Entering Cash Bonuses and Tips via Income Accounts

Managing your self-assessment tax returns accurately is essential, particularly if you're using the Pie Tax App for UK tax refunds, bookkeeping, and invoicing. If you’ve received additional earnings such as cash bonuses or tips from your employer, it's crucial to declare these to HM Revenue & Customs (HMRC) as they impact your tax calculations.

In this article, we'll guide you through adding your additional earnings to your employed income in the Pie Tax App. By following our step-by-step instructions, you can ensure your financial records are comprehensive and compliant with HMRC regulations, making your tax management seamless and accurate.

Your Step-by-Step Guide

Follow these steps to add your additional earnings to your employed income in the Pie Tax App.

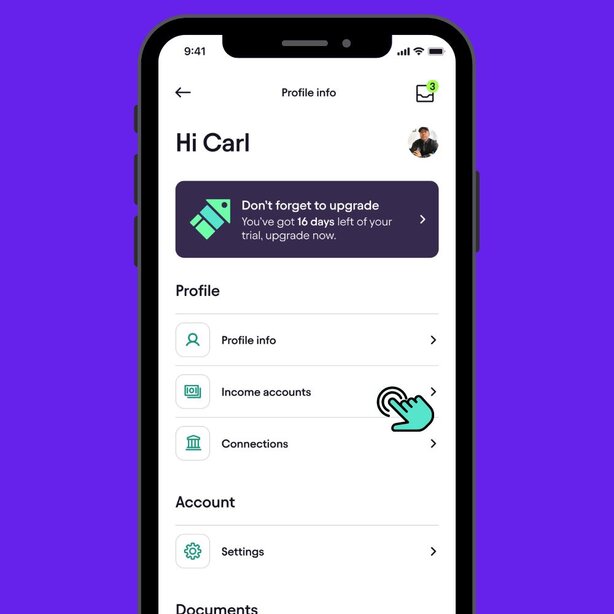

Launch the Pie Tax App on your device. Once the app is open, tap the avatar icon located in the top left corner of the screen to access your profile.Open the App and Access Your Profile

Within the settings menu, scroll down to find the section labelled “Income Accounts.” Make sure you have already created an employed income source in the Pie Tax App. If not, create one before proceeding.Locate Income Accounts

Tap on the “Income Accounts” section to view all income entries you have created in the app. Scroll through the list and select the employed income you wish to update by tapping on it.Select the Income to Update

Once you have opened the income details, look for the option to add “Additional Earnings.” Tap the “Add” button to continue.Add Additional Earnings

The app will ask if you have earned any additional income for the selected employed income. Specify whether these earnings are bonuses or tips. Enter the amount of the additional earnings, then tap ‘Next’ to save the changes.Enter Earnings Details

After saving, check the “Income Accounts” section to ensure the additional earnings have been correctly updated. Under ‘Additional Earnings,’ it should display the amount you entered, confirming the update.Verify the Update

Key Benefits

Here are three concise benefits of using the Pie Tax App to manage additional earnings like cash bonuses and tips

Adding extra earnings ensures precise tax calculations and helps avoid HMRC penalties.Accurate Tax Calculations

Recording all income sources provides a comprehensive view of your finances for better planning.Complete Financial Overview

Easily enter additional earnings to streamline your self-assessment process and save time.Simplified Tax Filing

Frequently Asked Questions

How do I add additional earnings to my employed income in the Pie Tax App?

To add additional earnings like bonuses or tips, access the “Income Accounts” section in the app, select the employed income, and use the “Add Additional Earnings” option to input the details.

Why do I need to report cash bonuses in the Pie Tax App?

Cash bonuses are considered earnings and must be reported to ensure accurate Pay As You Earn (PAYE) tax calculations and compliance with HMRC regulations.

Can I include tips as additional earnings in the Pie Tax App?

Yes, tips received as part of your income can be added as additional earnings in the Pie Tax App to ensure your tax calculations are accurate.

What happens if I don't report additional earnings in my tax return?

Failing to report additional earnings can lead to incorrect tax calculations and potential penalties from HMRC, so it’s essential to update your income accurately.

How can I verify that my additional earnings have been added correctly?

After entering your additional earnings, check the “Income Accounts” section in the app to ensure the amount is listed under ‘Additional Earnings,’ confirming the update is complete.