Understanding Mileage Calculation for Tax Returns

Are you a UK taxpayer, puzzled about how to calculate mileage for your tax return? Worry not! We've got you covered with a comprehensive guide on calculating mileage for tax purposes effortlessly.

Understanding Mileage Calculation for Tax Return.

When you need to calculate mileage for your tax return, it's crucial to understand several key components:

Business mileage refers to the miles traveled strictly for business purposes. Recording accurate business mileage is essential for tax deductions.Business Mileage

Private mileage is any mileage driven for personal reasons. This cannot be deducted for tax purposes, so distinguishing between business and private mileage is critical.Private Mileage

AMAP rates are set by HMRC to define the amount you can claim per mile when using your personal vehicle for business purposes. Adhering to these rates ensures your claims are accurate and compliant.Approved Mileage Allowance Payments (AMAP

How to Calculate Mileage for Tax Return

Follow these steps to calculate mileage for your UK tax return seamlessly:

Keep an accurate and detailed log of all business journeys, noting the date, destination, and purpose of each trip.Maintain a Mileage Log

Clearly differentiate between business and private mileage in your records.Distinguish Business vs. Private Mileage

Calculate the total business mileage and apply HMRC’s AMAP rates to determine your allowable deduction.Apply the HMRC AMAP Rates

Regularly review your mileage log to ensure all entries are accurate and compliant with HMRC guidelines.Review and Cross-Check Records

Enter your mileage claims accurately when submitting your tax return, ensuring all supporting documents are ready for any future audits.Report in Your Tax Return

Mileage Tracking Options

Option 1: Manual Mileage Tracking

Manually tracking your mileage for tax purposes involves maintaining a detailed logbook, either in physical form or digitally, where you record the date, destination, purpose, and distance of each business trip. Consistent and accurate entries are crucial to ensure you claim the correct mileage relief when completing your tax return. This method may take more time but provides a reliable record for HMRC audits if needed.

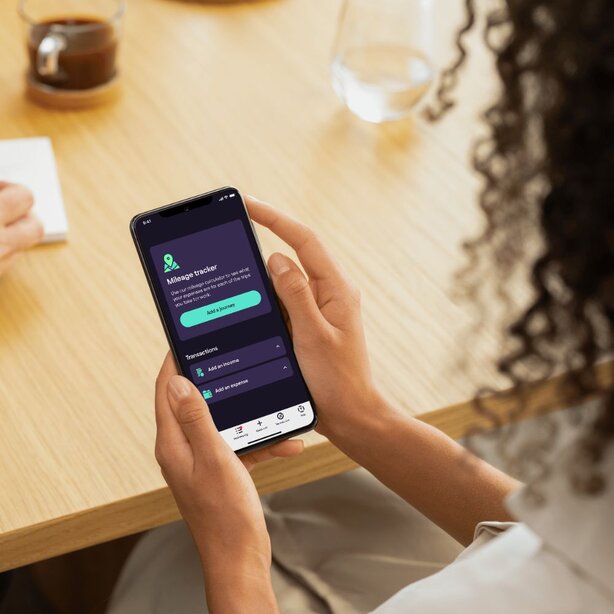

Option 2: Tracking Mileage using Pie App

The Pie.tax app offers a convenient mileage tracking feature where you can input your start and end addresses, and it automatically calculates the distance for you. This eliminates the need for manual calculations and ensures accurate mileage records for your tax return. By using this feature, you can easily keep track of your business trips, reducing the risk of errors and saving time when filing your self-assessment.

Additional Considerations

Regularly updating your mileage log prevents data loss and ensures accuracy.Regular Updates

Always follow HMRC guidelines for mileage claims to avoid penalties.Compliance

Maintain all related receipts and logs as proof for your claims.Documentation

Expert Assistance with Pie

Navigating mileage calculation for your tax return can be complex, but with Pie.tax, you have access to expert assistance that guides you through the process accurately and efficiently. Sign up today to simplify your mileage tracking and maximise your tax savings.

According to HMRC, over 20% of mileage claims are rejected due to inaccuracies.

Businesses can save up to 45% on taxes by correctly deducting business mileage.

Frequently Asked Questions

What is the HMRC AMAP rate for cars?

As of the last update, the HMRC AMAP rate for cars is 45p per mile for the first 10,000 miles and 25p per mile thereafter.

Can I claim mileage for commuting to my regular place of work?

No, you cannot claim mileage for commuting to your regular place of work as it is considered private mileage.

How long should I keep my mileage records?

You should retain mileage records for at least six years, as HMRC may request them during audits.

Is there a mileage allowance for cycling?

Yes, HMRC allows a tax-free mileage rate of 20p per mile for business travel using bicycles.

Can I claim mileage if I use a company car?

If you use a company car, you cannot claim mileage, but you may be able to claim fuel costs based on the company's policy.