Understanding Why HMRC Rejected Your Tax Return Submission

Are you a taxpayer in the UK, puzzled about why HMRC rejected your tax return submission? Worry not! We've got you covered with a comprehensive guide on identifying common mistakes and how to fix them.

Common Reasons for HMRC Rejected Tax Returns

When you submit a tax return, it's crucial to understand the common reasons for rejections.

Your tax return may be rejected if details such as your name, National Insurance number, or Unique Taxpayer Reference (UTR) are incorrect. Accurate information is paramount for HMRC to process your return.Incorrect Personal Information

If any income sources are omitted or the figures don't add up, HMRC may reject your return. Ensuring all income is declared accurately and calculations are correct is essential.Omitted Income or Incorrect Calculations

Claiming tax relief incorrectly or without proper documentation can lead to rejection. Ensure you have all necessary paperwork and your claims align with HMRC guidelines.Invalid Tax Relief Claims

How to Correct a Rejected Tax Return Using Pie App

Follow these steps to correct your rejected tax return seamlessly:

Double-check personal information such as name, NI number, and UTR.

Review your income sources and ensure none are omitted.

Validate all your calculations with your dedicated Pie Tax Assistant to ensure they are accurate.

Verify that all tax relief claims are valid and substantiated with proper documentation.

Resubmit your corrected tax return promptly to HMRC using the Pie App.

Options for Submitting Your Self-Assessment

Option 1: Manual Resubmission

Correct errors and submit your tax return manually via post or HMRC’s online portal. Ensure that all corrections are accurately reflected before resubmission. Double-checking your entries can help prevent delays in processing. If submitting by post, use the correct forms, such as the SA100 for Self Assessment, and include any additional documentation that supports your corrections. Additionally, ensure that any amendments are submitted within the allowed timeframe, typically within 12 months of the original filing deadline.

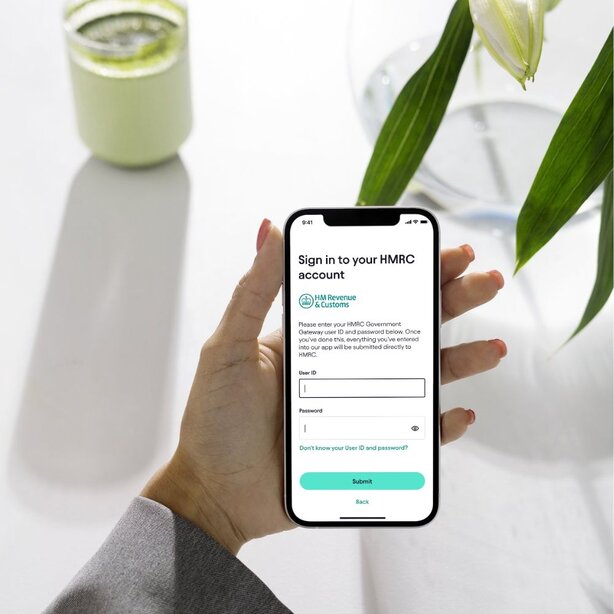

Option 2: Use Tax Software

Using a reliable tax software like Pie Tax can streamline the process. It helps to identify common mistakes, ensures accuracy, and simplifies the resubmission process. PieTax also offers access to tax assistants who can provide guidance and support, ensuring that your data is entered correctly. These experts can help clarify any uncertainties and provide advice on tax regulations, making the filing process smoother and more efficient. With this personalised assistance, you can confidently manage your tax obligations and reduce the risk of errors.

Additional Considerations

Tax laws and submission guidelines can change. Regularly check HMRC updates to stay compliant.Stay Updated

Keep detailed records of your income, expenses, and any correspondence with HMRC.Retain Records

When in doubt, consult with a tax advisor to avoid mistakes.Seek Professional Help

Expert Assistance with Pie

Navigating tax returns can be complex, but with PieTax, you have access to expert assistance to guide you through the process. Our software is designed to help you avoid common errors and ensure a smooth submission. Simplify your tax return process with PieTax today.

Tax return rejections by HMRC have risen by 10% over the past year due to incorrect personal information.

Approximately 15% of tax returns are rejected annually due to inaccuracies in income declarations and calculations.

Frequently Asked Questions

What should I do if my tax return is rejected?

Review the reason for rejection, correct any errors, and resubmit your return promptly.

How can I avoid common mistakes on my tax return?

Double-check personal details, ensure all income is declared, validate calculations, and ensure tax relief claims are accurate.

Can I resubmit my tax return online?

Yes, you can correct your tax return and resubmit it through HMRC’s online portal or via reliable tax software.

What happens if I miss the tax return deadline?

Missing the deadline may result in penalties. Ensure you submit on time to avoid additional charges.

How can Pie Tax help with my tax return?

Pie Tax simplifies the process by identifying errors, ensuring data accuracy, and providing expert guidance, making tax submissions hassle-free.