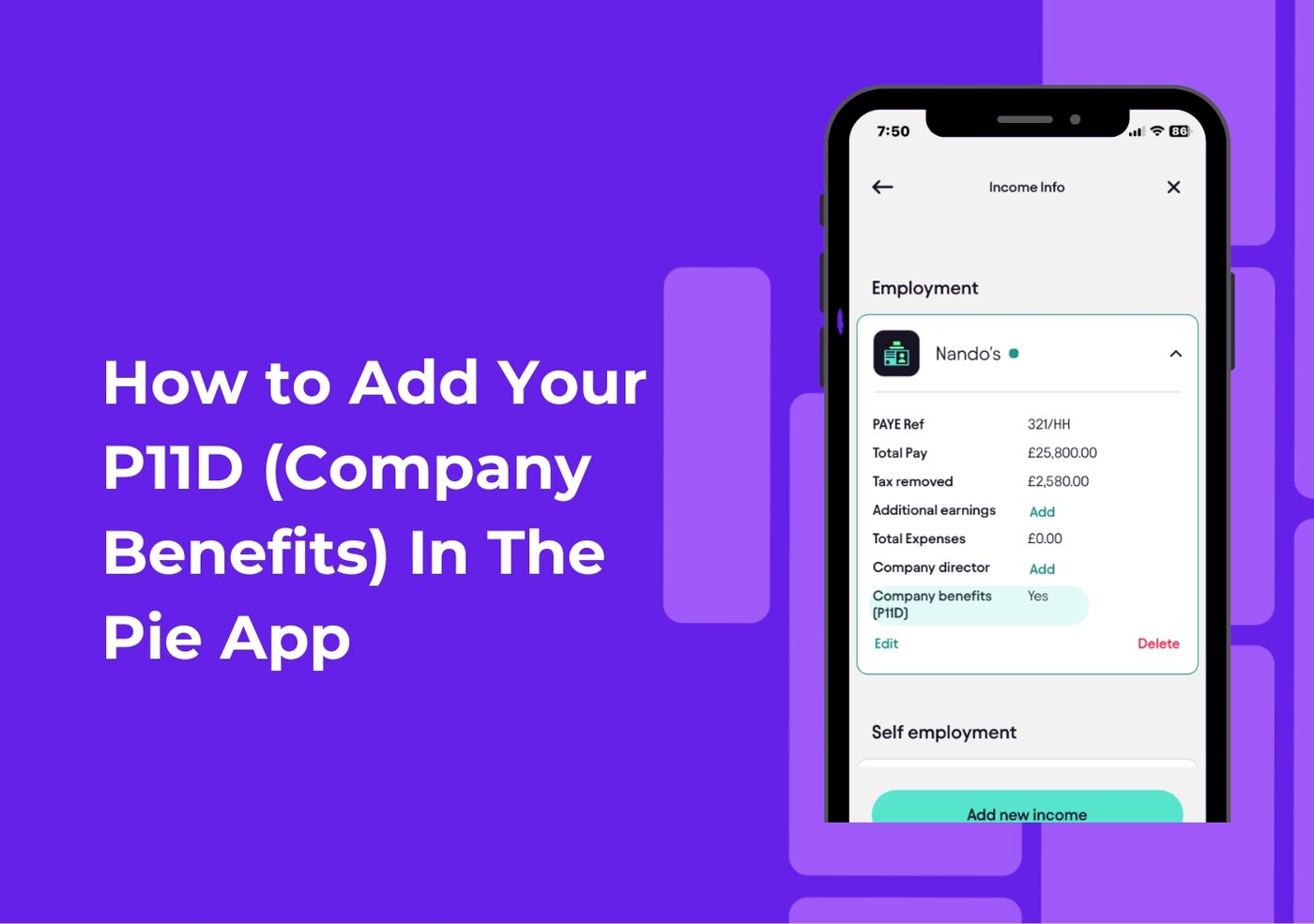

Keeping your employment details accurate made easy

If you receive company benefits from your employer (like healthcare, a company car, meals, or allowances), they’re usually reported on a P11D. Adding this information in the Pie App helps keep your tax summary accurate and ensures your return is checked correctly.

