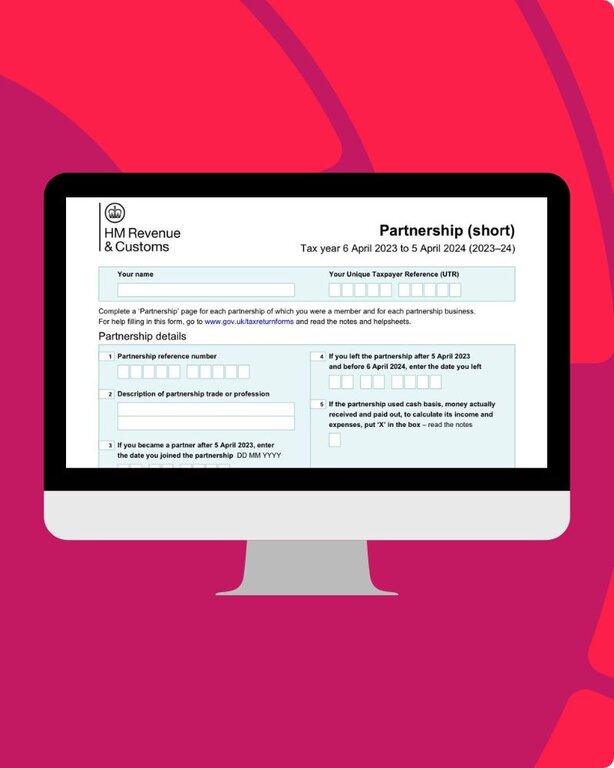

What is SA104 Form?

The SA104 form is a supplementary page that self-employed individuals in the UK need to include when filing their Self Assessment tax returns with HMRC. This form is particularly designed for those who operate as partners within a partnership business. The primary purpose of the SA104 form is to report an individual's share of the partnership profits, losses, and any other relevant financial details.

Understanding and completing the SA104 form correctly is essential for accurate tax reporting and compliance. Errors or omissions can lead to penalties and additional scrutiny from HMRC, making it crucial to have a thorough grasp of its requirements. Fortunately, the Pie Tax App and expert tax assistants available on the Pie app can assist in ensuring that your SA104 is filled out correctly and submitted promptly.

Given the intricacies involved, using the Pie Tax App to manage and submit the SA104 form can provide ease and accuracy. By leveraging such tools, individuals can better navigate the complexities of self-employment taxes, ensuring compliance and optimal financial outcomes.

Who Needs SA104?

In the UK, partners in any partnership must submit the SA104 form along with their Self Assessment tax returns. This form ensures that each partner accurately reports their share of the partnership’s profits or losses. Accurate completion of the SA104 form is essential to prevent discrepancies in tax reporting and to avoid potential penalties from HMRC. Each partner's tax liability is determined based on the information provided in this form, making it a critical component of the Self Assessment process. Ensuring accuracy helps maintain compliance with tax regulations and avoids complications during tax reviews or audits.

Why SA104 is Important?

The SA104 form is essential for ensuring the accurate distribution of tax liabilities within partnerships. By accurately reporting each partner's share of the partnership's profits or losses, the form helps maintain compliance with HMRC regulations. Proper completion of the SA104 form helps avoid penalties and discrepancies in tax reporting, ensuring that all partners meet their tax obligations correctly. This accuracy is crucial for avoiding potential legal issues and maintaining smooth operations within the partnership, ensuring that each partner's financial responsibilities are clearly defined and met.

In the 2021-22 tax year, HMRC collected a substantial £4.5 billion from partnership taxes. However, errors on submitted forms resulted in 3,000 reassessments, highlighting the importance of accurate tax reporting. Mistakes can lead to significant administrative burdens and potential penalties for the parties involved.Key SA104 Figures

The deadline for online Self Assessment tax returns is 31 January each year, while paper submissions must be completed by 31 October. Missing these deadlines can result in penalties, starting with an initial £100 fine.Filing Deadlines and Fines

Completing the SA104 Form

The SA104 form is divided into several sections, each requiring specific financial data related to partnership operations. These sections typically include income, losses, other financial gains, and adjustments. While filling out the form, it’s essential to cross-check the figures with the partnership's financial records to ensure accuracy.

