HMRC Announces £50 Payout for Parents: Essential Information

Recent announcements from HM Revenue and Customs (HMRC) reveal that certain parents are set to receive a £50 compensation. The compensation is intended to rectify a financial error that impacted numerous families due to delays in processing or miscommunication. This compensation is seen as a goodwill gesture from the government.

The compensation scheme is designed to target those parents who were affected between specific dates. HMRC has taken steps to identify and directly reach out to impacted families. However, it’s essential that parents stay informed about the criteria and ensure they receive their rightful compensation. Information about how to qualify and the procedure for claiming is vital for ensuring eligibility.

Who is Eligible for Compensation

If you are a parent who experienced delays in receiving child benefits or other related payments from HMRC, you may be entitled to compensation. HMRC is making a concerted effort to identify all affected families. However, if you believe you might qualify, it is worth checking with the agency directly.

Eligibility largely centers around those who suffered due to processing delays between specific periods. Detailed criteria are available directly from HMRC’s website. It is also advisable to keep any relevant documents or correspondences, as these might support your claim for compensation.

How to Apply for Compensation

HMRC states that it will be directly contacting families identified as eligible. However, if you have not received any communication and believe you qualify, it is recommended you contact HMRC as soon as possible. Proper documentation and evidence of impact may expedite the process.

An online portal may also be available for parents to log in and check their status. Staying proactive and ensuring your details with HMRC are up to date will assist in smoother processing.

Out of pocket or faced distress due to the delay? Here's how to claim redress

Here's our step-by-step guide on how to complain online:

1. Go to the complaints form at the top of this Gov.uk page.

You'll then be asked to log in with your Government Gateway ID and password. If you've forgotten your Government Gateway details, you can retrieve your user ID or reset your password online. If you've never used Government Gateway before, you can register on Gov.uk.

2. Select 'Make a new complaint'.

You'll then be asked what your complaint is about. Select 'Child Benefit including Guardian's Allowance, claims and appeals'. After each page of the form, click 'Save and continue' or, if you want to finish the complaint later, select 'Save and come back later'.

3. Give details of your complaint.

Explain exactly what happened, including the date you were supposed to receive your Child Benefit payment, how the situation affected you and details of any charges you incurred. You won't be asked to provide evidence of your charges at this stage, however HMRC may contact you to ask for this after you've made your complaint. So ensure you gather evidence, such as screenshots of fees or bank statements.

4. When asked if you know what you want HMRC to do to make things right, click 'Yes'.

You'll be able to explain here that you want redress for distress caused by the delay or costs you incurred due to the late payment.

On this page, you'll also be asked if you need any extra help making your complaint. If you answer 'yes', you'll be able to provide details of the help required – see Gov.uk for more details on how HMRC can support you. If you don't need extra help, select 'No'.

5. Provide your contact details.

You'll be asked if you want HMRC to contact you by phone. If you do, select 'Yes' and input your phone number. If you don't, select 'No'. Regardless of your answer to this question, you'll then be asked whether HMRC can contact you by email. If you're happy with this, select 'Yes' and enter your email address, and if not, select 'No'.

6. You'll see a summary of all the information you've entered – check this is all correct.

Then, click 'Save and continue'. On the next page, you'll be asked to confirm that all the info you've provided is accurate. There's also an option to enter your email address, so you can receive confirmation of your complaint – but you don't have to do this. Click 'Confirm and send' to submit your complaint.

7. You should hear back within 15 days of submitting your complaint.

HMRC will let you know the name and contact details of the person dealing with your complaint. Once it has reviewed your complaint, it'll get in touch to let you know the outcome.

If you're unhappy with the outcome, you'll be told how to ask for a review by email or over the phone. If your case is reviewed and you're still unhappy with the final decision, you can contact the Independent Adjudicator.

If you don't want to complain online, you can contact HMRC over the phone by ringing 0300 200 3100 between 8am and 6pm from Monday to Friday – though be aware that it's likely quicker to submit a complaint online if you're able to do so. Make sure you have your national insurance number to hand.

Alternatively, you can complain by post. Make sure you write 'Complaint' on your envelope and at the top of your letter. See Gov.uk for further details on what your letter should include. You can also see Gov.uk for the address to post complaints to.

Impact on Families

In light of HMRC’s intensified scrutiny, The £50 compensation may seem modest, but for many families, it represents acknowledgment from HMRC for the inconvenience caused. Financial delays can severely disrupt household budgets, causing undue stress to parents managing their finances tightly.

For some families, every penny counts, and this gesture from HMRC can help ease the financial strain. It also signifies a commitment to improving service delivery for families in the future.

Government’s Response

This compensation initiative from HMRC indicates a broader acknowledgment of administrative lapses. The government aims to restore confidence in its processes and ensure better service in the future. Such compensations, albeit modest, reflect a commitment to rectifying wrongs and providing better public service.

Responding proactively and reaching out to the affected families depicts an effort by the government to amend and avoid similar situations in the future. It stands as a testament to the ongoing improvements being made within HMRC and other governmental departments.

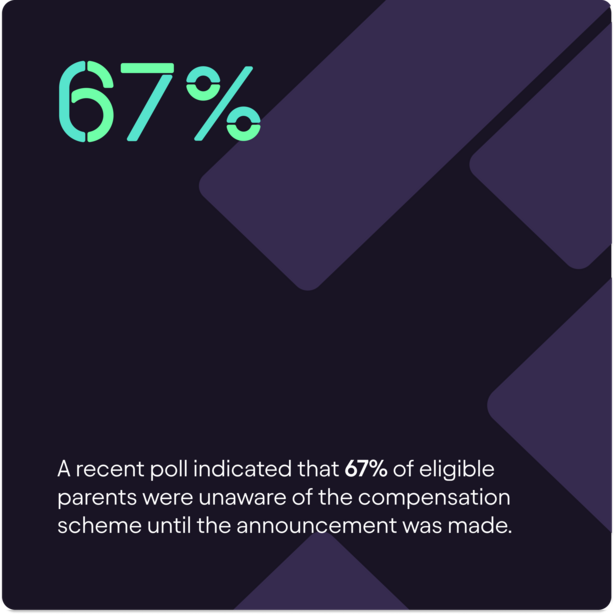

Fun Fact: Impact of Small Financial Aids

Did you know that small financial aids, such as a £50 compensation, can have a disproportionate positive effect on low-income families? A study found that even a £25 windfall can significantly improve a family's financial stability for a month, showing the importance of even modest compensations.

Conclusion

HMRC's announcement of the £50 compensation for parents underlines the agency's effort to rectify past service issues. Understanding the eligibility and the process to claim this compensation is pivotal for affected families. Keeping abreast of updates from HMRC and ensuring all documentation is in order ensures parents can receive their due amount. This initiative represents more than financial compensation; it’s a move towards transparency and improved service delivery.