Hairdressing is a highly competitive business where talented and determined professionals work tirelessly to carve out a place for themselves. Should you succeed it can provide a very comfortable living. And if you somehow manage to snag a celebrity client or two, well, the sky’s the limit.

But running a hairdressing salon is not all puppy dogs, sunshine and photo ops with the rich and famous. First and foremost it’s a lot of work. And that workload is made heavier by the need to ensure your books are always accurate and up-to-date. That’s where Pie comes in.

Pie was designed with the self-employed in mind. Every aspect of the mobile app is intended to make life easier for those intrepid individuals determined to walk their own path. Whether you own a salon or are currently working out of your home the need for timely, accurate accounting is exactly the same, and that is what Pie provides.

About Pie

Many of the team members behind the development of Pie have spent years working for themselves and understand to their core the myriad issues and challenges facing those who check “sole trader” on their tax forms.

We have experienced first-hand how other accounting and tax apps fail the self-employed often by making things too complex. It’s almost as though the people who created those apps are trying to impress you with how much they know and how much you don’t.

At Pie, we take a different approach. We understand accounting and taxes are about as much fun as losing your hair. Nonetheless, they must be dealt with. Our goal is to remove accounting for hairdressers from the “chore” column by making it quick, simple and reliable.

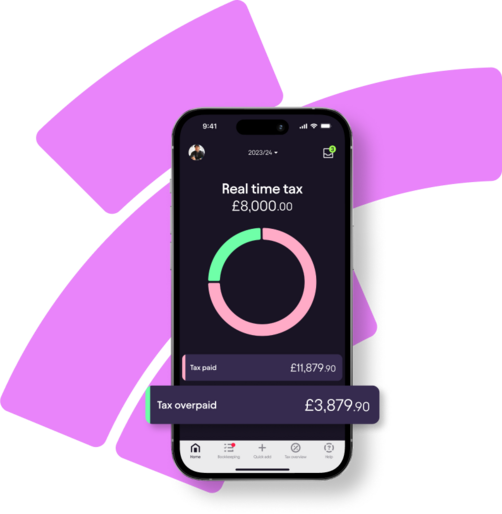

Our software is not only affordable and easy to use, it's also feature-rich with tools for taxes and invoicing, tax returns, real-time advice and much more.

And just in case you were wondering, Pie is also a CIMA-qualified accountancy practice that is regulated and recommended by HMRC.

More Than Just Another Tax App

Pie is the ideal accounting and tax app for hairdressers, regardless of the size of their business. It brings everything the busy hairdresser or other self-employed person needs to keep their books up-to-date under one roof while also providing a way to manage cash flow more effectively. The following are just a few of the benefits of embracing Pie as your hairdressing accounting app:

- You save time: If you’re a hairdresser, there’s a good chance you work long hours and rarely get more than a few minutes to sit and relax. The last thing you need is to have to spend your evenings making manual entries into your company books. Well, now you don’t have to. Pie enables you to automate rote tasks so that you have more time to enjoy the spoils of your labour.

- You elevate your business profile: If you are still doing your books and taxes the old-fashioned way, it's time to make the move into the 21st century with Pie. Everything about your accounting process will be simplified and streamlined and, just as important, Pie is completely scalable so it will grow with your business..

- Your tax filings are more accurate: Nobody wants to incur the wrath of HMRC, but if you are still filling out and filing your taxes the old-fashioned way there's a good chance an error or oversight will cause government auditors to descend upon you. Not good. Pie's tax software solution all but eliminates errors by automatically updating all your records as soon as you make a change to one.

Whether you are self-employed as a hairdresser, electrician, web designer or anything else, Pie accounting software and tax solutions simplify and stabilise your professional life.

Pie accounting software for hairdressers provides:

- Real-time tax updates

- Automated invoicing

- Bookkeeping

- Dedicated tax assistants

We are HMRC-approved and FCA-regulated and are always ready to address any questions or concerns our customers may have

Getting Started

Getting started with Pie is as easy as, well, pie! Just follow these 6 simple steps:

•Download the Pie app and install it on your smartphone.

•Connect to your personal tax account OR upload invoices.