The good news? It only takes a few taps.

What is a P11D?

Your employer gives HMRC details of any taxable benefits you received during the tax year. These benefits can affect your tax calculation, so Pie asks about them to make sure everything adds up correctly.

How to Add Your P11D in the Pie App

Follow these Simple steps to do this

Launch the Pie Tax App on your device. Once the app is open, tap the avatar icon located in the top left corner of the screen to access your profile.Open the App and Access Your Profile

Scroll down to the ‘Income Accounts’ section within your profile. Tap on this option to view and manage your income entries. Navigate to ‘Income Accounts’

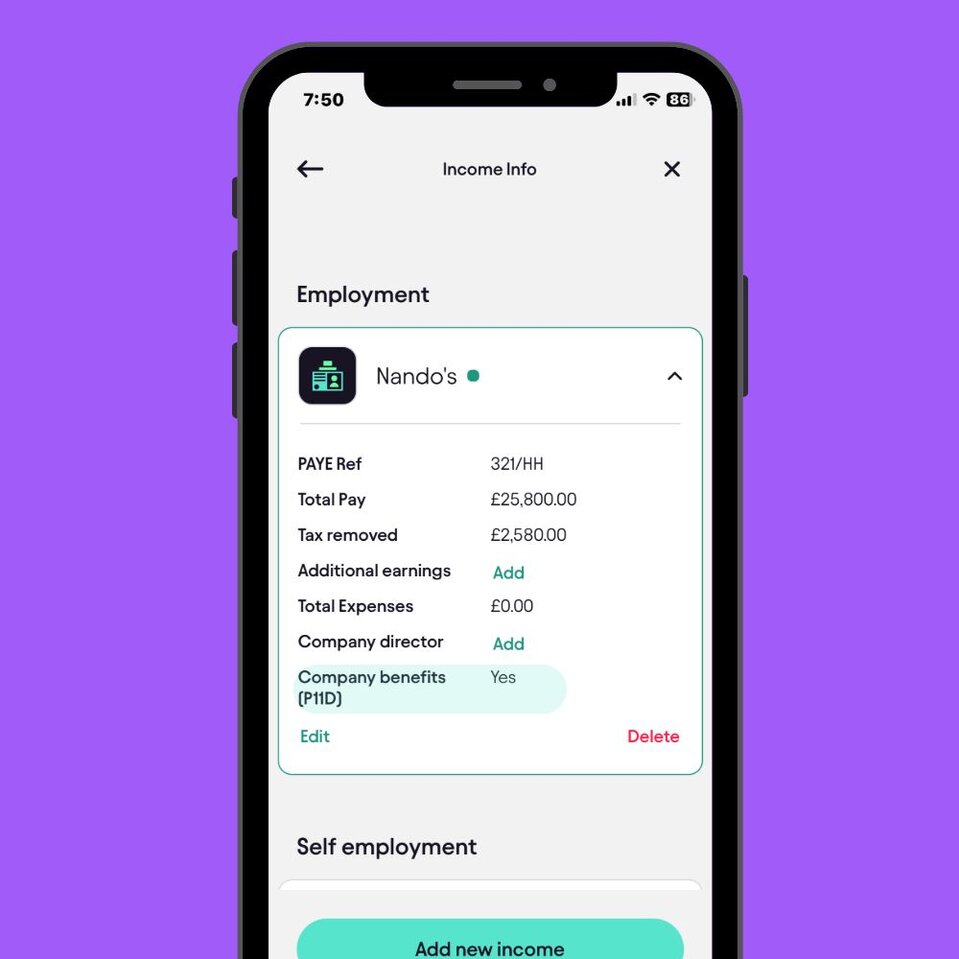

Under “Income accounts”, choose the employer you need to update for example, Nando’s.Select your Employment Income

