Lets dive in...

Looking for smart ways to grow your wealth while cutting your tax bill? The Enterprise Investment Scheme (EIS) might be just what you need.

Introduced in 1994, EIS has helped thousands of small UK businesses raise billions in funding. It offers generous tax perks to investors willing to back higher-risk companies.

The scheme provides income tax relief, capital gains exemptions, and loss relief. These incentives encourage investment in growth-focused enterprises.

For qualifying companies, EIS opens doors to investment that might otherwise be unavailable. Pie Tax, the UK's first personal tax app, allows you can submit your EIS investment relief directly to HMRC using the Pie Tax app. Or if you're just here to get to grips with it all, let's break it down!

What is EIS and how does it work?

EIS is a government-backed scheme designed to help smaller, higher-risk companies raise finance. It offers tax breaks to investors who buy new shares in these businesses. EIS, SEIS, and VCT also offer investors a range of tax benefits as part of their incentives.

Think of it as the government’s way of saying “thanks for supporting British innovation” by giving you back some tax money.

Launched in 1994, the scheme allows an EIS qualifying company to raise up to £5 million each year, with a lifetime limit of £12 million. The company's ownership and share structure must meet specific requirements to ensure it qualifies for EIS.

For investors, the maximum investment you can make is £1 million per tax year, or up to £2 million if you’re backing knowledge-intensive companies like tech startups. The maximum amount of tax relief available is calculated based on this investment limit. Only qualifying investors who meet the scheme's criteria can benefit from EIS tax reliefs. An EIS qualifying investment in a qualifying company is required to access the full range of tax reliefs.

Venture Capital Schemes: Where EIS Fits In

The Enterprise Investment Scheme (EIS) is just one part of the UK’s suite of venture capital schemes designed to encourage investment in early-stage, high-risk companies. Alongside EIS, you’ll find the Seed Enterprise Investment Scheme (SEIS) and Venture Capital Trusts (VCTs), each offering their own blend of tax reliefs to make investing in young, ambitious businesses more attractive.

EIS stands out by offering a combination of income tax relief, capital gains tax (CGT) exemption, and inheritance tax (IHT) relief for those who invest in qualifying companies.

These tax incentives are designed to offset the risks that come with backing smaller, unquoted businesses. SEIS, meanwhile, targets even earlier-stage companies and offers higher income tax relief on smaller investments, while VCTs allow investors to pool their money into a fund that invests in a range of qualifying companies, with their own set of tax benefits.

By understanding how the Enterprise Investment Scheme fits into the broader landscape of venture capital schemes, investors can make more informed choices about where to put their money for maximum tax efficiency. Whether you’re looking for income tax relief, CGT exemption, or IHT relief, EIS and its sister schemes offer a range of options to help you support high-growth companies while managing your tax bill.

Tax breaks that make EIS worth your while

The headline benefit is 30% income tax relief on investments up to £1 million per tax year. Invest £10,000 and you’ll get £3,000 back on your income tax bill! You can claim relief for EIS investments either in the current tax year or elect to set it against the previous tax year, giving you flexibility to maximise your tax benefits.

You won’t pay any Capital Gains Tax on profits from EIS shares if you hold them for at least three years. It's worth noting that this tax-free growth can be a significant advantage for investors in early-stage companies with high growth potential. If things don’t go to plan and you sell at a loss, EIS offers loss relief. This can offset against your income tax or capital gains, cushioning the blow. You can claim relief for loss relief in the current or previous year, depending on your circumstances.

Got a capital gain from selling another asset? Through capital gains deferral, you can reinvest it in EIS shares and defer the tax until you sell those shares. This is known as CGT deferral relief, which allows you to postpone paying Capital Gains Tax until the disposal of your EIS shares, at which point the prevailing rate of CGT will apply. Reinvestment relief may also be available, exempting or deferring CGT when you reinvest gains in the same investment or a qualifying investment within the required timeframe. Linking transactions in the same investment can help you optimise your tax position.

After two years, your EIS shares become exempt from Inheritance Tax too. This makes them a neat estate planning tool.

It's important to understand the tax rules that govern EIS reliefs, as eligibility and calculations can be complex. The tax treatment of EIS investments depends on your individual circumstances and may change, so consider seeking independent tax advice.

Deferral Relief and Inheritance Tax Relief Explained

One of the lesser-known but highly valuable features of the Enterprise Investment Scheme is deferral relief. This allows investors to defer capital gains tax on the sale of other assets by reinvesting the gain into EIS qualifying shares.