Errors and omissions can result in penalties or HMRC inquiries. Thus, using tools like the Pie Tax App can streamline the process, reduce errors, and ensure timely submissions. Additionally, expert tax assistants available on the Pie app can guide you through any complexities, helping you avoid common pitfalls and optimise your tax return.

Tips for SA104 Submission

Firstly, gather all necessary financial documents related to your partnership. This includes bank statements, accounting records, and any prior tax returns. Accuracy is paramount; even minor mistakes can lead to significant repercussions.

Secondly, consider consulting with a tax professional or using a tax management app like Pie Tax App. The expert tax assistants available on the Pie app can ensure your SA104 form is error-free and submitted on time. Their expertise can save you from potential penalties and make the tax submission process much smoother.

Tips for Understanding SA104 Trends

Digital tax filing is becoming the norm. HMRC may soon mandate digital-only submissions for SA104 forms. Stay ahead by adopting tax apps.

Utilize professional tax tools like the Pie Tax App for error-free submissions. They provide real-time guidance and ensure compliance with HMRC regulations.

Government initiatives aim to simplify tax processes. Expect fewer complications and more user-friendly interfaces in the coming years.

Interesting SA104 Fact

The SA104 form, first introduced in 1997, revolutionized the way partnerships report their income. Prior to its introduction, individuals had to navigate through complex paper returns, making the process cumbersome and time-consuming. Today, SA104 offers a streamlined, efficient method for handling partnership tax affairs.

Effective SA104 Filing Strategies

Ensure all partnership records are up-to-date and accurately reflect your financial position. Regularly update your accounts to avoid year-end stress. Utilize the Pie Tax App for continuous monitoring and simplified submissions.

Next, never wait until the last minute to complete your SA104 form. Early preparation ensures you have adequate time to review all entries for accuracy. Contact expert tax assistants available on the Pie app well in advance if you encounter any issues or uncertainties.

Finally, always double-check the figures entered on the SA104 form. Mistakes can lead to penalties and additional scrutiny from HMRC. Leveraging the expertise available through the Pie Tax App will provide a safety net, ensuring your submissions are accurate and compliant.

Thoroughly reviewing your partnership's financial records is essential for completing the SA104 form accurately. Make sure all income, expenses, and financial transactions are correctly recorded. Discrepancies can complicate your tax return and attract HMRC's attention. Leverage the Pie Tax App to keep your records organised throughout the year. With its real-time updates and expert tax assistants available on the app, managing your finances becomes more streamlined and accurate, reducing stress at tax time.Review Your Financial Records

Preparing your SA104 form early provides ample time to address any issues or discrepancies that may arise. It also reduces the stress and rush commonly associated with impending deadlines. Utilizing tools like the Pie Tax App will make this process more straightforward, ensuring that you don’t miss any critical details. With expert tax assistants available on the app, you can promptly resolve issues, guaranteeing a smooth submission process.Early Preparation Benefits

Summary

Understanding the SA104 form is crucial for self-employed individuals who are part of a partnership in the UK. This supplementary form, submitted alongside your Self Assessment tax returns, details your share of partnership profits and losses. Accurate completion is essential to avoid penalties and ensure compliance with HMRC regulations.

Using tools such as the Pie Tax App and seeking advice from expert tax assistants available on the Pie app can facilitate a smoother, more accurate tax filing experience. These tools help ensure timeliness and precision, reducing the risk of errors.

In conclusion, proactive planning, regular financial record reviews, and leveraging advanced tax management tools such as the Pie Tax App, are key to successfully managing the SA104 form. Stay informed about submission deadlines, and never hesitate to seek professional guidance when needed. By doing so, you ensure a hassle-free tax season and compliance with all necessary regulations.