Navigating Financial Decisions for Plant Machinery Acquisition

When it comes to acquiring plant machinery, businesses often face a pivotal decision: whether to buy outright or to finance. Each route comes with its own set of advantages that can impact financial stability, operational efficiency, and long-term growth. Understanding these options thoroughly can make a significant difference in your company's bottom line.

For businesses in the UK, especially in manufacturing and construction, plant machinery is not just a tool for production but also a substantial investment. The decision to buy or finance is not solely about immediate costs but also about aligning with strategic goals and future financial health. This article will delve into the key benefits of each choice, helping you make an informed decision.

Key Considerations When Buying Plant Machinery

One of the major benefits of buying plant machinery outright is the ownership it entails. You gain full control over the machinery without any restrictions on its use, and it can often be resold later if necessary. Additionally, owning your machinery can simplify maintenance decisions and modifications tailored to your operational needs.

Advantages of Financing Plant Machinery

Financing plant machinery can offer significant cash flow benefits. Instead of paying a large sum upfront, financing spreads out the cost over time, freeing up capital for other investments. Moreover, financing agreements can often be tailored to fit the cash flow patterns of your business, providing flexibility and financial ease.

Recent reports indicate that 67% of UK businesses prefer buying machinery to reduce long-term costs associated with renting. Additionally, surveyed companies reported an average cost reduction of 20% on equipment maintenance when owning machinery.Buying Plant Machinery

According to industry statistics, 75% of SMEs finance their machinery to better manage cash flows, with 90% experiencing improved liquidity within the first year. Moreover, many businesses find that financing allows them to afford more advanced technology without the hefty upfront costs.Financing Plant Equipment

Buying Plant Machinery: Detailed Exploration

Purchasing plant machinery outright eliminates ongoing financing costs and interest charges, potentially leading to savings in the long term. Ownership means no contractual obligations beyond the initial purchase, which allows for complete autonomy over machinery use. However, it requires a significant capital investment, which may impact cash flow.

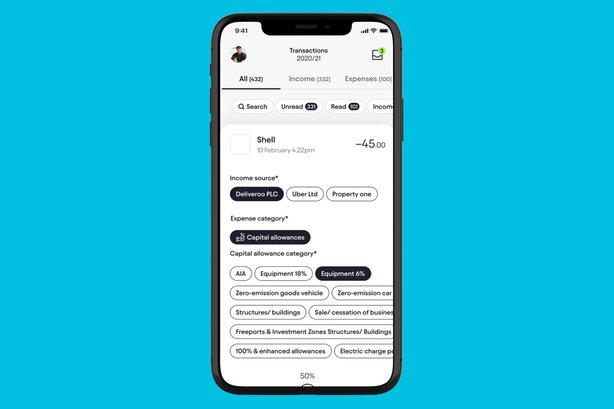

In contrast, owning machinery can provide substantial tax advantages, such as capital allowances, where businesses can likely claim deductions against profits. With the Pie Tax App and its expert tax assistants, navigating these complex tax benefits becomes much more manageable, ensuring businesses maximise potential savings.

Financing Machinery: A Strategic Approach

Financing plant machinery spreads the financial load and can alleviate immediate budget constraints, especially for medium to smaller-sized enterprises. Such flexibility enables businesses to keep pace with technological advancements by upgrading machinery more frequently without significant financial pressure.

However, financing usually incurs interest costs, and agreements might include clauses that limit modifications or use. Yet, for many, the benefit of maintaining liquidity outweighs these considerations, allowing them to invest in other business areas that drive growth and productivity.

The EIS Tax Relief Process

To claim EIS tax relief, the process involves three critical stages. First, the company must apply for SEIS approval from HMRC. Once approved, they will receive an EIS compliance certificate which is then forwarded to investors

In the second stage, investors can claim the tax relief either through their annual tax return or by marking the matching bank transaction as 'Capital allowance' in the bookkeeping section of the Pie Tax App. This claim must include the EIS compliance certificates. The Pie Tax App can simplify this process by guiding you through the process and ensuring you qualify for relief.

In the final stage, it's important to maintain your investment for at least three years to fully benefit from EIS. Selling your shares earlier can lead to a clawback of the relief claimed. Consistent adherence to EIS rules ensures continued compliance and maximisation of tax savings.

Tax Tips for Plant Machinery Acquisition

Consider immediate financial impacts when deciding to buy or finance plant machinery, balancing upfront costs with long-term cash flow needs.Weighing Immediate Costs Against Long-Term Gains

Purchasing machinery offers full ownership, allowing for control, modifications, and potential resale, enhancing your business’s financial flexibility over time.Ownership Benefits: Control and Resale Value

Financing plant machinery improves cash flow, allowing for manageable payments and investments in upgrades, benefiting businesses with varying capital needs.Cash Flow Management

Fun Fact About Machinery Acquisition

Did you know? The world’s largest excavator, Bagger 288, has a length of 240 metres and cost approximately £100 million to build. This illustrates the scale and investment involved in heavy machinery!

Handling Machinery Acquisition Decisions Wisely

Start by evaluating your current and future business needs. If immediate cash flow is critical, financing might be the more sensible option. Additionally, consider how often the machinery’s technology will need upgrading—rapid tech advancements might favour financing.

Consult with financial experts who understand your industry nuances. Leveraging insights from Pie Tax’s expert tax consultants can provide valuable perspectives that align with your fiscal strategies, maximising both tax efficiencies and operational growth.

Evaluate the total cost of ownership, including maintenance and potential downtime costs. Buying machinery might result in higher initial outlays, but understanding these can clarify the long-term value versus financing options.Assessing Total Cost of Ownership

Examine the rate of technological change within your industry. Financing can be advantageous in sectors with rapid advancements, allowing for faster equipment turnover and staying competitive without heavy cost burdens.Exploring Technological Advancements

A Balanced Perspective on Buying vs Financing

In conclusion, whether you choose to buy or finance plant machinery, it's crucial to consider both immediate and long-term financial implications. Buying offers complete control and potentially lower costs over time, while financing can provide flexibility and protect cash flow for other business opportunities.

Pie Tax can support your decision-making process through expert guidance and relevant tax advice, ensuring your machinery acquisition aligns seamlessly with your business strategy. The Pie Tax App is completely free to use, find out what features are included here:

How is Pie different?

Pie is the only app for self assessment with tools for bookkeeping, your live tax figure, easy tax returns and helpful advice when you need it.

Save £168 per year vs Quickbooks, file your self assessment today for free with Pie

FREE

£89

+£59

£126

Quickbooks

£168

per year7 features

TaxScouts

£169

per year4 features

Accountant

£450

avg per year5 features

* Optional add on

Frequently Asked Questions

What are the tax implications of buying versus financing machinery?

Buying may offer capital allowances, whereas financing can provide immediate cash flow benefits while still allowing some tax deductions.

Can financing affect my company’s credit score?

Financing, if managed well, can positively impact your credit by establishing a good payment history.

Is there a way to combine buying and leasing options?

Yes, some agreements offer lease-to-own options, allowing you flexibility with the potential of full ownership eventually.

Does Pie Tax offer support for machinery financing decisions?

Yes, Pie Tax provides expert consultation services to help navigate tax implications and optimise your financial strategies.

What are the tax implications of buying versus financing machinery?

Buying may offer capital allowances, whereas financing can provide immediate cash flow benefits while still allowing some tax deductions.