Understanding the CWF1 Form: Essential for Self-Employment in the UK

Embarking on a self-employment journey in the UK requires navigating through several administrative steps, one of which is completing a CWF1 form. The CWF1 form is a vital document for anyone planning to become self-employed, as it officially registers you with HMRC for tax purposes. This guide provides an in-depth look at what the CWF1 form is, its significance, and how to fill it out correctly.

The CWF1 form serves as the initial notification to HMRC that you are starting self-employment. This notification is crucial because it sets the groundwork for your tax obligations, ensuring that you are correctly registered for Self Assessment. Proper registration helps you avoid penalties and ensures that you receive the necessary documentation to manage your taxes. Filling out the CWF1 form requires detailed personal information, including your National Insurance number, business details, and the nature of your self-employment. It's essential to provide accurate and complete information to avoid delays in processing your registration.

Importance of Registering with HMRC Using the CWF1 Form

Registering with HMRC using the CWF1 form is essential for several reasons. Firstly, it ensures you meet your tax obligations by notifying HMRC of your self-employment status. This allows HMRC to accurately track your income and calculate the appropriate tax owed, preventing potential legal issues. Additionally, the CWF1 form registers you for Class 2 National Insurance contributions, which count towards your state pension and other benefits. Without registering and making these contributions, you could miss out on crucial entitlements.

Benefits of Registering with HMRC Using the CWF1 Form

Registering your self-employment with HMRC through the CWF1 form is a legal requirement in the UK. Failure to do so can result in penalties and interest on unpaid tax. Additionally, proof of registration with HMRC is often required to access financial services such as business banking and loans. Completing the CWF1 form also helps establish your business as a legitimate entity, enhancing your professional reputation.

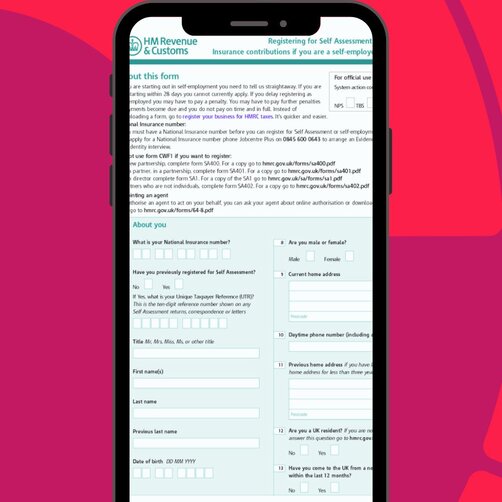

How to Complete a CWF1 Form

Filling out a CWF1 form is an essential step for anyone starting self-employment in the UK. Begin by providing your personal information, including your full name, date of birth, and National Insurance number. Ensuring the accuracy of these details is crucial to avoid any delays in processing your registration. Next, enter your business details, such as the nature of your business, the start date of your self-employment, and your business address. This information helps HMRC understand the scope and commencement of your business activities. Completing these sections thoroughly ensures that HMRC can accurately track your income and calculate the taxes you owe, keeping you compliant with legal requirements. By providing comprehensive and accurate information on the CWF1 form, you help facilitate smoother interactions with HMRC and avoid potential issues with tax obligations and National Insurance contributions.

Completing a CWF1 Form: Essential Information

When completing a CWF1 form, accurate contact information is vital. Provide a valid email address and phone number to ensure you can receive important correspondence from HMRC. If you have previously registered for Self-Assessment, include your Unique Taxpayer Reference (UTR). This number is crucial for tracking your tax records. If you do not have a UTR, HMRC will issue one upon registration. You can submit the CWF1 form either online through the HMRC website or by post. Online submission is recommended as it is faster and more efficient, helping expedite your registration process and ensuring you meet all necessary requirements promptly. Ensuring all details are accurate and submitting the form efficiently can help you stay compliant with HMRC regulations and avoid potential issues with tax obligations.

Fun Fact about CWF1

Did you know that the CWF1 form has been a critical part of the UK’s self-employment registration process since the introduction of Self-Assessment in 1997? It plays a vital role in helping HMRC track and manage the tax obligations of millions of self-employed individuals across the country.

Understanding the CWF1 Form.

The CWF1 form, also known as the Self-Assessment registration form, is used to notify HMRC that you are starting self-employment or becoming a partner in a business partnership. This form ensures that you are registered for Self-Assessment and National Insurance contributions, both of which are mandatory for self-employed individuals in the UK. By completing the CWF1 form, you officially inform HMRC of your new employment status, enabling them to track your income accurately and ensure you pay the correct amount of tax.

Additionally, registering for National Insurance contributions through this form is essential for securing your entitlement to the state pension and other benefits. Failure to complete this form can result in penalties and interest on unpaid taxes. Therefore, the CWF1 form is a crucial step in setting up your self-employment, ensuring you meet all legal obligations and secure necessary benefits.

Summary

Completing the CWF1 form is a vital step in your journey to becoming self-employed in the UK. This form notifies HMRC that you are starting self-employment or becoming a partner in a business partnership, ensuring you are registered for Self-Assessment and National Insurance contributions. Accurate completion of the CWF1 form helps you avoid penalties and establish a solid foundation for your business. Errors or omissions can lead to delays in processing and potential fines.

The Pie Tax App simplifies this process, guiding you through each step with ease. Additionally, our expert tax assistants are available to provide personalised support, ensuring you navigate the complexities of tax registration smoothly and efficiently. By leveraging these resources, you can focus on growing your business, knowing that your tax obligations are managed accurately.