Introduction to HMRC: Role and Functions

Her Majesty's Revenue and Customs (HMRC) is the non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, and the administration of regulatory regimes including the national minimum wage. Established in 2005, HMRC was formed from the merger of the Inland Revenue and HM Customs and Excise. Its mission is to ensure that money is available to fund the UK's public services and to support taxpayers with timely and accurate advice and services.

HMRC's responsibilities are extensive. They range from collecting income tax, VAT, and corporation tax to providing child benefits and tax credits. Notably, they are also in charge of enforcing the laws concerning the national minimum wage. HMRC employs thousands of people across the UK and uses advanced technology and data analytics to perform its duties effectively.

Understanding HMRC's role helps individuals and businesses comply with tax laws and benefit from available credits and deductions. The Pie Tax App and Expert tax assistants available on the Pie app provide personalised tax solutions to ensure compliance and maximise your benefits from HMRC services.

HMRC's Tax Collection Methods

HMRC uses several methods to collect taxes, tailored to different types of taxpayers. PAYE (Pay As You Earn) is used for employed individuals, where employers deduct income tax and National Insurance contributions directly from employees' wages before they receive their pay. Self-Assessment is employed for self-employed individuals, freelancers, and those with complex tax affairs, requiring them to file annual tax returns detailing their income and expenses. Corporations and businesses use direct tax returns to report their financial performance and pay taxes accordingly. Each method has its own set of requirements, deadlines, and procedures to ensure accurate and timely tax collection.

HMRC's Enforcement Actions

HMRC enforces tax compliance through a range of stringent measures. Late payments incur fines and interest charges, which can accumulate quickly. To ensure accuracy, HMRC conducts audits to investigate discrepancies and verify the correctness of tax returns. In cases of severe non-compliance or fraud, HMRC can initiate legal actions to recover unpaid taxes, which may include court proceedings and additional penalties. These measures are designed to deter tax evasion and ensure that individuals and businesses meet their tax obligations. Non-compliance can result in substantial financial penalties and legal consequences, underscoring the importance of adhering to tax regulations.

In the 2021/2022 financial year, HMRC collected £731 billion in tax revenue. This substantial amount underscores the importance of its role in funding public services.Tax Revenue

As of 2022, HMRC employs approximately 60,000 personnel across the UK. The workforce is dedicated to ensuring efficient tax collection and providing support to taxpayers.HMRC Workforce

The Evolution of HMRC

HMRC has evolved significantly since its formation in 2005. Initially formed from merging two entities, the department has continuously adapted to technological advancements and changing economic environments. The introduction of digital services like Making Tax Digital (MTD) exemplifies this evolution. With MTD, businesses and individuals can submit tax returns online, making the process more efficient and transparent.

The department's evolution also extends to its enforcement actions, with a growing emphasis on data analytics to identify tax evasion and fraud. By analysing vast datasets, HMRC can pinpoint discrepancies and take proactive measures. These advancements aim to improve tax collection efficiency and compliance, benefiting the wider public sector.

Impact of Digital Services

Digital transformation has fundamentally changed how HMRC operates. The Making Tax Digital initiative requires businesses to maintain digital records and submit tax information electronically. This transition to digital has streamlined the tax filing process, reducing errors and increasing convenience for taxpayers. Businesses and individuals can use platforms like the Pie Tax App to easily manage their tax records and submissions, ensuring they comply with MTD requirements.

Another significant digital service is the Personal Tax Account, allowing individuals to manage their tax information online efficiently. From checking tax codes to updating personal details, these online tools provide greater transparency and control over personal tax affairs.

Know more about HMRC

HMRC will continue to enhance its digital services. Future updates may further integrate artificial intelligence for more accurate tax assessments.Increased Digitalisation

Expect a stronger focus on utilising data analytics. HMRC will use these tools to spot inconsistencies and ensure compliance.Data-Driven Compliance

Enhanced digital tools aimed at improving customer interaction and faster resolution of queries. Improved Customer Service

HMRC's Historical Roots

Did you know HMRC's origins date back over 300+ years? The first tax agency, the Board of Inland Revenue, was established in 1849, while Customs and Excise was founded in 1909.

Navigating HMRC Services

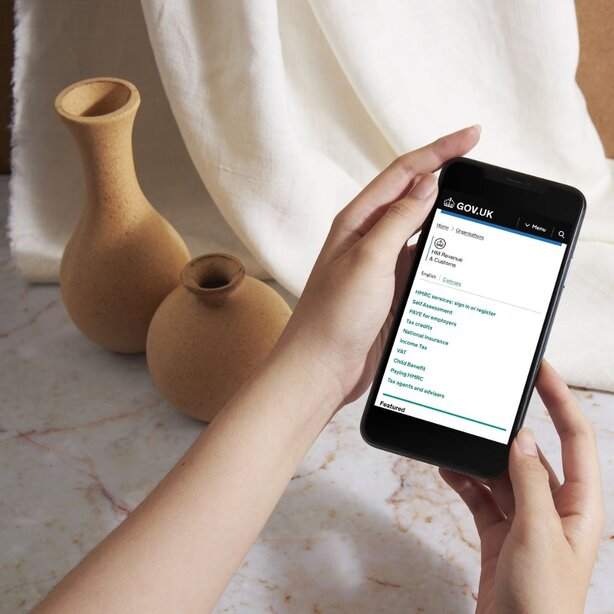

Navigating HMRC's services can be complex, but familiarity with their website and available resources can simplify the process. The HMRC website provides an array of useful tools, including tax calculators, information on tax credits, and guidelines for various taxes.

For those requiring more personalised support, the Pie Tax App offers an invaluable resource. Our Expert tax assistants available on the Pie app help individuals and businesses manage their taxes efficiently, ensuring compliance and maximising benefits.

Dealing with personal tax returns can be daunting during Self-Assessment season. However, tools like Pie Tax App can simplify this. The app offers step-by-step guidance, ensuring you don’t miss any deductions and correctly report all income.Personal Tax Returns

Businesses, particularly small enterprises, can greatly benefit from proper tax planning and compliance. Using tools like the Pie Tax App, businesses can ensure they meet various VAT obligations and take advantage of any eligible tax reliefs.Business Tax Tips

Summary

In summary, HMRC plays a crucial role in the UK's financial infrastructure. Understanding their operations, from tax collection methods to enforcement actions, is pivotal for compliance. As HMRC continues to evolve towards digitalisation, taxpayers can greatly benefit from the convenience of digital tools like the Pie Tax App. These services simplify tax management, making it more efficient and accurate.

Staying informed about HMRC policies and leveraging available resources ensures you remain compliant and optimise your tax liabilities. With the Pie Tax App and our Expert tax assistants available on the Pie app, you can navigate your tax obligations confidently and efficiently, ensuring you make the most of HMRC's services.

Frequently Asked Questions

What is HMRC's main role?

HMRC’s main role is to collect taxes, administer government support programs, and enforce tax-related laws to fund public services.

How can I submit my tax return?

You can submit your tax return online via HMRC’s digital services or use tools like the Pie Tax App for a simplified process.

What happens if I miss a tax deadline?

Missing a tax deadline can result in penalties. HMRC has various fines depending on the period and type of tax due.

How do I get help with Self-Assessment?

The Pie Tax App offers step-by-step guidance for Self-Assessment, ensuring you report income accurately and claim eligible deductions.

Is HMRC moving all services online?

Yes, with initiatives like Making Tax Digital, HMRC is increasingly moving services online to streamline tax collection and improve compliance.