Understanding the SA302 Form

Are you a UK self-employed individual or contractor, puzzled about how to procure your SA302 form for your mortgage application? Worry not! We've got you covered with a comprehensive guide on obtaining this essential document.

Importance of the SA302 Form

When you apply for a mortgage, it's crucial to understand the components related to your SA302 form:

This form provides proof of your declared earnings to lenders, ensuring they have an accurate picture of your financial status.Evidence of Income

The SA302 form shows a detailed breakdown of your income tax calculations, reinforcing transparency and consistency with your tax returnsTax Calculation

Many lenders specifically request the SA302 to verify your income, making it an essential document for your mortgage application.Lender Requirements

How to Obtain Your SA302 Form Using Pie App

Follow these steps to get your SA302 form seamlessly:

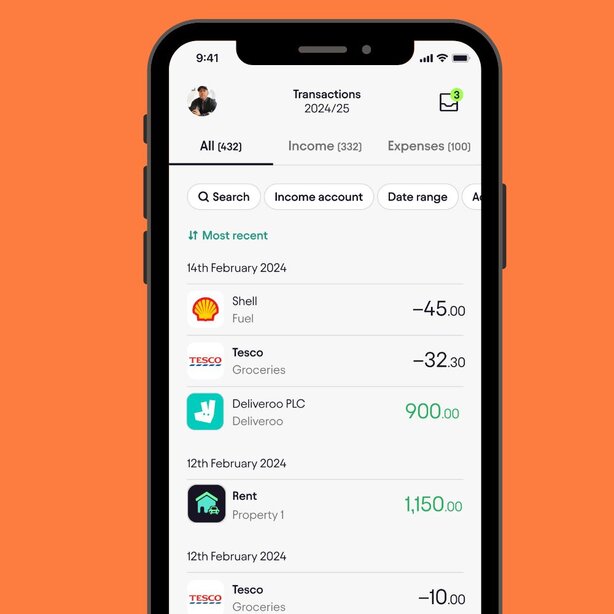

Use the Pie Tax App to easily complete your self-assessment, ensuring all necessary information is filled in accurately.Complete Your Self-Assessment

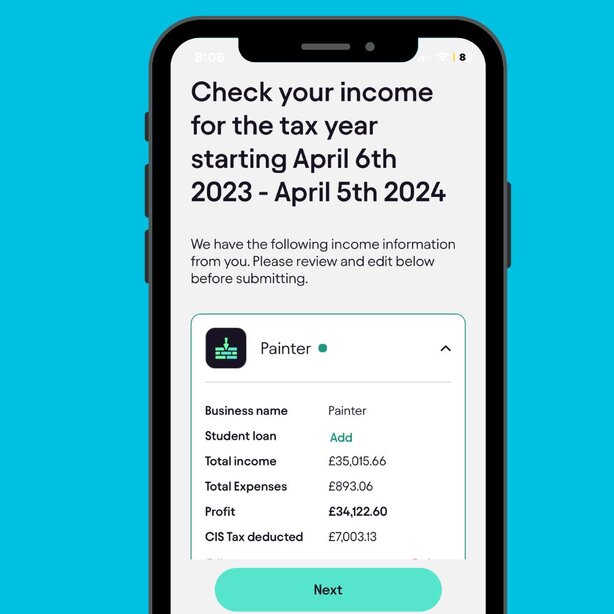

Before submitting your self-assessment to HMRC, carefully review all documents via the tax overview section to make sure there are no errors or missing information.Review Your Documents for Accuracy

