Essential Tips for Managing HMRC Payments

Understanding how to properly manage your payments to HMRC is crucial for avoiding unnecessary interest charges. We'll guide you through the key steps to effective tax management.

Managing your HMRC tax payments doesn't have to be overwhelming. By understanding the deadlines, payment options, and potential pitfalls, you can avoid interest charges and ensure your tax obligations are met efficiently.

Whether you're self-employed or managing a business, ensuring timely and accurate payments can save you from costly penalties.

Key Deadlines to Remember

Awareness of key HMRC deadlines is essential. Missing payment deadlines can lead to interest charges and penalties, so set reminders and stay informed.

Understanding Payment Options

HMRC offers multiple payment options, including direct debit and bank transfers. Choosing the right method can simplify your tax management and prevent interest accrual.

According to HMRC, over 95% of businesses comply with their tax requirements on time. This statistic highlights the importance of compliance for avoiding penalties.Compliance Rates

Interest charges can quickly accumulate. In 2022, HMRC collected over £1 billion in interest from late payments, underscoring the cost of delays.Interest Accumulation

A Two-Step Approach

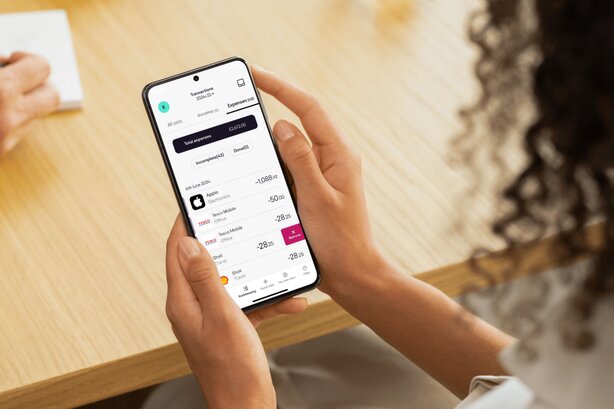

The first step in managing HMRC payments is organising your financial records. Accurate records ensure that you know exactly what you owe and when it’s due. The Pie Tax App simplifies this process by tracking all your income and expenses in one place.

Secondly, setting up your payments in advance can save you from last-minute scrambles. Consider using direct debit to automate regular payments, ensuring peace of mind and avoiding interest charges.

The Role of Expert Assistance

Having an expert assistant can be invaluable. With the Pie Tax App, expert tax assistants are available to provide advice tailored to your situation, helping you navigate complex tax codes and discover potential savings.

Moreover, these experts can answer questions and offer support around the clock, ensuring you make the most informed decisions possible. This assistance reduces the burden and stress often associated with tax management.

Essential Tips to Manage HMRC Tax Payments

Set Up a Direct Debit Set up a direct debit with HMRC to spread your tax payments across the year, reducing the risk of missing deadlines.

Track HMRC Deadlines Keep track of important HMRC deadlines by adding reminders to your calendar. Missing these dates can result in penalties and interest charges.

Consider a Time to Pay Agreement If struggling with payments, contact HMRC early to arrange a Time to Pay agreement. This can help you manage your tax bill in instalments.

Fun Facts

Every year, HMRC receives over 10 million self-assessment tax returns, showcasing the scale and complexity of the UK tax system.

Advice for Managing HMRC Payments

Understanding your financial responsibilities is the first step in effective tax management. Being proactive about your HMRC obligations will help you avoid unnecessary stress and interest charges.

By leveraging tools such as automated reminders and direct debits, you can streamline your tax management and ensure all your payments are on time. These practices make managing your tax payments significantly more manageable and efficient.

Ensure all your tax payments are made on time by setting up reminders through your preferred calendar or task management tool. This can alert you to upcoming deadlines.Setting Up Reminders

Selecting the appropriate payment plan is essential. Assess your financial situation carefully to choose a payment strategy that suits your cash flow and avoids unnecessary stress.Choosing the Right Payment Plan

Summary

Managing your HMRC tax payments can seem daunting, especially with the accompanying threat of interest charges for missed deadlines. However, by understanding key deadlines, leveraging payment options, and enlisting expert assistance, you can effectively navigate your tax obligations.

The Pie Tax App is an invaluable tool that simplifies this process by providing reminders and expert advice, helping you save time and avoid potential costs. By incorporating these strategies, you can ensure a smooth and financially savvy tax season.

Frequently Asked Questions

What happens if I miss a tax payment deadline?

You may incur interest charges and additional penalties for late payments.

Can I set up a payment plan with HMRC?

Yes, HMRC offers various payment plans to suit different financial situations.

How can the Pie Tax App help me?

The app provides reminders, tracks expenses, and offers expert tax assistance to manage your payments effectively.

Is expert tax advice available through Pie Tax?

Yes, the app connects you with expert tax assistants for tailored advice and support.

Are there any automated ways to manage payments?

Setting up a direct debit with HMRC ensures your payments are automatically managed and spread throughout the year.