Understanding Changes in your HMRC Account Balance

Are you a taxpayer in the UK, puzzled about changes in your HMRC account balance? Worry not! We've got you covered with a comprehensive guide on understanding these fluctuations.

Why Does My HMRC Account Balance Change?

When you notice changes in your HMRC account balance, it's crucial to understand the following components:

Errors in reporting or calculations from previous years can lead to adjustments. HMRC may update your balance to reflect these corrections accurately.Adjustments and Corrections

Any recent payments you make or refunds issued by HMRC for overpayment will directly affect your account balance. This also includes interim payments on account.Payments and Refunds

New charges, assessments, or interests accrued on unpaid balances can cause your account balance to fluctuate. Keeping track of new notices from HMRC is crucial.Assessments and Charges

How to pay your HMRC account balance?

Follow these steps to pay your HMRC account balance smoothly and efficiently.

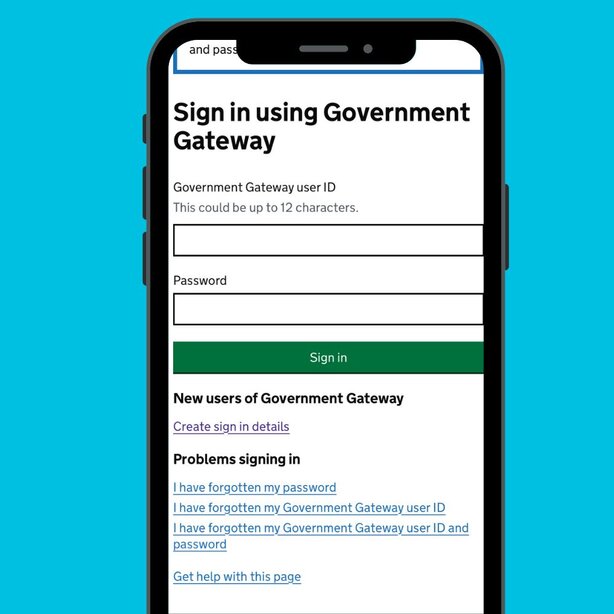

Log into your personal HMRC account via the HMRC App.

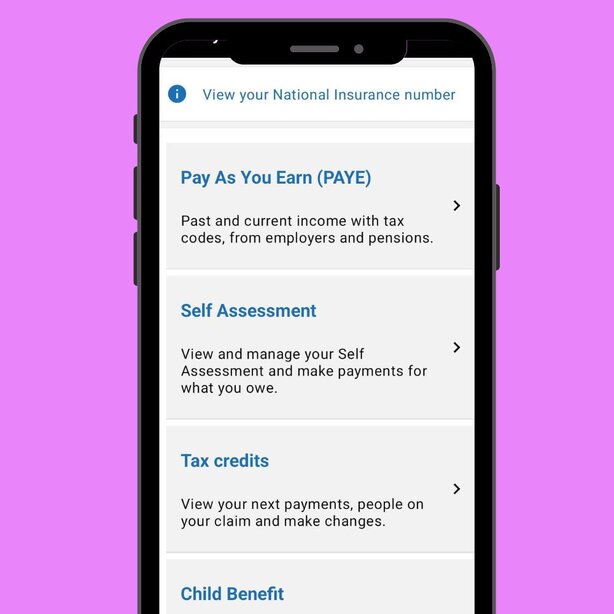

Navigate to the self-assessment section, which will take you to your self-assessment summary.

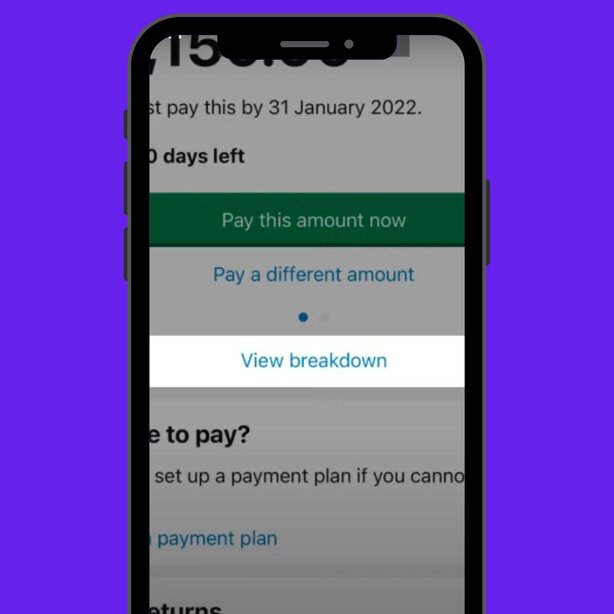

Click on the "view breakdown" and review which payments must be made.