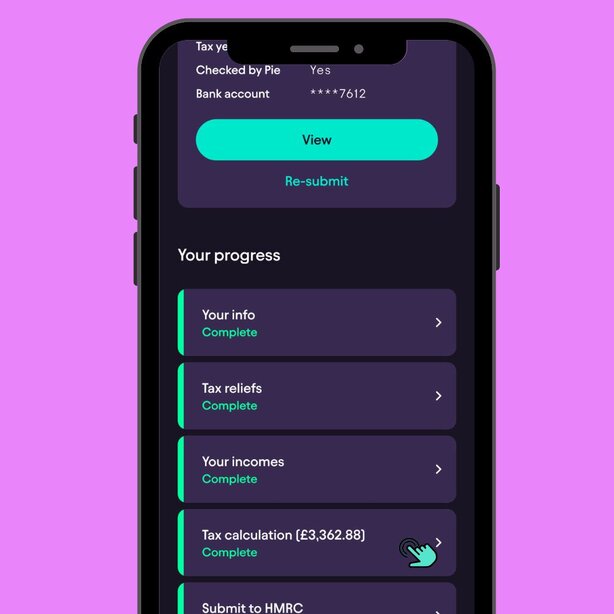

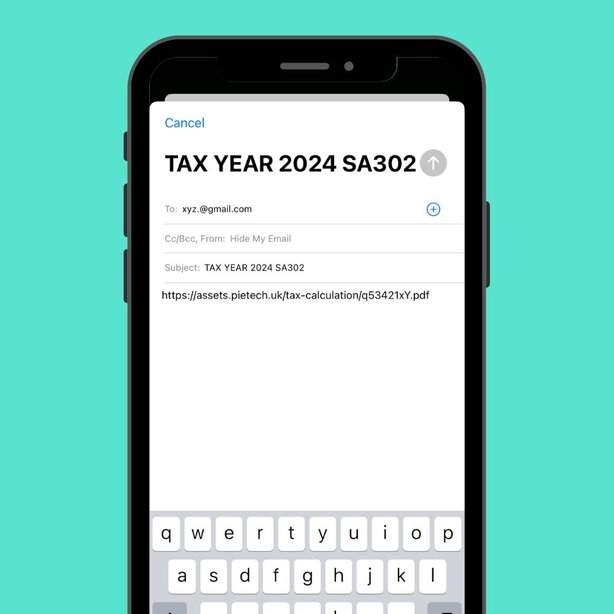

Go to the Tax Overview section in the app, and then click on the "Tax Calculation" option to proceed.Navigate to the Tax Overview Section

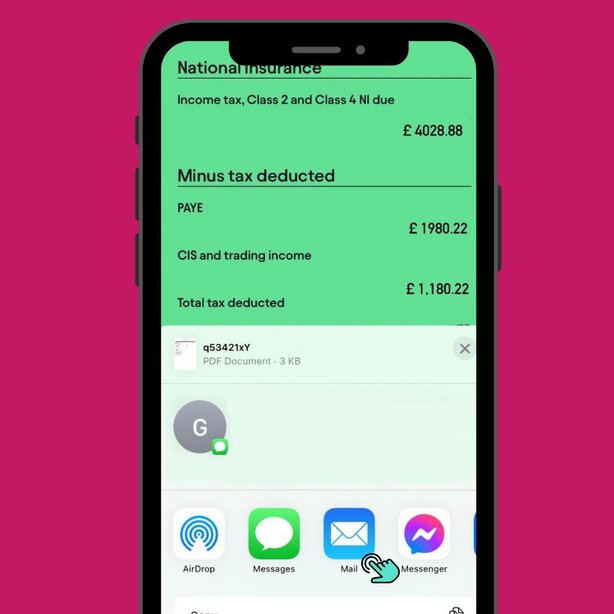

Scroll to the bottom of the page and click on the "Share Tax Calculation (SA302)" button to generate and share the document.Share Your Tax Calculation (SA302)

Send your SA302 to your email for safekeeping and download the file to maintain proper records for future reference.Keep Records of Your SA302

Options for Submitting Your Self-Assessment

Option 1: Request via HMRC Phone Service

You can request your SA302 form by calling HMRC's phone service at 0300 200 3310. During the call, you'll need to provide your unique tax reference (UTR) number for verification. This method is useful if you prefer direct communication or need additional support with your request. After the call, HMRC will process your request and send the document to you, though this may take a few days.

Option 2: Use Third-Party Accounting Software

Many third-party accounting software platforms integrate with HMRC, allowing you to generate your SA302 form automatically. This option streamlines the process by pulling your tax information directly from your records and submitting it to HMRC without needing to manually request the form. It’s a faster and more efficient method, especially if you regularly use accounting software for managing your finances. Just ensure the software you use is compatible with HMRC’s system for a seamless experience.

Additional Considerations

Be aware of potential delays and plan ahead, especially during busy periods.Plan for Processing Times

Ensure your tax returns are accurate and up-to-date before requesting SA302 forms.Update Tax Returns

Check with your lender which tax years are needed to prevent delays.Confirm Lender Requirements

Expert Assistance with Pie

Navigating the process of obtaining your SA302 form can be complex, but with Pie Tax, you have access to expert assistance who can guide you through the process. Simplify your tax management and mortgage applications with Pie Tax. Sign up today for hassle-free tax solutions.

Over 68% of self-employed individuals in the UK reported needing an SA302 form for mortgage applications in 2022.

HMRC processed over 1.5 million requests for SA302 forms between 2021 and 2022.

Frequently Asked Questions

How long does it take to get an SA302 form?

It typically takes up to two weeks if requested online, but this may vary during peak periods.

Can I get an SA302 form for previous tax years?

Yes, you can obtain SA302 forms for multiple previous tax years as required by your lender.

What if my lender does not accept the online SA302 form?

Some lenders might prefer a form directly from HMRC. You can request it by contacting HMRC directly over the phone.

Do I need SA302 if I am employed?

Generally, salaried employees provide P60s and P45s as income proof, but SA302 might be needed if you have additional self-employed income.

How many years of SA302 do I need for a mortgage application?

Most lenders require at least two to three years of SA302 forms to verify your income stability.