Essentially, if you’ve made a capital gain elsewhere, you can invest that gain into an EIS company and postpone paying the tax until you eventually sell your EIS shares. This can be a powerful tool for managing your capital gains tax liability and keeping more of your money working for you.

EIS shares also offer significant inheritance tax relief through Business Relief (previously known as Business Property Relief). If you hold EIS qualifying shares for at least two years and still own them at the time of your death, their value can be exempt from inheritance tax. This makes EIS investments not only a way to grow your wealth but also a smart strategy for estate planning, helping you pass on more to your loved ones.

Understanding how deferral relief and inheritance tax relief work within the EIS framework can help you make strategic decisions about your investments, tax planning, and long-term financial goals.

Is your company eligible for EIS?

Your business needs to be an unquoted UK company with a permanent establishment in the UK. Being listed on AIM is fine, but not on the main stock exchange. Size matters, your gross assets must not exceed £15 million before investment and £16 million after. For inheritance tax relief, only qualifying assets are eligible for Business Relief or Agricultural Relief, and the value of these qualifying assets will impact the available relief, especially with new caps applying from 2026.

You’ll need fewer than 250 full-time employees. This increases to 500 for knowledge-intensive companies.The company must be carrying on a qualifying trade. Many sectors qualify, but some like property development, hotels, and financial services are excluded. Social investment tax relief is another scheme with specific eligibility criteria, so be sure to check if your business or investment qualifies.

When structuring your share capital, subscriber shares held by existing shareholders can affect EIS eligibility, so it’s important to consider how these shares are issued and held.

Timing counts too, you can’t have been trading for more than 7 years. Knowledge-intensive companies get 10 years. When applying for EIS, you must submit a compliance statement to HMRC, which certifies that your scheme meets all the necessary conditions for tax relief eligibility.

EIS Shares: What Investors Need to Know

EIS shares come with a suite of tax benefits that can make a real difference to your investment returns. Investors can claim income tax relief of up to 30% of the amount invested, enjoy tax-free growth on their EIS shares, and defer capital gains tax by reinvesting gains into qualifying companies. However, to unlock these tax reliefs, it’s crucial to ensure both you and the company meet the qualifying conditions set out by the Enterprise Investment Scheme.

The company must be an unquoted trading business with gross assets below the specified threshold and a permanent establishment in the UK. As an investor, you need to have sufficient income tax liability to claim the relief, and you must hold your EIS shares for at least three years to keep the income tax relief and benefit from tax-free growth. Knowledge intensive companies, those focused on innovation, research, or technology, may offer even greater tax incentives and higher investment limits.

By understanding the requirements for EIS shares and the tax benefits they offer, you can make smarter decisions about where to invest, how to structure your portfolio, and how to reduce your overall tax liability. EIS shares are a powerful tool for investors looking to support high-growth companies while maximising their tax advantages.

Getting EIS investment: The journey

First, an investor purchases new shares in your qualifying company. These must be ordinary shares with no special rights. Most companies apply to HMRC for advance assurance before seeking investment. It’s not mandatory but gives investors confidence. An advance assurance letter is a document from HMRC providing a preliminary indication that your company’s share issue is likely to meet the requirements of venture capital schemes such as EIS or SEIS, offering some comfort to investors, though it does not guarantee tax relief.

After issuing shares, the company applies for EIS3 certificates from HMRC. Investors need these to claim their tax relief. The three-year minimum holding period starts from when shares are issued. Or when trading begins, if that’s later. If the company ceases to qualify during this period, investors may lose their tax relief and could be required to repay it.

Investors can claim tax relief up to 5 years after the January 31st following the tax year of investment.

The availability of EIS and SEIS reliefs depends on individual circumstances, so professional advice should be sought.

Watch out for these EIS pitfalls

Make sure your company maintains its EIS qualification throughout the three-year period. Breaching conditions can mean investors lose their relief. Check you're not involved in excluded activities. I once advised a client whose EIS application failed because their property development side-business disqualified them.

Connected persons face restrictions. If you're an employee, director, or own more than 30% of the company, special rules apply. Keep your share structure simple. Preference shares or shares with other special rights don't qualify for EIS.

Remember that selling shares too early means tax relief will be withdrawn. Patience pays with EIS!

Final Thoughts

EIS offers one of the UK's most generous tax breaks for investors willing to back growing businesses. For investors, it cuts risk while keeping the potential for great returns. For companies, getting EIS status can transform your fundraising prospects. This is especially true if you're an innovative startup.

The rules are complex though, so always get professional advice before diving in. The tax savings are worth the homework!

