Lets break it down...

Thinking about renting out a spare room in your home? In the UK, it’s a brilliant way to earn extra income to help with household expenses, but it does come with some tax considerations.

The good news is that HMRC’s Rent-a-Room Scheme offers generous tax relief. This makes it possible to earn rental income with minimal tax implications.

Understanding what counts as rental income and how to report it correctly is essential. It helps you stay on the right side of the taxman. Pie tax, the UK’s first personal tax app, helps you track rental income and calculate your tax-free allowances effortlessly. Or if you’re just here to get to grips with it all, let’s break it down!

What is the Rent-a-Room Scheme?

The Rent-a-Room Scheme is a government initiative designed to encourage homeowners and tenants to rent out spare rooms in their own home.

The room scheme lets both homeowners and tenants earn tax-free income by renting out a room in their main residence. Under this scheme, you can earn up to £7,500 per year tax free.

This allowance applies to income from furnished accommodation in your main home. It covers taking in a lodger, hosting Airbnb guests, or running a small B&B from your property. More households across the UK are taking advantage of the scheme, and more people are exploring it as a way to supplement their income.

If you share the income with someone else, the allowance is split. You’d each get £3,750 tax-free if sharing with a partner or spouse.

The scheme applies to those renting out a room in their own home, and tenants with their landlord's permission can also benefit from the scheme. Tenants as well as homeowners can participate and enjoy the associated tax allowances.

The beauty of this scheme is its simplicity. If your rental income stays below the threshold, you don’t need to do anything. There’s no need to report it to HMRC or complete a tax return solely for this purpose. This makes it one of the most straightforward tax reliefs available.

When Do You Need to Complete Self Assessment for a Spare Room?

You’ll need to register for self assessment if your rental income exceeds the £7,500 annual threshold. This is where HMRC wants their slice of the pie. If you already complete a tax return for other reasons, you must include your rental income. This applies regardless of the amount you earn from renting.

Some people choose to opt out of the Rent-a-Room Scheme, perhaps because they have high expenses. If you do this, you’ll need to complete a self assessment return. Remember to register for self assessment by 5th October following the tax year in which you started letting. Missing this deadline could result in penalties.

For more guidance, visit the relevant HMRC self assessment for rental income page. If you are unsure about your obligations, seek detailed information from HMRC or a qualified tax professional. More detailed information is available on the HMRC website for those with complex situations.

Calculating Your Taxable Income from a Spare Room

When your rental income (revenue) exceeds the £7,500 threshold, you have two options for working out your tax. Both methods can be beneficial depending on your circumstances. Option 1 is to take the automatic £7,500 allowance.

You simply pay tax on your gross receipts (total revenue) minus this allowance, with no need to calculate expenses. This includes all payments received from your lodger, such as rent, payments for meals, and other services provided.

Option 2 involves calculating your actual profit. Add up all your rental income, then deduct allowable expenses related to the letting. These expenses might include a portion of utility bills, insurance, maintenance costs, and cleaning. Only costs directly related to the rented room are allowable.

If you use part of your home as an office and rent out a room, you must report the income from the office or rental activity accordingly.

Here are some examples:

- If your total revenue from letting a room is £9,000, under Option 1 you would pay tax on £1,500 (£9,000 minus the £7,500 allowance).

- Under Option 2, if your revenue is £9,000 and your allowable expenses (including cleaning and meals provided) total £2,000, you would pay tax on £7,000 (£9,000 minus £2,000).

If two people share the same property and both receive income from letting, the £7,500 allowance is split between them, so each person can claim up to £3,750. Compare both methods each tax year and choose the one that results in the lower tax bill.

You’re allowed to switch between methods from year to year. Any taxable profit is added to your other income and taxed at your normal rate. This could be 20%, 40% or 45%, depending on your total income.

How to Report Rent-a-Room Income on Your Tax Return

If you need to complete a self assessment tax return, you'll report your rental income in the property section. The form has specific sections for Rent-a-Room income.

There's a specific box you need to tick to indicate you're using the Rent-a-Room Scheme. Missing this could mean paying more tax than necessary.

You'll need to declare your gross rental receipts, the total amount received before any deductions. Keep records of all payments received, even cash transactions.

The online tax return will guide you through the process step by step. The submission deadline is 31st January following the tax year end. I once forgot to tick the Rent-a-Room box and ended up paying an extra £300 in tax. A quick amendment sorted it out, but it taught me to double-check everything!