•Connect to your bank account.

•Perform quick and easy bookkeeping using Pie.

•View your tax liability in real-time.

•Submit your tax return directly to HMRC from the Pie app.

In terms of pricing, we offer two different options:

•Essential - £6.99 per month

•Premium - £9.99 per month

However, we also offer a 60-day free trial so that you can try out our mobile app and get a taste of its user-friendly, intuitive interface before signing up.

More information about our pricing and free trial can be found here.

More Ways Pie Accounting Software Can Help Your Salon Business

Above we listed a few of the ways Pie can help your hairdressing business. But those are not the only advantages of embracing Pie accounting software for hairdressers. Other advantages include:

More Time to Cultivate your Customer Base

When people get to know and trust a particular hairdresser they tend to stick with them through thick and thin. But developing relationships with your clients is not always possible if you spend lots of time trying to balance your books and create accurate tax filings.

When you embrace Pie, the software will do most of the mundane accounting and tax work for you automatically so you have more time to spend with the people who really matter: your customers.

Your Books Will Always Be Current

With Pie, all you have to do is make a few simple entries and all of your financial and tax information is automatically updated. Your books are always current, and best of all, you know you can rely on the information because the programme all but eliminates errors.

Pie Will Automatically Generate Monthly Financial Statements

Maybe you do well enough that you can outsource your accounting to a third party. But the fact is, most hairdressers don’t have that luxury. They need to handle everything, including sales tax, VAT, bookkeeping and more all by themselves. You Benefit From Our Advice

As we mentioned earlier Pie is a CIMA-qualified accountancy practice regulated and certified by HMRC. If you are not sure what that means you can rest assured it’s a good thing. CIMA (Certified Investment Management Analyst) certification is the highest level of investment education for client-facing tax assistants like the team at Pie.

What it means is that we know what we’re doing. We’re not programmers pretending to be financial professionals, we’re financial professionals who worked with the best programmers in the business to develop an accounting and tax app that will facilitate your success. Pie accounting and tax software contains all of the knowledge and expertise of our team. And that is no small thing.

You Reduce Your Audit Exposure

Audits are disruptive, stressful events that can change the course of a person's business and personal life. While a fair percentage of people and businesses are randomly selected for audits, others invite them by submitting tax filings that are full of unintentional errors and omissions. Pie can help reduce your exposure to audits by ensuring all your financials are in harmony and that your tax filings are error-free.

Get in Touch With Pie

Whether you are just starting out or you have an established salon you need to make sure your books and tax filings are always in order. For many hairdressers updating their financials manually is like a second full-time job, and even then it’s nearly impossible to avoid costly mistakes.

Pie accounting software for hairdressers was designed by recognised accounting experts for the sole purpose of making the life of the sole trader easier. You’ll save time and money, you’ll have more time to spend on cultivating your customer base, you can rest easy knowing your books are tidy and will withstand scrutiny, and best of all you’ll reduce the odds of ever getting the dreaded audit notice.

To learn more about Pie accounting software, call us on 0203 576 2433 or write to help@pie.tax. One of our accounting software experts will get back to you shortly.

Accounting Software for Hairdressers: FAQs

Do I need to know accounting to use Pie accounting software for hairdressers?

No. Our accounting and tax software is simple and intuitive and should you ever need help, our experts are never more than a phone call away. But while you do not have to be an accountant to use our software, it’s likely you already have more than a passing knowledge of accounting basics, as you have been the one handling your business finances from the start. That kind of experience will no doubt make it easier to use our accounting software. But again, it’s not necessary.

Do I really need accounting software?

From 2026, self-employed workers with an annual income of more-than £50,000 will be legally obligated to follow the government’s Making Tax Digital requirements - which entails choosing a personal tax software to use going forwards. From 2027, the same rules will apply to self-employed workers with an annual income of more-than £30,000.

In addition to the imminent legal requirement to adopt accounting software for hairdressers, there are also plenty of laws regarding company finances and tax issues that must all be respected if you want to keep the powers that be at bay. Ultimately, the argument for adopting Pie accounting software is far more compelling than any argument not to, simply because accounting is precisely the type of numbers-heavy activity that computer software can streamline.

