Seed Enterprise Investment Scheme, Social Investment Tax Relief, and Venture Capital Scheme, also offer tax reliefs for investments in qualifying companies.

The scheme offers 30% income tax relief on investments up to the maximum amount of £1 million per tax year, subject to annual limits set by HMRC. To retain EIS tax relief, investors must meet a minimum holding period of three years from the date of share issue. This maximum amount increases to £2 million for knowledge-intensive companies.

How EIS Income Tax Relief Carry Back Works

EIS carry back is a brilliant tax planning tool that allows flexibility with your investments. EIS investments made in the current tax year can be carried back, meaning you can treat them as if they were made in the previous tax year.

This means you can claim the 30% income tax relief against your previous year’s income tax bill. It’s particularly useful if you had a higher income in the previous year.

For example, if you invest £50,000 in an EIS-qualifying company in 2023/24, you could carry back this investment to 2022/23. This would give you £15,000 off your 2022/23 income tax bill. When making your claim, you should report the actual amount invested, not the amount of tax relief you are seeking.

You don’t need to have used all your current year’s EIS allowance before carrying back. It’s entirely your choice which tax year to use. Carry back is only available for the previous tax year and cannot be applied to future tax years.

The timing of your investment and any carry back election is important for tax purposes, as it determines when you can claim relief and how your investment is treated by HMRC.

Time Limits and Rules for EIS Eligibility

When it comes to claiming EIS tax reliefs, timing is everything. Under the Enterprise Investment Scheme, investors have up to five years after 31st January following the end of the tax year in which their EIS investment was made to claim tax relief. This generous window gives you plenty of time to organise your paperwork and ensure you don’t miss out on valuable income tax relief or capital gains tax relief.

For example, if you made an EIS investment during the 2022-2023 tax year, you have until 31st January 2029 to claim your EIS tax relief. This applies whether you’re claiming income tax relief, capital gains tax relief, or both. It’s important to keep track of the tax year in which your EIS investment was made, as this determines your eligibility window for claiming relief.

Remember, the ability to claim tax relief also depends on the type of investment and the timing of your initial investment. Missing the deadline could mean losing out on significant tax reliefs, so always check your dates and keep your records up to date. Staying aware of these time limits ensures you can claim EIS relief, reduce your tax liability, and make the most of your EIS investments.

When to Use EIS Carry Back

Carry back is particularly valuable if your income fluctuates year to year. Perhaps you received a large bonus or sold a business in the previous tax year.

If you’ve already paid your tax bill for the previous year, HMRC will issue you a refund. You will have received income tax relief only after your claim is processed and approved.

You might also use carry back if you’ve already used your full EIS allowance in the current year. This allows you to make additional investments while still being able to claim income tax relief, provided all qualifying conditions are met and you follow the correct procedure for claiming.

Remember, you can only carry back to the immediately preceding tax year. You can’t go back further than that. Note that certain restrictions may prevent you from receiving tax relief, so always check eligibility before claiming.

Be aware that EIS investments are high risk and you could lose all the money you invest.

How to Claim EIS Carry Back

To claim carry back relief, you’ll need your EIS3 certificate from the company you invested in. This typically arrives 4-6 months after your investment. If your investment was made through an EIS fund, the fund manager is responsible for issuing the necessary compliance certificates to investors.

You’ll need to complete the Additional Information pages of your Self Assessment tax return. You can also claim EIS relief through your tax return online, following HMRC’s step-by-step process. Enter the details in the “Other tax reliefs” section. If you are claiming capital gains deferral, you must also complete the capital gains summary pages of your tax return.

When reinvesting gains from other assets into EIS shares, you may be eligible for capital gains deferral relief (also known as deferral relief). To claim capital gains deferral, follow HMRC procedures and reference your EIS3 certificate. You must report any chargeable gains on your tax return when claiming these reliefs. EIS investments may also qualify for capital gains tax exemption if certain conditions are met. If the requirements for exemption or deferral are not satisfied, you may need to pay capital gains tax on the relevant gains.

Make sure you tick the box indicating you want to apply the relief to the previous tax year. This is crucial for HMRC to process your carry back claim correctly.

If you’ve already submitted your tax return for the relevant year, you can amend it. Just ensure it’s within the allowed timeframe to include your EIS carry back claim.

Your tax code may be adjusted by HMRC to reflect your EIS claim, and PAYE taxpayers can request changes to their PAYE tax code using the EIS3 certificate.

Final Thoughts

EIS carry back gives you valuable flexibility to maximise your tax relief. It’s especially useful when your income varies between years.

While the tax benefits are attractive, always remember that EIS investments are high-risk. They should be evaluated primarily on their investment merits. Investing through an EIS fund can help build a diversified portfolio by spreading your investment across multiple portfolio companies, which reduces the risk compared to investing in a single company directly.