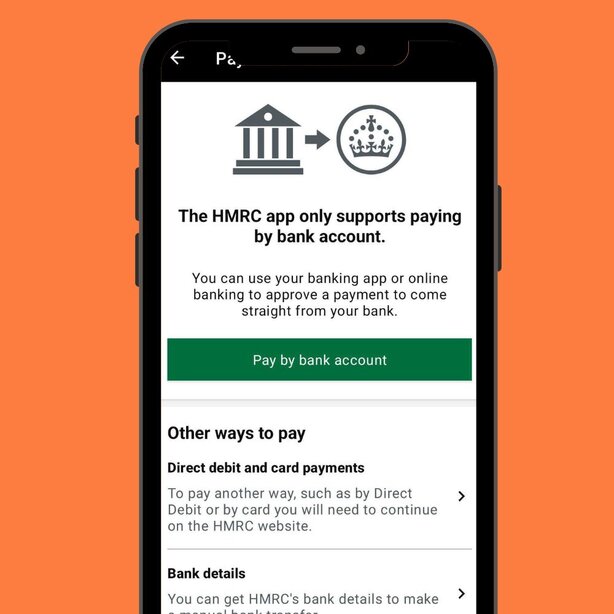

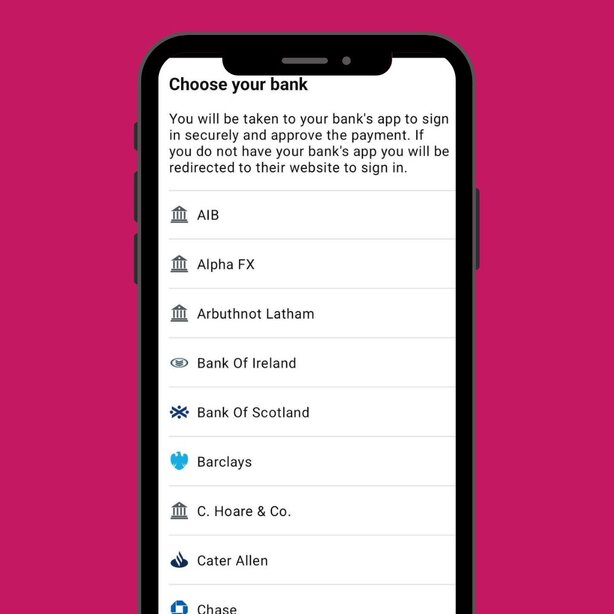

Choose your payment method. You can pay through the HMRC app using online banking.

Choose the specific bank that you will use and continue to the payment section.

Options to Resolve Account Balance Issues

Option 1: Use the HMRC Helpline

For direct assistance with your account, it's best to call the HMRC helpline. By speaking with a representative, you can receive personalised advice tailored to your specific situation. They can help answer your questions, guide you through any processes, and address any concerns you may have. This direct approach ensures that you get the support you need quickly and efficiently.

Option 2: Consult with a Tax Professional

Engaging with a tax advisor can provide expert insights into your tax situation and help resolve complex issues effectively. With their specialised knowledge, they can guide you through intricate tax regulations and identify opportunities for savings. Pie Tax assistants are available to offer personalised support, ensuring that your tax affairs are handled accurately and efficiently.

Additional Considerations

Regularly check your HMRC account and keep up-to-date with yearly tax regulations and deadlines.Stay Informed

Always review notifications or letters from HMRC to avoid missing important updates or notices.Monitor Communications

Organise your tax documents, receipts, and correspondence so they’re easy to find. This will make filing easier and help if you're ever audited or need to provide proof.Organise Documents

Expert Assistance with Pie

Navigating changes in your HMRC account balance can be complex, but with Pie.tax, you have access to expert support that can guide you through the process. Get started with Pie.tax today to ensure accurate and up-to-date tax filings.

Over 5 million taxpayers in the UK receive adjustments in their HMRC account annually due to misreported income.

Approximately 20% of UK taxpayers fail to notice errors in their HMRC account, leading to penalties and interest charges.

Frequently Asked Questions

Why does my account show a balance due for periods I have already paid?

This might be due to processing delays or errors. Contact HMRC for clarification.

What should I do if I receive an unexpected tax refund?

Confirm the refund's accuracy with your records or contact HMRC to ensure it’s correct.

How frequently should I check my HMRC account balance?

Checking your account balance monthly can help you stay on top of any changes or discrepancies.

Can I dispute an adjustment made to my account balance?

Yes, contact HMRC to address any discrepancies or file an appeal if necessary.

How long does HMRC take to process account balance adjustments?

Adjustments typically take a few weeks to process, but it can vary depending on the nature of the correction.