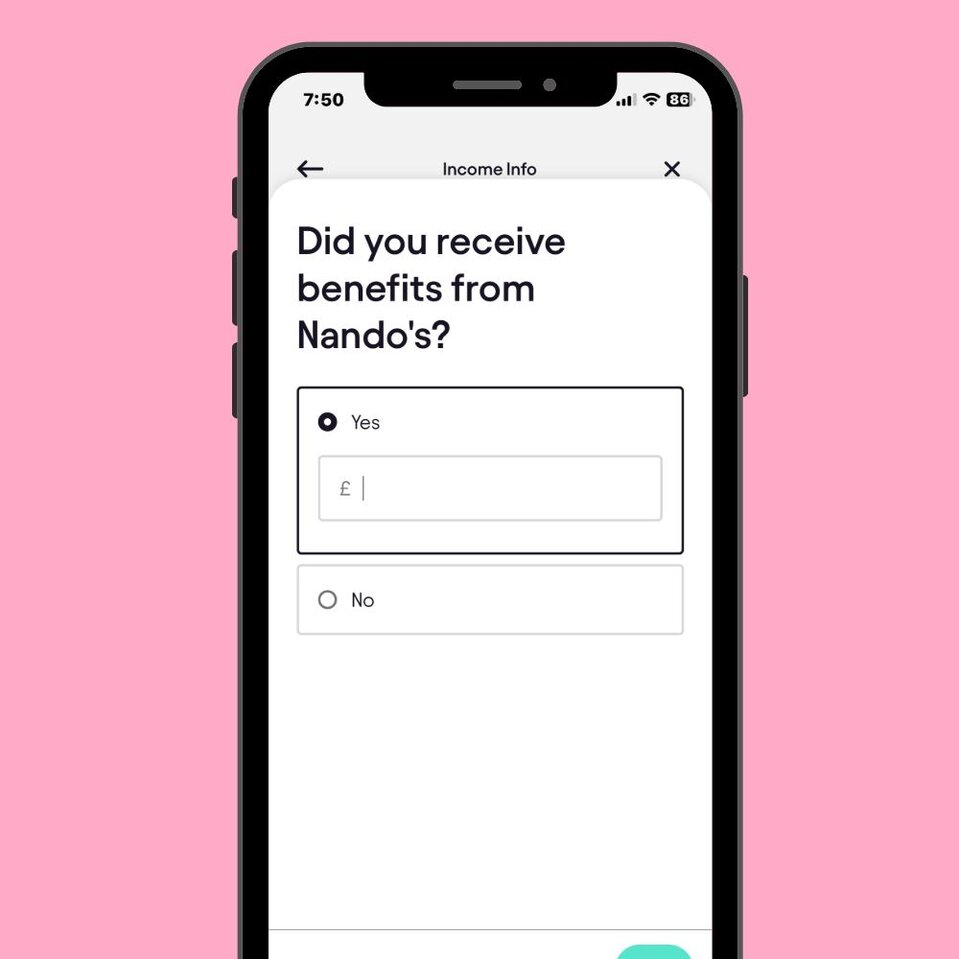

You’ll see a summary of the details Pie already has: The app will ask if you are contributing towards a student loan. Tap ‘Yes’ to proceed.Tap “Company Benefits (P11D)”

If you have a P11D form, add the total value shown on it. If you don’t have your P11D yet, you can ask your employer’s HR or payroll team they’re required to provide it.Enter the amount

Pie will automatically update your tax projection and factor this into your return. No spreadsheets, no stress.Save, and you’re done

Why adding your P11D matters

It helps Pie make sure:

- your tax calculation is accurate

- your PAYE and benefit information matches HMRC records

- your return is checked quickly with fewer delays

It’s all part of keeping you in control of your money with clarity, not confusion.

How to Add Your P11D in the Pie App

Adding your P11D (company benefits) in the Pie App helps keep your tax details accurate. You can update it in just a few steps:

- Open the Pie App and go to Profile → Income accounts.

- Select your employer from the list.

- Tap Company benefits (P11D).

- Choose Yes and enter the total amount from your P11D form.

- Tap Save Pie updates your tax projection automatically.

It’s quick, simple, and ensures your tax return is checked without delays.