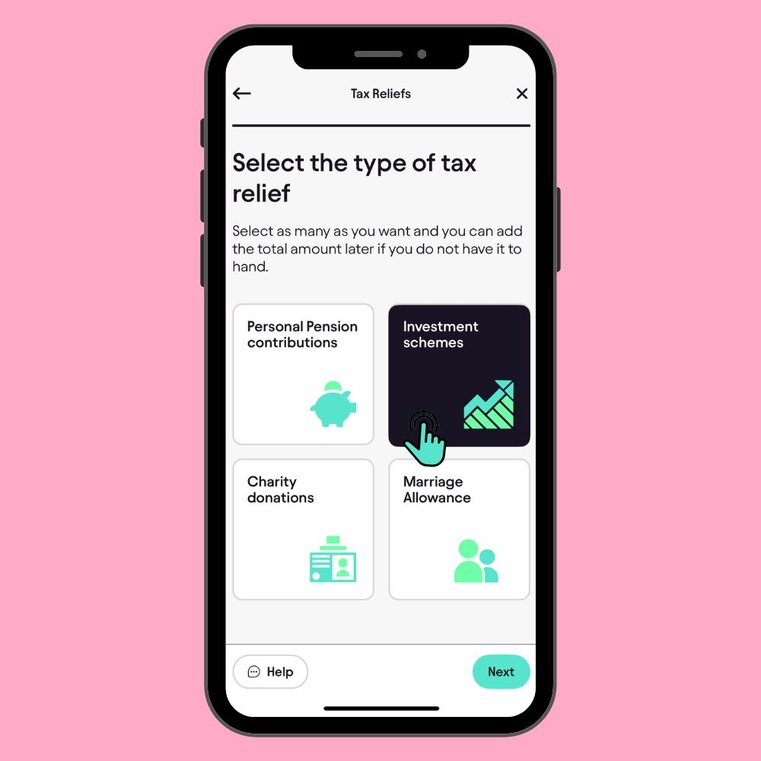

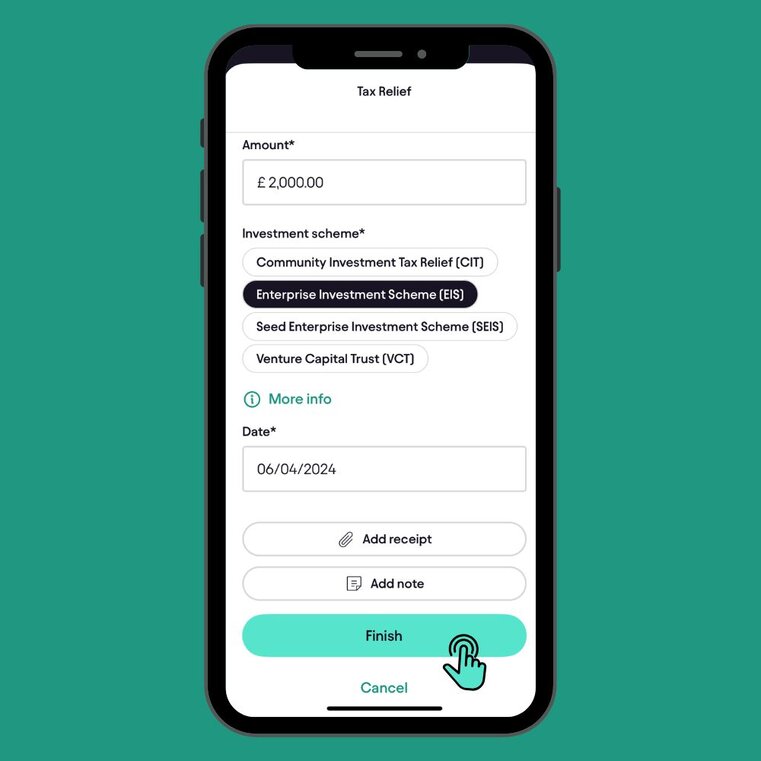

Pie tax: Simplifying EIS Tax

Getting your head around EIS shouldn't feel like solving a puzzle with missing pieces. Pie tax, the UK's first personal tax app, helps you track all your EIS investments in one place. It automatically calculates your available tax reliefs.

We keep all your EIS3 certificates organised and easily accessible when you need them for your tax return. This helps you plan your next moves. Fancy seeing how we make EIS tax simple? Take a look at our app to see how it works for yourself.

Quick and Easy Guide to Adding EIS Tax Relief in the Pie App

Follow these steps to add EIS tax Relief