All You Need to Know About SA102

The SA102 form is essential for taxpayers who receive employment income but not directly included in their Self Assessment tax return. Filling out this form ensures that the correct tax is paid on income from employment, as opposed to self-employed income.

Understanding the SA102 form can save you from costly errors and delays in your tax filings. In this guide, we will explore its purpose, highlight common pitfalls, and provide actionable tips for accurate completion. With expert assistance from the Pie Tax App and our team, you can navigate this seemingly complex process with confidence.

Let’s delve into the specifics of the SA102 form so that you can fulfil your tax obligations efficiently and accurately.

Purpose of the SA102 Form

The SA102 form is an essential supplement to your Self Assessment tax return, detailing your employment income. It covers salary, bonuses, deductions, and benefits-in-kind. Accurately completing this form ensures you pay the correct amount of tax, preventing both underpayment and overpayment.

This precision in tax reporting offers financial peace of mind, helping you manage your finances effectively and avoid potential issues with HMRC. Understanding the SA102 form is crucial for maintaining accurate tax records.

Who Needs to Fill Out SA102?

If you are employed and receive income from one or multiple employers, you must fill out the SA102 form. This requirement also applies if you're a company director paid under PAYE. Completing this form accurately is crucial, as it ensures all employment income is correctly reported to HMRC.

By doing so, you prevent tax discrepancies and potential issues with underpayment or overpayment of taxes, contributing to smoother financial management and compliance with tax regulations.

In the tax year 2021/2022, 32 million people in the UK received employment income. This represents a significant proportion of taxpayers who need to pay special attention to SA102. 11.6% of these taxpayers faced issues with underpaid or overpaid taxes, often due to errors in form completion.Significant Numbers: Employment Income in the UK

Approximately 85% of UK workers are under the PAYE system, which directly affects the need to complete the SA102 form for a majority. Out of these, nearly 20 million taxpayers are subjected to additional reporting requirements to correct any discrepancies from the PAYE system.Numbers under PAYE System

Detailed SA102 Form Instructions

The SA102 form consists of several sections requiring meticulous data input, including income, benefits, and expenses under employment. Accurate and timely entries are crucial, as even minor errors can lead to miscalculated tax returns. Such discrepancies can trigger costly HMRC queries and potential fines.

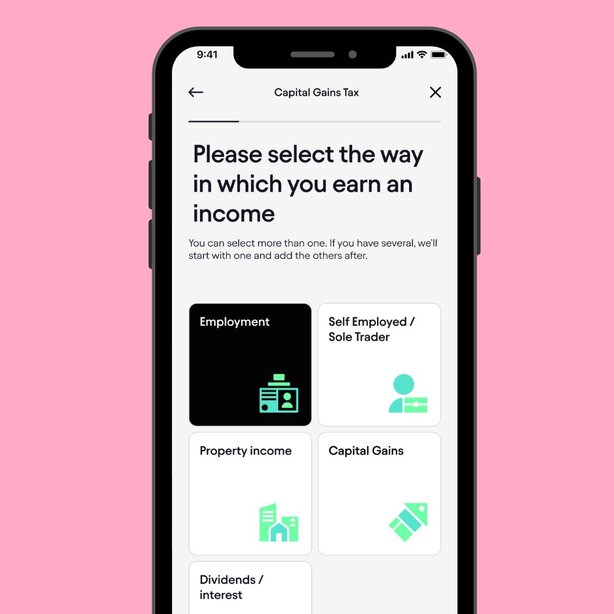

Ensuring your information is precise not only keeps you compliant with tax laws but also helps in managing your finances effectively. The Pie Tax App simplifies this process by providing step-by-step guidance and expert tax assistance.

With professional support available directly within the app, you can be confident that your entries are accurate, reducing the risk of errors and the associated financial consequences.

Avoiding Common Mistakes in SA102

Common errors in the SA102 form include incorrect figures, missing information, or misclassification of income types. These mistakes can lead to inaccurate tax calculations, resulting in underpayment or overpayment of taxes and potential penalties. To alleviate these risks, using authorised tax software or consulting expert tax assistants available on the Pie Tax App is highly recommended.

Cross-checking your data against income statements and double-checking entries can significantly reduce the likelihood of errors. This meticulous approach to data verification ensures a hassle-free tax submission process.

Prevention is always better than cure, especially in taxation. By taking these precautionary measures, you can avoid costly errors and enjoy peace of mind knowing your tax return is accurate and compliant with HMRC requirements.

Preparing for the Future: SA102 Updates

Keeping an eye on tax regulations helps you stay compliant. Regularly reviewing updates on the HMRC website ensures you are informed about any changes affecting the SA102 form.Stay Compliant with Tax Regulations

Using digital tools like the Pie Tax App keeps you ahead. Regular notifications and expert consultations mean you're always in compliance without the need to constantly check for updates.Leverage Digital Tools

With expert consultations available on the Pie Tax App, you can confidently manage your tax returns. This support helps you understand the regulatory changes, ensuring accurate and timely submissions.Benefit from Expert Assistance

Fun Fact About SA102

Did you know the SA102 form has evolved significantly since its inception? Initially slim and simple, it now includes intricate sections addressing modern employment conditions.

This complexity is a reflection of the growing variety of employment benefits and deductions, making it essential to use tools like the Pie Tax App.

Expert Tips for Handling SA102

Consulting with tax professionals ensures accuracy and timeliness. Expert tax assistants available on the Pie app provide tailored advice, improving your filing experience.

Additionally, utilising digital tools simplifies the collation and reporting of your employment income, eliminating the stress and complexity of manual calculations.

Many UK employees are required to complete the SA102 form, and a notable portion face tax discrepancies each year. Utilising expert tax assistance, such as the Pie Tax App, can greatly minimise this risk, ensuring accurate and compliant tax submissions.Key Factors Affecting SA102

Double-check your entries to avoid errors. Use the Pie Tax App for step-by-step guidance and expert assistance. Stay updated with HMRC changes to ensure compliance and accurate tax submissions. By following these steps, you can manage your tax return process efficiently and with confidence.Final Advice for SA102

Summary

The SA102 form is a crucial document for accurately reporting employment income. By understanding its purpose, who needs to complete it, and the importance of accurate entries, you can avoid common pitfalls and ensure smooth tax processing. Remember, tools like the Pie Tax App and expert tax assistants available on the Pie app can make this process seamless. Keeping informed and using the best resources available guarantees a hassle-free tax season.

Frequently Asked Questions

Do I need to fill out the SA102 if I'm self-employed?

No, the SA102 is specifically for employment income. For self-employment, other forms like SA103 are used.

What happens if I miss filling out the SA102?

You might face penalties or discrepancies in your tax returns, necessitating corrective measures.

Can I use the Pie Tax App for guidance?

Yes, the Pie Tax App offers step-by-step guidance and expert assistance to ensure accurate form completion.

What if I have multiple employers?

You will need to aggregate your income from all employers and report it accurately in the SA102 form.

How often is the SA102 form updated?

The form is reviewed annually to incorporate any changes in tax legislation, making it essential to stay updated.