Getting professional advice is worthwhile if you’re making significant EIS investments. This is also true if you have a complex tax situation. EIS shares may also qualify for inheritance tax relief, which can reduce inheritance tax liabilities as part of estate planning.

EIS is part of the broader venture capital landscape, which includes other tax-efficient investment options such as venture capital trusts.

Pie.tax: Simplifying EIS Tax Relief

Getting to grips with EIS tax reliefs shouldn't be complicated. At Pie.tax, we make it easy to include your EIS investments in your Self Assessment.

You can add your EIS investments directly to the platform, and we’ll help ensure they’re properly accounted for in your tax return.

If you’re unsure about anything, you can ask our Pie.tax experts for help with any EIS-related queries, ensuring you get the right guidance when you need it.

Explore Pie to see how we can help you manage your EIS investments with confidence and ease when it’s time to file your return.

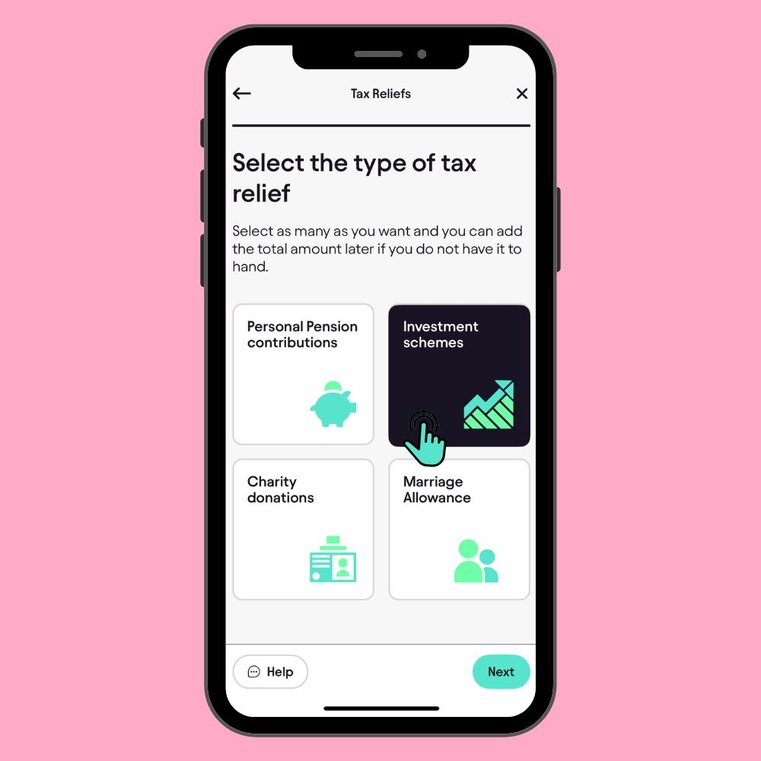

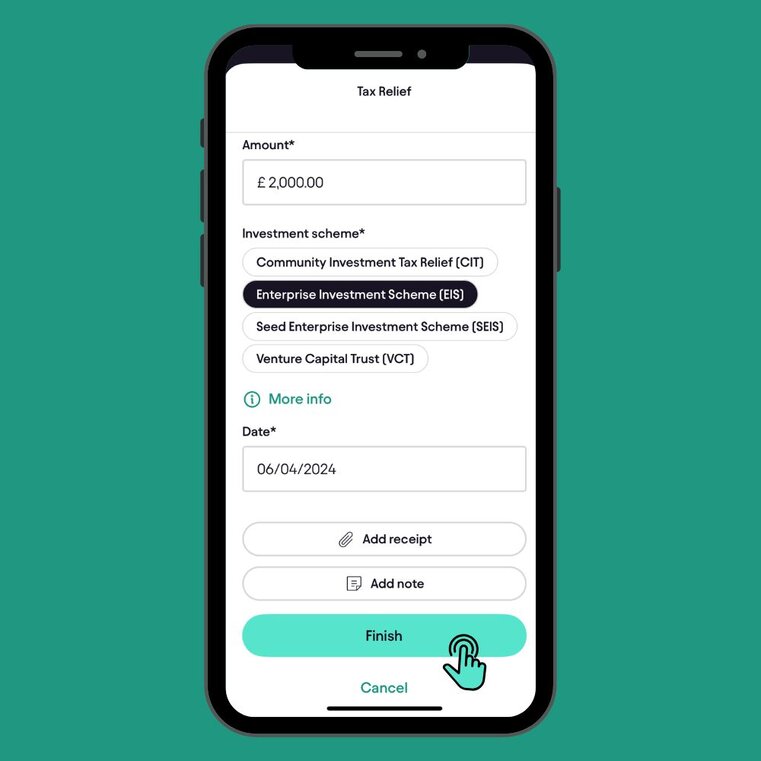

Quick and Easy Guide to Adding EIS Tax Relief in the Pie App

Follow these steps to add EIS tax Relief