Common Pitfalls to Avoid

Many people forget to keep proper records of their rental income.

HMRC can ask to see evidence going back several years, so keep everything organised Short-term lettings through platforms like Airbnb count too! Some hosts mistakenly think these brief stays don't need declaring.

If you rent out multiple rooms, the £7,500 allowance doesn't multiply. It's a single allowance for your whole property regardless of how many rooms you let. Check your mortgage and insurance policies before taking in lodgers. Some providers don't allow it, and renting without permission could invalidate your agreements.

Special Considerations for Different Arrangements

Renting to family members works differently. If you charge a relative less than market rate, it may not qualify for the Rent-a-Room Scheme.

If you receive housing benefit or universal credit, rental income could affect your entitlement. Always notify the relevant authorities to avoid potential overpayments.

Council tax implications can arise too. Taking in a lodger might affect single-person discounts, so factor this into your calculations.

For those with multiple properties, remember the Rent-a-Room relief only applies to rooms in your main residence. It doesn't cover properties you own but don't live in.

Final Thoughts

The Rent-a-Room Scheme offers a generous tax break for homeowners with space to spare. For many, it means earning completely tax-free income.

Even if you go over the threshold, the tax treatment is still favourable compared to other types of income. The scheme is designed to be accessible and straightforward.

Always keep good records and understand your reporting obligations. Rules can change, so check for updates each tax year. If your situation is complicated or you're unsure about anything, getting professional advice could save you money. A tax professional can help you navigate the complexities.

Pie tax: Simplifying Rent-a-Room Tax

We understand that keeping track of rental income alongside HMRC's rules can feel overwhelming.

Pie tax makes it simple to record your income as it arrives. Our app gives you real-time visibility of where you stand against the £7,500 threshold. You'll never be caught out by unexpectedly exceeding the limit.

Pie tax automatically calculates which method would be most tax-efficient for your situation. It compares claiming the allowance against deducting your actual expenses.

The dashboard clearly separates different income streams for easy viewing. You can see at a glance how your property income fits with your overall tax picture.

Why not take a look at how Pie tax could make managing your spare room income easier?

Quick and Easy Guide to Adding Property Income Under Rent-a-Room

Follow these steps to get started:

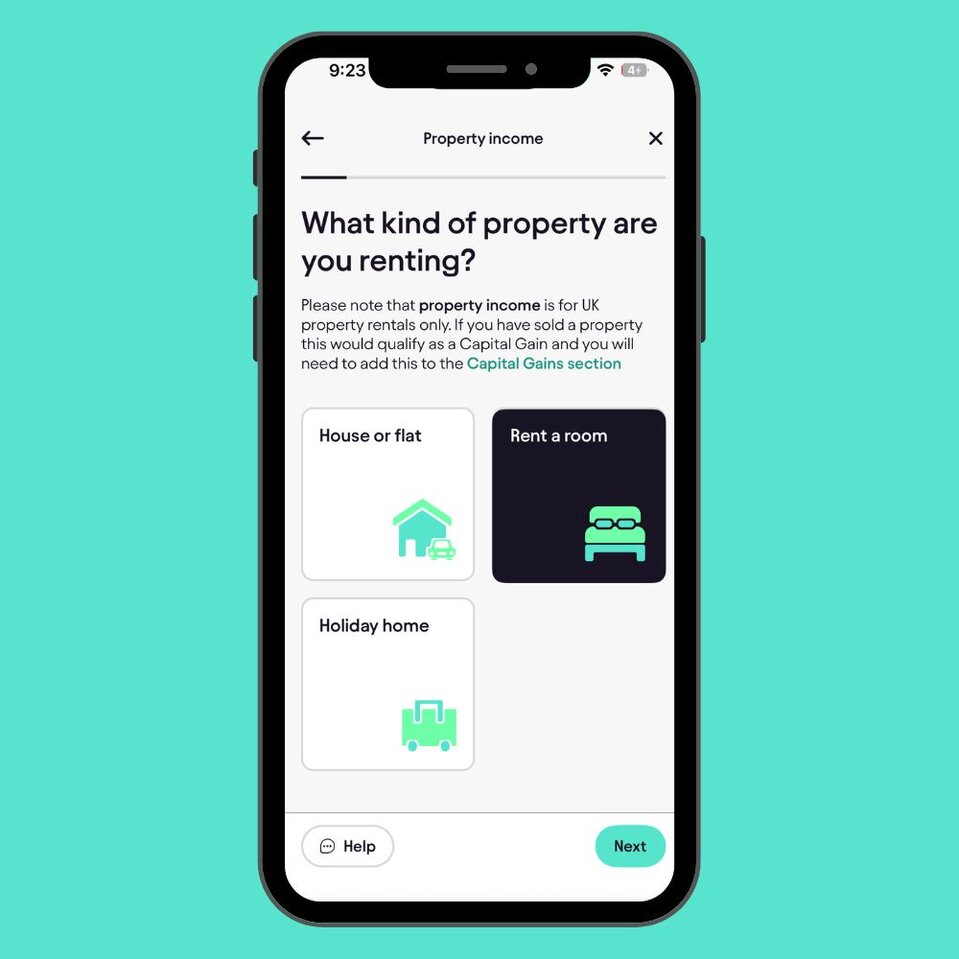

To add a property income source, tap ‘Quick Add’ on the Pie App home screen. Choose ‘Create an Income Type’ and select Property. Once you’re in, you’ll see an option to choose ‘Rent a Room’ if that applies.Step 1

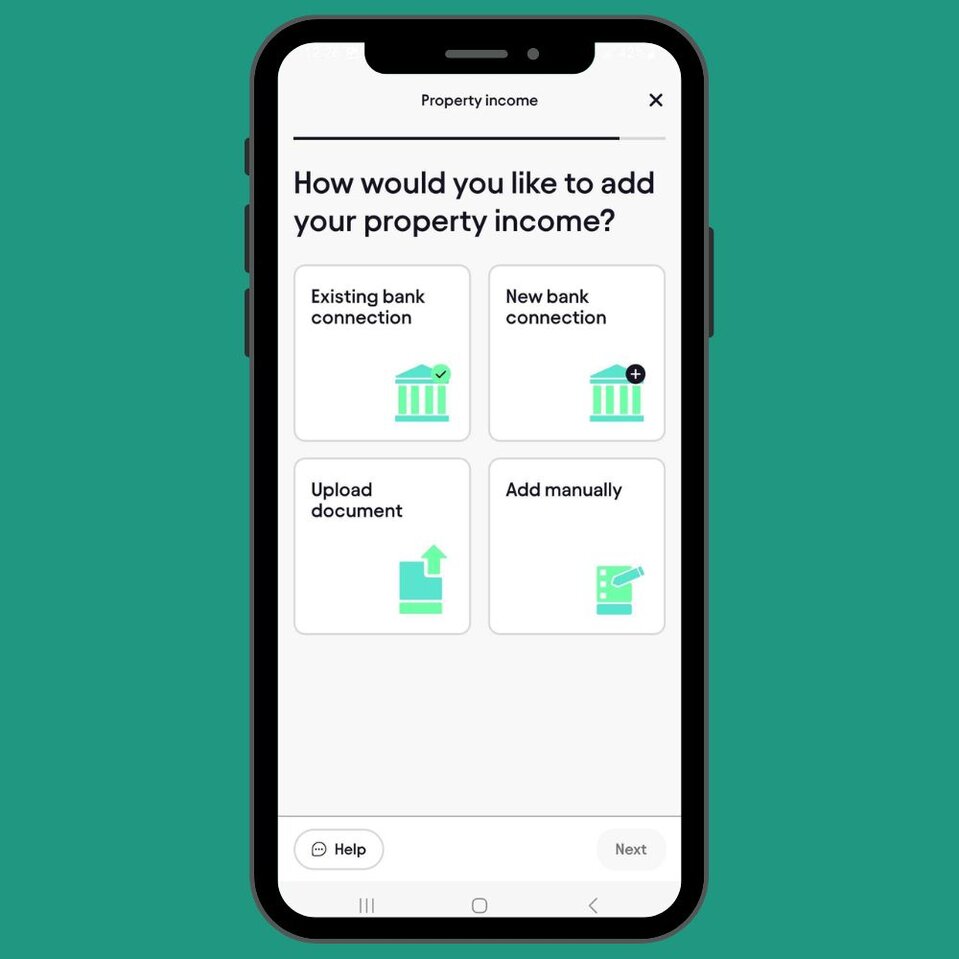

Once you’ve created an income source for rent a room, you can choose to add income via existing bank connection, new bank connection, upload a document, or manually.Step 2