By moving your accounting and tax activity to the intuitive Pie mobile app, you will be lifting a significant weight off your shoulders, reducing or eliminating errors in your bookkeeping and tax filings and have a more stress-free life where you can concentrate on growing your client base instead of double and triple checking your books.

Will I still need an accountant if I adopt Pie accounting software?

No, if you currently have an accountant handling all aspects of your bookkeeping and tax filings, Pie accounting software enables you to go accountant-free - thereby saving a lot of money. The vast capabilities of Pie mean that the app is very similar to having an accountant in your pocket at all times!

Is it safe to enter my financial data into the Pie accounting app?

The Pie accounting software for hairdressers was designed by top professionals and imbued with state-of-the-art encryption along with 2-factor authentication and other measures designed to ensure your financial data never falls into the wrong hands. With Pie, all your data is stored in our secure cloud servers so even if your smartphone or tablet is lost, stolen or damaged you will not lose any data and all your data will be safe and secure.

Is Pie accounting and tax software only for hairdressers?

Not at all. Our state-of-the-art accounting software is designed to work for anyone who is self-employed regardless of the industry or the size of their enterprise. Whether you are a freelance designer, consultant, architect, make-up artist, musician or any other type of sole trader Pie accounting and tax software will help facilitate your success.

Can I switch to Pie accounting software at any time?

Yes. You can make the switch from manual bookkeeping to Pie accounting software any time you feel comfortable doing so. That said, it is usually a good idea to make such a switch at the beginning of a new fiscal year. It just makes things simpler and enables you to tie a bow on the previous year using one method.

If you do not want to wait until the end of the fiscal year the next easiest time to make the switch would be at the end of the VAT quarter, provided, of course, that your business is VAT registered. But again, you can make the switch at any time.

Will the Pie software stay current with changing financial and tax legislation?

Absolutely. Any time there are changes to finance or tax laws those changes will be integrated into the Pie accounting software without delay. The cost of these important, regular updates will be included in the cost of the software. Contact one of our customer care representatives to learn more.

Will anyone else be able to access my Pie accounting software?

Not unless you allow them to. If you wish you can allow access to specific people, but we would advise you to limit access to an accountant, or someone else regularly involved in your bookkeeping or tax filing processes. Remember, security is always of paramount importance when it comes to financial matters. You want to make sure the only people who can access your Pie software account are those with a compelling need to do so.

Is Pie accounting software for hairdressers GDPR compliant?

Of course. Because hairdressers often collect personal data on their regular clients the Pie tax software is designed to be fully compliant with UK GDPR regulations regarding the collection and processing of that information. Your clients can rest easy knowing that their personal and financial information is not being shared with others or left vulnerable to hacks or unauthorised use.

Will I need to keep backup paper records?

All the data you enter into the Pie accounting software for hairdressers is automatically backed up to our cloud server. Should anything happen to your mobile device, a backup of all your latest data is readily available.

For that reason, it does not make sense to keep paper backups. Doing so, in fact, would largely negate the benefit of using automated accounting software in the first place. That said, if you want to keep hard copies of key documents you can print them from the programme and file them away in a secure location.

Is Pie accounting and tax software a viable long-term solution?

Yes. Pie software is designed to be a long-term solution that not only makes your life easier today, but also next month, next year and the year after that. Pie is automatically updated whenever UK financial reporting or tax legislation changes so you are never caught off guard. Pie is also completely scalable.

Why not just use free accounting software?

There are several free accounting software options out there, but as is the case with most things in life, you get what you pay for with free accounting software.

First of all, customer support is typically non-existent with free tools. If you're lucky there may be a forum where you can ask questions of other users who are just as lost as you.

Second, it's rare for free software to stay up-to-date on changes in accounting and tax law. In most cases, they release the program as is and that's that.

Third, if the free programme makes an error and you end up sitting across from an auditor do you think the people that wrote the programme are going to be there next to you to take responsibility? Of course not. You’re on your own.

The bottom line is that you should never entrust something as important as your company books and tax filings to a free software program. Especially where there are affordable, cost-effective options available like Pie accounting software.