Navigating the Shift from Self-Employment to PAYE Employment

Transitioning from self-employment to a PAYE job can be a daunting experience. For years, you’ve enjoyed the freedom and flexibility that come with being your own boss. The shift to a structured PAYE role involves numerous changes, not just in your day-to-day work but in how you manage your finances, especially taxes. Understanding these changes is crucial for a smooth transition.

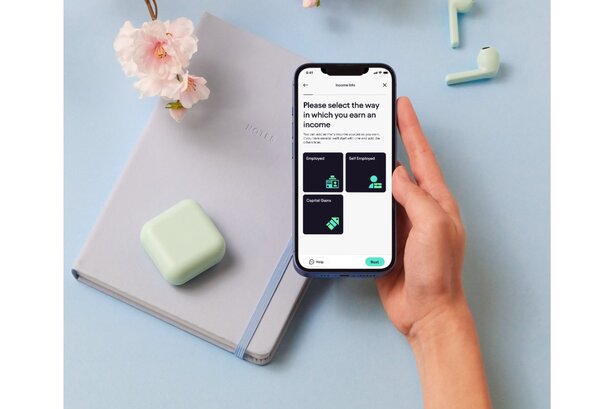

This guide will walk you through the essential tips and experiences to make this switch as seamless as possible. We’ll cover everything from adjusting to a new routine, managing your taxes using the Pie Tax App, to utilising the expert tax assistants available on the Pie app. With proper planning and the right resources, you’ll find the transition less stressful and much more manageable.

Embrace Routine Changes

Transitioning from self-employment to a PAYE job means adapting to a more structured work environment. The flexibility and autonomy of being your own boss will be replaced by fixed hours and a more rigid routine. Embracing these changes is essential for maintaining productivity and job satisfaction. This shift may require adjustments in how you plan your day and manage your time, but with the right mindset and preparation, you can smoothly transition into this new work style, making it a positive experience.

Financial Adjustment

The shift to PAYE employment brings significant changes to how you manage your finances, particularly in terms of taxes. Unlike self-employment, where you’re responsible for calculating and paying taxes, PAYE simplifies this with taxes automatically deducted from your salary. However, it’s crucial to stay informed and manage your finances effectively. Using tools like the Pie Tax App can help you track your earnings and tax obligations, while the expert tax assistants available on the app can provide personalised guidance. Proper financial adjustment ensures a smooth and stress-free transition into your new role.

Around 94% of UK employees handle their taxes via PAYE. Unlike self-employment, PAYE simplifies tax deductions directly from your salary, reducing the burden of self-managing taxes.Tax Changes

Approximately 85% of PAYE employees receive health insurance benefits from their employers. This could be a significant improvement compared to having to arrange private health insurance when self-employed.Health Insurance Benefits

Benefits of Professional Assistance

Hiring professional assistance when transitioning to a PAYE job can significantly simplify the process. A professional can help you understand the complicated aspects of taxes and employment benefits in a PAYE system. Expert tax assistants available on the Pie app are always ready to provide advice and help you maximise your tax efficiency.

On the other hand, the Pie Tax App allows you to seamlessly integrate all your tax information, ensuring you don't miss critical deductions or face any tax-related issues. It’s always a good idea to consult with experts to make your transition smooth and stress-free.

Maintaining Your Financial Health

As you move from self-employment to a PAYE job, don't forget to account for both your self-employed and PAYE income within the tax year. It's crucial to ensure that all your earnings are correctly reported and that you've set aside enough to cover any tax liabilities. You might still owe tax on your self-employed income, so make sure to factor this in and pay the correct amount to avoid any penalties.

Your financial strategy will need an overhaul once you shift from self-employment to a PAYE job. Start by setting a budget, considering the regular income and any deductions like taxes and benefits. It’s important to review and adjust your financial plans to align with your new income structure.

Tips on How to Transition from Self-Employment to PAYE

Transitioning from self-employment to PAYE employment requires adapting to a structured schedule. Embrace this change by planning your day and setting realistic goals.Adjusting to a New Work Routine

Although PAYE handles your income tax, remember to set aside funds for taxes owed on your self-employment income. The Pie Tax App can help you manage and track these payments.Reminder to Pay Taxes Owed from Self-Employment

Utilise expert tax assistance through the Pie app for personalised advice. This support will help you navigate the financial changes during your transition smoothly.Leveraging Expert Tax Assistance

Fun Facts about PAYE

Did you know that the PAYE system was introduced in the UK in 1944? It was originally implemented to help efficiently collect taxes during World War II. This system has evolved over the years, making tax collection more streamlined and less burdensome for both employees and employers.

Managing Stress during Transition

Transitioning from self-employment to a PAYE job can be stressful. To effectively manage this stress, start by recognising and accepting that change is a part of growth. Being proactive and preparing for this change can reduce anxiety significantly. Engage in stress-relieving activities like regular exercise or meditation to keep your mind clear and focused. Remember, the Pie Tax App and expert assistants are here to handle your tax-related concerns, so you can focus on adapting to your new work environment.

Set clear career goals when you start your new PAYE job. This will give you direction and motivation, making the transition smoother. Regularly reassess these goals and make adjustments as needed.Plan Your Career Growth

Keep a journal or use an app to track your career and financial progress regularly. This will help you stay organised and focused, facilitating a smoother transition overall.Track Your Progress

Summary

Transitioning from self-employment to a PAYE job entails significant changes in routine, finance management, and tax obligations. Embrace the predictable income and benefits, while ensuring you re-evaluate your financial strategies. The shift may seem daunting at first, but with the right planning and resources, you can make this transition smoothly and efficiently. Remember, it’s not just a change in your employment status but an opportunity for growth and stability.

Make your transition easier with the Pie Tax App—your go-to tool for managing tax obligations, tracking finances, and getting expert guidance every step of the way. Download the app today and take control of your financial future. The Pie Tax App is completely free to use, find out what features are included here:

How is Pie different?

Pie is the only app for self assessment with tools for bookkeeping, your live tax figure, easy tax returns and helpful advice when you need it.

Save £168 per year vs Quickbooks, file your self assessment today for free with Pie

FREE

£89

+£59

£126

Quickbooks

£168

per year7 features

TaxScouts

£169

per year4 features

Accountant

£450

avg per year5 features

* Optional add on

Frequently Asked Questions

What is the biggest challenge when transitioning from self-employment to a PAYE job?

The biggest challenge often is adjusting to a fixed schedule and relinquishing the flexibility of self-employment. It requires a change in routine and mindset.

How can the Pie Tax App help during the transition?

The Pie Tax App simplifies tax management by integrating all your tax information, ensuring you don’t miss out on critical deductions and efficiently manage your taxes.

What are the financial benefits of a PAYE job?

Regular income, employer-provided benefits like health insurance, and contributions to pensions are significant financial benefits of a PAYE job.

Can I still be self-employed while working a PAYE job?

Yes, it is possible to have a side business while working a PAYE job. However, it’s essential to keep your finances and taxes well-organised,

What should I do if I find the transition stressful?

Managing stress is crucial; you could engage in activities like regular exercise to keep anxiety at bay.