Introduction to Free Business Account Deposit Restrictions

In today’s financial climate, many businesses seek free banking solutions. Free business bank accounts often come with multiple benefits but also restrictions, such as the cash deposit limit. Understanding these limits is essential to managing business cash flow efficiently. While some business owners might think free accounts offer boundless advantages, comprehending the fine print regarding limits is crucial. Awareness of these restrictions not only affects how businesses handle cash but also impacts daily operations and financial planning. Here, we dive into the specifics of cash deposit limits and how they affect your business banking choices.

Why Deposit Limits Matter

Cash deposit limits can impact a business by influencing its cash flow management and transaction capabilities. Understanding these limits helps businesses avoid fees and manage their funds more effectively.

Balancing Costs and Benefits

While free business accounts save money, they may impose restrictions such as deposit limits. Evaluating these limits against the benefits allows businesses to make informed financial decisions.

80% of free bank accounts impose deposit limits, influencing business operations significantly. Businesses often choose accounts without fees, underscoring the importance of understanding these limits.Recent Cash Deposit Limit Stats

The typical cash deposit limit for free accounts is around £5,000 per month, with variations based on the bank. Staying within these limits prevents unnecessary charges.Average Business Deposit Statistics

Detailed Analysis of Cash Deposit Restrictions

Many free business bank accounts apply cash deposit limits to manage costs and prevent misuse. These limits help banks control operations and costs associated with handling physical currency. Therefore, understanding these restrictions helps businesses avoid unanticipated costs and aids in efficient cash flow planning.

It is essential to assess account terms before selecting a bank, as exceeding deposit limits may incur additional fees or require account upgrades. Explore and research the best bank that meets your business requirements, considering the versatility of your financial and operational needs. This allows businesses to adjust strategies accordingly and effectively accommodate any banking limitations.

Exploring Solutions to Cash Deposit Limits

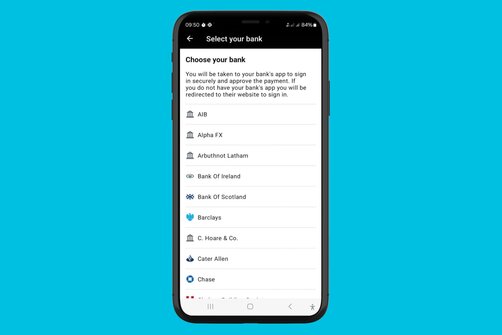

To bypass cash deposit limitations, businesses could consider solutions like using digital transactions or multiple bank accounts. By diversifying transaction methods, businesses not only surpass deposit limits but also strengthen financial resilience.

Many digital platforms, such as the Pie Tax App, offer tools to track finances and suggest strategies for managing deposits effectively. These tools allow businesses to adapt to evolving banking landscapes, ensuring seamless operations despite limits.

Practical Tax Tips for Managing Limits

Keeping track of your cash deposits is essential. Regular monitoring helps avoid exceeding limits and incurring unnecessary fees, ensuring better financial management.Monitor Your Cash Deposits Regularly

For larger operations, using multiple bank accounts can be beneficial. This strategy allows businesses to diversify cash flow and manage deposits more effectively.Consider Multiple Bank Accounts

Utilising digital transactions reduces reliance on cash deposits. Embracing technology helps businesses stay within limits while enhancing efficiency in their financial operations.Embrace Digital Transaction Methods

Fun Facts About Banking LImits

Did you know that UK banks handle approximately £3 billion in coins annually? This fun fact highlights the importance of digital banking and strategies to manage physical cash effectively.

Managing Your Business Finances Effectively

When handling cash deposit limits in business banking, understanding and foreseeing cash needs is essential. Prioritising an account that aligns with business scale and operations from the start saves time and monetary resources. Professional financial advisors can play a pivotal role, guiding businesses towards making solid financial decisions while adhering to deposit limits. This approach not only safeguards financial health but also enhances overall business strategy and efficiency.

When managing cash deposit limits, it's crucial for businesses to clearly understand their financial needs. This involves evaluating both current and future cash flow requirements. By accurately forecasting income and expenses, businesses can select the most suitable bank account.Prioritise Understanding Your Financial Needs

Developing a robust cash flow management strategy is essential for handling deposit limits effectively. This involves forecasting income and expenses to anticipate cash needs accurately. By planning ahead, businesses can time their deposits to stay within limits, ensuring they avoid penalties.Implement a Cash Flow Management Strategy

Summary

Understanding cash deposit limits is integral for businesses opting for free banking accounts. By proactively managing these restrictions, businesses enhance their financial management strategies and ensure smooth operations. Through meticulous planning and expert guidance, businesses can thrive within imposed deposit limits while attaining their financial goals. Digital tools, such as the Pie Tax App, significantly facilitate monitoring and managing cash deposits, providing an effective solution for navigating financial constraints. The Pie Tax App is completely free to use, find out what features are included here:

How is Pie different?

Pie is the only app for self assessment with tools for bookkeeping, your live tax figure, easy tax returns and helpful advice when you need it.

Save £168 per year vs Quickbooks, file your self assessment today for free with Pie

FREE

£89

+£59

£126

Quickbooks

£168

per year7 features

TaxScouts

£169

per year4 features

Accountant

£450

avg per year5 features

* Optional add on

Frequently Asked Questions

Do all free business accounts have cash deposit limits?

Yes, most fixed cash deposit limits, but these limits vary by bank.

Does Monzo bank business account have a limit for cash deposits?

Yes, Monzo Business Banking has a cash deposit limit of £5–£300 per transaction and up to £1,000 every six months. Monzo added this limit to help reduce the risk of money laundering, which criminals can use cash deposits for. Monzo plans to review the limit after gathering more data on how customers use it.

How can Pie Tax App assist businesses?

Pie Tax App offers financial tracking and expert advice, aiding businesses in efficiently managing their cash deposits.

Are fees applicable upon exceeding deposit limits?

Typically, exceeding limits incurs fees, which depend on the bank’s specific policies.

Can digital transactions help bypass cash deposit limits?

Absolutely, embracing digital transactions reduces physical cash reliance, thus dodging deposit limit issues.